A Wake North Carolina Promissory Note in Connection with Sale of Motor Vehicle is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller during the sale of a motor vehicle in the Wake County area of North Carolina. It serves as a written promise from the buyer to the seller to repay the loan amount in full by a specified date. The note typically includes essential information such as the full name and contact information of the buyer and seller, the make and model of the vehicle, the vehicle identification number (VIN), the purchase price, and any other specific details related to the transaction. It also includes the terms of repayment, including the interest rate (if applicable), payment schedule, and consequences for defaulting on the loan. In Wake County, there are various types of Promissory Notes in connection with the sale of motor vehicles. Some notable examples include: 1. Simple Promissory Note: This is a straightforward agreement that outlines the loan terms, including repayment conditions and interest (if applicable). It is commonly used when the buyer and seller have a good relationship and already agree on the terms informally. 2. Secured Promissory Note: This type of note requires the buyer to provide collateral, such as the motor vehicle being sold, to secure the loan. If the buyer defaults on the loan, the seller can seize the collateral to recover the outstanding amount. 3. Balloon Promissory Note: A balloon note includes smaller monthly payments over a specific term, with a large final "balloon" payment at the end. This option can be suitable for buyers who expect a significant amount of money at the end of the term. 4. Installment Promissory Note: This note divides the total loan amount into equal monthly installments, including principal and interest, to be paid over a specific period. It is a commonly used type of note for vehicle financing. It is important to note that these examples can have variations and can be customized to meet individual needs. When using a promissory note in connection with the sale of a motor vehicle in Wake North Carolina, it is advisable to consult with a legal professional to ensure compliance with local laws and to protect the rights of both parties involved in the transaction.

Wake North Carolina Promissory Note in Connection with Sale of Motor Vehicle

Description

How to fill out Wake North Carolina Promissory Note In Connection With Sale Of Motor Vehicle?

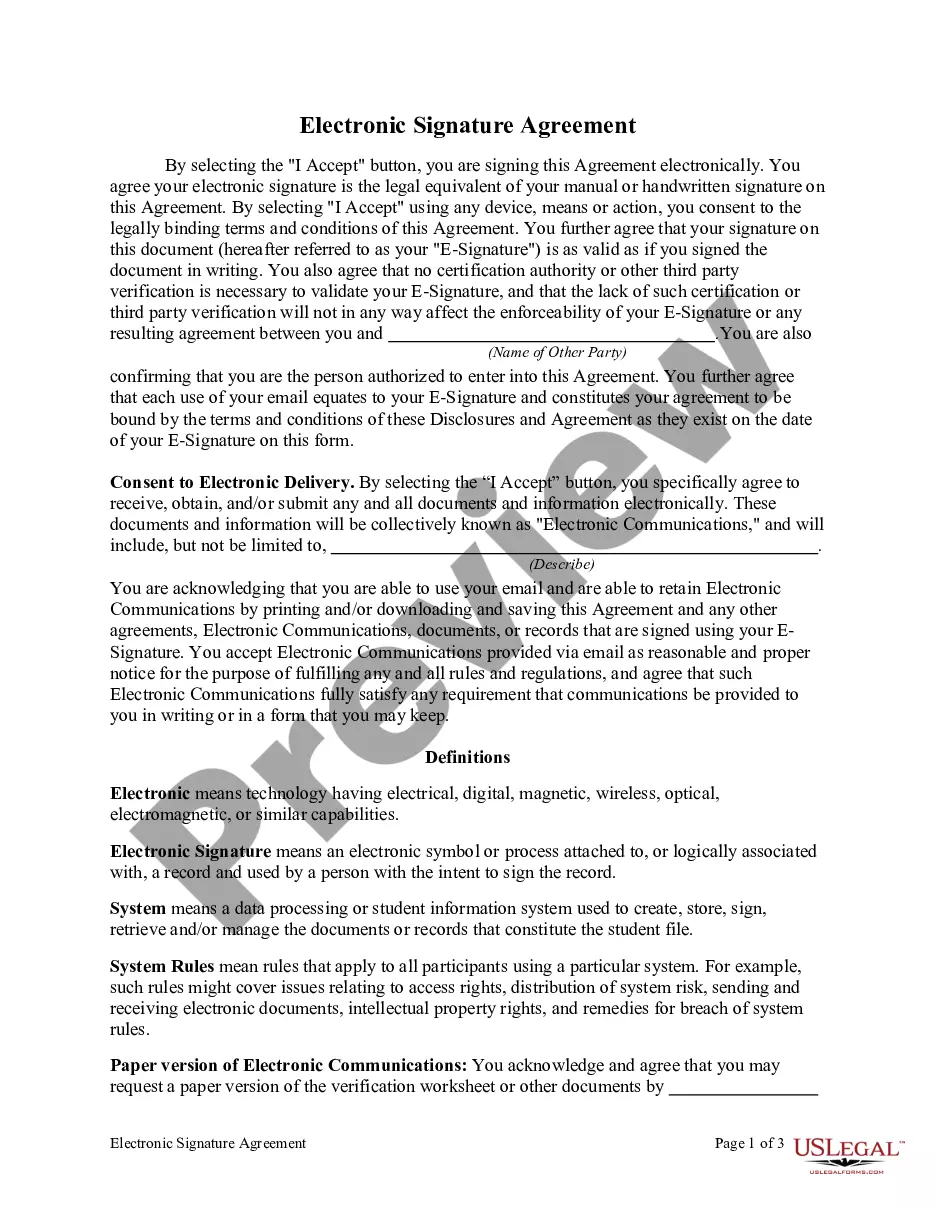

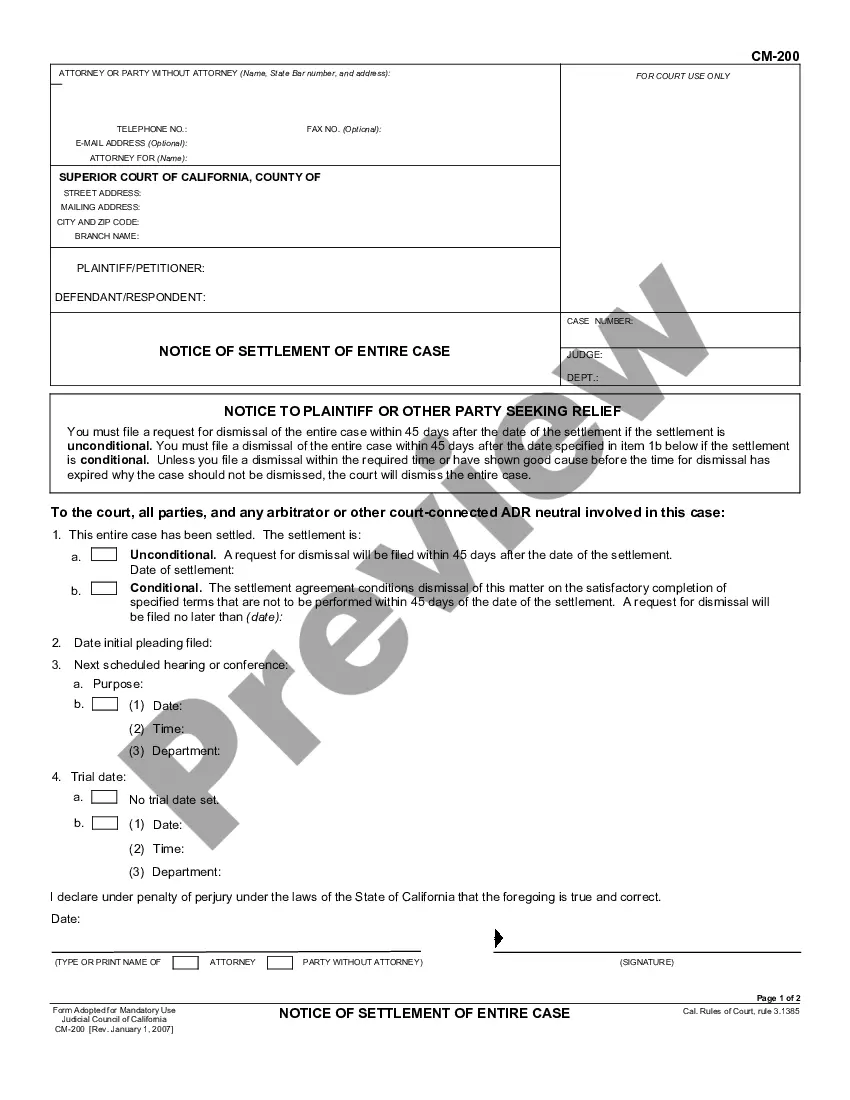

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life scenario, finding a Wake Promissory Note in Connection with Sale of Motor Vehicle suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Aside from the Wake Promissory Note in Connection with Sale of Motor Vehicle, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Wake Promissory Note in Connection with Sale of Motor Vehicle:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Wake Promissory Note in Connection with Sale of Motor Vehicle.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!