San Bernardino California Judgment Foreclosing Mortgage and Ordering Sale is a legal process that occurs when a party obtains a judgment against a borrower in San Bernardino, California, for non-payment of a mortgage or loan. This judgment allows the creditor to initiate foreclosure proceedings and sell the borrower's property to recover the outstanding debt. The process begins with the creditor filing a lawsuit against the borrower in the San Bernardino County Superior Court, seeking a judgment for foreclosure. The court then reviews the case and, if the creditor is able to prove their claim, issues a judgment ordering the foreclosure of the mortgage and sale of the property. There are different types of San Bernardino California Judgment Foreclosing Mortgage and Ordering Sale, including: 1. Judicial Foreclosure: This type of foreclosure requires a court proceeding to obtain a judgment against the borrower. The court then orders the sale of the property to satisfy the debt. 2. Non-Judicial Foreclosure: In this type of foreclosure, also known as a power of sale foreclosure, the lender follows a specific procedure outlined in the deed of trust or mortgage contract. The procedure allows the lender to foreclose and sell the property without involving the court system. 3. Judicial Sale: Once the judgment has been granted, the court sets a foreclosure sale date. The property is then sold at a public auction to the highest bidder. The proceeds from the sale are first used to pay off any outstanding debts, including the loan amount, interests, and fees. Any surplus will be returned to the borrower. 4. Sheriff's Sale: In San Bernardino, California, the court may appoint a sheriff to oversee the foreclosure sale process. The sheriff will advertise the sale and conduct the auction, following the guidelines set by the court. 5. Redemption Period: In some cases, California law grants the borrower a redemption period after the foreclosure sale. During this period, the borrower has the opportunity to repurchase the property by paying off the outstanding debt and any additional costs. It is important to note that each foreclosure case in San Bernardino, California, can have unique circumstances and specific legal requirements. Therefore, it is advisable for borrowers and creditors to consult with a qualified attorney familiar with San Bernardino County foreclosure laws to ensure compliance with all relevant regulations.

San Bernardino California Judgment Foreclosing Mortgage and Ordering Sale

Description

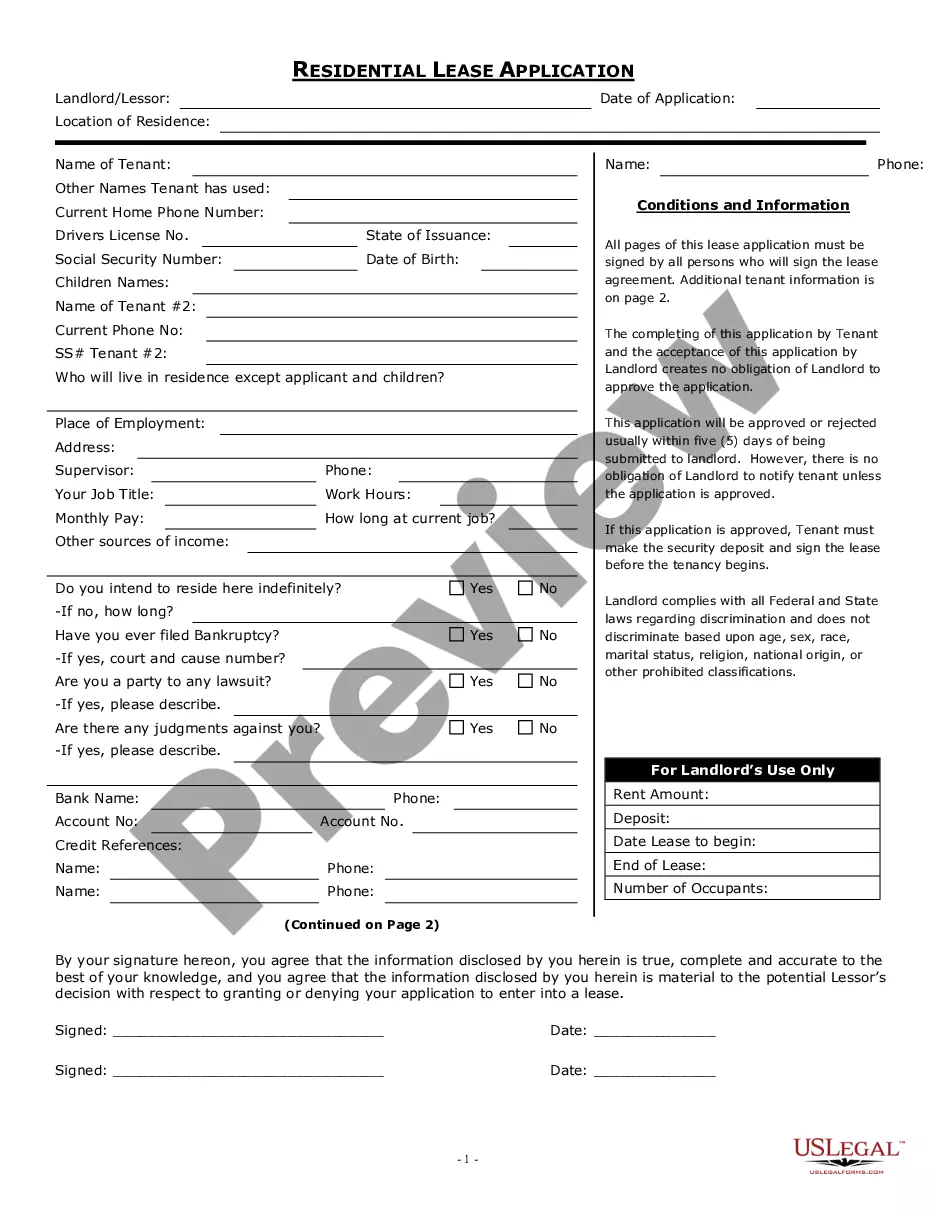

How to fill out San Bernardino California Judgment Foreclosing Mortgage And Ordering Sale?

If you need to get a reliable legal paperwork provider to find the San Bernardino Judgment Foreclosing Mortgage and Ordering Sale, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to locate and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to search or browse San Bernardino Judgment Foreclosing Mortgage and Ordering Sale, either by a keyword or by the state/county the document is created for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the San Bernardino Judgment Foreclosing Mortgage and Ordering Sale template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly available for download as soon as the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less pricey and more reasonably priced. Create your first business, arrange your advance care planning, draft a real estate contract, or execute the San Bernardino Judgment Foreclosing Mortgage and Ordering Sale - all from the comfort of your home.

Sign up for US Legal Forms now!