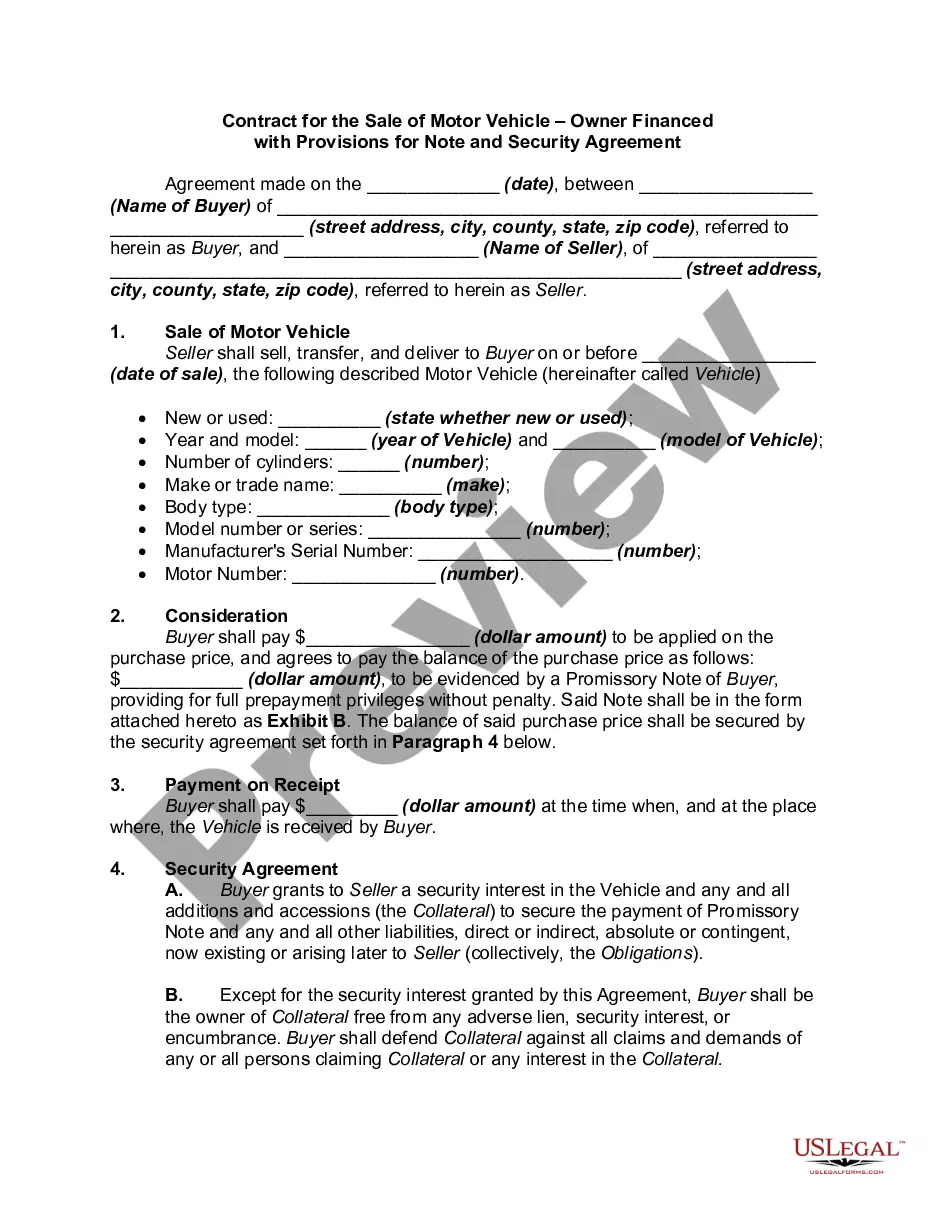

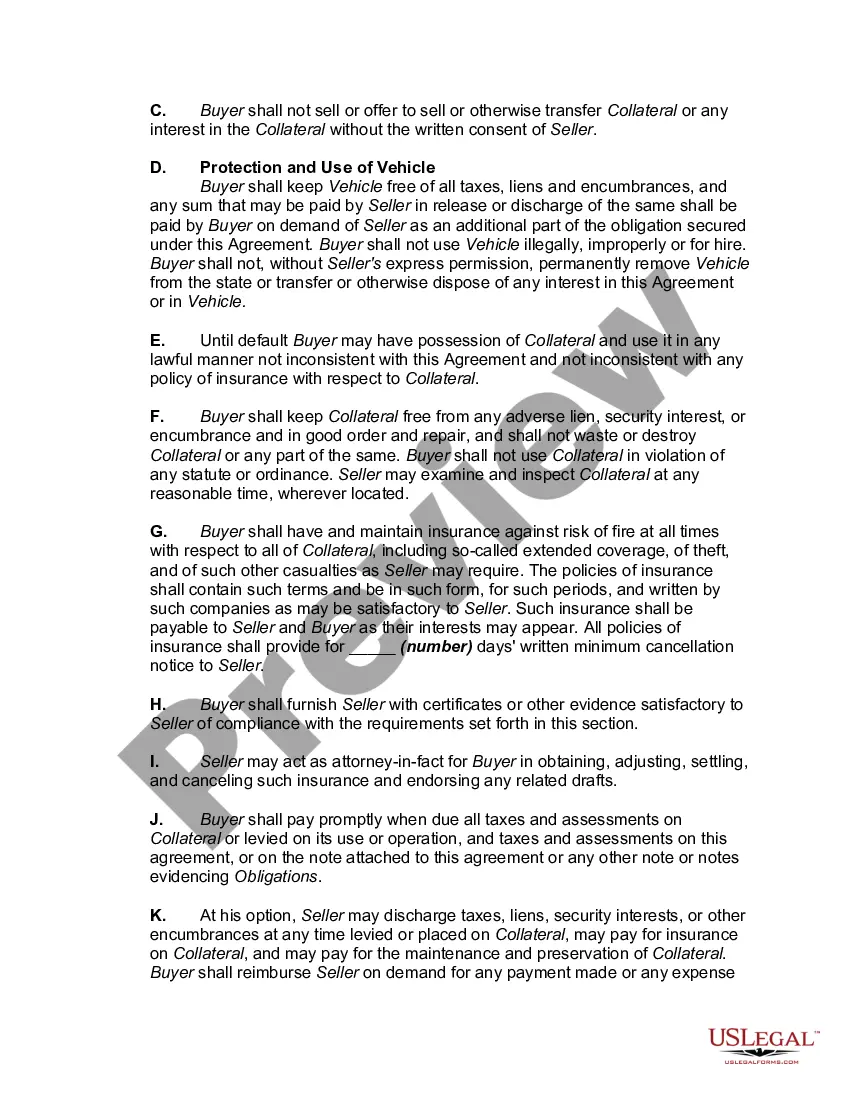

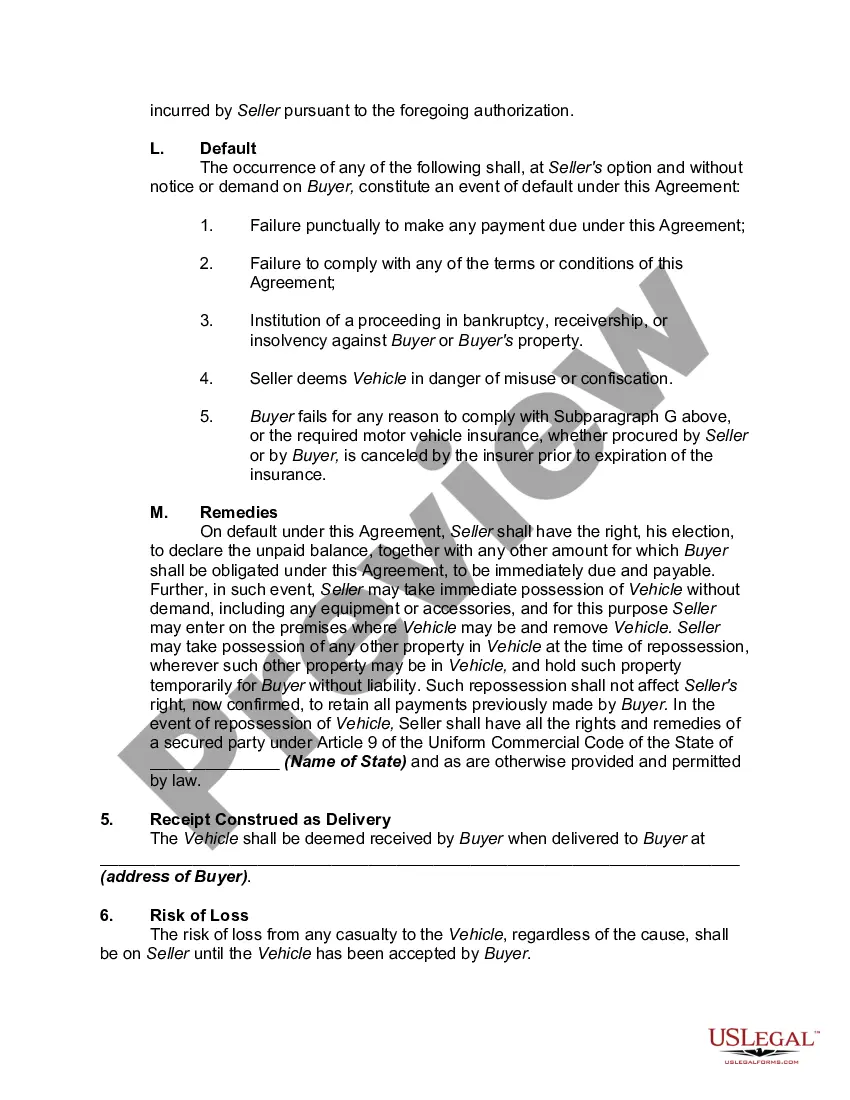

Palm Beach, Florida is a picturesque coastal town renowned for its stunning beaches, upscale lifestyle, and vibrant cultural scene. Being a popular tourist destination, Palm Beach attracts visitors from all over the world. Alongside its glamorous resorts and luxurious shopping destinations, Palm Beach offers a range of exciting recreational activities including golfing, boating, and deep-sea fishing. For those interested in purchasing a motor vehicle in Palm Beach, Florida, the option of an owner-financed contract can be a viable solution. This type of contract allows buyers to secure a vehicle without traditional bank financing, offering increased flexibility and convenience. Typically, a Palm Beach Florida Contract for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement includes specific provisions to ensure a smooth transaction and protect the interests of both parties involved. One common variation of this contract is the provision for a promissory note. This provision details the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any applicable penalties or fees. The promissory note serves as evidence of the buyer's commitment to repay the loan according to the agreed-upon terms. Another crucial component of the Palm Beach Florida Contract for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement is the security agreement. This agreement establishes a security interest in the motor vehicle being sold as collateral for the loan. It outlines the rights and responsibilities of both the buyer and the seller in the event of default or non-payment. The security agreement ensures that the seller has a legal claim to repossess the vehicle if the buyer fails to comply with the terms of the contract. In conclusion, Palm Beach, Florida offers buyers the option of an owner-financed contract for the sale of motor vehicles, providing flexibility and convenience in purchasing a vehicle. The contract typically includes provisions for a promissory note, outlining the loan's terms, and a security agreement to protect the seller's interests. These contracts are designed to facilitate a smooth and secure transaction for buyers and sellers alike.

Palm Beach Florida Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement

Description

How to fill out Palm Beach Florida Contract For The Sale Of Motor Vehicle - Owner Financed With Provisions For Note And Security Agreement?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Palm Beach Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Palm Beach Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Palm Beach Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement:

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!