A San Diego California Private Annuity Agreement with Payments to Last for Life of Annuitant is a legally binding contract that allows individuals to transfer ownership of property or assets in exchange for a guaranteed income stream for the duration of the annuitant's life. This financial arrangement ensures a consistent source of income for retirees or individuals who wish to monetize their assets while avoiding immediate tax liabilities. There are various types of San Diego California Private Annuity Agreements with Payments to Last for Life of Annuitant, each catering to different needs and preferences. These can include: 1. Single-Life Private Annuity: This type of agreement guarantees payments for the lifetime of one individual, the annuitant, who enters into the contract. 2. Joint-and-Survivor Private Annuity: This arrangement ensures payments for the lives of two individuals, typically married couples or domestic partners. Payments continue until the last surviving annuitant passes away, providing financial security for both partners. 3. Indexed Private Annuity: In this agreement, payments are linked to changes in a specific index, often the Consumer Price Index (CPI). This helps protect against inflation, ensuring that annuitants' purchasing power remains relatively stable over time. 4. Deferred Private Annuity: With a deferred private annuity, the annuitant can delay the start of payments until a future date of their choosing. This can be beneficial for individuals who want to secure a guaranteed income stream for retirement but do not immediately require the funds. 5. Lump Sum Payment Private Annuity: While the primary focus of private annuity agreements is to provide regular income, some arrangements may include an option for a lump sum payment instead of periodic payments. This provides flexibility for annuitants who may need a substantial amount of money for a specific purpose, such as purchasing a new property or funding a business venture. 6. Fixed-Term Private Annuity: Unlike the traditional private annuity that lasts for the annuitant's lifetime, a fixed-term private annuity provides payments for a predetermined period, typically a specific number of years. This type of agreement may suit individuals who want to receive a consistent income for a set duration without the uncertainty of longevity. In San Diego, California, individuals can engage in these different types of Private Annuity Agreements to secure a reliable income stream for their future. These agreements not only offer financial stability but also provide tax advantages by deferring capital gains tax on the underlying assets until the annuitant starts receiving payments. It is advisable to consult with financial planners or legal professionals to understand the intricacies of these agreements and determine which option best suits individual needs and goals.

San Diego California Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out San Diego California Private Annuity Agreement With Payments To Last For Life Of Annuitant?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life sphere, finding a San Diego Private Annuity Agreement with Payments to Last for Life of Annuitant suiting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the San Diego Private Annuity Agreement with Payments to Last for Life of Annuitant, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your San Diego Private Annuity Agreement with Payments to Last for Life of Annuitant:

- Examine the content of the page you’re on.

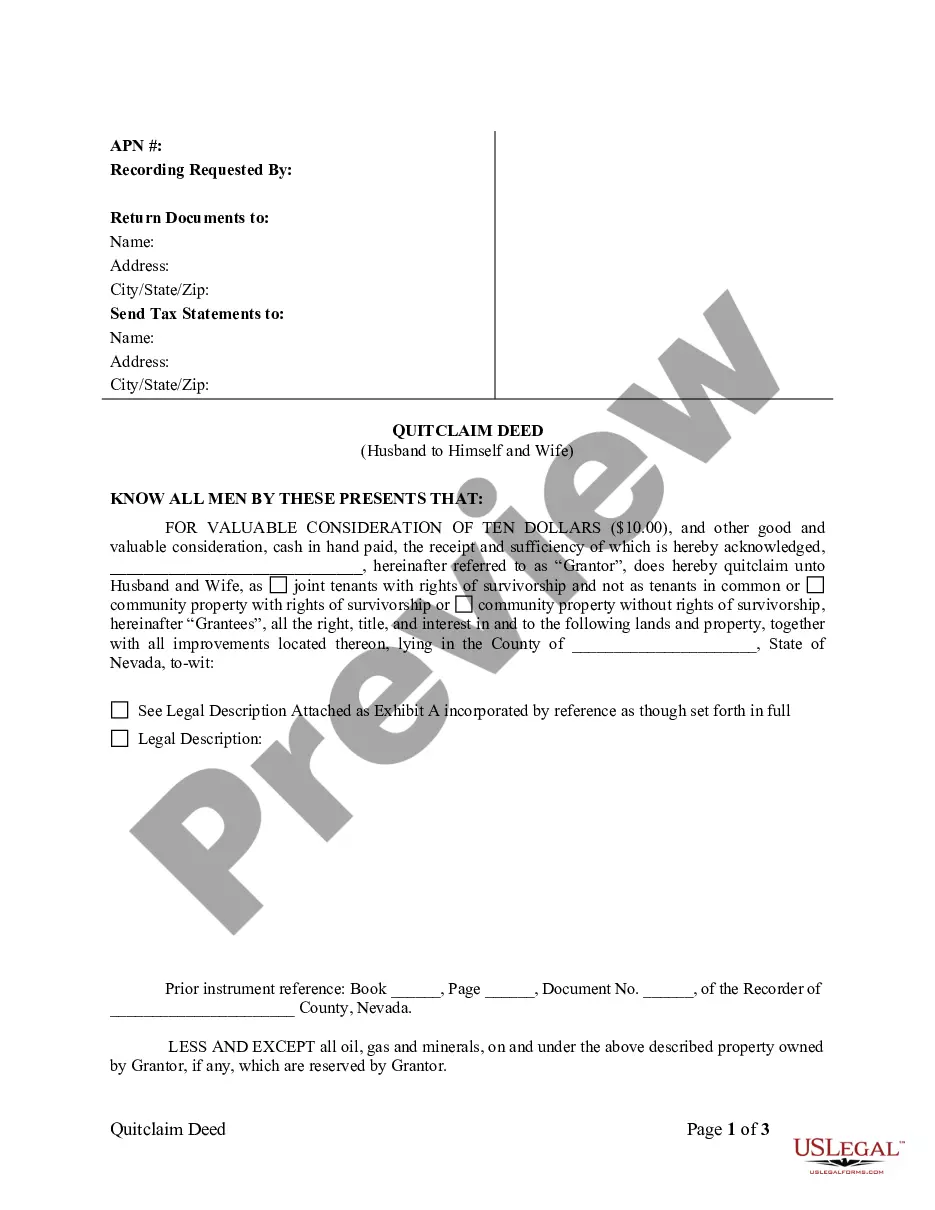

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Diego Private Annuity Agreement with Payments to Last for Life of Annuitant.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!