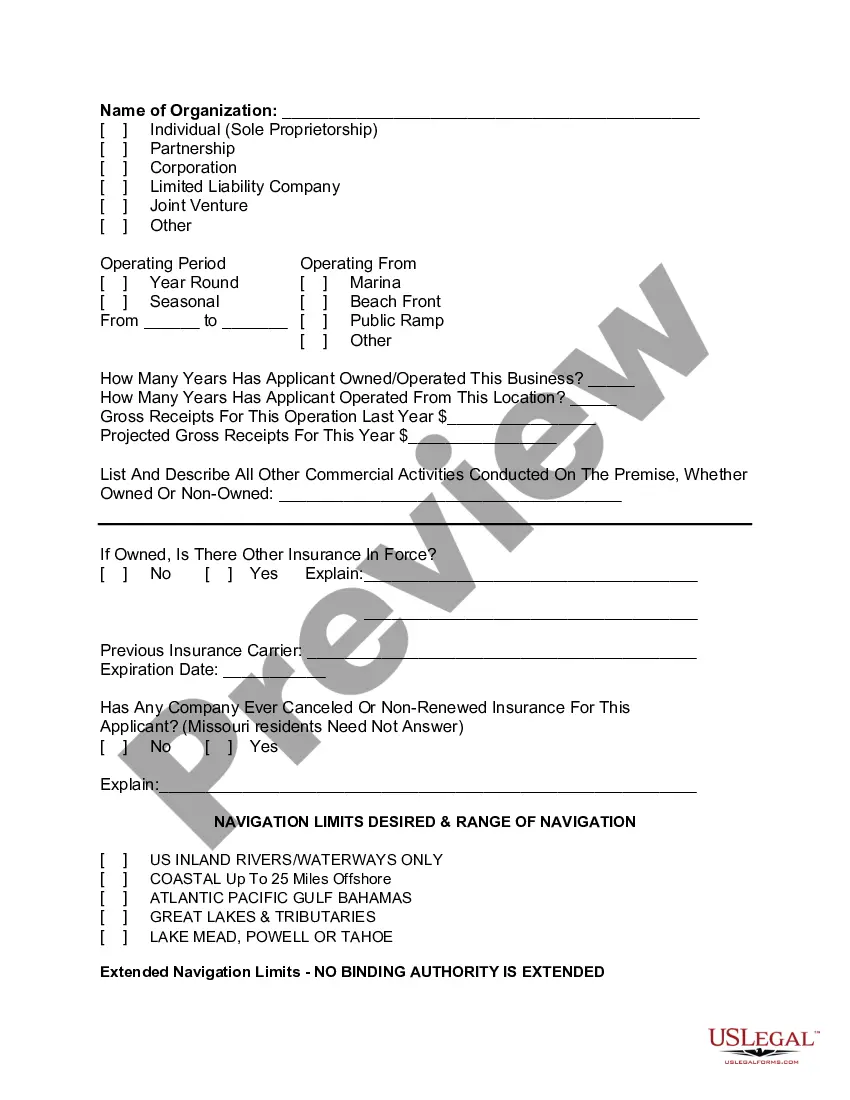

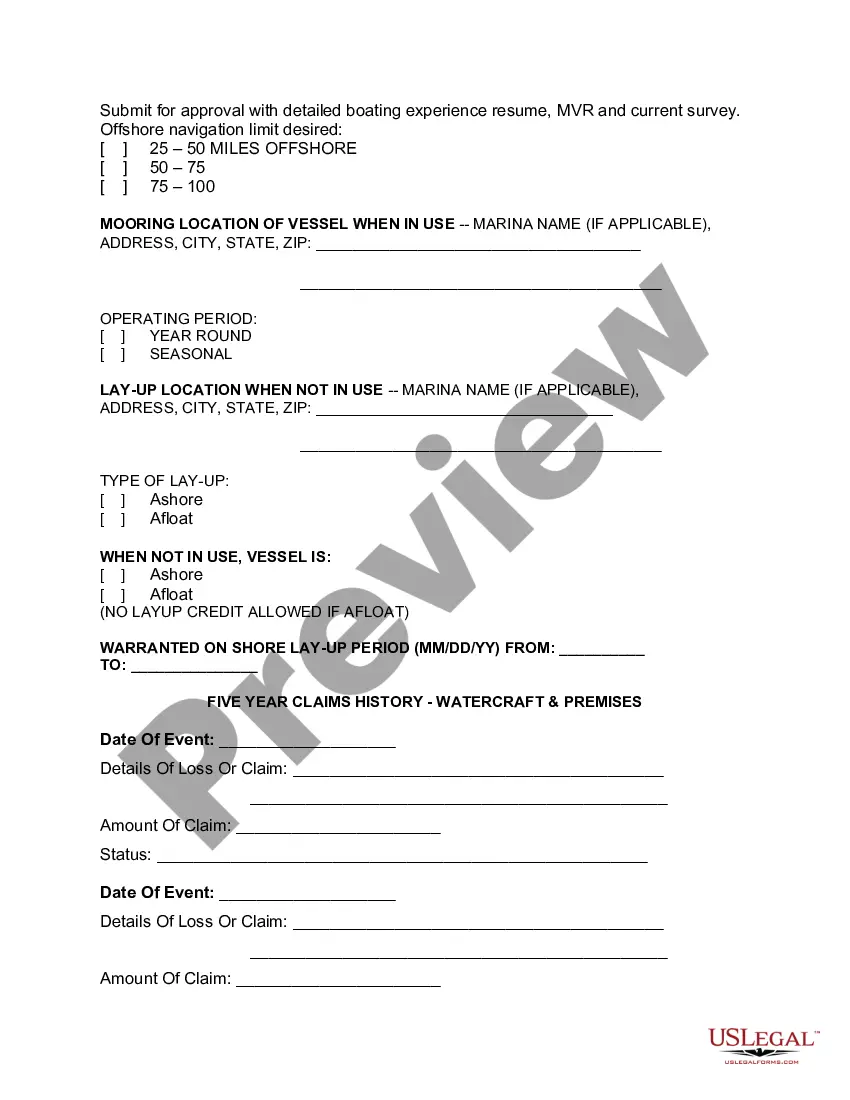

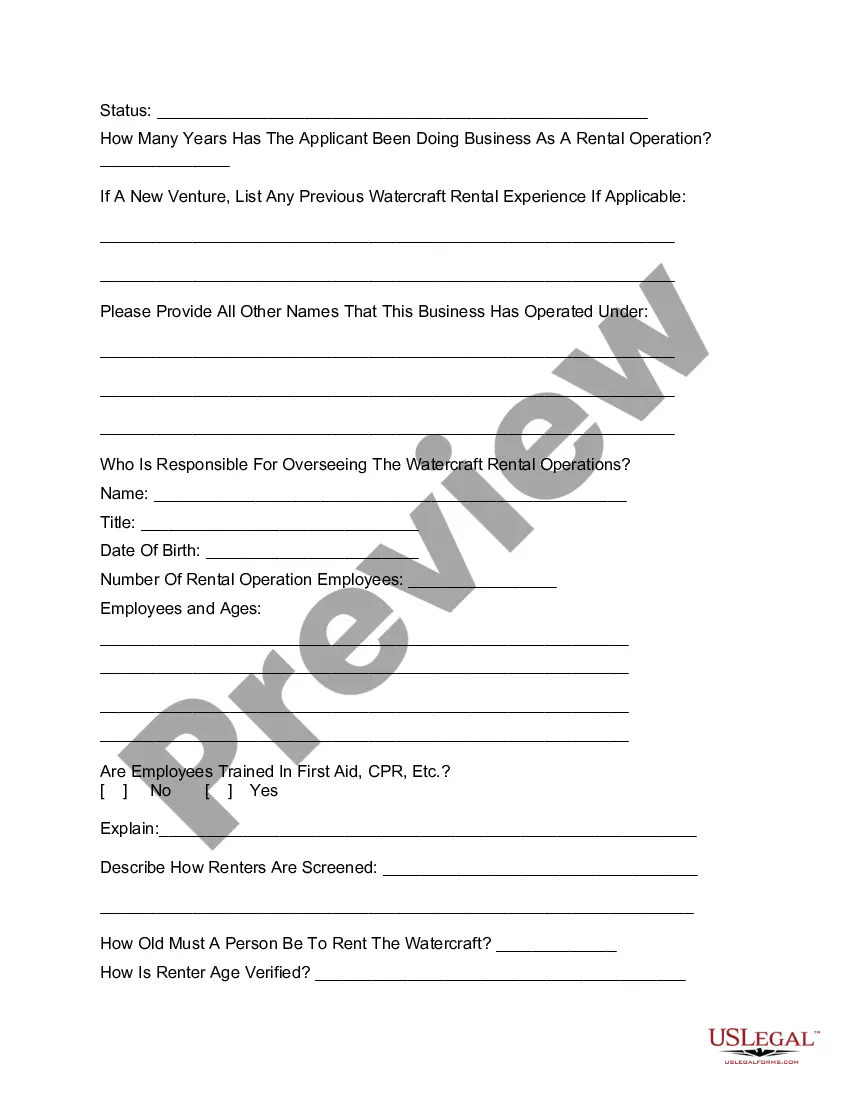

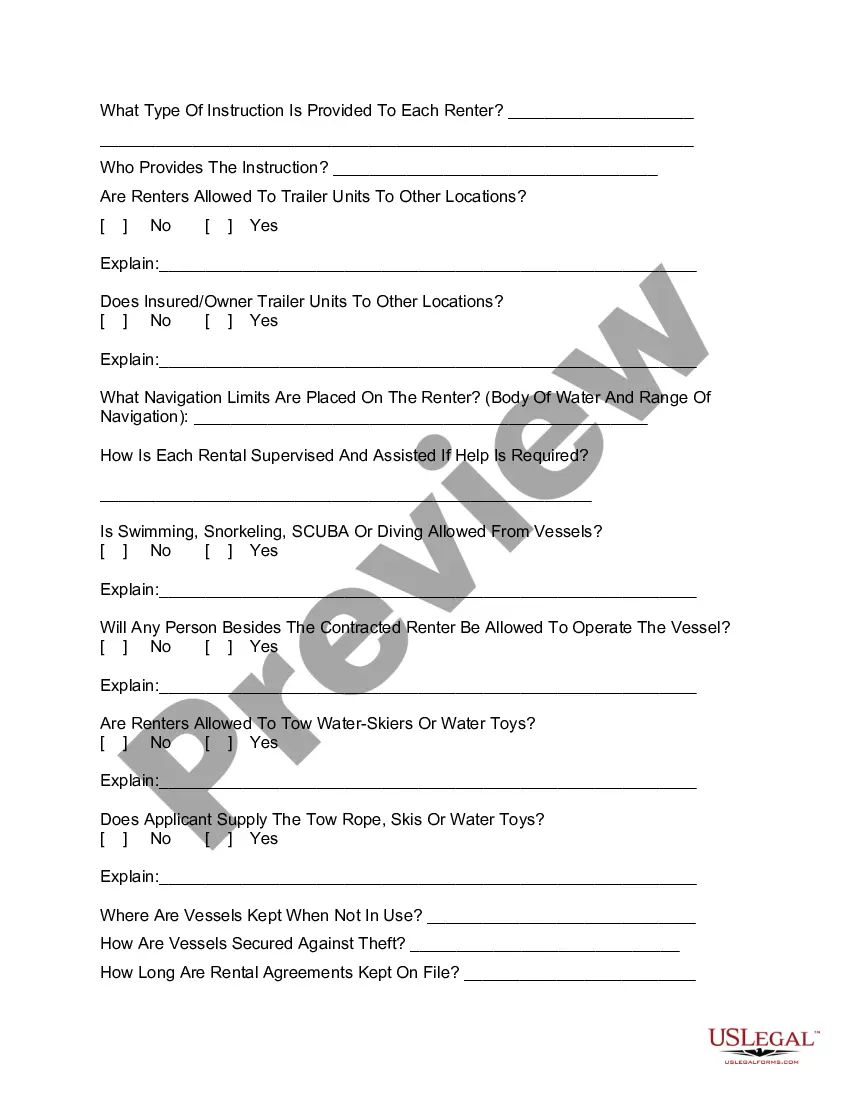

Los Angeles Commercial Watercraft Rental Insurance Application is a comprehensive insurance application specifically designed for businesses that operate in the watercraft rental industry in Los Angeles, California. This insurance policy provides coverage for potential damages, liability, and accidents that may occur during the rental of commercial watercraft. In Los Angeles, there are different types of Commercial Watercraft Rental Insurance Applications available to cater to the specific needs of various businesses. Some of these include: 1. Liability Insurance Application: This type of insurance application focuses on providing coverage for bodily injury or property damage caused by the rental watercraft to third parties. It protects the business owner from legal claims and expenses arising from accidents or losses during the rental period. 2. Property and Equipment Protection Application: This application safeguards the business owner's watercraft and any associated equipment from damages, theft, or vandalism. It covers repairs or replacement costs of the rented watercraft due to covered perils, ensuring business continuity. 3. Business Interruption Insurance Application: In the event of a covered loss that interrupts the rental operations, this application provides coverage for loss of rental income, ongoing expenses, and additional costs required to minimize the business interruption impact. 4. Workers' Compensation Insurance Application: This application offers coverage for employees who may sustain injuries during the course of their work. It pays for medical expenses, lost wages, disability benefits, and rehabilitation costs, avoiding potential legal disputes and claims from employees. 5. Umbrella Liability Insurance Application: This application provides additional liability coverage that goes beyond the limits of other primary policies. It acts as an extra layer of protection in case of high-value claims, ensuring businesses in Los Angeles have ample coverage against unforeseen circumstances. Each insurance application is tailored to the specific requirements of Los Angeles watercraft rental businesses and takes into account varying risk factors, such as the type of watercraft rented, the location of operation, the number of employees, and the projected revenue of the business. To ensure a smooth and successful application process, it is crucial for businesses to provide detailed information about their operations, including the types of watercraft rented, their maintenance protocols, safety measures implemented, and any prior claims' history. Additionally, disclosing accurate financial information helps insurance providers assess the appropriate coverage limits and premiums. Partnering with an experienced insurance agent or broker familiar with the unique challenges faced by watercraft rental businesses in Los Angeles can streamline the application process and help secure the most suitable insurance coverage.

Los Angeles California Commercial Watercraft Rental Insurance Application

Description

How to fill out Los Angeles California Commercial Watercraft Rental Insurance Application?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Los Angeles Commercial Watercraft Rental Insurance Application, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Los Angeles Commercial Watercraft Rental Insurance Application from the My Forms tab.

For new users, it's necessary to make some more steps to get the Los Angeles Commercial Watercraft Rental Insurance Application:

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

GEICO has teamed up with its subsidiary, BoatUS, to bring boaters a policy developed by experts, with the great service you expect from GEICO. Policies are underwritten by GEICO Marine Insurance Company.

The average annual cost of PWC coverage can cost anywhere from $150 to $500 per year for a typical plan.

Commercial insurance can protect you from some of the most common losses experienced by business owners such as property damage, business interruption, theft, liability, and worker injury.

What Isn't Covered by Business Insurance? Losses from certain types of natural disasters, floods and other major weather events may not be covered by standard commercial property insurance policies. The same applies for customers' property that is stored at your business.

Commercial property insurance, which helps protect your company's owned or rented building and equipment used to operate. Commercial general liability insurance helps cover claims that your company caused bodily injury or property damage to someone else.

How Commercial Insurance Works. Commercial insurance is typically a one-year contract that agrees to assume your business liabilities for a negotiated amount of money at the beginning of a policy term. This amount is generally determined by the amount of property you own or the liabilities you are exposed to.

Commercial insurance, also known as business insurance, financially protects your business from common risks such as client lawsuits, customer or employee injuries, property theft and damage, as well as other unexpected events.

Commercial insurance protects companies and their assets in case of lawsuits, natural disasters, theft, auto accidents and other shocks. Commercial insurance and business insurance are interchangeable terms for the same types of coverage.

Commercial health insurance, also called private health insurance, is coverage issued by a private company or entity. It is not from government-issued insurance like Medicare or Medicaid. Commercial health insurance companies include: Aetna.

BoatUS acquired TowBoatUS, formerly Vessel Assist, in 2003. The towing service was rebranded and relaunched as TowBoatUS in 2015. The BoatUS towing service reportedly has 540,000 members nationwide, 603 towboats in its fleet, 305 locations nationwide and 70,297 annual requests for towing services.