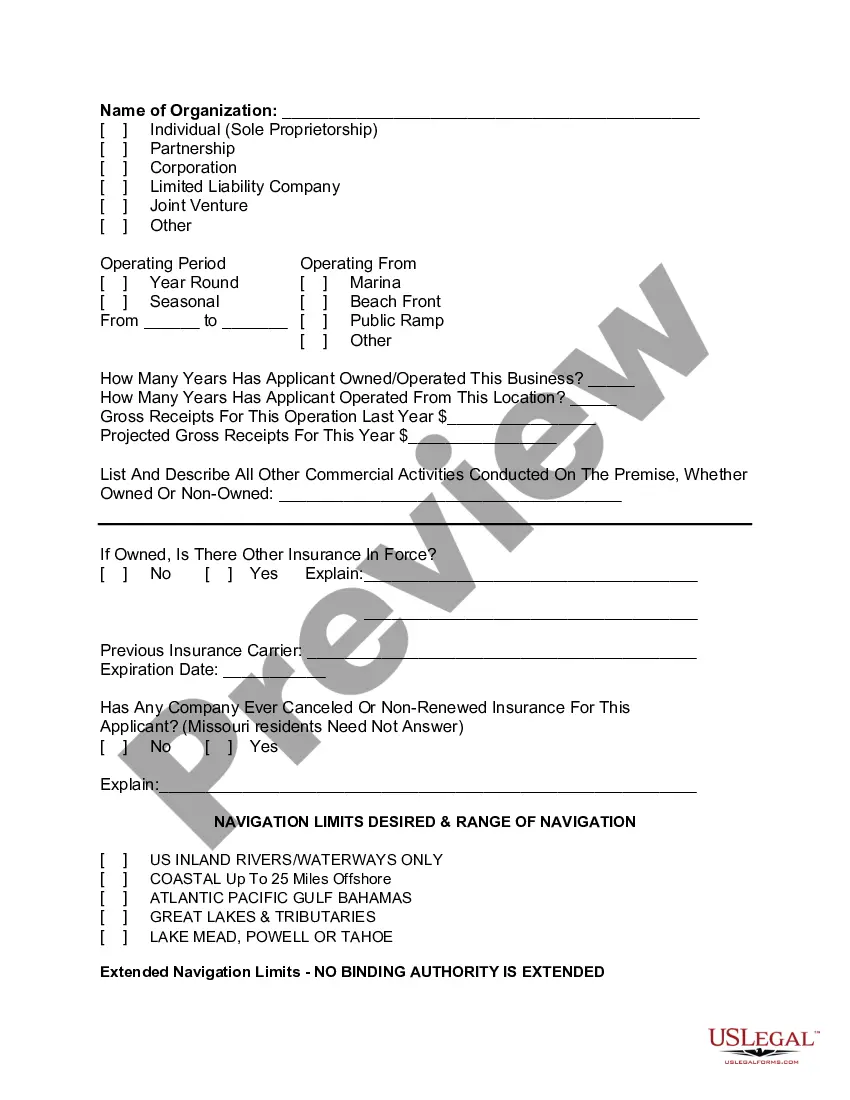

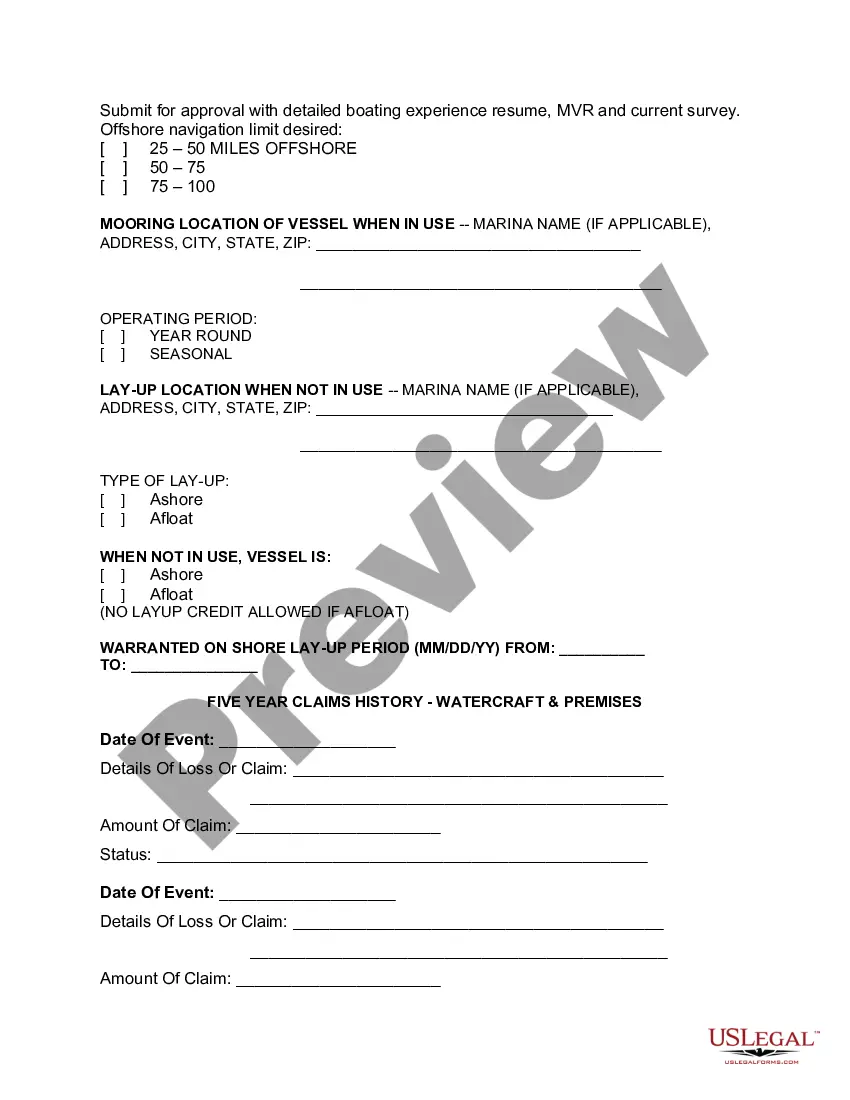

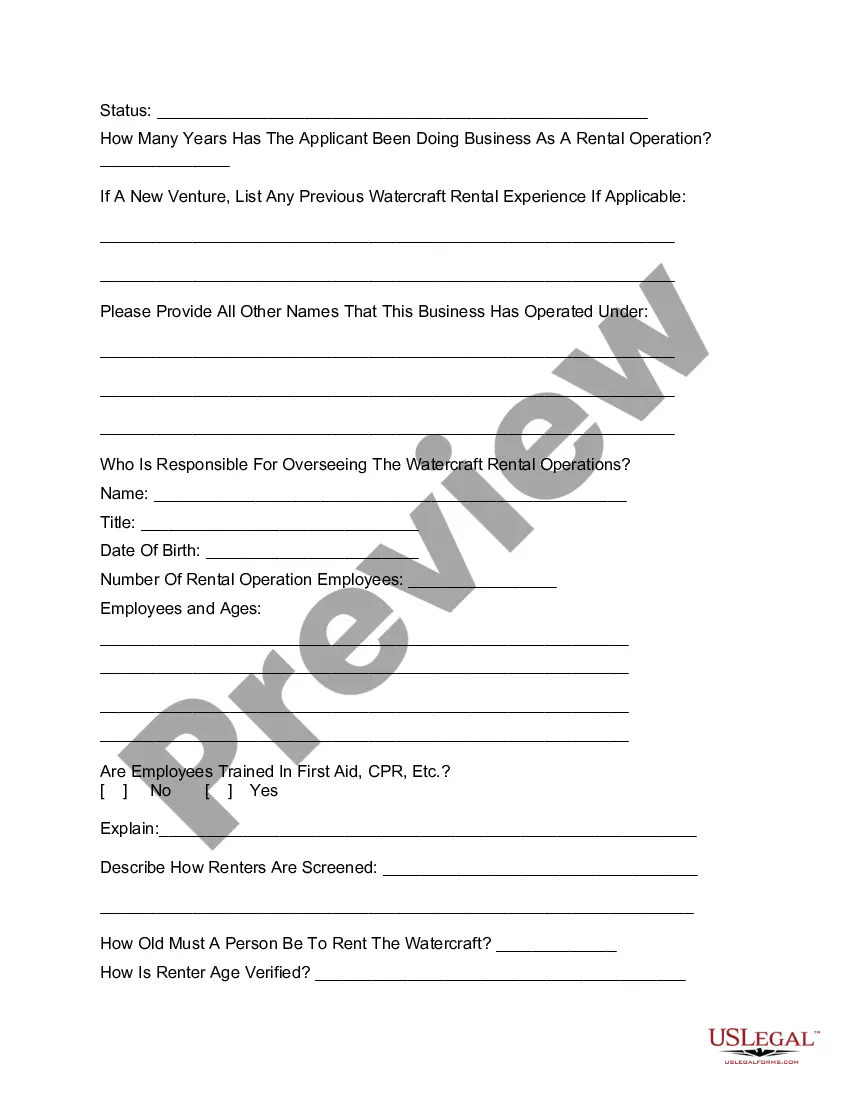

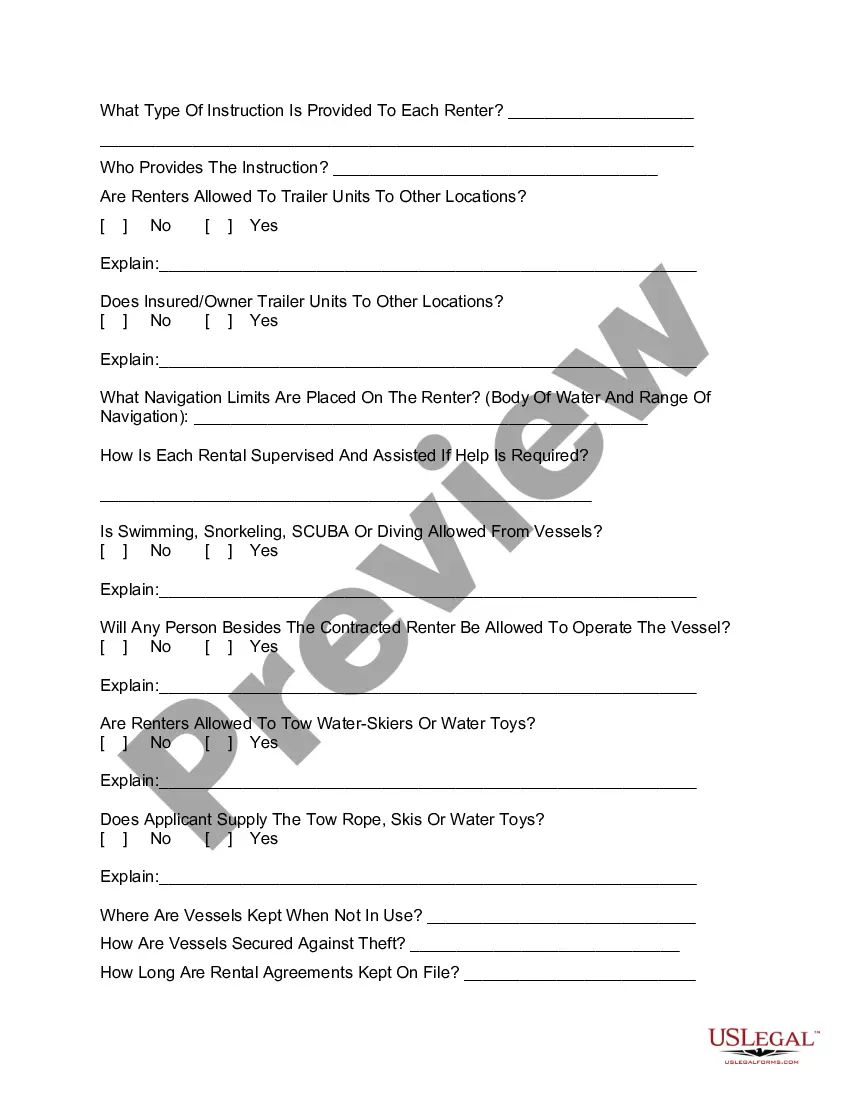

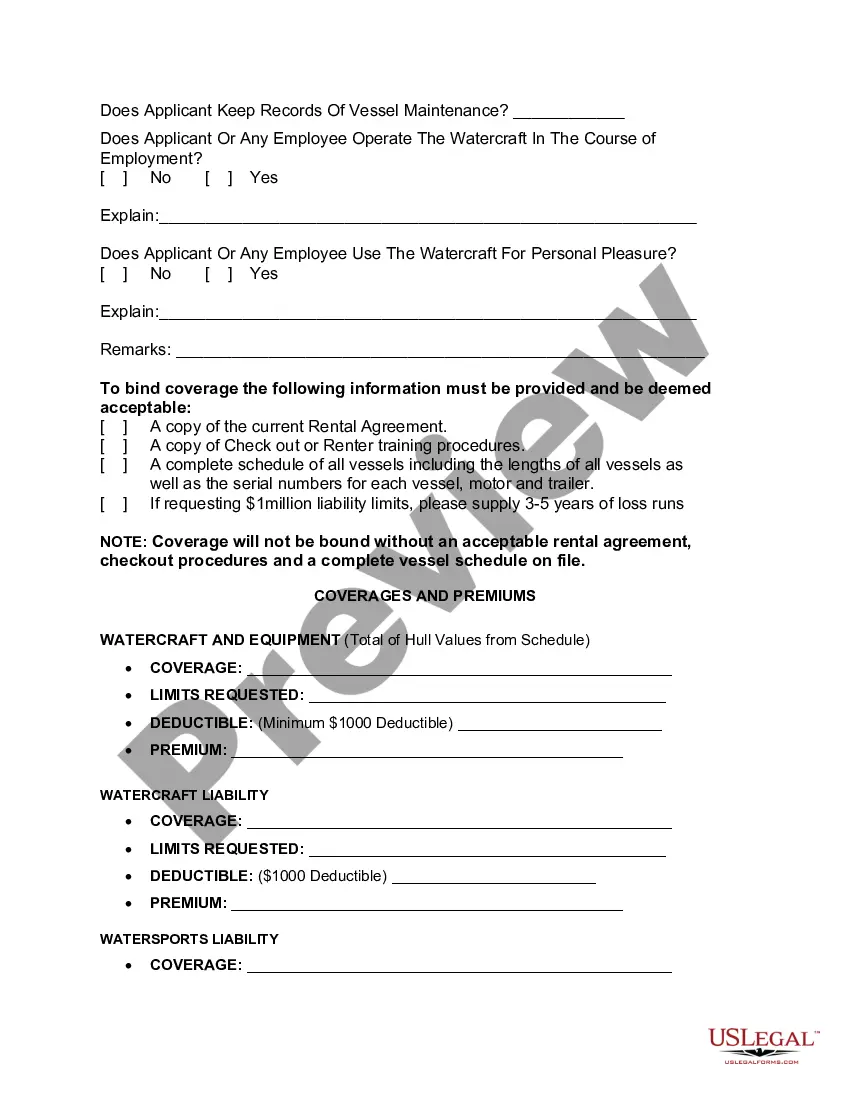

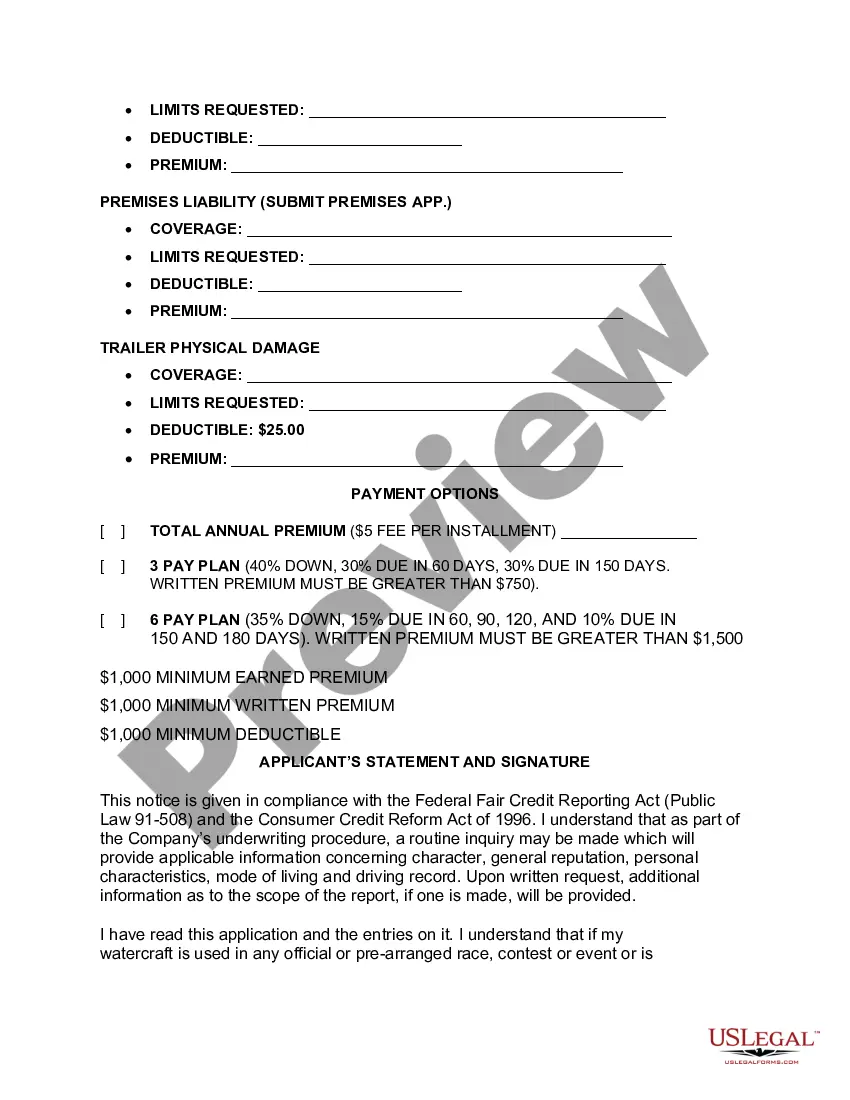

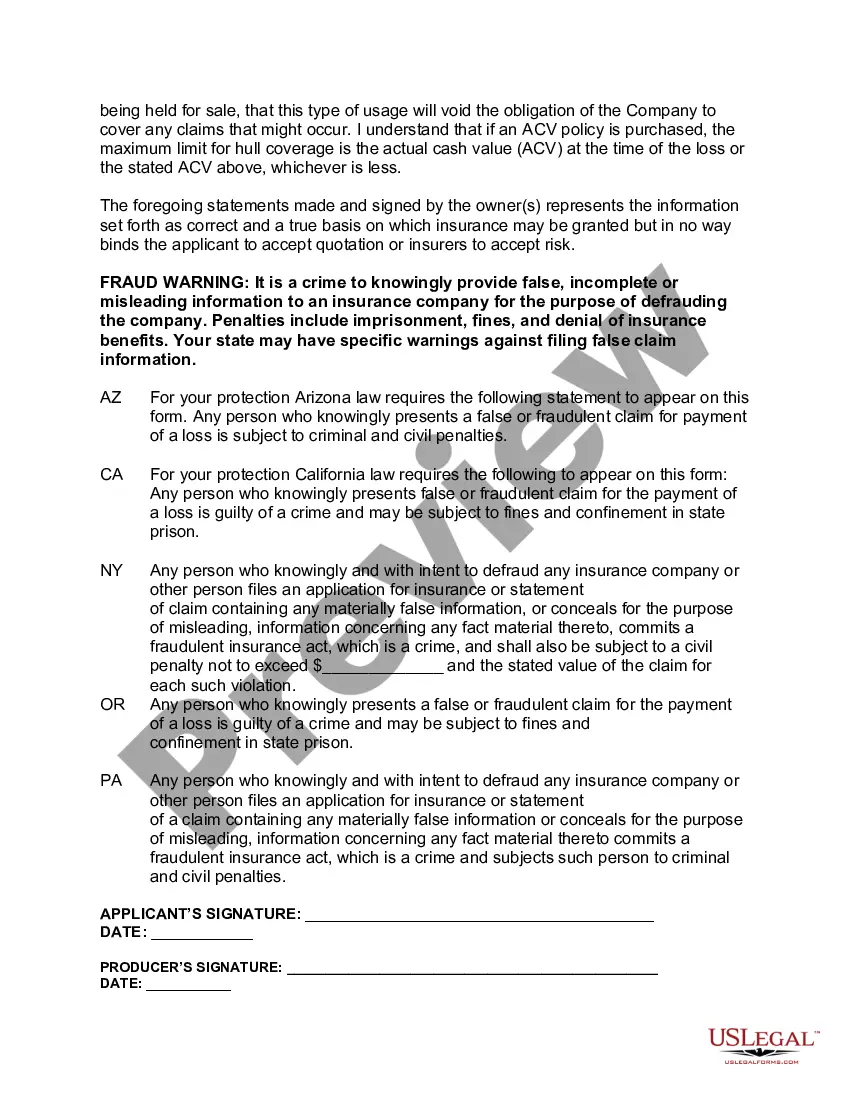

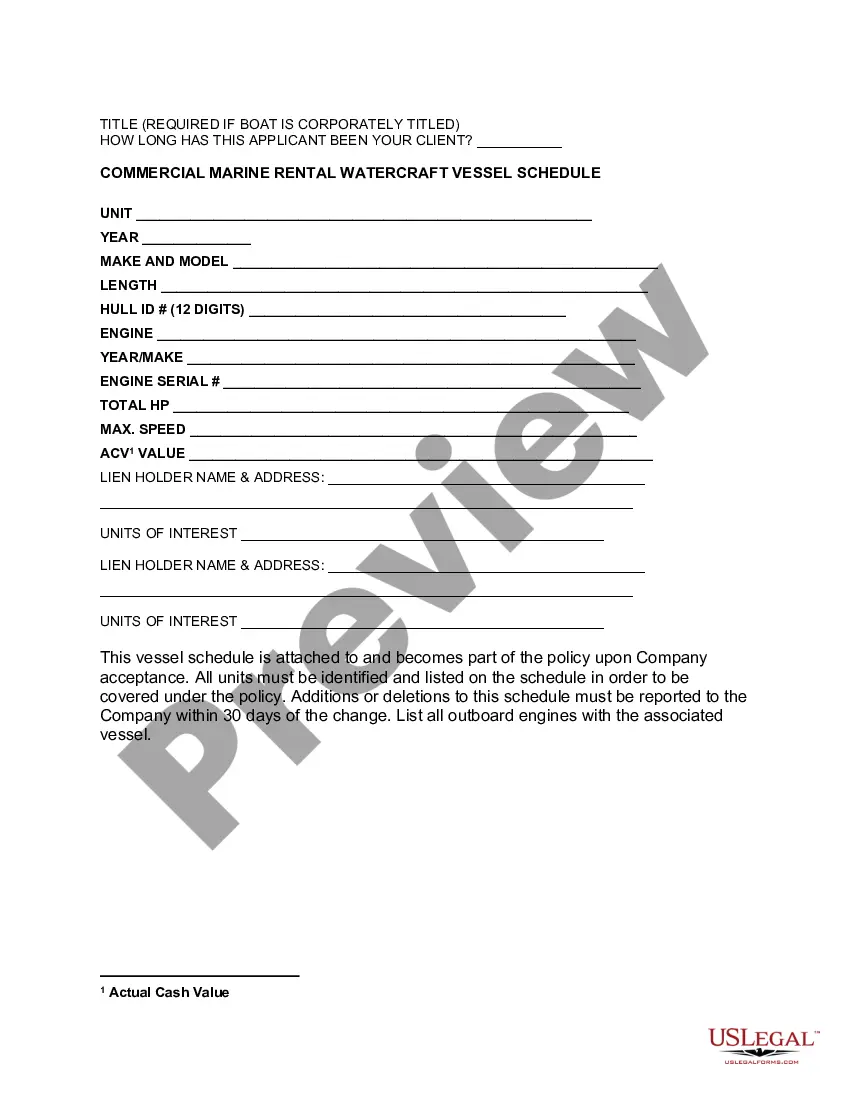

Houston Texas Commercial Watercraft Rental Insurance Application is a comprehensive insurance form that caters specifically to businesses and individuals engaged in commercial watercraft rental services in the Houston, Texas area. This application is designed to protect operators and owners from potential risks and liabilities associated with the operation of watercraft rental businesses. The Houston Texas Commercial Watercraft Rental Insurance Application encompasses various vital pieces of information that insurers require to assess the risk exposure of a rental business accurately. It typically includes details such as the name and contact information of the applicant, the type and size of watercraft involved in the rental operations, the expected number of rentals, and the specific water bodies where the rentals will take place, among other essential information. The application also involves a thorough evaluation of the rental business's safety protocols and risk management practices. This may include asking about the availability and condition of safety equipment on board the watercraft, staff training procedures, emergency response plans, and any additional measures taken to ensure customer safety and satisfaction. Different types of Houston Texas Commercial Watercraft Rental Insurance Applications can exist, depending on the specific coverage needs of the rental business. Some common variations may include: 1. Liability Coverage Application: This form focuses primarily on providing coverage for bodily injury, property damage, or other liabilities that may arise from watercraft rental operations. It covers expenses related to legal disputes, medical costs, and property repairs or replacements. 2. Property Coverage Application: This type of application is more centered around protecting the physical assets of a commercial watercraft rental business. It typically covers damage or loss of watercraft, equipment, and other property used in the rental operations. 3. Rental Income Protection Application: Businesses heavily reliant on rental income may opt for this form of coverage. It safeguards against financial losses in the event of business interruption due to damage, accidents, or unforeseen circumstances that render the rental operations temporarily inoperative. 4. Personal Injury Coverage Application: Designed to protect against lawsuits or claims arising from allegations of personal injury, this type of application focuses on providing coverage for incidents such as wrongful detention, false arrest, libel, slander, or invasion of privacy. Houston Texas Commercial Watercraft Rental Insurance Applications play a crucial role in ensuring that watercraft rental businesses in the area operate with adequate protection against potential risks and liabilities. By acquiring comprehensive coverage through a carefully filled-out application, operators and owners can focus on providing excellent service to customers, knowing that they are well-protected in the face of unforeseen events.

Houston Texas Commercial Watercraft Rental Insurance Application

Description

How to fill out Houston Texas Commercial Watercraft Rental Insurance Application?

Whether you intend to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Houston Commercial Watercraft Rental Insurance Application is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Houston Commercial Watercraft Rental Insurance Application. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Houston Commercial Watercraft Rental Insurance Application in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!