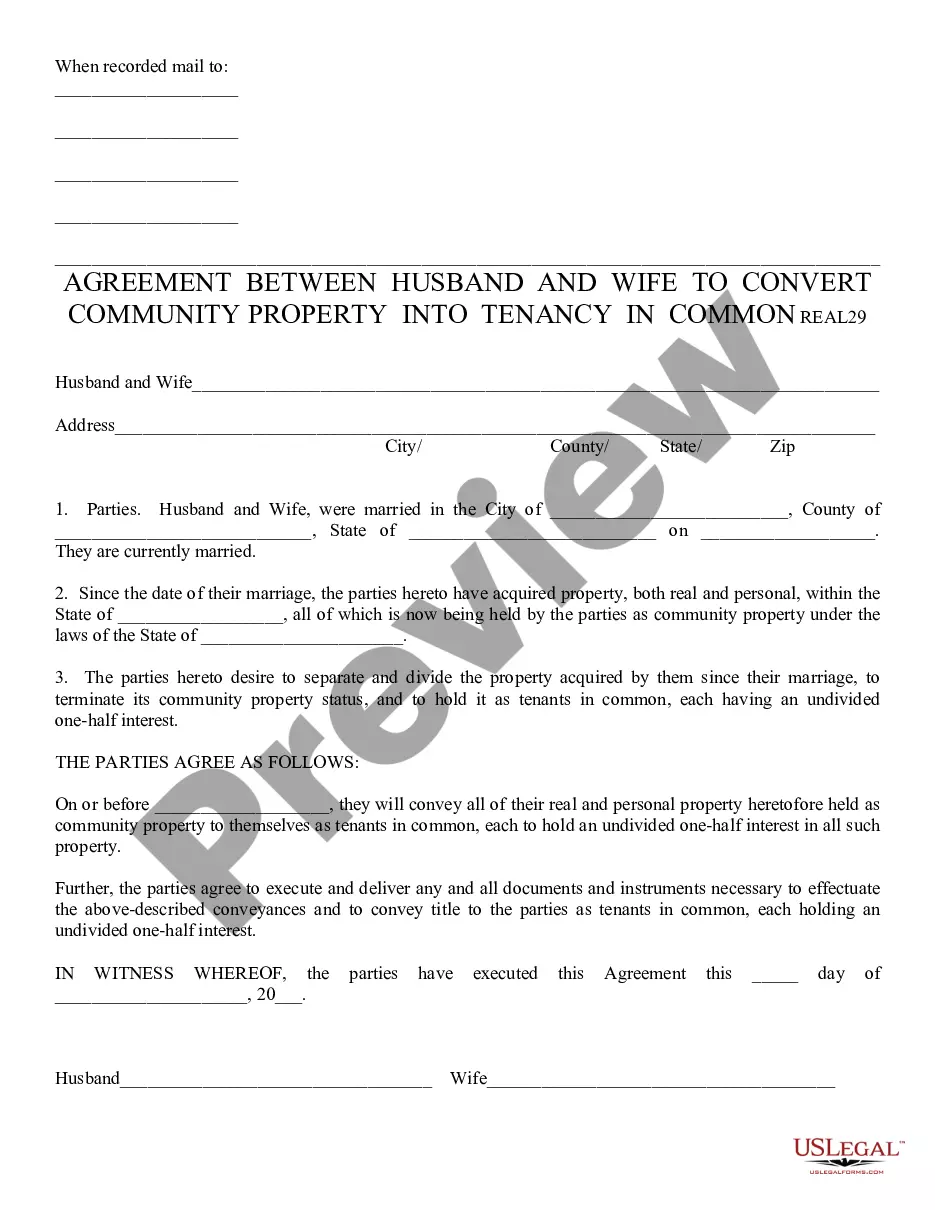

The Maricopa Arizona Agreement to Purchase Note and Mortgage is a binding legal document that outlines the terms and conditions involved in the sale and financing of real estate properties located in Maricopa, Arizona. This agreement sets forth the responsibilities and obligations of both the buyer and the seller, ensuring a smooth and transparent transaction. The agreement to purchase note and mortgage serves as a contract that binds the buyer to fulfill the financial obligations associated with the purchase of the property. It specifies the purchase price, down payment amount, interest rates, and monthly mortgage payments. Additionally, it details the terms of the loan, such as the repayment period and any potential penalties for missed payments. In Maricopa, Arizona, there are various types of Agreement to Purchase Note and Mortgage that cater to different circumstances and parties involved. Some of these types may include: 1. Residential Agreement to Purchase Note and Mortgage: This type of agreement is specifically designed for residential properties, including single-family homes, condominiums, and townhouses. It covers the buyer's obligations, the seller's warranties, and the conditions under which the mortgage is granted. 2. Commercial Agreement to Purchase Note and Mortgage: This type of agreement caters to commercial properties such as office buildings, retail spaces, and industrial complexes. It typically includes additional provisions related to zoning requirements, lease agreements, and potential environmental issues. 3. Vacant Land Agreement to Purchase Note and Mortgage: This type of agreement focuses on the sale and financing of undeveloped land. It may include specific stipulations regarding land use, potential development restrictions, and any existing easements or encumbrances on the property. 4. Seller-Financed Agreement to Purchase Note and Mortgage: In this type of agreement, the seller acts as the lender and finances the purchase directly, eliminating the need for third-party lenders. It outlines the terms of the loan, such as the repayment schedule, interest rates, and any applicable late payment fees. It is important for both the buyer and the seller to review the Maricopa Arizona Agreement to Purchase Note and Mortgage thoroughly and seek legal counsel if necessary. This ensures that all parties involved fully understand their rights, obligations, and any potential risks associated with the transaction. By following the guidelines set forth in the agreement, all parties can mitigate conflicts or misunderstandings, resulting in a successful real estate transaction in Maricopa, Arizona.

Maricopa Arizona Agreement to Purchase Note and Mortgage

Description

How to fill out Maricopa Arizona Agreement To Purchase Note And Mortgage?

Draftwing forms, like Maricopa Agreement to Purchase Note and Mortgage, to take care of your legal affairs is a difficult and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents created for a variety of cases and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Maricopa Agreement to Purchase Note and Mortgage template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Maricopa Agreement to Purchase Note and Mortgage:

- Ensure that your document is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Maricopa Agreement to Purchase Note and Mortgage isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start using our service and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is ready to go. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!