A Dallas Texas Judgment Foreclosing Mortgage and Ordering Sale is a legal process that occurs when a court orders the foreclosure of a property due to the borrower's default on their mortgage payments. This judgment enables the lender to initiate proceedings to sell the property in order to recover the outstanding debt. In Dallas, Texas, there are two primary types of judgment foreclosing mortgage and ordering sale. Firstly, there is a judicial foreclosure, which involves the lender filing a lawsuit against the borrower, requesting the court to grant a judgment for foreclosure. The court then examines the evidence, evaluates the default, and orders the sale of the property through a public auction. The second type is non-judicial foreclosure, also known as a power of sale foreclosure. This type of foreclosure allows the lender to initiate the process without involving the court system. Instead, the lender follows a pre-established procedure outlined in the mortgage contract and state laws. Non-judicial foreclosure typically involves the lender providing notice to the borrower, advertising the property for sale, and conducting an auction to sell the property. When a property goes through a Dallas Texas Judgment Foreclosing Mortgage and Ordering Sale, it is essential to have a clear understanding of the process and its implications. The foreclosure process can be complex and highly regulated, requiring compliance with specific timelines, notice requirements, and documentation. It is crucial for both borrowers and lenders to seek legal advice to navigate through the process effectively. To protect their interests, borrowers should be aware of their rights and options when facing a mortgage foreclosure. They may explore alternatives such as loan modification, repayment plans, or filing for bankruptcy to halt the foreclosure proceedings. Lenders, on the other hand, need to ensure they follow all legal requirements and procedures during the foreclosure process. This includes providing proper notice to the borrower, adhering to timelines, and accurately documenting each step taken. Additionally, lenders should be prepared for potential challenges, such as legal defenses raised by borrowers, bankruptcy filings, or other obstacles that may hinder the foreclosure sale. In conclusion, a Dallas Texas Judgment Foreclosing Mortgage and Ordering Sale is a legal process involving the foreclosure of a property due to the borrower's delinquency in mortgage payments. Understanding the different types of foreclosure processes, such as judicial and non-judicial foreclosures, is crucial for both borrowers and lenders to navigate through the complex and regulated foreclosure system successfully. Seeking legal counsel is strongly advised to ensure compliance with all regulations and protect the interests of all parties involved.

Dallas Texas Judgment Foreclosing Mortgage and Ordering Sale

Description

How to fill out Dallas Texas Judgment Foreclosing Mortgage And Ordering Sale?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

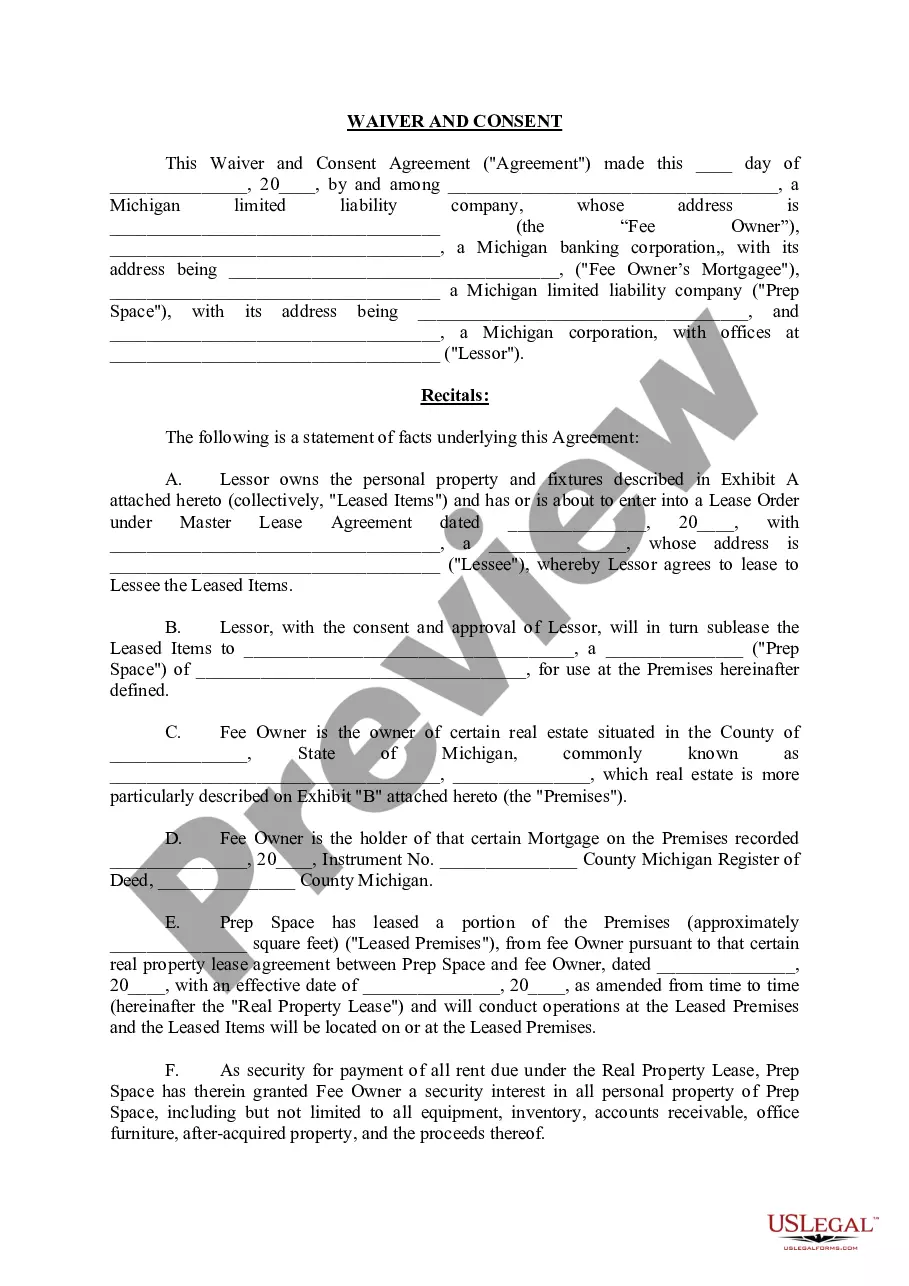

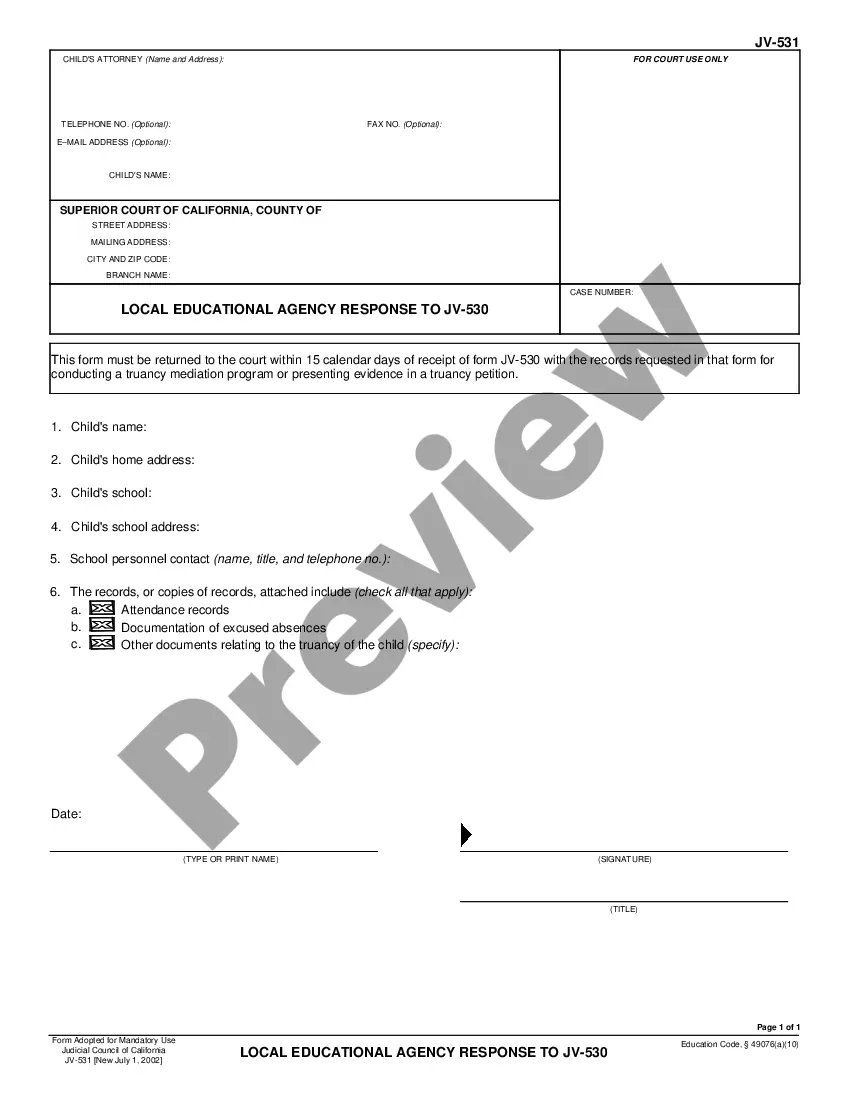

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the Dallas Judgment Foreclosing Mortgage and Ordering Sale.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Dallas Judgment Foreclosing Mortgage and Ordering Sale will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the Dallas Judgment Foreclosing Mortgage and Ordering Sale:

- Ensure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Dallas Judgment Foreclosing Mortgage and Ordering Sale on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

The process may take as little as 41 days, depending on the timing between mailing the required notices and the actual foreclosure date. All foreclosure sales in Texas occur on the first Tuesday of the month between 10 a.m. and 4 p.m. The commissioner's court designates the loca- tion.

A judicial foreclosure requires the lienholder to file a civil lawsuit against the homeowner. They must obtain a judgment from the court before they are allowed to sell the property. This procedure is rare in Texas. See Rule 309 of the Texas Rules of Civil Procedure for the court rule governing judicial foreclosures.

In general, mortgage companies start foreclosure processes about 3-6 months after the first missed mortgage payment. Late fees are charged after 10-15 days, however, most mortgage companies recognize that homeowners may be facing short-term financial hardships.

To recover surplus money from a foreclosure sale, claimants must act quickly. There will be a limited window for you to recover the funds. You'll also need to provide proof of prior ownership to the trustee or the court. You may also have to complete and submit a claim form and/or attend a court hearing.

Foreclosure sales are generally held the first Tuesday of each month between a.m. and p.m. at the county courthouse. The sale must begin at the time stated in the notice of sale, but no later than three hours after the time scheduled on the notice of sale. (Tex. Prop.

Surplus funds, also referred to as overage or excess funds, are the funds remaining after a mortgage is paid through the final judgment of a foreclosure auction. The trustee appointed in the foreclosure auction is responsible for disbursing the funds without charging additional fees.

(12 C.F.R. § 1024.41). This 120-day preforeclosure period provides most homeowners with ample opportunity to submit a loss mitigation application to the servicer.

Distribution of Excess Funds After the foreclosure sale, if the property sells for a higher price than what is owed, the excess funds would then be used to pay off any additional liens that may be on the property.

Most loans from a bank must be 120 days delinquent before any foreclosure activity starts. However, smaller lenders can sometimes start foreclosure even if you are only 1 day late. The lender is only required to send you two notices before a foreclosure sale.

Texas is a combination of a judicial and non-judicial foreclosure state; in short it allows for non-judicial foreclosures but ONLY if the lender or lienholder has a deed of trust as stated previously. Without a deed of trust the lender must obtain a court order to proceed with the foreclosure sale.