Title: Alameda California Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder Introduction: The Alameda California Shareholders' Agreement with Buy-Sell Agreement is a legal document that outlines the rights and obligations of shareholders within a corporation. In particular, this agreement establishes the first right of refusal for the corporation to purchase shares from a deceased shareholder's beneficiaries if they intend to sell. This safeguard ensures seamless transition of ownership and stability within the corporation. Let's explore the various types of Alameda California Shareholders' Agreement with Buy-Sell Agreement to gain a comprehensive understanding. 1. Standard Shareholders' Agreement with Buy-Sell Agreement: In this type, the Alameda California Shareholders' Agreement with Buy-Sell Agreement revolves around the first right of refusal clause. When a shareholder passes away, their beneficiaries must offer the shares to the corporation before considering any external buyers. The corporation may then choose to purchase the shares at a fair market value. 2. Valuation Methodologies: The valuation of shares within the Alameda California Shareholders' Agreement with Buy-Sell Agreement is crucial to determine a fair price. Various valuation methodologies, such as the book value or an independent business appraiser, can be specified to assess the shares' worth accurately. These methodologies ensure transparency and prevent disputes over pricing. 3. Share Redemption Provision: Another component that may be included in the Alameda California Shareholders' Agreement with Buy-Sell Agreement is a share redemption provision. This provision allows the corporation to redeem the shares of a deceased shareholder directly instead of going through the beneficiaries. With this provision, the corporation becomes the sole owner of the shares, streamlining the transfer process. 4. Offer and Acceptance Procedures: The Alameda California Shareholders' Agreement with Buy-Sell Agreement outlines specific procedures for offering and accepting shares. When a shareholder passes away, the beneficiaries must tender a written offer to the corporation detailing their intention to sell. The agreement will then specify the time within which the corporation should respond with an acceptance or rejection. 5. Payment Terms and Financing: In some instances, the Alameda California Shareholders' Agreement with Buy-Sell Agreement may outline payment terms and financing options for the corporation. This ensures a smooth transition, as the agreement can account for scenarios where the corporation requires time to arrange funds for the purchase. It may also specify acceptable modes of payment, such as lump sum or installment payments. Conclusion: The Alameda California Shareholders' Agreement with Buy-Sell Agreement, specifically incorporating the first right of refusal for the corporation, is a crucial aspect for maintaining stability within a corporation when a shareholder passes away. Additionally, this agreement ensures a fair valuation of shares and streamlines the transfer process, safeguarding the interests of both the beneficiaries and the corporation. By adhering to the relevant legal guidelines, corporations can effectively navigate the complexities surrounding the sale of shares by deceased shareholders.

Alameda California Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder should the Beneficiaries of the Deceased Shareholder Desire to Sell such Shares

Description

How to fill out Alameda California Shareholders' Agreement With Buy-Sell Agreement Allowing Corporation The First Right Of Refusal To Purchase The Shares Of Deceased Shareholder Should The Beneficiaries Of The Deceased Shareholder Desire To Sell Such Shares?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Alameda Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder should the Beneficiaries of the Deceased Shareholder Desire to Sell such Shares, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Alameda Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder should the Beneficiaries of the Deceased Shareholder Desire to Sell such Shares from the My Forms tab.

For new users, it's necessary to make some more steps to get the Alameda Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder should the Beneficiaries of the Deceased Shareholder Desire to Sell such Shares:

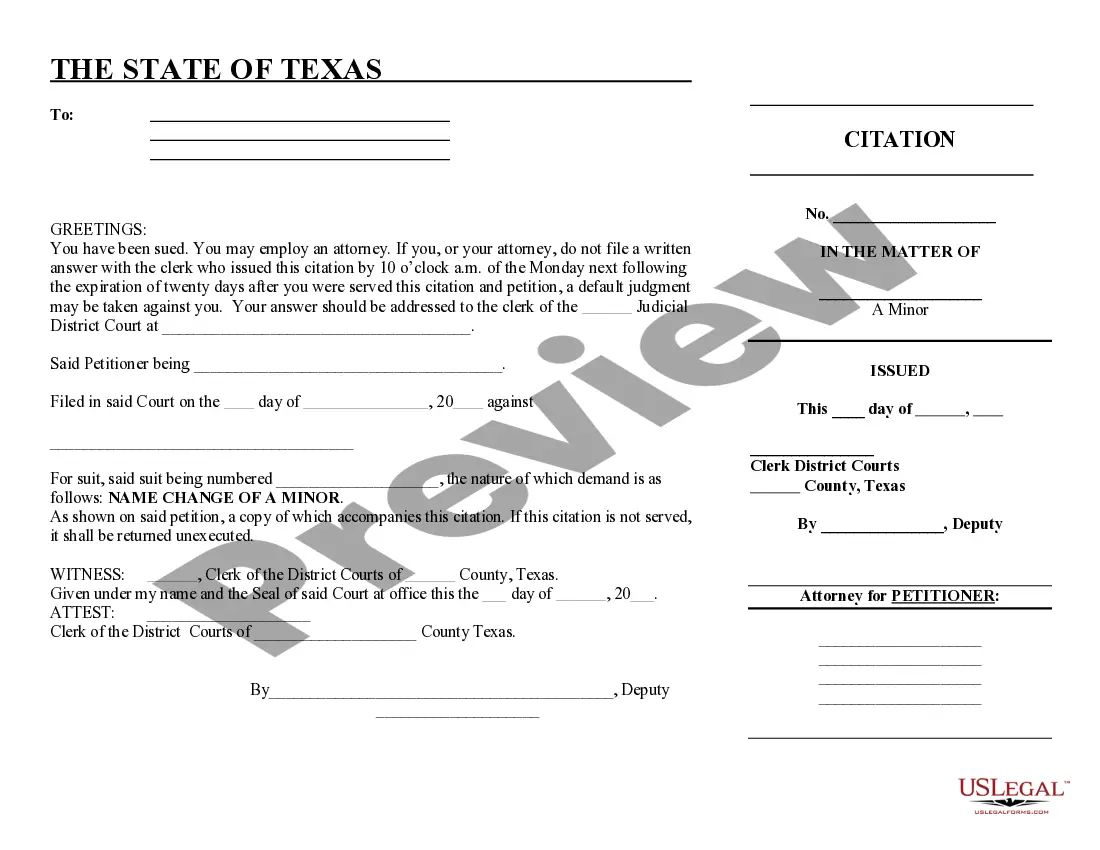

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!