Maricopa, Arizona Shareholders' Agreement with Buy-Sell Agreement: The Maricopa, Arizona Shareholders' Agreement with Buy-Sell Agreement plays a crucial role in providing a clear framework for handling shares of a deceased shareholder. This agreement ensures that the corporation is given the first right of refusal to purchase the shares in case the beneficiaries of the deceased shareholder intend to sell them. By incorporating this provision, the agreement safeguards the interests of both the corporation and the deceased shareholder's beneficiaries. In the context of Maricopa, Arizona, various types of Shareholders' Agreements with Buy-Sell Agreements exist, all of which prioritize the corporation's right to purchase the shares in case of the shareholder's demise. Some different types may include: 1. Specific Buy-Sell Agreement: This agreement outlines the specific terms and conditions for the corporation's first right of refusal to purchase the shares of the deceased shareholder. It provides detailed provisions regarding the valuation of the shares, the process of notification to the corporation, and the timeline within which the purchase must be completed. 2. Shotgun Buy-Sell Agreement: This type of agreement allows either the beneficiaries or the corporation to make an offer to purchase the deceased shareholder's shares at a specified price. However, if the offer is made, the other party has the choice to either accept the offer or to sell their shares at the same price. This back-and-forth mechanism helps ensure fair treatment and avoids conflicts. 3. Wait-and-See Buy-Sell Agreement: With this agreement, the corporation initially refrains from purchasing the deceased shareholder's shares, providing the beneficiaries an opportunity to explore other potential buyers. If the beneficiaries are unsuccessful in finding alternative buyers or decide to sell the shares to the corporation anyway, the agreement allows the corporation to exercise its right of first refusal. The Maricopa, Arizona Shareholders' Agreement with Buy-Sell Agreement offers multiple advantages for both the corporation and the beneficiaries. It prevents external parties from acquiring shares without the corporation's consent, thereby maintaining control and stability within the company. Simultaneously, it allows the beneficiaries to explore other options if they find suitable buyers, promoting transparency and fair market value for the shares. Overall, the incorporation of a detail-oriented Shareholders' Agreement with Buy-Sell Agreement allows for a smooth transition of shares and protects the interests of the corporation and the beneficiaries in Maricopa, Arizona. By providing a comprehensive framework for handling the shares of a deceased shareholder, this agreement establishes a foundation of clarity and fairness within the corporation.

Maricopa Arizona Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder should the Beneficiaries of the Deceased Shareholder Desire to Sell such Shares

Description

How to fill out Maricopa Arizona Shareholders' Agreement With Buy-Sell Agreement Allowing Corporation The First Right Of Refusal To Purchase The Shares Of Deceased Shareholder Should The Beneficiaries Of The Deceased Shareholder Desire To Sell Such Shares?

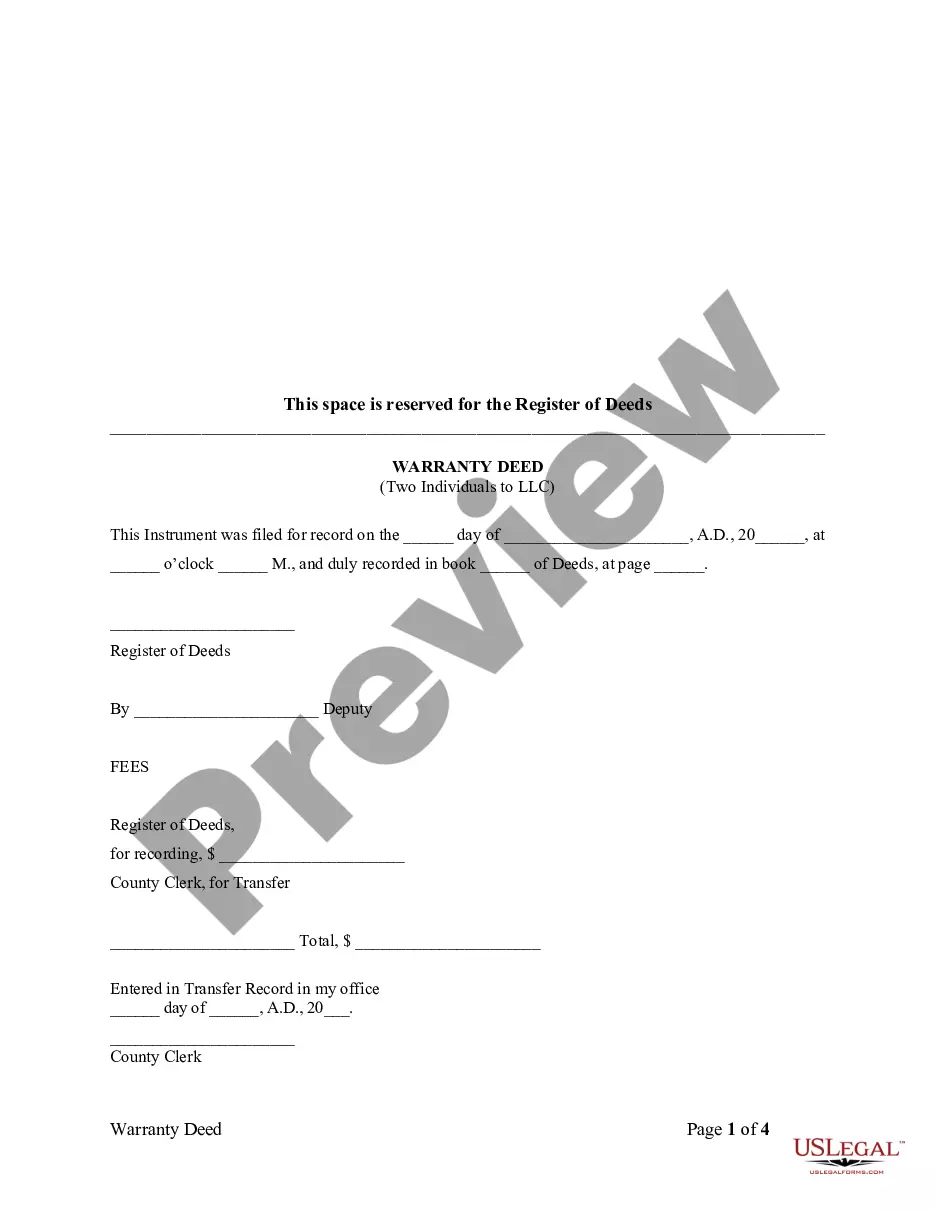

Are you looking to quickly create a legally-binding Maricopa Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder should the Beneficiaries of the Deceased Shareholder Desire to Sell such Shares or maybe any other document to manage your personal or business matters? You can go with two options: hire a legal advisor to draft a legal document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-compliant document templates, including Maricopa Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder should the Beneficiaries of the Deceased Shareholder Desire to Sell such Shares and form packages. We offer templates for an array of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, double-check if the Maricopa Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder should the Beneficiaries of the Deceased Shareholder Desire to Sell such Shares is tailored to your state's or county's regulations.

- If the document has a desciption, make sure to verify what it's intended for.

- Start the search over if the document isn’t what you were seeking by using the search bar in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Maricopa Shareholders' Agreement with Buy-Sell Agreement Allowing Corporation the First Right of Refusal to Purchase the Shares of Deceased Shareholder should the Beneficiaries of the Deceased Shareholder Desire to Sell such Shares template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the templates we offer are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!