Montgomery Maryland Judgment Foreclosing Mortgage and Ordering Sale is a legal process utilized to enforce a judgment against a property owner who has failed to meet their mortgage obligations. This process results in the sale of the property to satisfy the outstanding debt. In Montgomery County, Maryland, there are two primary types of judgment foreclosure processes: strict foreclosure and foreclosure by sale. Strict Foreclosure: This type of foreclosure process allows the lender to obtain the property title without a public auction or sale. The court sets a specific time period within which the borrower must pay the outstanding mortgage debt. If the borrower fails to meet this deadline, ownership of the property is transferred to the lender, thus satisfying the debt. Foreclosure by Sale: Unlike strict foreclosure, foreclosure by sale involves the sale of the property at a public auction. Once a judgment has been obtained against the borrower, the court authorizes the sale of the property to repay the mortgage debt. Interested parties, such as potential buyers or investors, can participate in the auction by placing bids to purchase the property. The property is typically sold to the highest bidder, and the proceeds are used to settle the debt owed. In both types of Montgomery Maryland Judgment Foreclosing Mortgage and Ordering Sale, the property owner is provided with notice of the foreclosure proceedings and an opportunity to contest the judgment or negotiate a resolution. It is important for property owners facing foreclosure to seek legal advice to understand their rights and available options. Additionally, during the foreclosure process, the court may appoint a trustee to oversee the sale and distribution of the proceeds among various lien holders. This ensures that all parties with a legal interest in the property, such as other creditors or lien holders, are appropriately compensated. Montgomery Maryland Judgment Foreclosing Mortgage and Ordering Sale can have significant implications for both borrowers and lenders. For borrowers, it can result in the loss of their property and credit repercussions. On the other hand, lenders benefit from recouping their investment through the sale of the property. Understanding the different types of foreclosure processes in Montgomery County, Maryland, and their implications is crucial for anyone involved in mortgage-related disputes or seeking to purchase distressed properties at auction.

Montgomery Maryland Judgment Foreclosing Mortgage and Ordering Sale

Description

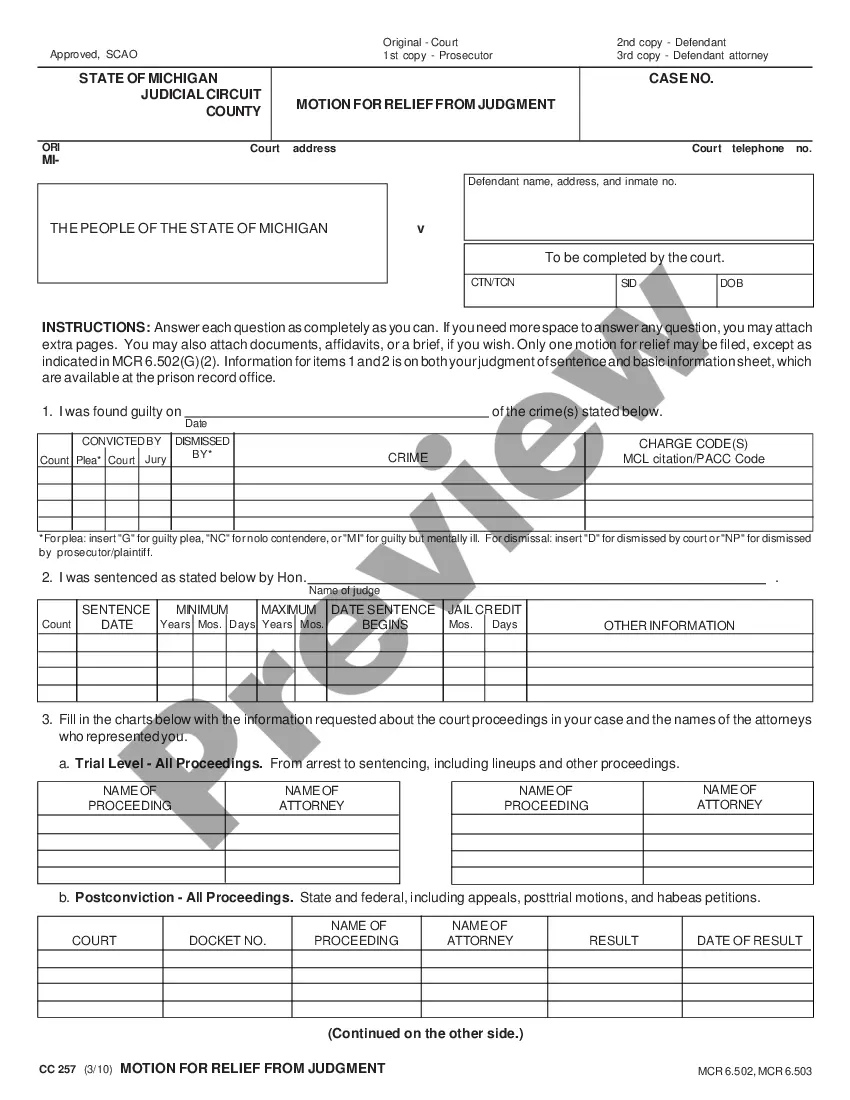

How to fill out Montgomery Maryland Judgment Foreclosing Mortgage And Ordering Sale?

Draftwing paperwork, like Montgomery Judgment Foreclosing Mortgage and Ordering Sale, to manage your legal matters is a difficult and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for various scenarios and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Montgomery Judgment Foreclosing Mortgage and Ordering Sale form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Montgomery Judgment Foreclosing Mortgage and Ordering Sale:

- Make sure that your form is compliant with your state/county since the regulations for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Montgomery Judgment Foreclosing Mortgage and Ordering Sale isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and download the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!