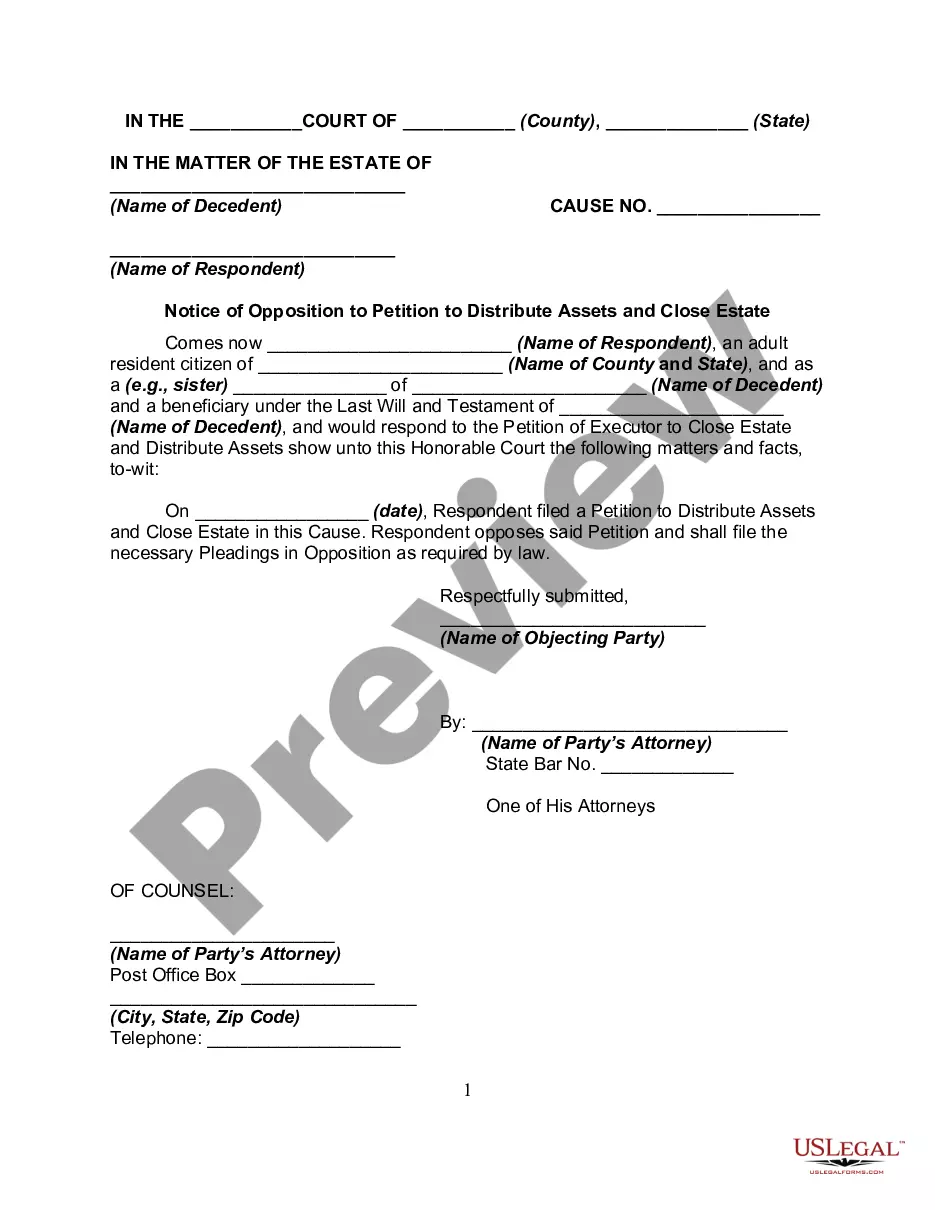

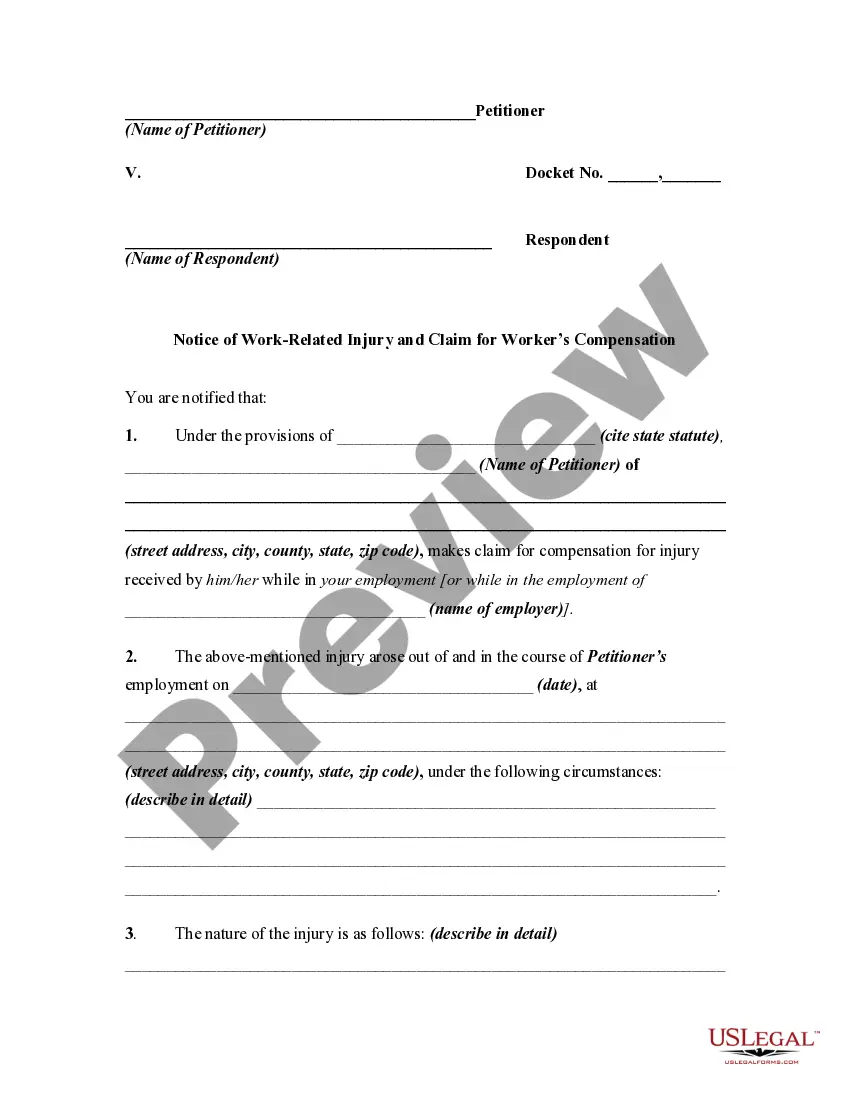

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Hennepin County, Minnesota, Notice of Opposition to Petition to Distribute Assets and Close Estate is a legal document used to contest the distribution of assets and closure of an estate in Hennepin County, Minnesota. This notice is typically filed by an interested party who disagrees with the distribution plan proposed by the estate's personal representative or executor. In Hennepin County, there may be various types of Notice of Opposition to Petition to Distribute Assets and Close Estate, depending on the specific grounds for opposition. Some common types include: 1. Lack of Valid Will: If there are concerns regarding the validity of the deceased person's will, an interested party may file a notice of opposition to petition. This could occur if there are allegations of undue influence, fraud, forgery, or if the will does not meet the formal legal requirements. 2. Inaccurate Asset Distribution: If an interested party believes that the proposed plan for distributing the estate's assets is unfair, incorrect, or does not comply with the deceased person's intentions or Minnesota probate laws, they can contest it through this notice. 3. Mismanagement of Estate: If the petitioner feels that the personal representative or executor has mismanaged the estate and their actions have negatively affected the distribution of assets, this notice can be filed to oppose the petition to close the estate. 4. Disputed Claims and Debts: If the petitioner disputes certain claims or debts presented by the personal representative or executor, they can file a notice of opposition to protect their interests and ensure a fair resolution. 5. Other Grounds for Opposition: Depending on the specific circumstances of the estate, there may be other grounds on which a person can file a notice of opposition. These could include concerns over the competency of the personal representative, conflicts of interest, or any other issues that may affect the proper distribution of assets. When filing a Hennepin County, Minnesota, Notice of Opposition to Petition to Distribute Assets and Close Estate, it is crucial to provide detailed reasons supporting the opposition, cite relevant Minnesota probate laws, and present any evidence to substantiate the claims. This legal document should also specify the relief being sought, such as a modified distribution plan or removal of the personal representative. It is advisable to consult with an attorney specializing in probate and estates to ensure compliance with the local laws and increase the chances of a successful opposition.A Hennepin County, Minnesota, Notice of Opposition to Petition to Distribute Assets and Close Estate is a legal document used to contest the distribution of assets and closure of an estate in Hennepin County, Minnesota. This notice is typically filed by an interested party who disagrees with the distribution plan proposed by the estate's personal representative or executor. In Hennepin County, there may be various types of Notice of Opposition to Petition to Distribute Assets and Close Estate, depending on the specific grounds for opposition. Some common types include: 1. Lack of Valid Will: If there are concerns regarding the validity of the deceased person's will, an interested party may file a notice of opposition to petition. This could occur if there are allegations of undue influence, fraud, forgery, or if the will does not meet the formal legal requirements. 2. Inaccurate Asset Distribution: If an interested party believes that the proposed plan for distributing the estate's assets is unfair, incorrect, or does not comply with the deceased person's intentions or Minnesota probate laws, they can contest it through this notice. 3. Mismanagement of Estate: If the petitioner feels that the personal representative or executor has mismanaged the estate and their actions have negatively affected the distribution of assets, this notice can be filed to oppose the petition to close the estate. 4. Disputed Claims and Debts: If the petitioner disputes certain claims or debts presented by the personal representative or executor, they can file a notice of opposition to protect their interests and ensure a fair resolution. 5. Other Grounds for Opposition: Depending on the specific circumstances of the estate, there may be other grounds on which a person can file a notice of opposition. These could include concerns over the competency of the personal representative, conflicts of interest, or any other issues that may affect the proper distribution of assets. When filing a Hennepin County, Minnesota, Notice of Opposition to Petition to Distribute Assets and Close Estate, it is crucial to provide detailed reasons supporting the opposition, cite relevant Minnesota probate laws, and present any evidence to substantiate the claims. This legal document should also specify the relief being sought, such as a modified distribution plan or removal of the personal representative. It is advisable to consult with an attorney specializing in probate and estates to ensure compliance with the local laws and increase the chances of a successful opposition.