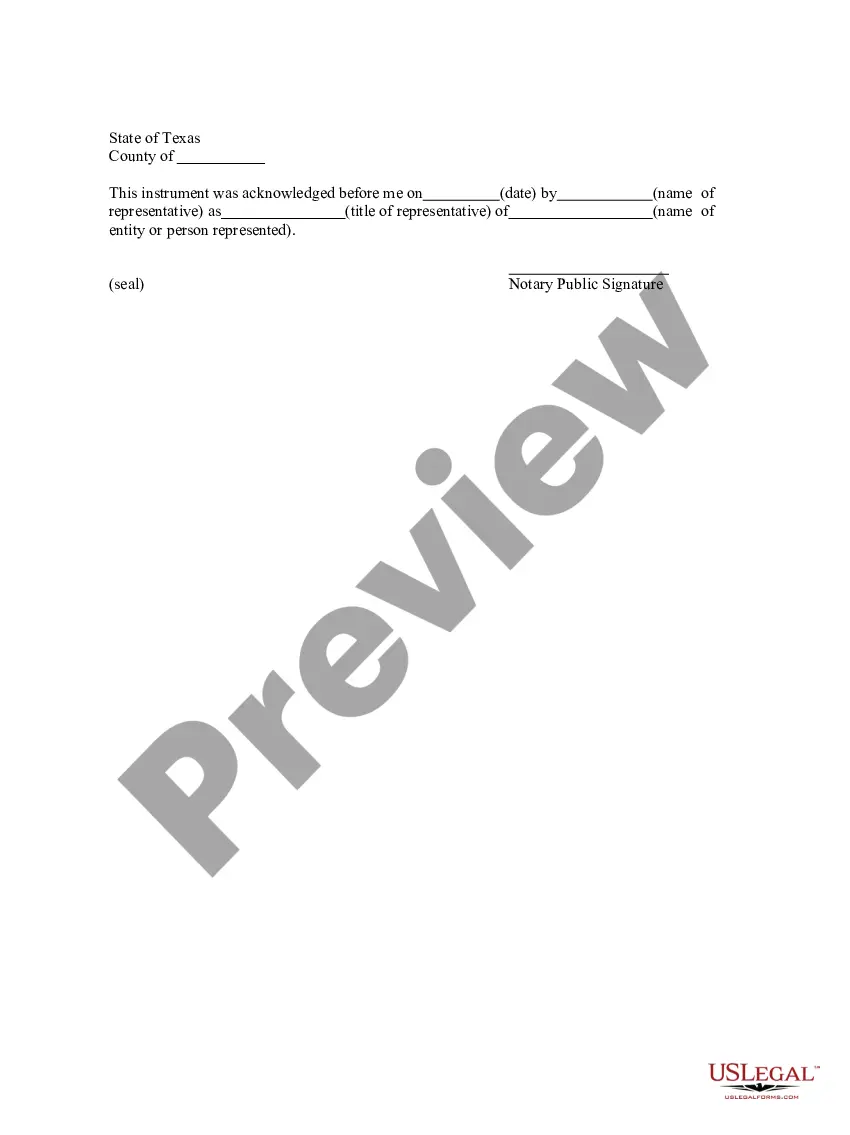

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Maricopa Arizona Petition to Determine Distribution Rights of the Assets of a Decedent is a legal document filed in Maricopa County, Arizona, that seeks to establish the rightful distribution of a deceased person's assets. This petition is typically filed when there is a dispute or confusion regarding the distribution of assets among the heirs or beneficiaries. It plays a crucial role in ensuring a fair and lawful distribution process following the decedent's wishes or according to the state's intestacy laws. There may be different types or scenarios in which a Maricopa Arizona Petition to Determine Distribution Rights of the Assets of a Decedent is filed. These variations depend on the circumstances of the estate and the potential conflicts that arise. Some common types of petitions include: 1. Maricopa Arizona Petition to Determine Distribution Rights of the Assets of a Decedent with a valid will: In this case, the petition is filed to validate and enforce the terms of the decedent's will. The court reviews the will and ensures that the distribution of assets adheres to its provisions. 2. Maricopa Arizona Petition to Determine Distribution Rights of the Assets of a Decedent without a valid will: When the decedent did not leave a valid will, the court steps in to determine the rightful distribution of assets based on the state's intestacy laws. This petition ensures a proper distribution among the heirs according to the prescribed order of inheritance. 3. Maricopa Arizona Petition to Determine Distribution Rights of the Assets of a Decedent with disputed beneficiaries: When there are disputes or disagreements among potential beneficiaries, this petition is filed to resolve the conflicts and determine who should rightfully receive the assets. 4. Maricopa Arizona Petition to Determine Distribution Rights of the Assets of a Decedent with creditors' claims: If there are outstanding debts or claims against the estate, this petition helps establish the order of priority for distribution. It ensures that creditors' claims are honored before the remaining assets are distributed among the beneficiaries. Regardless of the specific type, filing a Maricopa Arizona Petition to Determine Distribution Rights of the Assets of a Decedent requires a thorough understanding of estate laws and procedures. It is essential to seek legal counsel to navigate the complexities of the process and safeguard the interests of all parties involved.