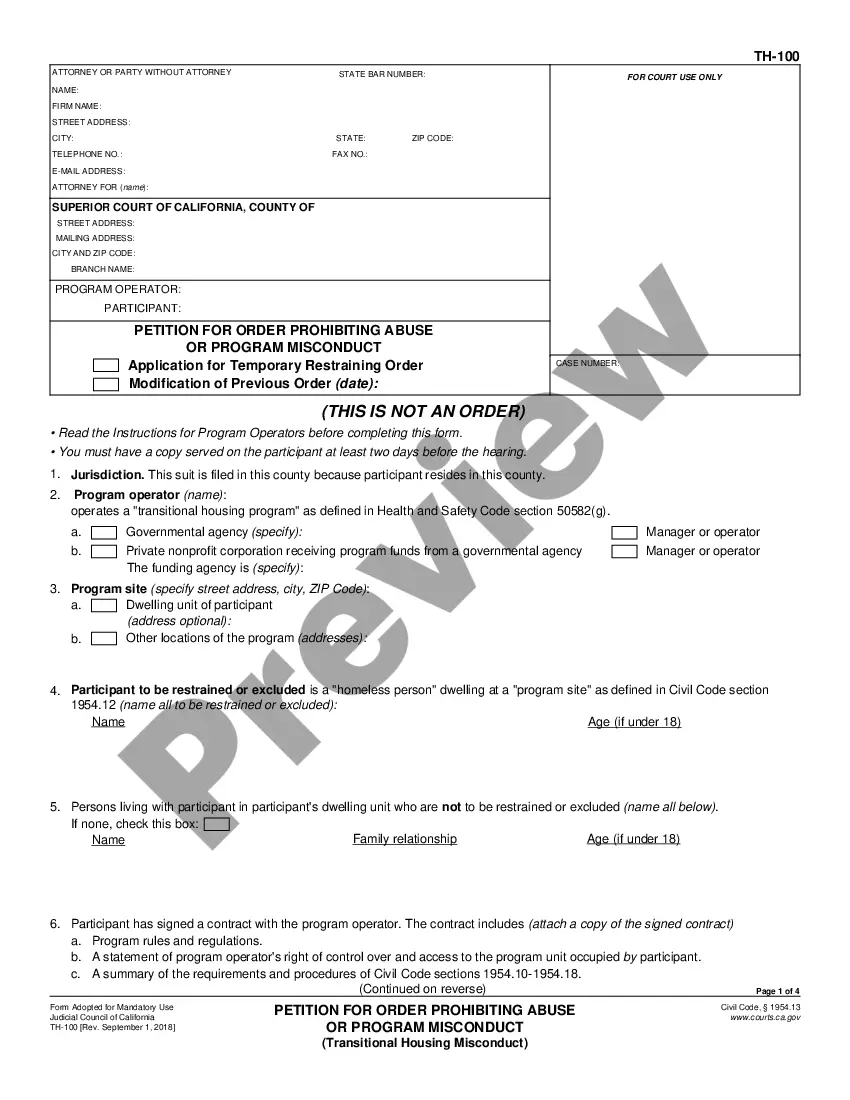

Any interested party in an estate of a decedent generally has the right to make objections to the accounting of the executor, the compensation paid or

proposed to be paid, or the proposed distribution of assets. Such objections must be filed within within a certain period of time from the date of service of the Petition for approval of the accounting.

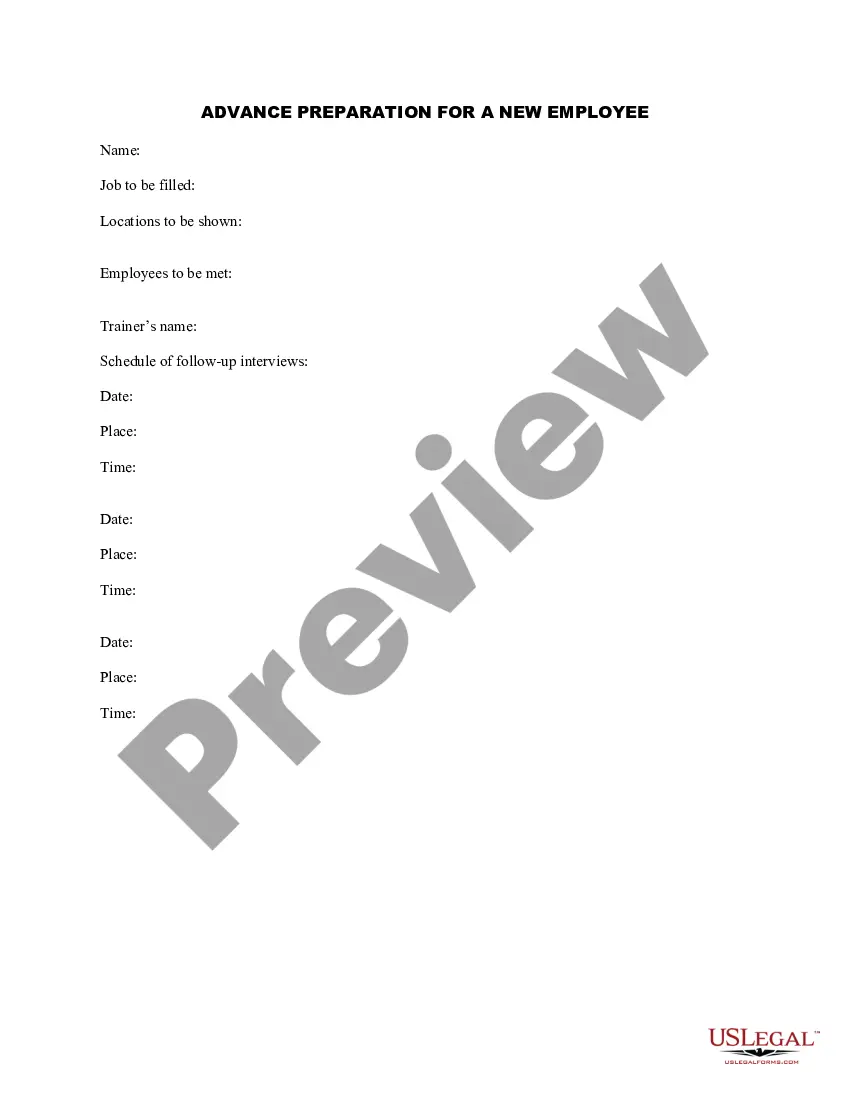

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Santa Clara, California Objection to Allowed Claim in Accounting refers to a legal process that occurs within the field of accounting in the Santa Clara County of California. It involves an objection raised by one party regarding the validity or accuracy of a claim made by another party. One type of Santa Clara, California Objection to Allowed Claim in Accounting is related to financial disputes in business settings. In these cases, one party may object to the claim made by another party regarding the amount of money owed or the appropriateness of the expenses recorded in accounting books. Another type of Santa Clara, California Objection to Allowed Claim in Accounting pertains to taxation matters. Individuals or businesses may dispute the claims made by tax authorities regarding the amount of tax owed, the deductions claimed, or the interpretation of certain tax regulations. The objection process typically involves the following steps: 1. Filing the Objection: The party raising the objection submits a formal document stating their objections to the claim in question. This document outlines the reasons for the objection, provides evidence to support their stance, and requests a review by the relevant authorities. 2. Review and Evaluation: The accounting authorities or relevant parties review the objection and evaluate it based on the provided evidence. They may conduct further investigations or request additional documentation from both parties involved. 3. Negotiations and Medications: In some cases, the disputing parties may engage in negotiations or seek mediation to resolve the objection. This involves discussion and compromise to achieve a mutually acceptable resolution. 4. Formal Hearing: If the parties fail to reach an agreement through negotiations or mediation, a formal hearing may be scheduled. During the hearing, both sides present their arguments and evidence before an impartial judge or adjudicator. 5. Decision and Appeal: After the hearing, the judge or adjudicator will reach a decision based on the merits of the case and applicable laws or regulations. If either party disagrees with the decision, they may file an appeal to a higher court or authority. Relevant keywords for Santa Clara, California Objection to Allowed Claim in Accounting may include: accounting dispute resolution, claim objections in Santa Clara, California, accounting claim review process, taxation claim disputes, accounting legal procedures, financial disagreements in Santa Clara, California, accounting objection hearings.