Travis Texas Conveyance of Deed to Lender in Lieu of Foreclosure is a legal process that allows a borrower to transfer ownership of a property to the lender, thereby satisfying the debt owed, instead of going through a foreclosure procedure. This can be a viable solution for borrowers who are unable to keep up with their mortgage payments and want to avoid the negative consequences and impact on credit associated with a foreclosure. The Travis Texas Conveyance of Deed to Lender in Lieu of Foreclosure is a voluntary agreement reached between the borrower and the lender. It involves the borrower willingly relinquishing their rights to the property by signing over the deed, effectively transferring ownership to the lender. In return, the lender agrees to release the borrower from any further obligations related to the loan, including the remaining debt. By opting for a Conveyance of Deed to Lender in Lieu of Foreclosure in Travis Texas, borrowers can potentially mitigate the financial and emotional hardships associated with a foreclosure. It allows them to avoid the public auction process, preserve their credit score to some extent, and potentially negotiate a more favorable arrangement with the lender. It's important to note that there are different types or variations of the Travis Texas Conveyance of Deed to Lender in Lieu of Foreclosure, such as: 1. Traditional Conveyance: This is the standard process where the borrower voluntarily transfers the ownership of the property to the lender, releasing themselves from any further obligations. 2. Deed-in-Lieu with Cash for Keys: In some cases, lenders may offer a "cash for keys" incentive to borrowers who agree to the Conveyance of Deed. This involves the lender providing a financial incentive to the borrower to vacate the property in good condition within a specified timeframe. 3. Assumption of Liabilities: This variation allows the borrower to negotiate with the lender to assume certain liabilities, such as unpaid property taxes or outstanding homeowner association fees, as part of the Conveyance of Deed to Lender. 4. Property Condition Negotiation: In certain circumstances, borrowers and lenders may negotiate terms regarding the property's condition. For example, the lender may require the borrower to make necessary repairs or address specific issues before completing the Conveyance of Deed. 5. Bifurcation of Liens: In situations where a property has multiple liens, the Conveyance of Deed to Lender may involve negotiations between the lender and other lien holders to determine the order of priority and potential offset of debts. In Travis Texas, the Conveyance of Deed to Lender in Lieu of Foreclosure provides an alternative solution for borrowers who are experiencing financial hardships and want to avoid the long-term consequences of foreclosure. It is advisable for individuals considering this option to seek legal counsel and consult with a knowledgeable real estate professional to understand the specific implications and potential outcomes.

Travis Texas Conveyance of Deed to Lender in Lieu of Foreclosure

Description

How to fill out Travis Texas Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Travis Conveyance of Deed to Lender in Lieu of Foreclosure, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the current version of the Travis Conveyance of Deed to Lender in Lieu of Foreclosure, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Travis Conveyance of Deed to Lender in Lieu of Foreclosure:

- Glance through the page and verify there is a sample for your area.

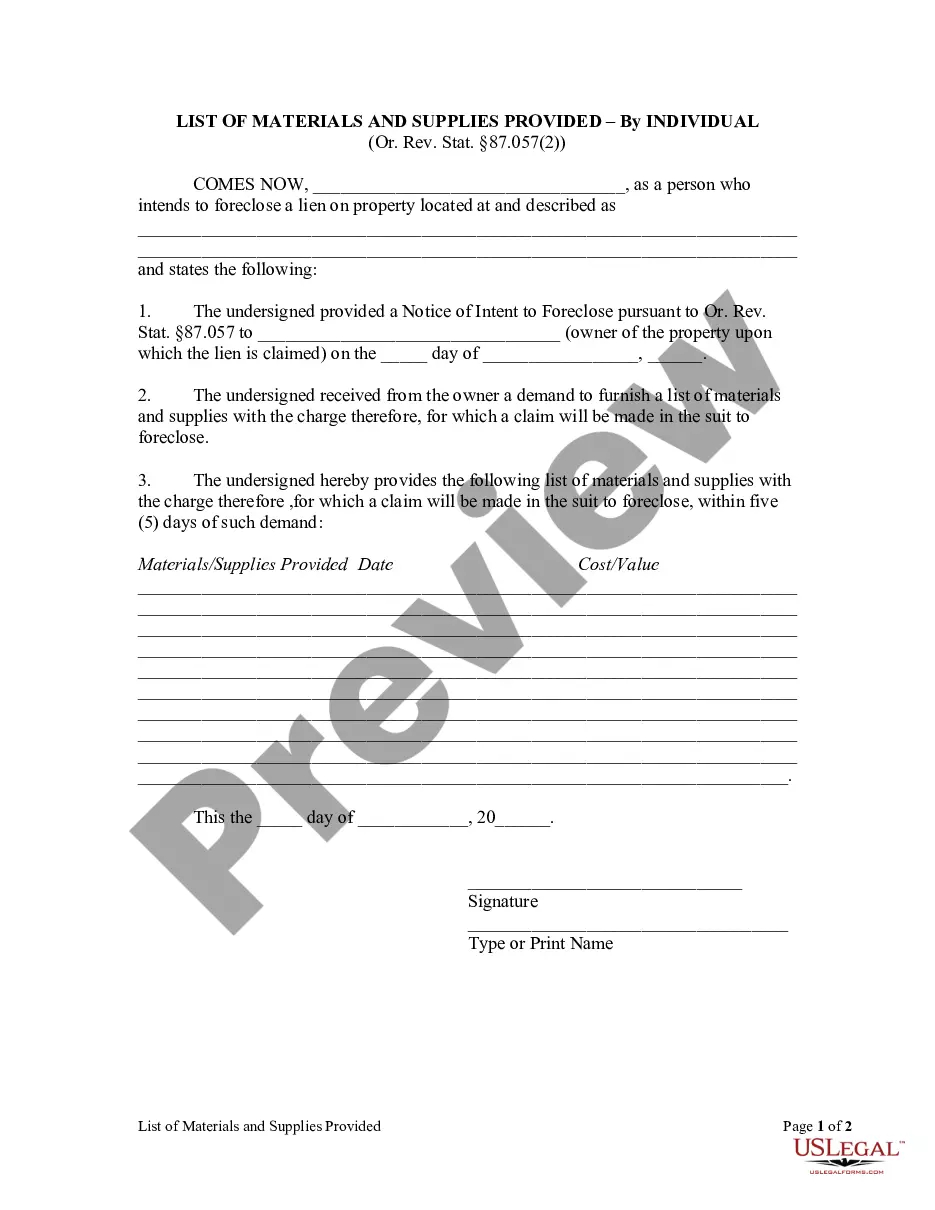

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Travis Conveyance of Deed to Lender in Lieu of Foreclosure and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!