Miami-Dade Florida Private Annuity Agreement with Payments to Last for Life of Annuitant: A Comprehensive Overview Introduction: In Miami-Dade, Florida, private annuity agreements with payments to last for the life of an annuitant offer individuals a secure and predictable income stream throughout their lifetime. These agreements are commonly used by retirees or individuals seeking financial stability by receiving regular payments without the worry of market fluctuations. Private annuities in Miami-Dade present several variations, each tailored to different circumstances, including fixed annuities, variable annuities, and equity-indexed annuities. Fixed Annuities: Fixed annuities are a popular type of private annuity agreement in Miami-Dade. With fixed annuities, the annuitant receives a fixed, predetermined payment amount at regular intervals, typically on a monthly basis. These payments remain constant throughout the life of the annuitant, providing a stable income stream regardless of market downturns or interest rate fluctuations. Fixed annuities are particularly suitable for those who prioritize financial security and a reliable income source. Variable Annuities: For individuals seeking potential growth opportunities within their annuity agreement, variable annuities in Miami-Dade offer an alternative. These agreements allow annuitants to invest their funds into various investment vehicles, such as stocks, bonds, or mutual funds, chosen from a predetermined selection provided by the issuer. The payments received through variable annuities fluctuate based on the performance of the chosen investment options. It is important to note that while variable annuities offer a potential for higher returns, they also carry a higher degree of risk compared to fixed annuities. Equity-Indexed Annuities: Equity-indexed annuities provide a unique hybrid approach that combines elements of both fixed and variable annuities. Miami-Dade's residents considering this type of annuity agreement can expect payments linked, at least in part, to the performance of a specific market index, such as the S&P 500. This arrangement allows annuitants to potentially benefit from market upswings while providing downside protection in the event of market declines. Equity-indexed annuities provide a solution that balances growth opportunities with security, making them ideal for risk-averse individuals seeking moderate returns. Conclusion: Miami-Dade, Florida, offers a range of private annuity agreements with payments designed to last for the life of the annuitant. Fixed annuities provide stability and a predictable income stream, ensuring financial security throughout retirement. Variable annuities introduce potential growth opportunities but come with higher risk. Equity-indexed annuities strike a balance between growth and security by linking payments to market performance. Determining the most suitable annuity type depends on an individual's financial goals, risk tolerance, and retirement objectives. Consulting with a financial advisor can help guide Miami-Dade residents towards the most appropriate private annuity agreement to meet their unique needs.

Miami-Dade Florida Private Annuity Agreement with Payments to Last for Life of Annuitant

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02696BG

Format:

Word;

Rich Text

Instant download

Description

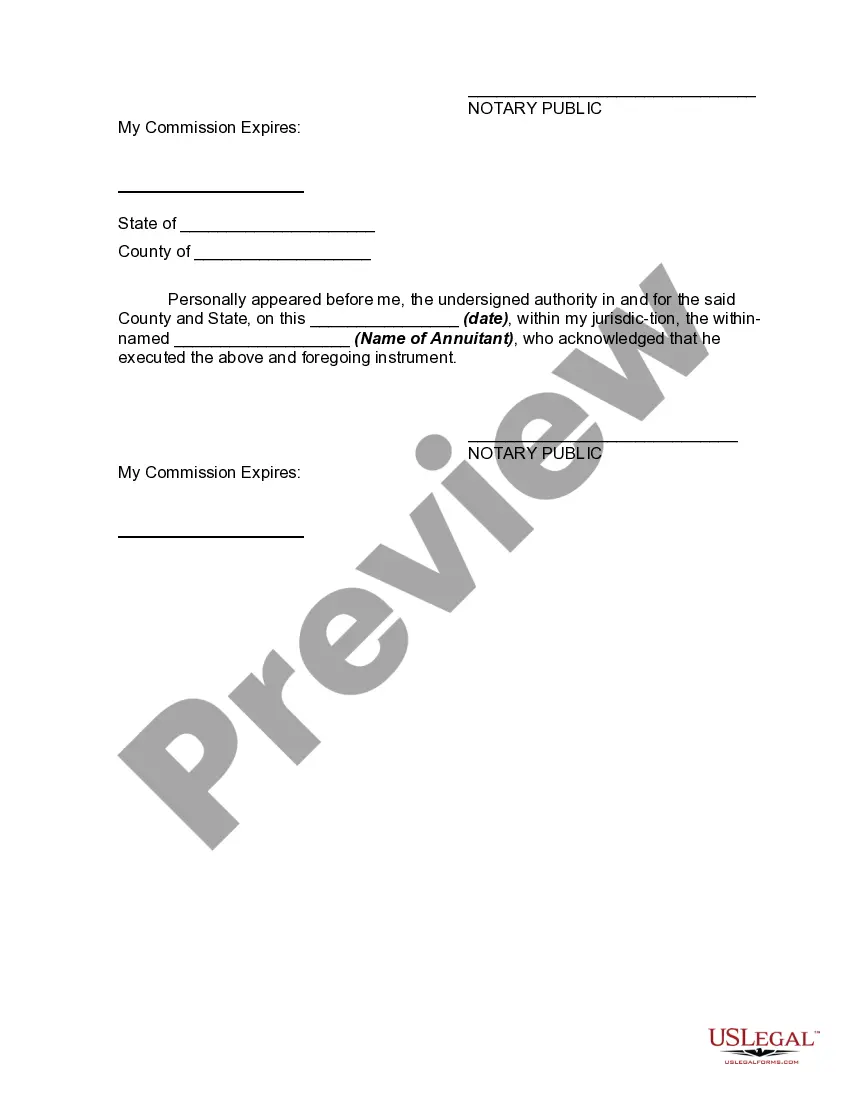

In its simplest form, a private annuity agreement with payments to last for life of annuitant provides guaranteed payments over the lifetime of one person, with payments ceasing upon the annuitant's death.

Miami-Dade Florida Private Annuity Agreement with Payments to Last for Life of Annuitant: A Comprehensive Overview Introduction: In Miami-Dade, Florida, private annuity agreements with payments to last for the life of an annuitant offer individuals a secure and predictable income stream throughout their lifetime. These agreements are commonly used by retirees or individuals seeking financial stability by receiving regular payments without the worry of market fluctuations. Private annuities in Miami-Dade present several variations, each tailored to different circumstances, including fixed annuities, variable annuities, and equity-indexed annuities. Fixed Annuities: Fixed annuities are a popular type of private annuity agreement in Miami-Dade. With fixed annuities, the annuitant receives a fixed, predetermined payment amount at regular intervals, typically on a monthly basis. These payments remain constant throughout the life of the annuitant, providing a stable income stream regardless of market downturns or interest rate fluctuations. Fixed annuities are particularly suitable for those who prioritize financial security and a reliable income source. Variable Annuities: For individuals seeking potential growth opportunities within their annuity agreement, variable annuities in Miami-Dade offer an alternative. These agreements allow annuitants to invest their funds into various investment vehicles, such as stocks, bonds, or mutual funds, chosen from a predetermined selection provided by the issuer. The payments received through variable annuities fluctuate based on the performance of the chosen investment options. It is important to note that while variable annuities offer a potential for higher returns, they also carry a higher degree of risk compared to fixed annuities. Equity-Indexed Annuities: Equity-indexed annuities provide a unique hybrid approach that combines elements of both fixed and variable annuities. Miami-Dade's residents considering this type of annuity agreement can expect payments linked, at least in part, to the performance of a specific market index, such as the S&P 500. This arrangement allows annuitants to potentially benefit from market upswings while providing downside protection in the event of market declines. Equity-indexed annuities provide a solution that balances growth opportunities with security, making them ideal for risk-averse individuals seeking moderate returns. Conclusion: Miami-Dade, Florida, offers a range of private annuity agreements with payments designed to last for the life of the annuitant. Fixed annuities provide stability and a predictable income stream, ensuring financial security throughout retirement. Variable annuities introduce potential growth opportunities but come with higher risk. Equity-indexed annuities strike a balance between growth and security by linking payments to market performance. Determining the most suitable annuity type depends on an individual's financial goals, risk tolerance, and retirement objectives. Consulting with a financial advisor can help guide Miami-Dade residents towards the most appropriate private annuity agreement to meet their unique needs.

Free preview