A San Jose California Private Annuity Agreement with Payments to Last for Life of Annuitant is a legal arrangement between two parties, where one party (the annuitant) transfers assets or property to another party (the annuity issuer) in exchange for a series of periodic payments that will continue for the lifetime of the annuitant. One type of San Jose California Private Annuity Agreement with Payments to Last for Life of Annuitant is the Fixed Annuity, where the annuitant receives a fixed amount of payments for their lifetime. This type provides a stable income stream, and the payments remain consistent regardless of market fluctuations. Another type is the Variable Annuity, offering payments that fluctuate based on the performance of underlying investments chosen by the annuitant. The annuitant assumes some investment risk but also has the potential for higher returns. The San Jose California Private Annuity Agreement also includes a Deferred Annuity option, where the annuitant chooses to delay payments until a specific date in the future. This allows for the accumulation of funds over time, potentially resulting in larger payments when the annuitant starts receiving distributions. It is important to note that San Jose California Private Annuity Agreements are subject to specific laws and regulations that vary by jurisdiction. Consulting with a qualified financial advisor or attorney in San Jose, California, is highly recommended ensuring compliance with local regulations and to fully understand the implications of entering into such an agreement. Overall, a San Jose California Private Annuity Agreement with Payments to Last for Life of Annuitant offers financial security and a guaranteed income stream throughout the annuitant's life. By exploring the different types available, individuals in San Jose, California, can choose the most suitable annuity option based on their financial goals, risk tolerance, and personal circumstances.

San Jose California Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

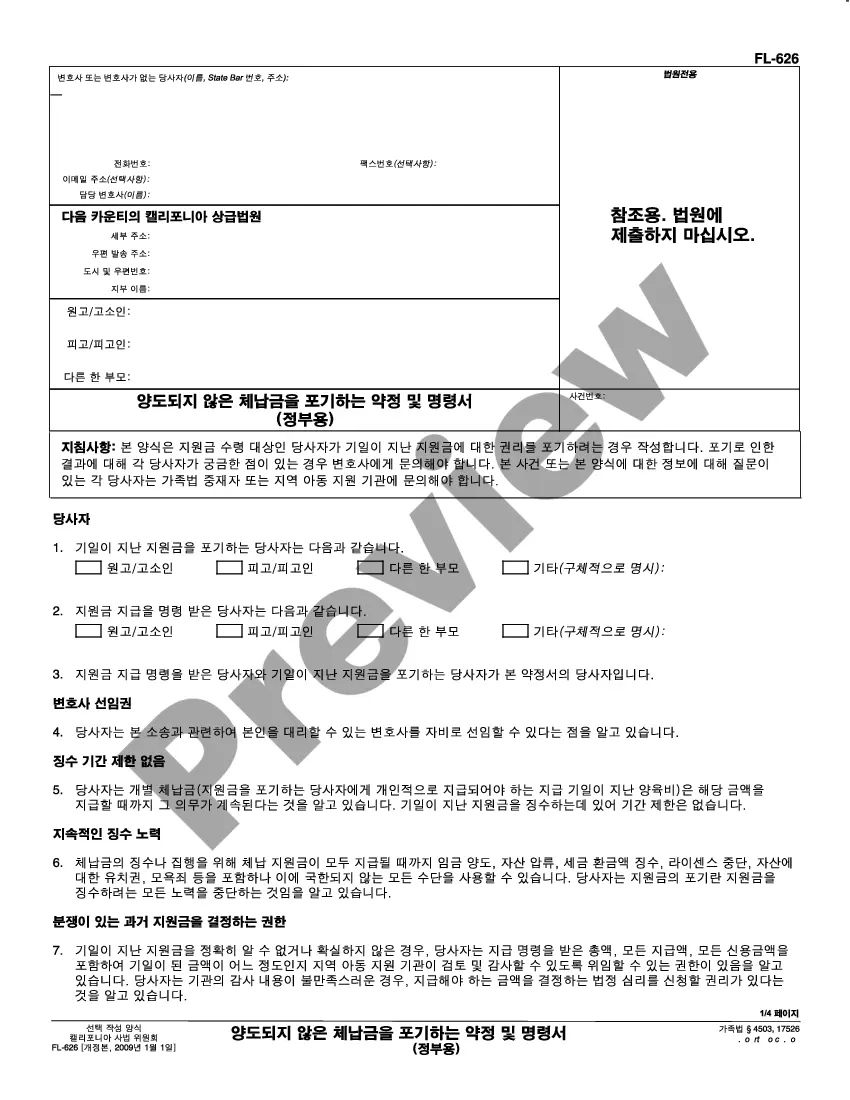

How to fill out San Jose California Private Annuity Agreement With Payments To Last For Life Of Annuitant?

Draftwing documents, like San Jose Private Annuity Agreement with Payments to Last for Life of Annuitant, to manage your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents intended for different cases and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the San Jose Private Annuity Agreement with Payments to Last for Life of Annuitant form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading San Jose Private Annuity Agreement with Payments to Last for Life of Annuitant:

- Ensure that your document is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the San Jose Private Annuity Agreement with Payments to Last for Life of Annuitant isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin utilizing our website and get the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is ready to go. You can try and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Income annuities provide guaranteed lifetime income, either now or in the future, while other types of annuities help defer taxes or provide protection from stock market losses.

Payments are made to you for the rest of your life until the day you die, guaranteed. When you die, the surviving spouse will continue to receive annuity payments for the rest of their life as well.

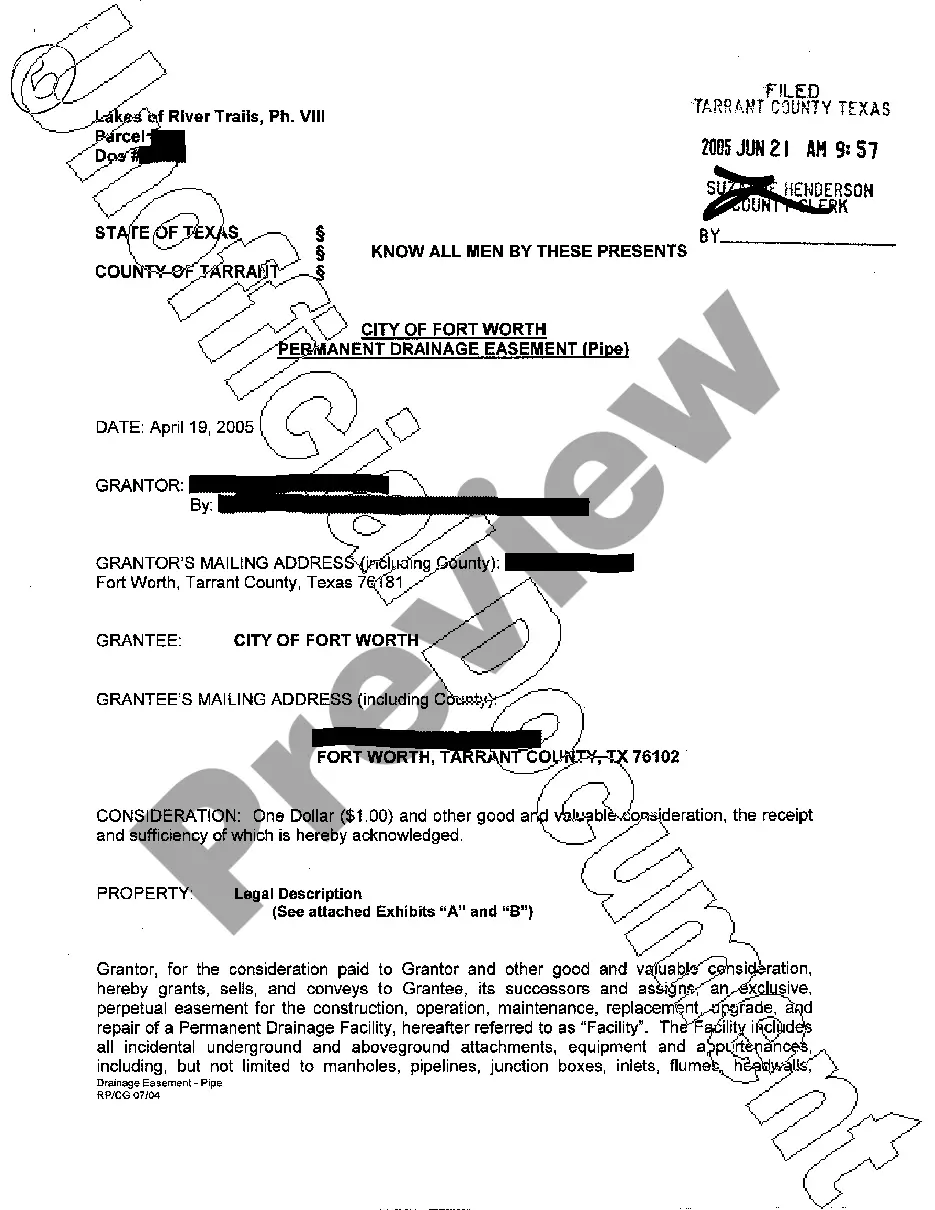

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.

A private annuity is an arrangement where an individual (the annuitant) transfers assets to another (the obligor) in exchange for regular payments for the remainder of the annuitant's life (an annuity).

If the annuity is structured as a joint life annuity, it guarantees payments for both the lifetime of the annuitant and that person's spouse. Upon one spouse's death, the survivor will continue to receive payments for life.

If the annuity is structured as a joint life annuity, it guarantees payments for both the lifetime of the annuitant and that person's spouse. Upon one spouse's death, the survivor will continue to receive payments for life.

When the holder of a commercial annuity dies, any death benefits or payments to heirs may be included in the annuitant's estate for tax purposes. The private annuity arrangement does not, however, avoid taxation altogether.

An annuitant is a person who is entitled to the income benefits from an annuity. This is also the person whose life expectancy determines the payment amounts. The annuitant is usually the annuity contract owner but can also be the spouse or a friend or relative of the annuity owner.

Lifetime annuities provide income for as long as you live - even after all the money you contributed is exhausted. They can be useful for those who want the certainty and security of establishing a regular and guaranteed income stream.

An annuitant is an individual whose life expectancy is used as for determining the amount and timing when benefits payments will start and cease. In most cases, though not all, the owner and annuitant will be the same person.