Orange California Promissory Note in Connection with Sale of Motor Vehicle is a legal document used in the state of California to facilitate the sale of a motor vehicle between a buyer and a seller. It outlines the payment structure and terms agreed upon by both parties involved. The Orange California Promissory Note includes various details such as the names and contact information of the buyer and seller, the vehicle's description (make, model, year, identification number), the agreed purchase price, and the payment arrangement. It serves as evidence of debt and contains a promise from the buyer to pay the seller the agreed amount within a specified timeframe. There are a few different types of Orange California Promissory Notes in Connection with Sale of Motor Vehicle, including: 1. Simple Promissory Note: This type of promissory note is the most basic form and includes essential details such as payment terms, interest rate (if applicable), and consequences for default. 2. Secured Promissory Note: A secured promissory note adds a layer of protection for the seller by including collateral, such as the motor vehicle itself, which can be used to recoup losses in case of default. 3. Vehicle-Specific Promissory Note: Some promissory notes may be specific to a particular type of motor vehicle, such as motorcycles, trucks, or boats. These notes may have additional clauses and terms tailored to the specific type of vehicle being sold. 4. Installment Payment Promissory Note: This type of promissory note allows the buyer to make payments in installments rather than paying the full amount upfront. It specifies the frequency and amount of each installment payment until the debt is fully paid. 5. Legal Promissory Note: A legal promissory note is drafted and reviewed by an attorney to ensure compliance with all relevant laws and regulations in California. It is important for both buyers and sellers to understand the terms and obligations outlined in the Orange California Promissory Note in Connection with Sale of Motor Vehicle before signing. Seeking legal advice or consulting an attorney can help ensure that all parties are protected and that the promissory note is legally binding.

Orange California Promissory Note in Connection with Sale of Motor Vehicle

Description

How to fill out Orange California Promissory Note In Connection With Sale Of Motor Vehicle?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a Orange Promissory Note in Connection with Sale of Motor Vehicle suiting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Aside from the Orange Promissory Note in Connection with Sale of Motor Vehicle, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Orange Promissory Note in Connection with Sale of Motor Vehicle:

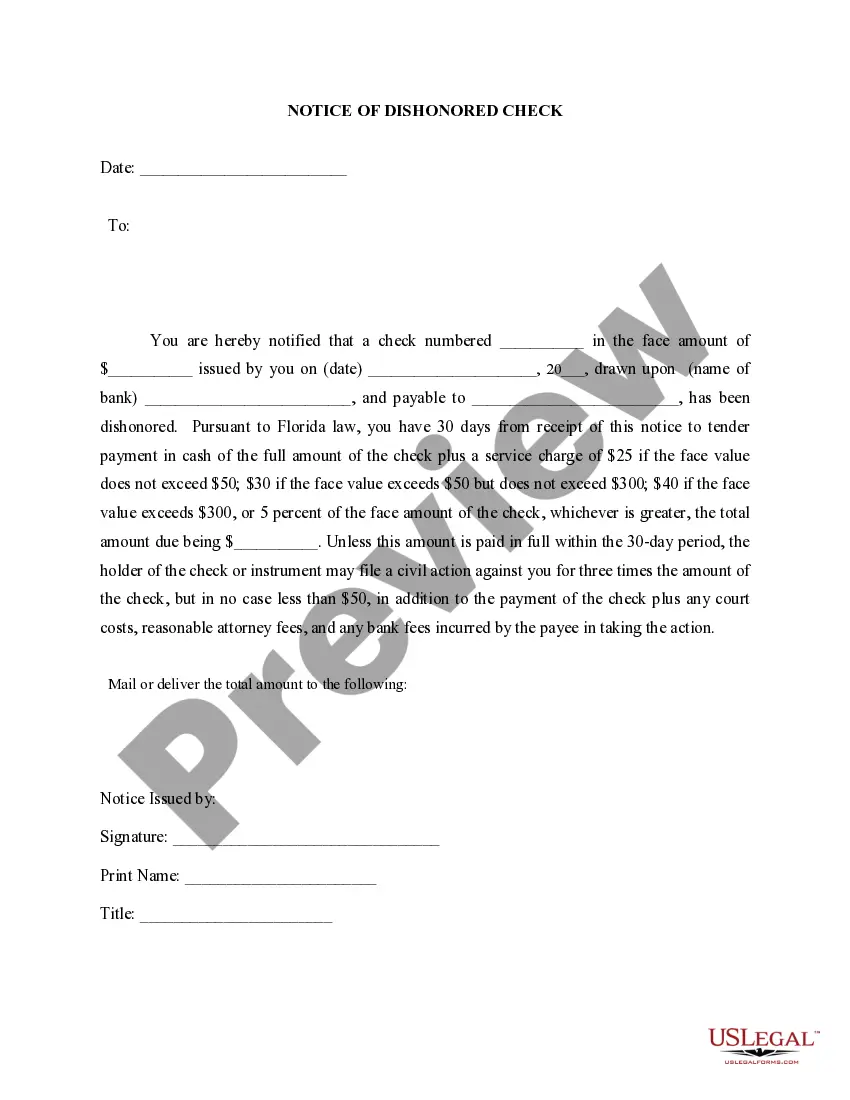

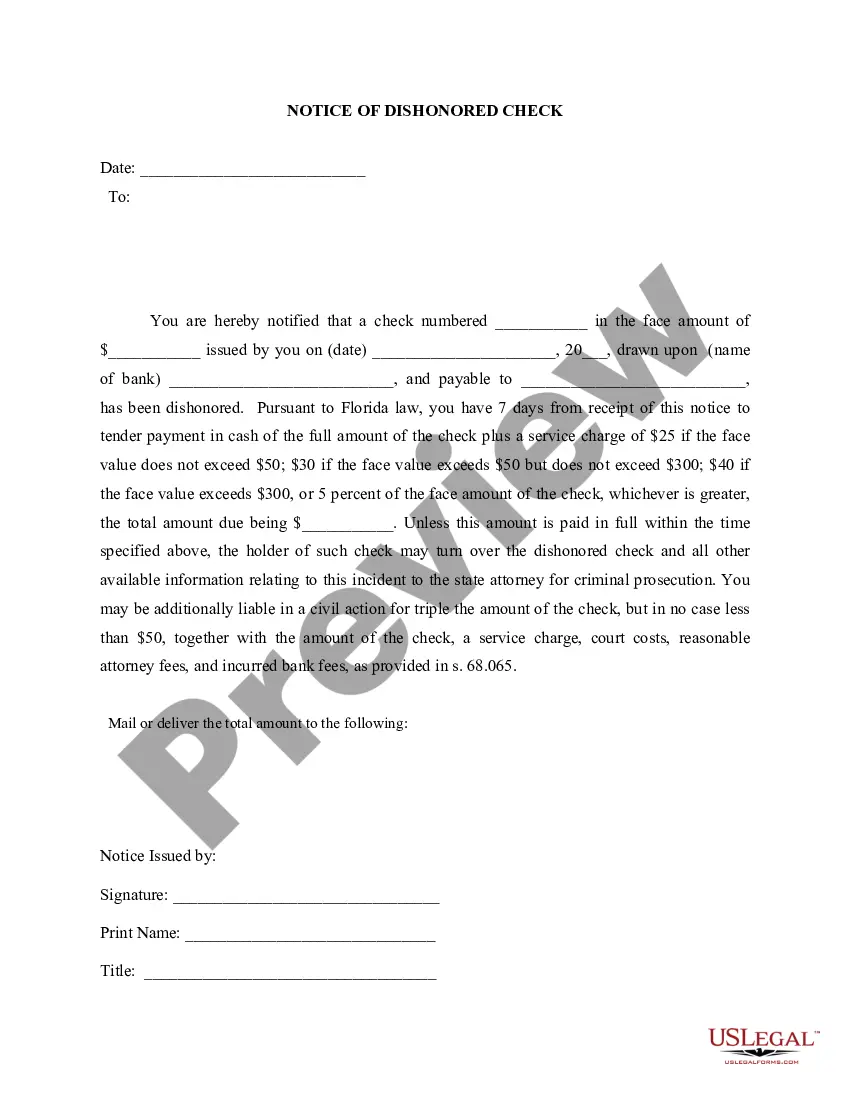

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Orange Promissory Note in Connection with Sale of Motor Vehicle.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!