A Los Angeles California Private Annuity Agreement is a legally binding contract between two parties where one party, known as the annuitant, transfers their assets or property to the other party, known as the obliged, in exchange for a promise to make regular payments for the rest of the annuitant's life. This agreement serves as a means to provide guaranteed income and financial security to the annuitant during their retirement years. The key feature of this private annuity agreement is that the payments are designed to last for the entire lifetime of the annuitant, ensuring a steady income stream regardless of how long they live. The annuitant can receive these payments on a monthly, quarterly, or annual basis, depending on their preferences and financial needs. These private annuity agreements in Los Angeles, California, offer various benefits for both parties involved. For the annuitant, it provides a reliable source of income throughout their retirement, shielding them from market volatility and economic uncertainties. Additionally, the annuitant may potentially reduce their estate tax liability, as the assets transferred are no longer considered part of their estate. For the obliged, this agreement allows them to acquire property or assets without the immediate need for a substantial outlay of cash. Instead, they make payments over time, making it an attractive option for individuals or businesses interested in acquiring valuable assets without significant upfront costs. There are different types of Los Angeles California Private Annuity Agreements with Payments to Last for the Life of the Annuitant. Some variations may include: 1. Immediate Annuity: Under this type, the annuitant starts receiving payments immediately after the agreement is established, providing immediate financial stability. 2. Deferred Annuity: In a deferred annuity agreement, the annuitant delays the start of the payments until a specific future date, allowing for potential growth of the assets before income payments begin. 3. Fixed Annuity: A fixed annuity agreement guarantees a predetermined payment amount for the life of the annuitant, providing a stable income source that is unaffected by market fluctuations. 4. Variable Annuity: Contrary to a fixed annuity, a variable annuity's payments fluctuate based on the performance of the underlying investment portfolios, allowing for potential growth but also presenting some level of market risk. In Los Angeles, California, Private Annuity Agreements with Payments to Last for the Life of the Annuitant are an effective financial tool to ensure a consistent income stream during retirement while allowing for the transfer of assets or property. It is crucial to consult with financial advisors or legal professionals familiar with annuities and tax regulations to navigate the complexities of such agreements and to ensure they align with individual financial goals and requirements.

Los Angeles California Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

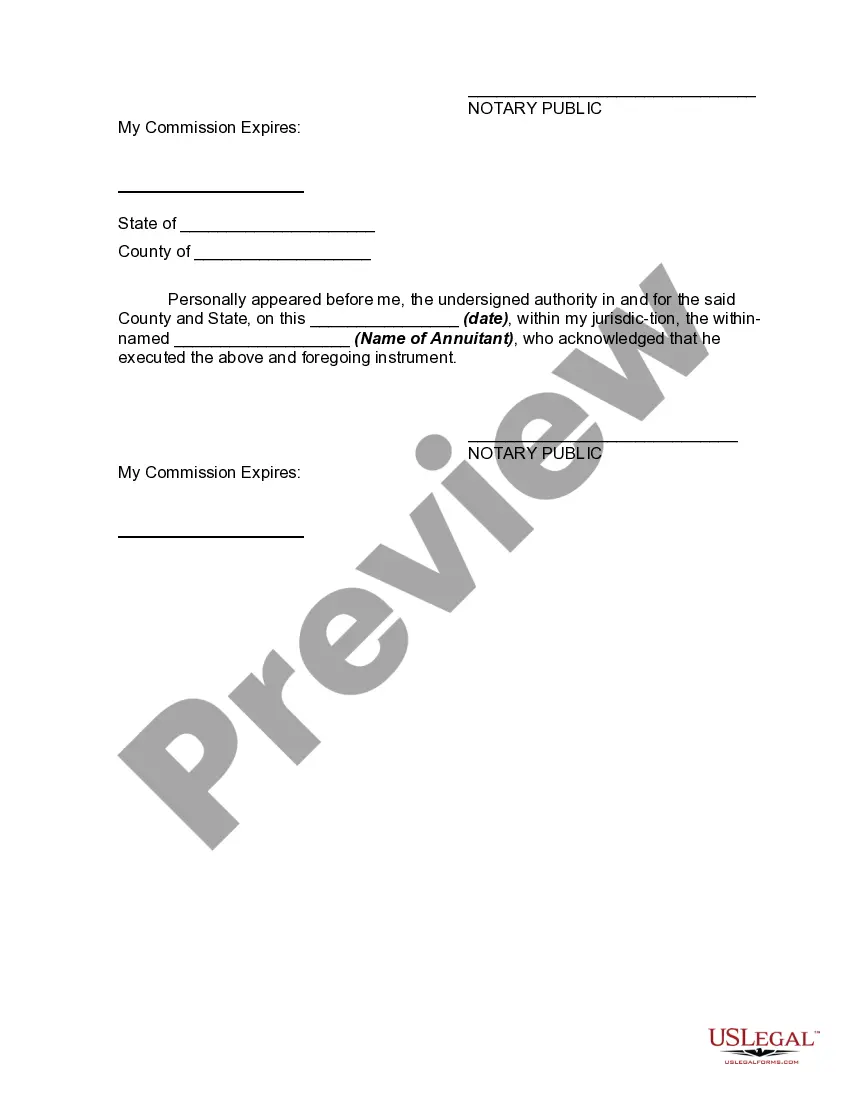

How to fill out Los Angeles California Private Annuity Agreement With Payments To Last For Life Of Annuitant?

Do you need to quickly draft a legally-binding Los Angeles Private Annuity Agreement with Payments to Last for Life of Annuitant or maybe any other document to handle your personal or corporate affairs? You can select one of the two options: hire a legal advisor to write a legal paper for you or draft it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you get professionally written legal documents without paying unreasonable fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-compliant document templates, including Los Angeles Private Annuity Agreement with Payments to Last for Life of Annuitant and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, double-check if the Los Angeles Private Annuity Agreement with Payments to Last for Life of Annuitant is tailored to your state's or county's laws.

- If the form includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the document isn’t what you were looking for by using the search box in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Los Angeles Private Annuity Agreement with Payments to Last for Life of Annuitant template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!