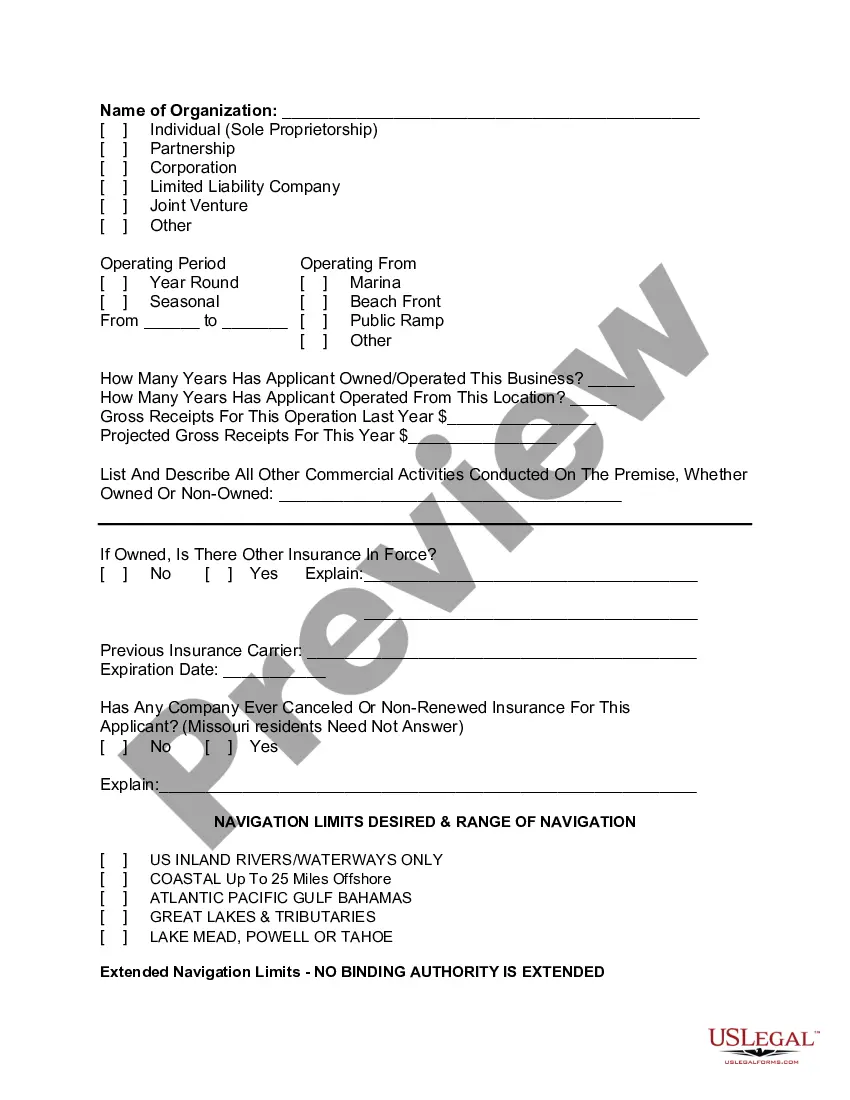

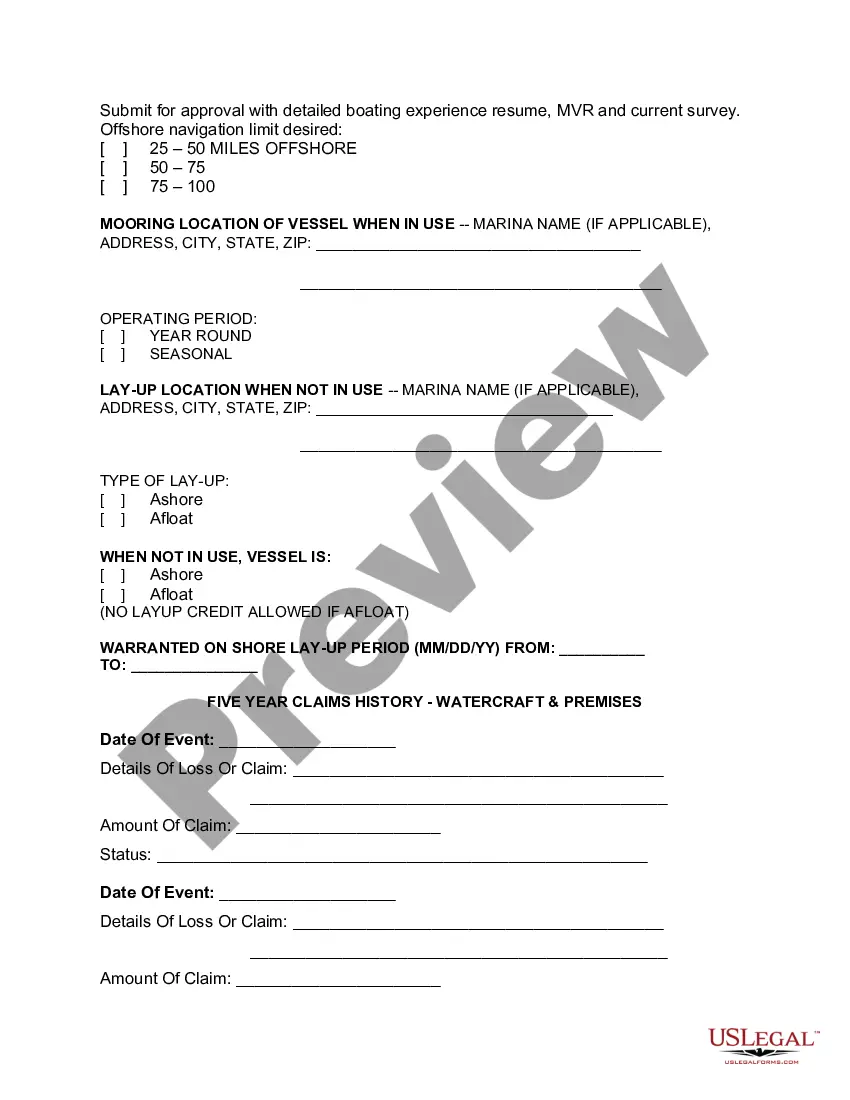

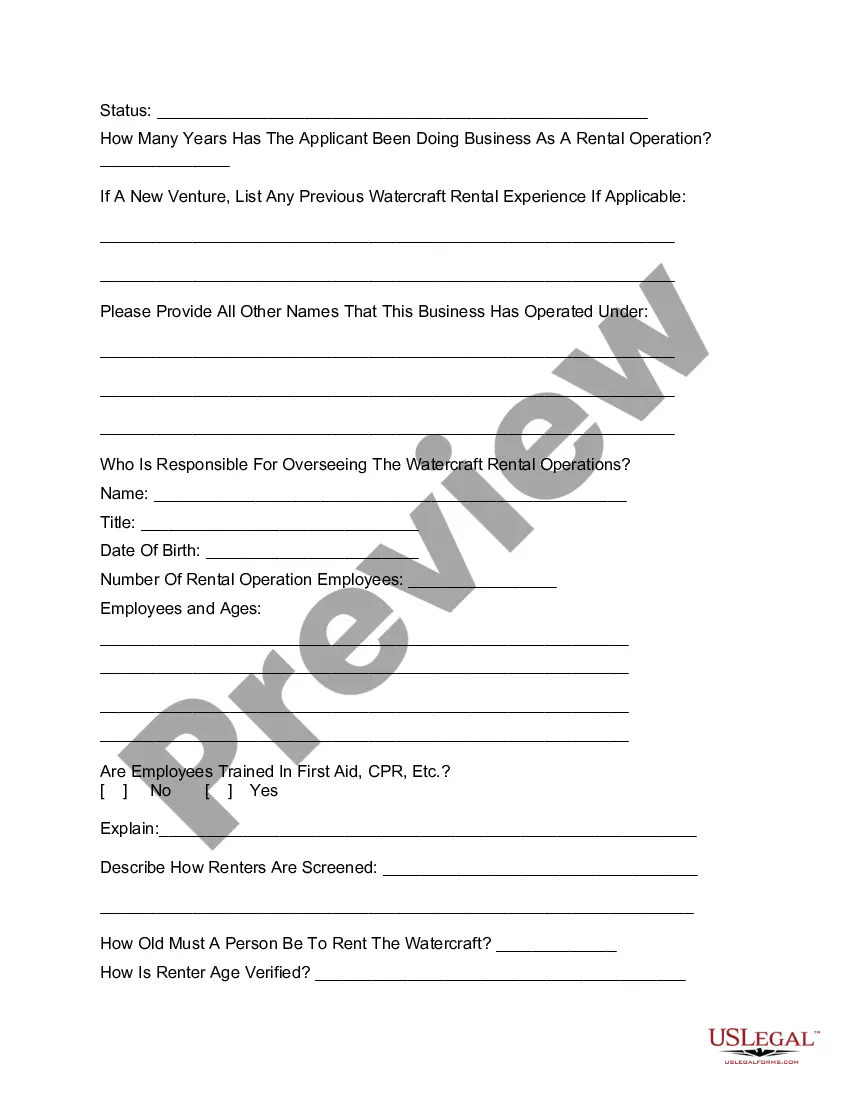

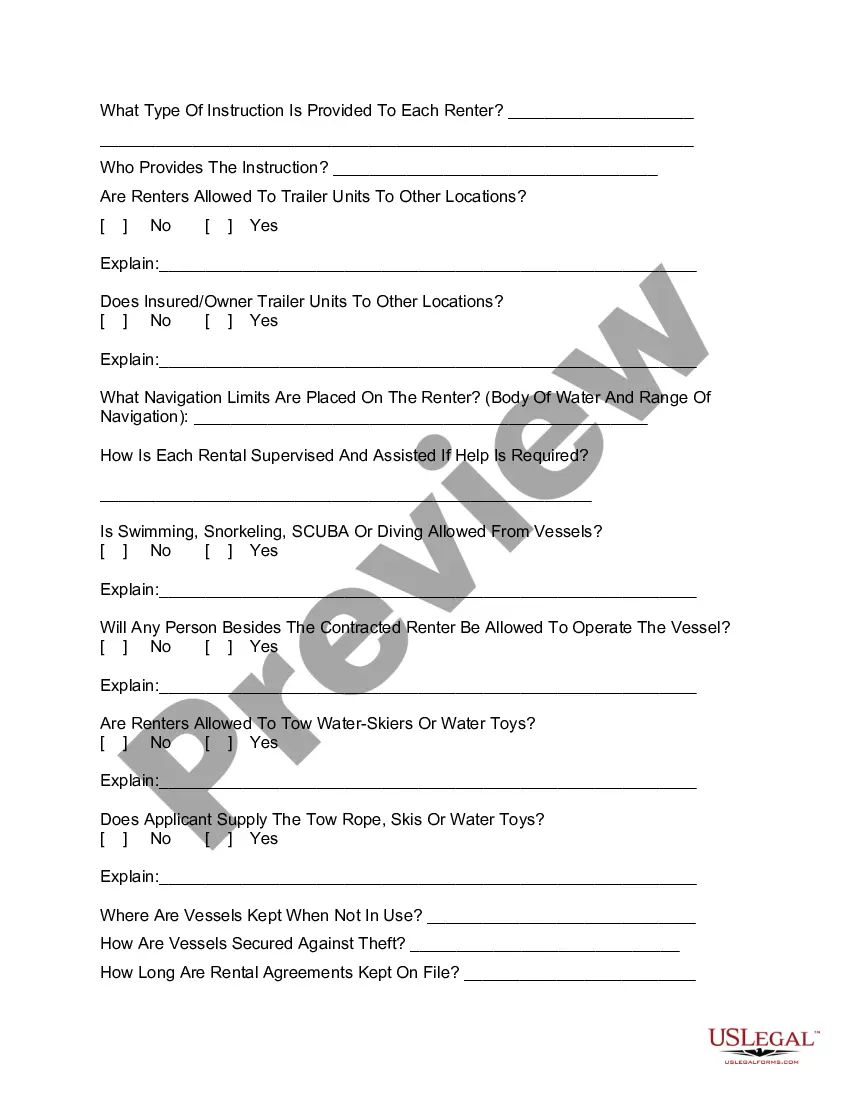

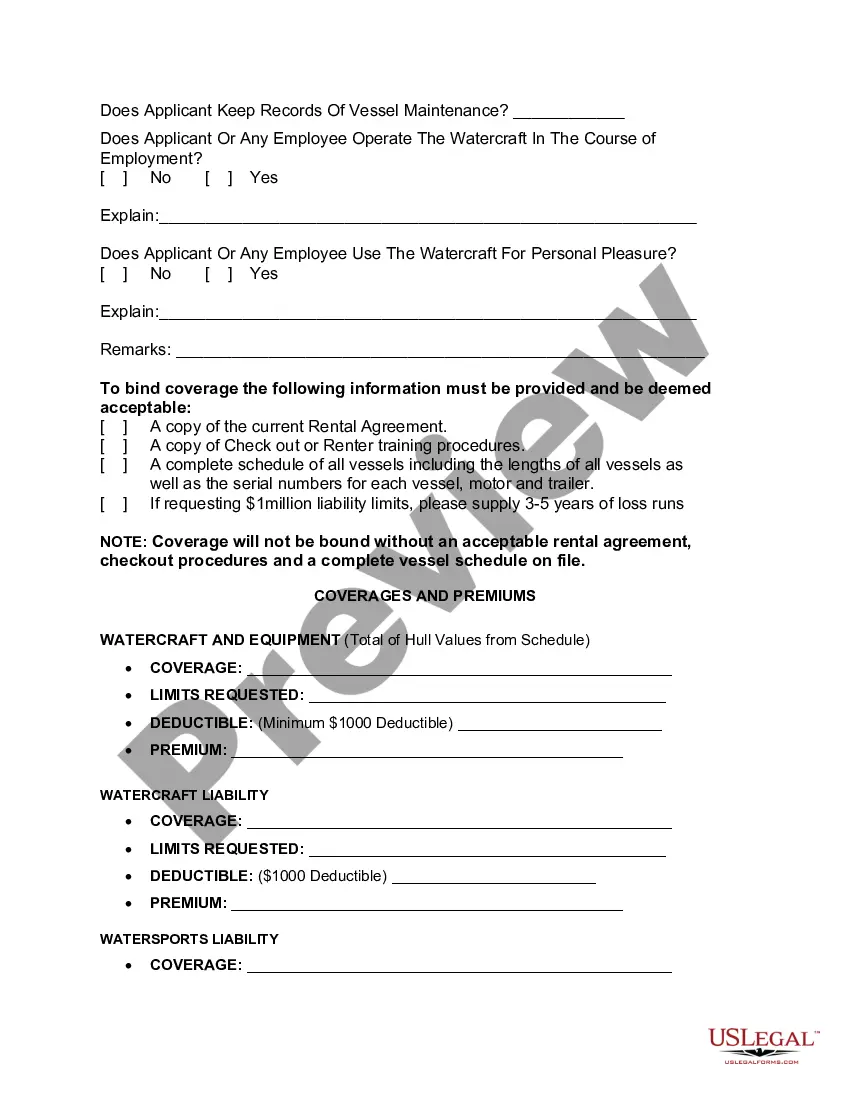

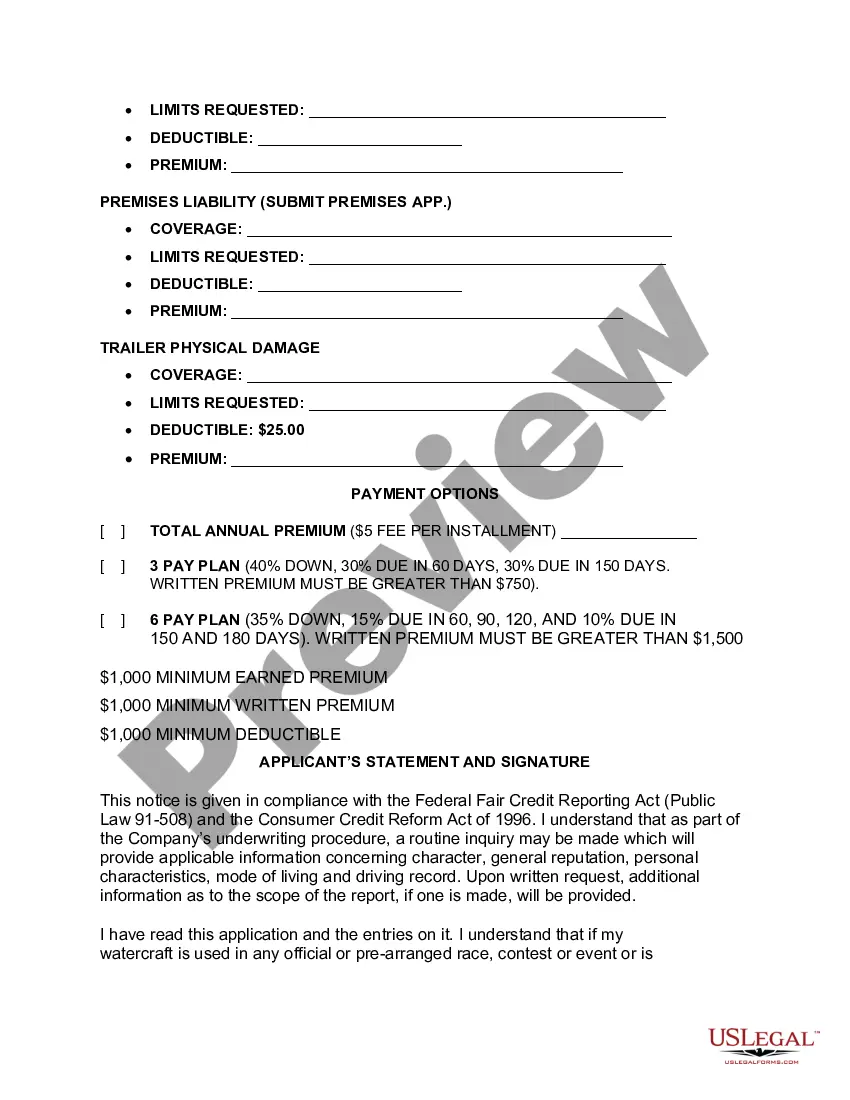

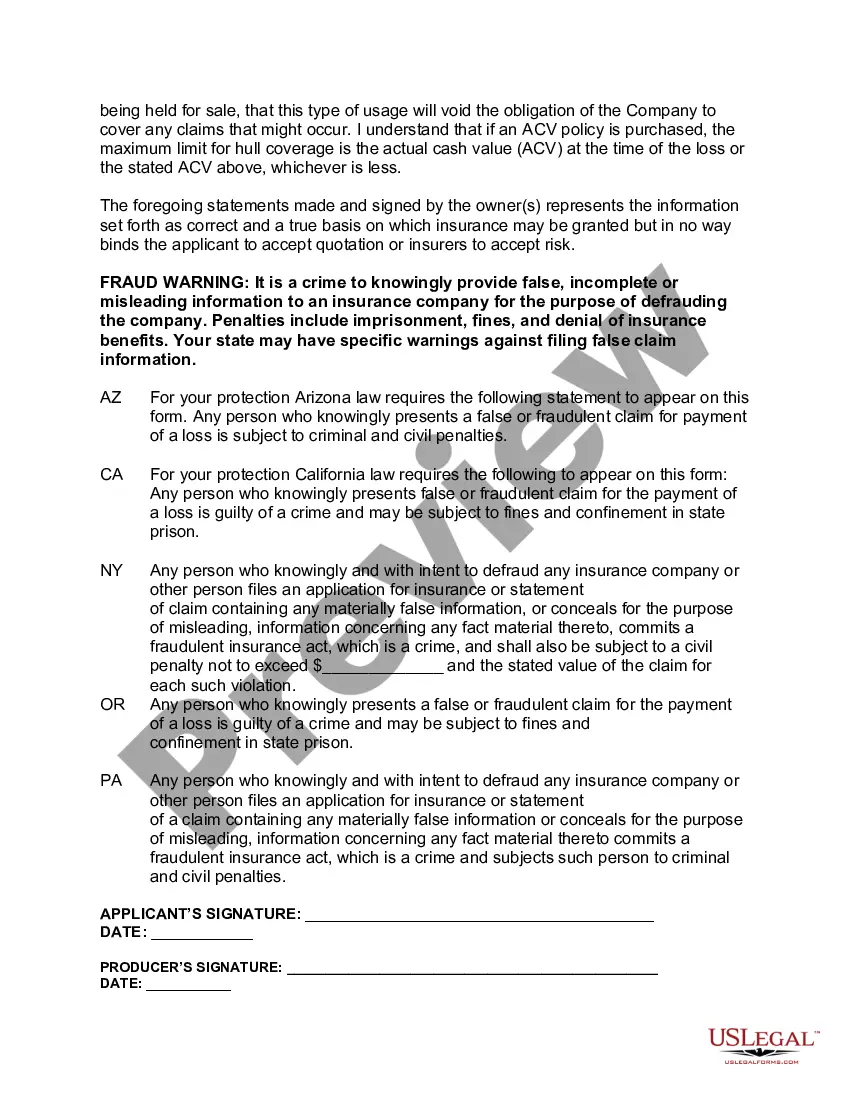

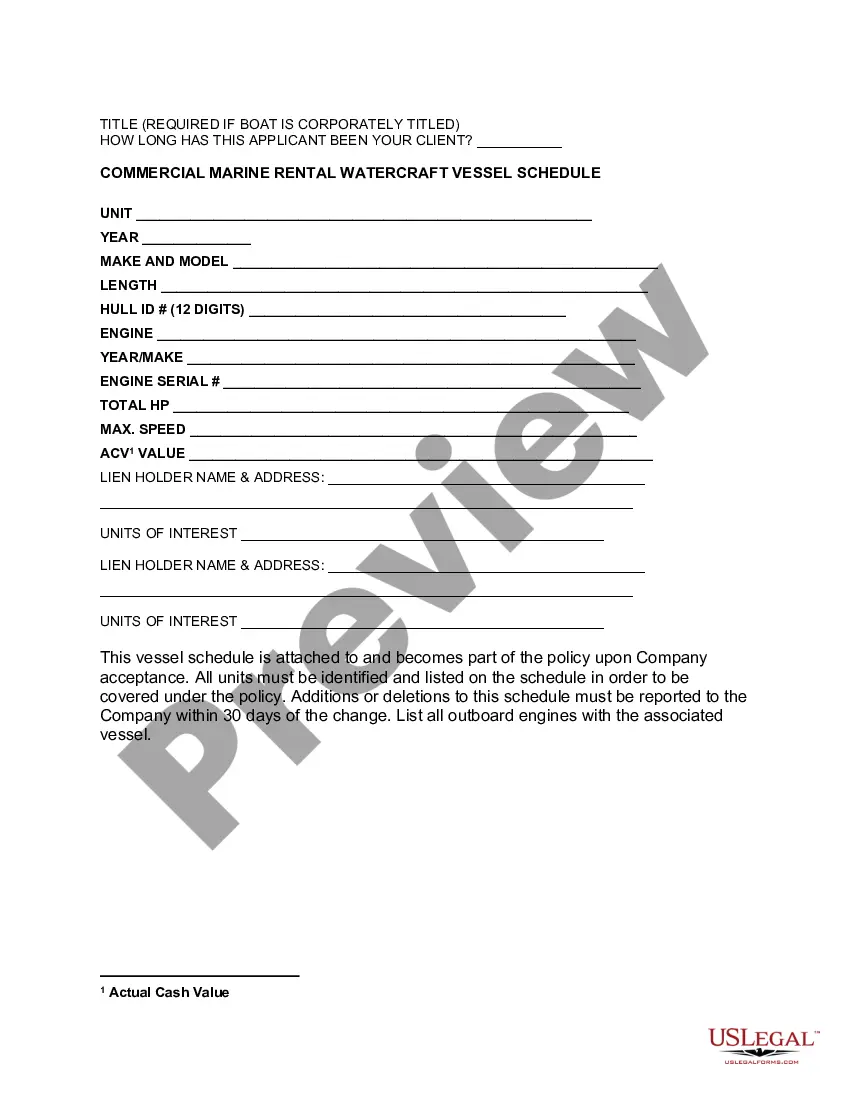

San Antonio Texas Commercial Watercraft Rental Insurance Application is a comprehensive insurance application specifically designed for businesses involved in renting watercraft, such as boats, jet skis, and yachts, in the San Antonio area. Commercial watercraft rental businesses require specialized insurance coverage to protect themselves against various risks and liabilities associated with renting out watercraft. This insurance application provides the necessary coverage options for these businesses to operate safely and securely. Key features of San Antonio Texas Commercial Watercraft Rental Insurance Application include: 1. Liability Coverage: This type of insurance protects the rental business against third-party claims for bodily injury or property damage caused by the watercraft. It covers legal defense costs and settlement expenses, providing financial security in case of accidents or incidents. 2. Physical Damage Coverage: This coverage protects the watercraft rental business against damage to their own boats or equipment, including repairs or replacements due to accidents, vandalism, or natural disasters. It ensures that the rental business can continue operations without significant financial setbacks. 3. Personal Injury Coverage: This coverage protects the business in case a renter or third party files a claim for injuries due to negligence or wrongdoing on the part of the rental business. It covers medical expenses, legal defense costs, and settlements related to personal injury claims. 4. Rental Income Protection: In the event of a covered loss or damage to the watercraft, this coverage provides reimbursement for lost rental income. It helps the business to continue operating and recover lost revenues during repair or replacement periods. 5. Equipment and Contents Coverage: This coverage includes protection for equipment or personal property owned by the rental business and used in the rental operations. It offers financial assistance for repair or replacement of items damaged or stolen. 6. Additional Insured Coverage: This type of coverage allows the watercraft rental business to extend liability protection to other parties, such as marinas, vendors, or event organizers, with whom they collaborate. It provides comprehensive coverage for all involved entities. Some variations or types of San Antonio Texas Commercial Watercraft Rental Insurance Applications may include specific policies for different watercraft types like boats, jet skis, or yachts. Other variations could be based on the size of the rental operation or the specific needs of the business. Overall, San Antonio Texas Commercial Watercraft Rental Insurance Application offers vital protection for rental businesses in the San Antonio area, safeguarding them against potential liabilities and financial losses associated with their operations.

San Antonio Texas Commercial Watercraft Rental Insurance Application

Description

How to fill out San Antonio Texas Commercial Watercraft Rental Insurance Application?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the San Antonio Commercial Watercraft Rental Insurance Application, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the San Antonio Commercial Watercraft Rental Insurance Application from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the San Antonio Commercial Watercraft Rental Insurance Application:

- Analyze the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!