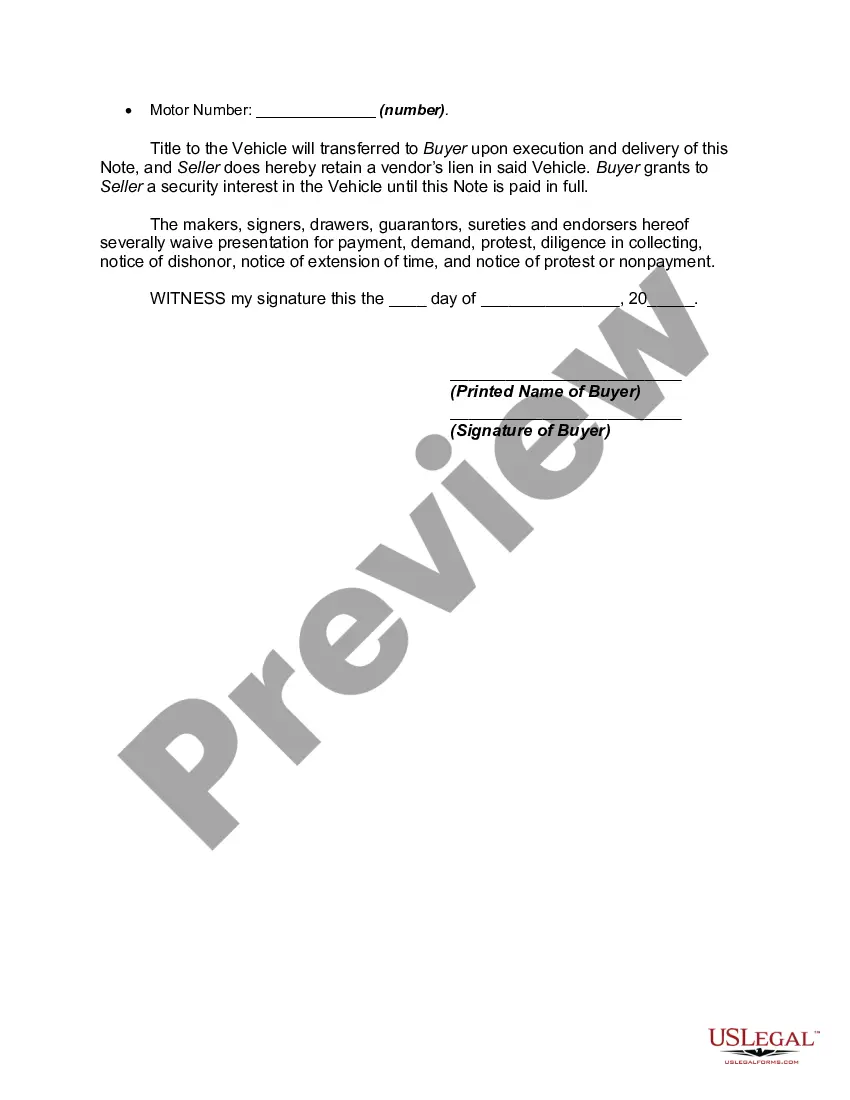

A Lima Arizona Promissory Note in connection with the sale of a motor vehicle is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller for the purchase of a motor vehicle. This type of Promissory Note is specific to Lima, Arizona, and ensures compliance with the applicable state laws and regulations. The Lima Arizona Promissory Note includes various key elements such as the buyer's and seller's details, vehicle description (make, model, VIN), loan amount, interest rate, repayment terms (monthly installments, due dates), late payment penalties, and the consequences of defaulting on the loan. Different types of Lima Arizona Promissory Notes in connection with the sale of a motor vehicle may include: 1. Fixed-Term Promissory Note: This is the most common type of Promissory Note, where the loan amounts plus interest is repaid over a fixed period, usually through equal monthly installments. 2. Balloon Promissory Note: In this type of Promissory Note, the buyer makes smaller monthly payments for a certain period, and a large "balloon" payment is due at the end of the term. 3. Secured Promissory Note: With a secured Promissory Note, the motor vehicle serves as collateral for the loan. If the buyer defaults on payments, the seller has the right to repossess the vehicle. 4. Unsecured Promissory Note: Unlike a secured Promissory Note, an unsecured Promissory Note does not require collateral. However, it is important to note that the lack of collateral may result in higher interest rates. 5. Simple Interest Promissory Note: A simple interest Promissory Note calculates interest based on the principal loan amount. The interest is usually determined on an annual basis. It is crucial for both parties involved in the sale of a motor vehicle to carefully review and understand the provisions within the Lima Arizona Promissory Note before signing. Seeking legal advice or assistance may also be beneficial to ensure compliance with Lima's specific laws and regulations.

Pima Arizona Promissory Note in Connection with Sale of Motor Vehicle

Description

How to fill out Pima Arizona Promissory Note In Connection With Sale Of Motor Vehicle?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Pima Promissory Note in Connection with Sale of Motor Vehicle, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Pima Promissory Note in Connection with Sale of Motor Vehicle from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Pima Promissory Note in Connection with Sale of Motor Vehicle:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!