Maricopa County, Arizona, is a diverse and bustling area known for its stunning desert landscapes, vibrant culture, and growing population. Within this county, a Maricopa Arizona Judgment Foreclosing Mortgage and Ordering Sale is a legal process that occurs when a property owner defaults on their mortgage loan, leading to a foreclosure lawsuit and subsequent sale of the property. In a Maricopa Arizona Judgment Foreclosing Mortgage and Ordering Sale proceeding, the lender files a lawsuit against the borrower to reclaim the property due to non-payment or breach of the mortgage agreement. This legal action typically starts with a complaint filed in the Maricopa County Superior Court and outlines the details of the mortgage agreement, the amount owed, and the borrower's default. Throughout the litigation process, various steps may occur: 1. Summons and Complaint: The lender initiates the lawsuit by serving the borrower with a summons and complaint, notifying them of the legal action and demanding repayment of the outstanding debt. 2. Responses: The borrower has a specific timeframe to respond to the complaint. They may choose to defend themselves, negotiate a settlement, or contest the lender's claims. 3. Court Proceedings: If necessary, the case proceeds to court, where the judge reviews the evidence, examines any defenses raised by the borrower, and makes a decision based on the applicable laws. 4. Judgment: If the court finds in favor of the lender, a judgment is issued against the borrower. The judgment states the amount owed, provides a deadline for payment, and grants the lender the right to foreclose on the property if the debt remains unpaid. 5. Foreclosure Sale: If the borrower fails to satisfy the judgment within the specified timeframe, the lender can proceed with a foreclosure sale. This involves listing the property for sale to the public, generally through a public auction or trustee sale, to recoup the outstanding debt. It's important to note that there are no specific variations or types of Maricopa Arizona Judgment Foreclosing Mortgage and Ordering Sale. However, the process can differ based on the unique circumstances of each case, such as the type of mortgage (e.g., conventional, FHA, VA), the presence of additional liens on the property, or any applicable state or federal laws impacting foreclosure procedures. In conclusion, a Maricopa Arizona Judgment Foreclosing Mortgage and Ordering Sale is a legal process that occurs when a property owner defaults on their mortgage loan in Maricopa County. It involves a lawsuit filed by the lender, court proceedings, and eventual foreclosure sale if the debt remains unpaid.

Maricopa Arizona Judgment Foreclosing Mortgage and Ordering Sale

Description

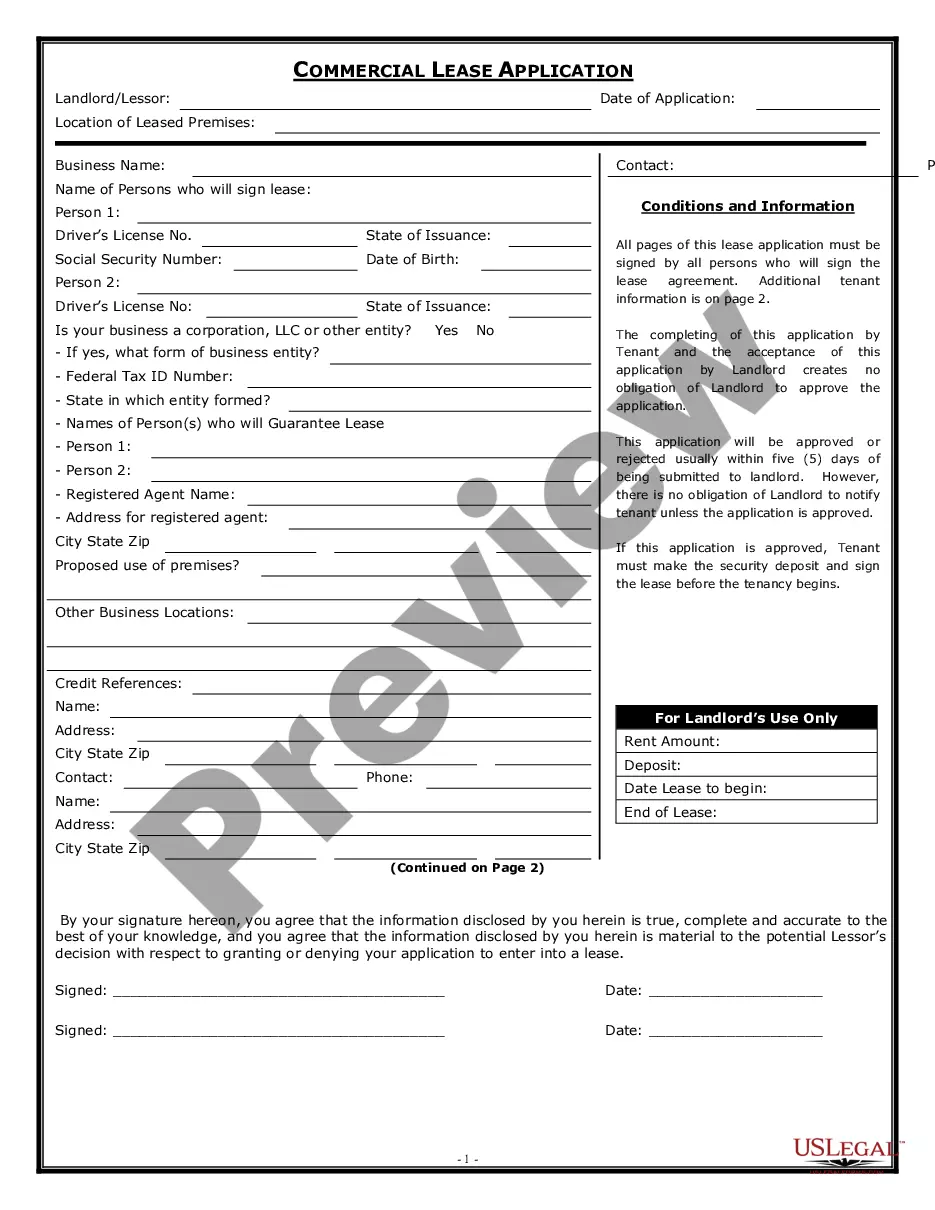

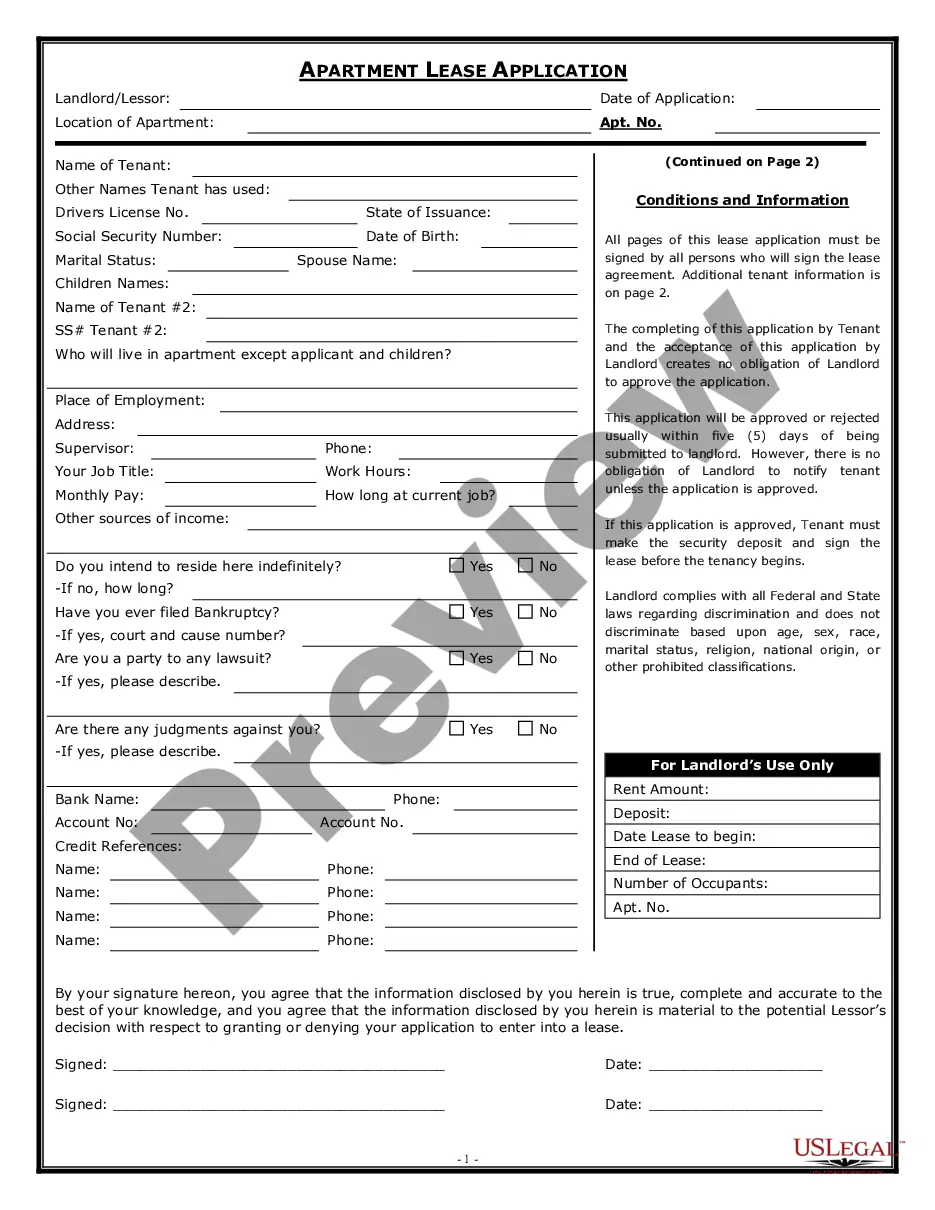

How to fill out Maricopa Arizona Judgment Foreclosing Mortgage And Ordering Sale?

If you need to get a reliable legal form supplier to obtain the Maricopa Judgment Foreclosing Mortgage and Ordering Sale, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can select from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support make it easy to find and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to look for or browse Maricopa Judgment Foreclosing Mortgage and Ordering Sale, either by a keyword or by the state/county the document is created for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Maricopa Judgment Foreclosing Mortgage and Ordering Sale template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and select a subscription option. The template will be instantly available for download once the payment is completed. Now you can complete the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate contract, or execute the Maricopa Judgment Foreclosing Mortgage and Ordering Sale - all from the convenience of your sofa.

Join US Legal Forms now!