Hennepin County, located in Minnesota, operates a legal procedure known as "Judgment Foreclosing Mortgage and Ordering Sale." This process is designed to resolve mortgage delinquencies and enforce the repayment of outstanding home loans through the sale of the property. In a Hennepin Minnesota Judgment Foreclosing Mortgage and Ordering Sale, the lender, typically a mortgage company or bank, initiates a lawsuit against the borrower who has failed to make regular mortgage payments. This legal action aims to obtain a judgment against the borrower, allowing the lender to foreclose on the property and sell it to recover the outstanding debt. The process begins when the lender files a complaint in the Hennepin County District Court, asserting its right to foreclose due to the borrower's default. The court will review the complaint and, if deemed valid, issue a judgment in favor of the lender. This judgment grants the lender the authority to foreclose on the property and order its sale to generate funds for loan repayment. Once the judgment is obtained, the lender must follow specific legal procedures to foreclose on the property. This may include publishing notices of the foreclosure sale, providing information about the sale to interested parties, and holding an auction. The sale typically takes place at the Hennepin County Sheriff's Office or an appointed venue. There are different types or stages within the process of Hennepin Minnesota Judgment Foreclosing Mortgage and Ordering Sale: 1. Pre-Foreclosure: During this period, the borrower receives notifications and opportunities to pay the outstanding mortgage debt, settle the case, or seek legal assistance. 2. Default Judgment: If the borrower fails to respond to the lender's complaint or does not successfully defend their case, the court may issue a default judgment. This judgment grants the lender the power to foreclose and order the sale of the property. 3. Redemption Period: Minnesota law allows a post-judgment redemption period, which provides the borrower with an opportunity to reclaim the property by paying the outstanding debt, interest, and other associated fees. The length of this period varies depending on the circumstances and can range from six months to one year. 4. Sheriff's Sale: If the borrower does not redeem the property within the given timeframe, the lender proceeds with the sale. The sheriff's sale is conducted through a public auction where interested buyers can bid on the property. The highest bidder becomes the new owner of the foreclosed property. It is crucial for borrowers facing a Hennepin Minnesota Judgment Foreclosing Mortgage and Ordering Sale to seek legal advice from professionals specializing in foreclosure laws and procedures. Consulting with an attorney can help borrowers explore alternative options, negotiate with lenders, and potentially avoid foreclosure altogether.

Hennepin Minnesota Judgment Foreclosing Mortgage and Ordering Sale

Description

How to fill out Hennepin Minnesota Judgment Foreclosing Mortgage And Ordering Sale?

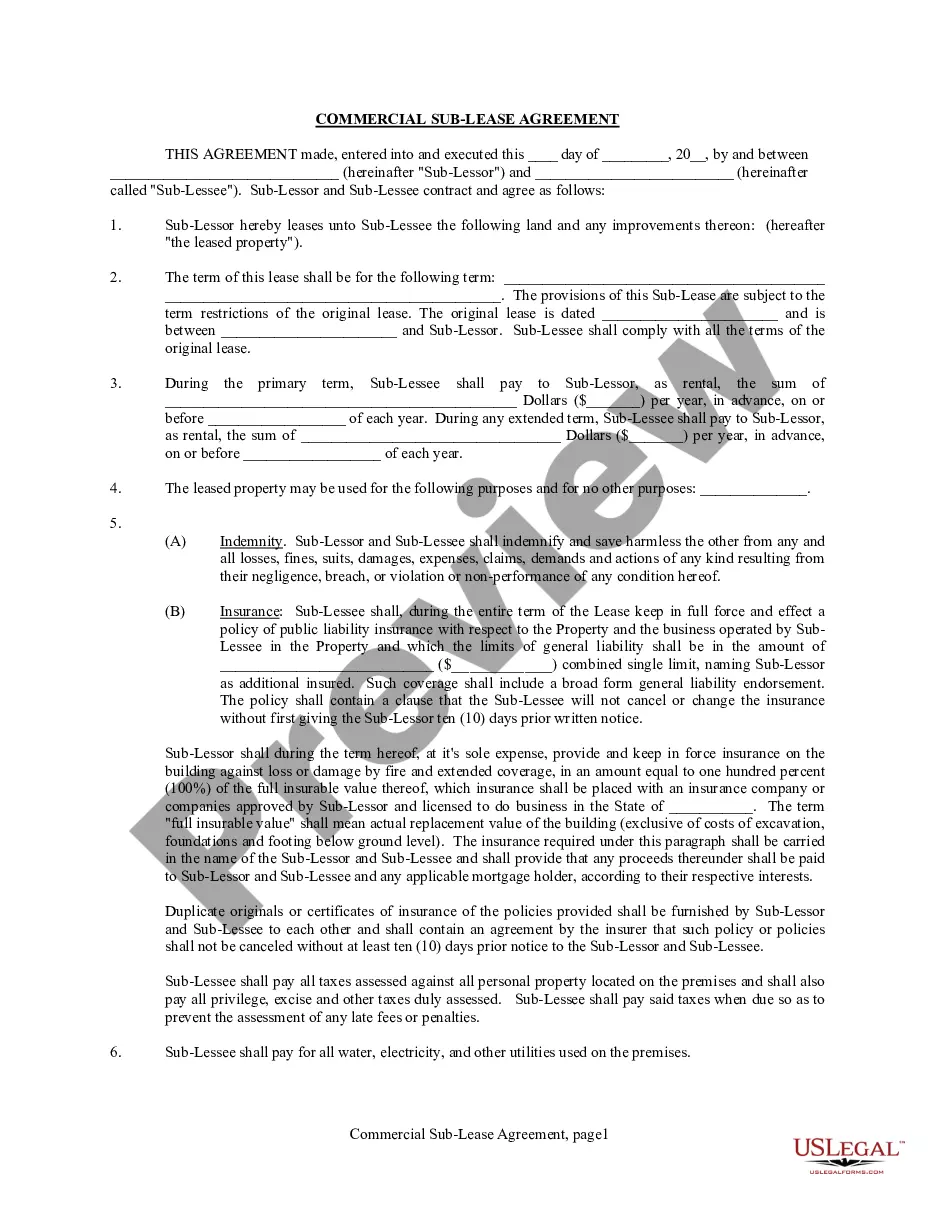

Are you looking to quickly draft a legally-binding Hennepin Judgment Foreclosing Mortgage and Ordering Sale or probably any other form to take control of your own or corporate affairs? You can go with two options: hire a professional to draft a legal paper for you or draft it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you get neatly written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-compliant form templates, including Hennepin Judgment Foreclosing Mortgage and Ordering Sale and form packages. We offer templates for an array of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, double-check if the Hennepin Judgment Foreclosing Mortgage and Ordering Sale is adapted to your state's or county's regulations.

- In case the document comes with a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were seeking by using the search box in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Hennepin Judgment Foreclosing Mortgage and Ordering Sale template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the documents we provide are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!