Any interested party in an estate of a decedent generally has the right to make objections to the accounting of the executor, the compensation paid or proposed to be paid, or the proposed distribution of assets. Such objections must be filed within within a certain period of time from the date of service of the Petition for approval of the accounting.

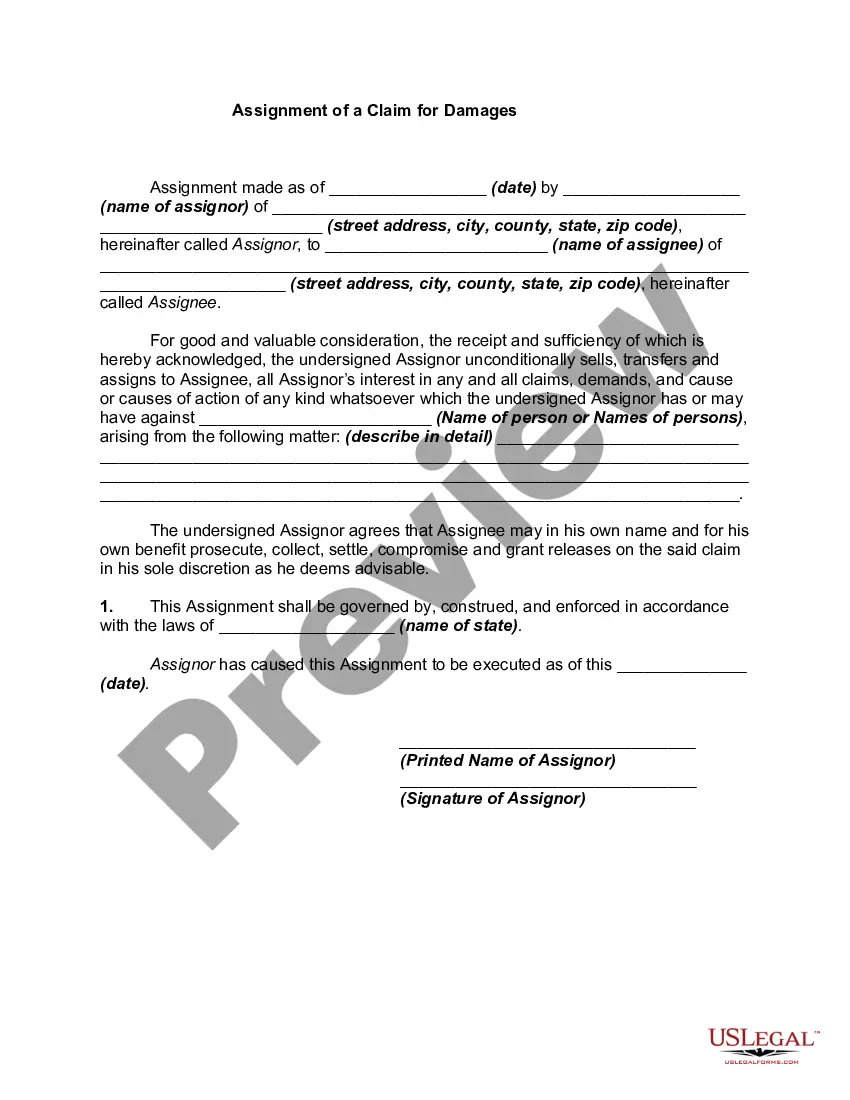

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cook Illinois is a leading transportation company that provides various services such as school bus transportation, charter bus services, and public transit systems. As with any large organization, Cook Illinois is expected to follow accounting principles and maintain accurate financial records. However, there may be instances where Cook Illinois objects to certain claims that are allowed in accounting, and this objection can arise for various reasons. One common type of Cook Illinois objection to an allowed claim in accounting is related to improper expense claims. In some cases, employees might submit claims for expenses that are not directly related to their job responsibilities or do not adhere to the company's expense policies. Cook Illinois, as part of its financial management practices, raises objections to such claims to ensure that only legitimate expenses are recorded and reimbursed. Another type of objection that Cook Illinois may encounter is regarding misleading revenue recognition practices. Revenue recognition is a crucial aspect of accounting, and any misinterpretation or incorrect recognition of revenue can significantly skew the financial reports. Cook Illinois may object to certain claims related to revenue recognition if they believe that the reported revenue does not align with the actual contractual terms or if there are any irregularities in the sales process. Furthermore, Cook Illinois might also object to claims that involve inappropriate allocation of costs. Ensuring accurate and fair allocation of costs is essential for maintaining transparency and integrity in financial statements. Cook Illinois may object to claims that wrongly distribute costs to different departments or fail to consider the appropriate cost drivers for allocation purposes. In summary, Cook Illinois objection to allowed claims in accounting can occur due to various factors such as improper expense claims, misleading revenue recognition practices, and inappropriate allocation of costs. By objecting to these claims, Cook Illinois aims to safeguard the accuracy and reliability of its financial statements, ensuring that only valid and legitimate transactions are recorded.Cook Illinois is a leading transportation company that provides various services such as school bus transportation, charter bus services, and public transit systems. As with any large organization, Cook Illinois is expected to follow accounting principles and maintain accurate financial records. However, there may be instances where Cook Illinois objects to certain claims that are allowed in accounting, and this objection can arise for various reasons. One common type of Cook Illinois objection to an allowed claim in accounting is related to improper expense claims. In some cases, employees might submit claims for expenses that are not directly related to their job responsibilities or do not adhere to the company's expense policies. Cook Illinois, as part of its financial management practices, raises objections to such claims to ensure that only legitimate expenses are recorded and reimbursed. Another type of objection that Cook Illinois may encounter is regarding misleading revenue recognition practices. Revenue recognition is a crucial aspect of accounting, and any misinterpretation or incorrect recognition of revenue can significantly skew the financial reports. Cook Illinois may object to certain claims related to revenue recognition if they believe that the reported revenue does not align with the actual contractual terms or if there are any irregularities in the sales process. Furthermore, Cook Illinois might also object to claims that involve inappropriate allocation of costs. Ensuring accurate and fair allocation of costs is essential for maintaining transparency and integrity in financial statements. Cook Illinois may object to claims that wrongly distribute costs to different departments or fail to consider the appropriate cost drivers for allocation purposes. In summary, Cook Illinois objection to allowed claims in accounting can occur due to various factors such as improper expense claims, misleading revenue recognition practices, and inappropriate allocation of costs. By objecting to these claims, Cook Illinois aims to safeguard the accuracy and reliability of its financial statements, ensuring that only valid and legitimate transactions are recorded.