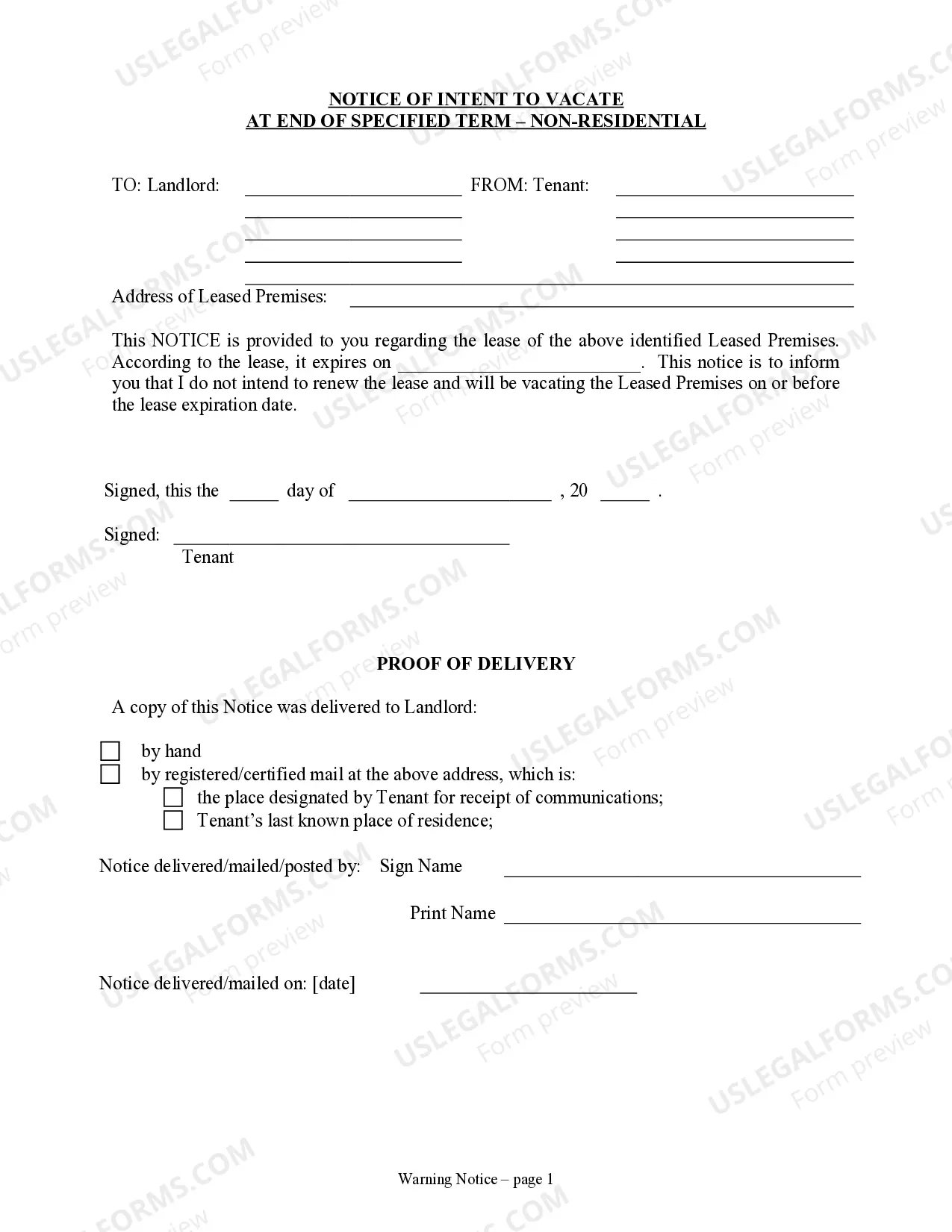

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nassau County, located in the state of New York, follows specific procedures when it comes to carrying out estate distribution and closing procedures. One important document that may be filed during this process is the "Notice of Opposition to Petition to Distribute Assets and Close Estate." This legal document signifies an objection raised by a concerned party against the proposed distribution plan or closing of an estate within Nassau County, New York. The Nassau New York Notice of Opposition to Petition to Distribute Assets and Close Estate is submitted to the appropriate court and must contain specific elements to be considered valid. These may include the full legal name of the objecting party, their contact information, and representation details if applicable. It is crucial to provide a detailed explanation outlining the objections being raised against the proposed distribution plan or estate closure. The content should clearly state the reasons, supporting evidence, and any legal basis for the opposition. In Nassau County, variations of the Notice of Opposition to Petition to Distribute Assets and Close Estate can be filed depending on the specific circumstances or grounds for the opposition. Some of these variations may include: 1. Lack of Proper Documentation Objection: This type of opposition is raised when the objecting party believes that the proposed distribution plan or estate closure lacks the necessary documentation, such as a valid will, proof of inheritance, or complete accounting records. 2. Contesting the Will Objection: In certain cases, individuals may oppose the distribution plan or closure due to disputes or challenges related to the validity of the deceased individual's will. This type of opposition raises concerns over the authenticity, execution, or legality of the will in question. 3. Disagreements Regarding Asset Distribution: When parties involved have differing opinions regarding the allocation of assets, this type of objection can be filed. It highlights objections related to unequal distribution or disputes between beneficiaries and executors regarding the estate's assets. 4. Allegations of Mismanagement or Breach of Fiduciary Duty: In some instances, an objecting party may claim that the executor or administrator of the estate has failed to fulfill their fiduciary duties, mismanaged the estate, or acted in a manner that is not in the best interest of the beneficiaries. This objection focuses on concerns related to potential financial or asset mishandling. 5. Disputes Over Estate Debts and Liabilities: This type of objection arises when there are disagreements regarding outstanding debts or liabilities of the deceased individual that may affect the distribution of assets. The objecting party may contest the proposed distribution plan, requesting a thorough assessment of liabilities and proper settlement before the estate can be closed. When filing a Nassau New York Notice of Opposition to Petition to Distribute Assets and Close Estate, it is crucial to consult an experienced attorney familiar with probate laws and practices in Nassau County. This ensures that all necessary information is included, objections are properly articulated, and the objection is filed in accordance with local court rules and procedures.Nassau County, located in the state of New York, follows specific procedures when it comes to carrying out estate distribution and closing procedures. One important document that may be filed during this process is the "Notice of Opposition to Petition to Distribute Assets and Close Estate." This legal document signifies an objection raised by a concerned party against the proposed distribution plan or closing of an estate within Nassau County, New York. The Nassau New York Notice of Opposition to Petition to Distribute Assets and Close Estate is submitted to the appropriate court and must contain specific elements to be considered valid. These may include the full legal name of the objecting party, their contact information, and representation details if applicable. It is crucial to provide a detailed explanation outlining the objections being raised against the proposed distribution plan or estate closure. The content should clearly state the reasons, supporting evidence, and any legal basis for the opposition. In Nassau County, variations of the Notice of Opposition to Petition to Distribute Assets and Close Estate can be filed depending on the specific circumstances or grounds for the opposition. Some of these variations may include: 1. Lack of Proper Documentation Objection: This type of opposition is raised when the objecting party believes that the proposed distribution plan or estate closure lacks the necessary documentation, such as a valid will, proof of inheritance, or complete accounting records. 2. Contesting the Will Objection: In certain cases, individuals may oppose the distribution plan or closure due to disputes or challenges related to the validity of the deceased individual's will. This type of opposition raises concerns over the authenticity, execution, or legality of the will in question. 3. Disagreements Regarding Asset Distribution: When parties involved have differing opinions regarding the allocation of assets, this type of objection can be filed. It highlights objections related to unequal distribution or disputes between beneficiaries and executors regarding the estate's assets. 4. Allegations of Mismanagement or Breach of Fiduciary Duty: In some instances, an objecting party may claim that the executor or administrator of the estate has failed to fulfill their fiduciary duties, mismanaged the estate, or acted in a manner that is not in the best interest of the beneficiaries. This objection focuses on concerns related to potential financial or asset mishandling. 5. Disputes Over Estate Debts and Liabilities: This type of objection arises when there are disagreements regarding outstanding debts or liabilities of the deceased individual that may affect the distribution of assets. The objecting party may contest the proposed distribution plan, requesting a thorough assessment of liabilities and proper settlement before the estate can be closed. When filing a Nassau New York Notice of Opposition to Petition to Distribute Assets and Close Estate, it is crucial to consult an experienced attorney familiar with probate laws and practices in Nassau County. This ensures that all necessary information is included, objections are properly articulated, and the objection is filed in accordance with local court rules and procedures.