Fulton Georgia Acceptance of Claim by Collection Agency and Report of Experience with Debtor is a legal process that involves acknowledging and approving a claim submitted by a collection agency regarding a debtor in Fulton County, Georgia. This procedure ensures transparency and records the collection agency's experience while dealing with the debtor. Here are some types of Fulton Georgia Acceptance of Claim by Collection Agency and Report of Experience with Debtor: 1. Residential Debt Collection: This type of acceptance and reporting process primarily revolves around outstanding debts owed by individuals related to residential properties in Fulton County, Georgia. It covers various categories like mortgage loans, utility bills, credit card debts, and personal loans, among others. 2. Commercial Debt Collection: Fulton Georgia Acceptance of Claim by Collection Agency and Report of Experience with Debtor also pertains to the collection of outstanding debts from businesses operating within Fulton County. This may include unpaid invoices, lease payments, business loans, or any other type of commercial arrangement. 3. Medical Debt Collection: Medical debts can significantly burden both individuals and healthcare providers. Therefore, this specific type focuses on reporting and accepting claims related to unpaid medical bills, outstanding hospital fees, or any other healthcare services provided in Fulton County, Georgia. 4. Student Loan and Education Debt Collection: Fulton County is home to several educational institutions, making the collection of student loans and educational debts an important aspect. This type of Acceptance and Report encompasses delinquent student loans, defaulted tuition payments, and other educational-related debts. 5. Professional Services Debt Collection: Professionals such as attorneys, accountants, consultants, or freelancers may also encounter difficulties in receiving payments for their services. This category addresses the acceptance of claims and reporting experiences with debtors who have outstanding debts with professional service providers in Fulton County. When a collection agency submits a claim to Fulton Georgia, they must provide detailed documentation and evidence supporting the debt owed by the debtor. The Fulton Georgia authorities review the claim, ensuring it complies with legal requirements and local regulations. Once the claim is accepted, the collection agency can proceed with further legal actions to recover the outstanding debt. The Report of Experience with Debtor is an essential part of the process. It includes documenting each interaction, payment agreement, or lack thereof, and any legal actions taken against the debtor. This report serves as a record of the collection agency's experiences while attempting to recover the debt and helps in assessing the debtor's financial behavior for potential legal actions. In summary, Fulton Georgia Acceptance of Claim by Collection Agency and Report of Experience with Debtor encompasses several types of debt collection procedures applicable to residential, commercial, medical, student loan, and professional service-related debts. This process ensures a standardized approach to debt collection while maintaining transparency between collection agencies, debtors, and Fulton County authorities.

Fulton Georgia Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Fulton Georgia Acceptance Of Claim By Collection Agency And Report Of Experience With Debtor?

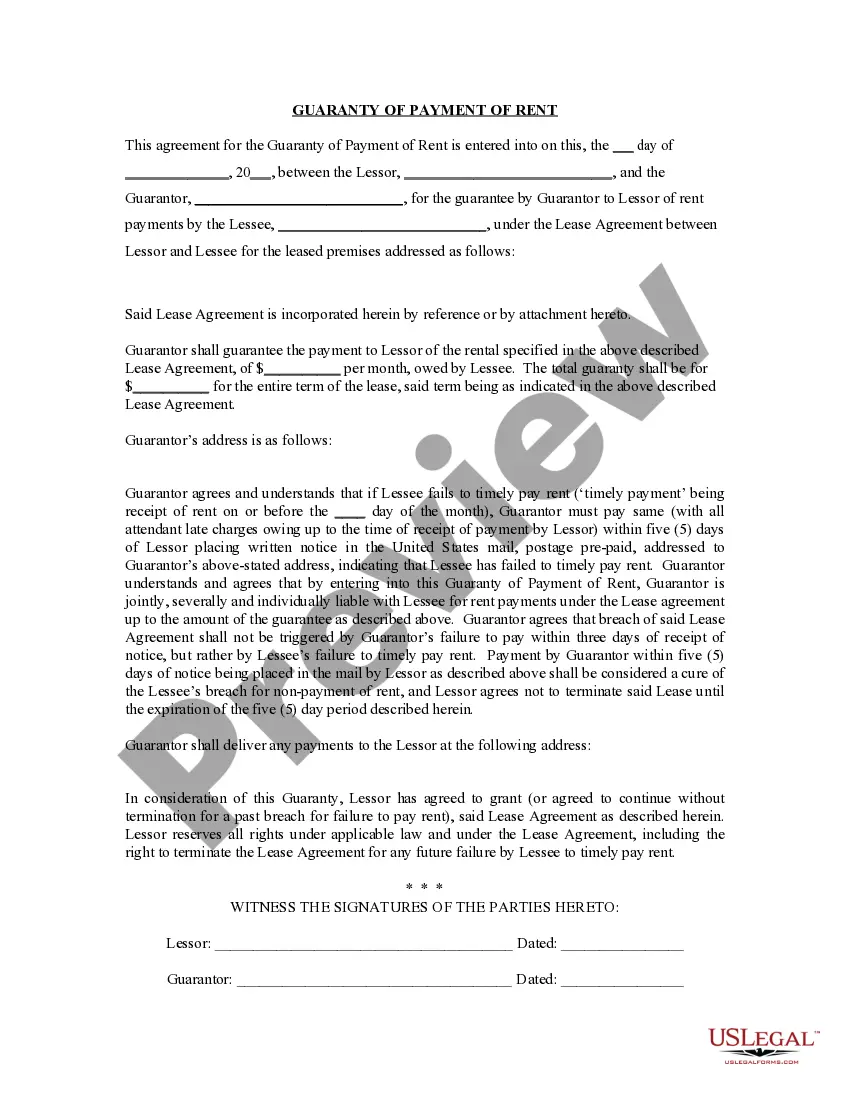

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Fulton Acceptance of Claim by Collection Agency and Report of Experience with Debtor, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Consequently, if you need the current version of the Fulton Acceptance of Claim by Collection Agency and Report of Experience with Debtor, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Fulton Acceptance of Claim by Collection Agency and Report of Experience with Debtor:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Fulton Acceptance of Claim by Collection Agency and Report of Experience with Debtor and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

In your own words introduce yourself and cover the following points: The invoice number in question. The amount due. The due date. If they say payment is in the mail, ask for the date it was mailed and the check number.

I am responding to your contact about a debt you are attempting to collect. You contacted me by phone/mail, on date. You identified the debt as any information they gave you about the debt. Please stop all communication with me and with this address about this debt.

Follow these steps to respond to a debt collection case in California Answer each claim listed in the complaint. Assert your affirmative defenses. File the Answer with the court and serve the plaintiff.

You should put the name of the court, the case name, and the case number at the top of your answer. You should sign it and date it and put your contact information under your signature. After you finish writing your answer, take it to the court clerk and ask the clerk to file it.

I do not have any responsibility for the debt you're trying to collect. If you have good reason to believe that I am responsible for this debt, mail me the documents that make you believe that. Stop all other communication with me and with this address, and record that I dispute having any obligation for this debt.

3. Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

You should not ignore a debt collection letter as not responding to them in time (or at all) can lead to the collection agency filing a lawsuit against you. Not only will this result in you being responsible for additional fees, but it can allow them to take legal action to get the funds from you in other ways.

Typically, credit bureaus wait up to 180 days to report these collections to allow time for individuals to work with insurance companies and providers to get debts paid appropriately. Sign up for ExtraCredit to access your credit reports and see 28 FICO® scores.

You only need to say a few things: This is not a good time. Please call back at . I don't believe I owe this debt. Can you send information on it? I prefer to pay the original creditor.My employer does not allow me to take these calls at work.