Cook Illinois General Form of Factoring Agreement — Assignment of Accounts Receivable is a legally binding document between a business (known as the "Assignor") and a factoring company (known as the "Assignee") that outlines the terms and conditions for the sale and assignment of accounts receivable. This type of factoring agreement is a financial arrangement commonly used by businesses to improve cash flow and access immediate funds. By transferring their accounts receivable to the factoring company, businesses can receive an upfront payment for the outstanding invoices, typically around 80-90% of the total value. The factoring company then collects the payment directly from the customers and pays the remaining balance, minus a fee (known as the discount rate), to the business. The Cook Illinois General Form of Factoring Agreement — Assignment of Accounts Receivable is designed to provide a comprehensive framework for both the Assignor and the Assignee, ensuring a smooth and mutually beneficial relationship. It includes essential clauses such as: 1. Assignment of Accounts Receivable: This section outlines the transfer of ownership rights of the accounts receivable from the Assignor to the Assignee. It clarifies that the Assignee assumes all collection responsibilities and has the right to pursue legal action against non-paying customers. 2. Factoring Fee: This clause specifies the discount rate that the Assignor agrees to pay the Assignee for their services. The discount rate varies based on factors such as the creditworthiness of the customers, the volume of invoices, and the overall risk involved. 3. Obligations and Representations: This section establishes the responsibilities of both parties. The Assignor must ensure the accuracy of the accounts receivable, guarantee non-duplication of assignments, and not engage in any activity that may jeopardize the collection process. The Assignee, on the other hand, commits to diligently collecting the assigned accounts and remitting the remaining balance to the Assignor. 4. Confidentiality and Non-Disclosure: This clause protects the privacy and confidentiality of both parties' financial information. It ensures that any sensitive data, such as customer details and financial records, remains confidential and prohibits either party from disclosing such information to third parties. Other variations or types of Cook Illinois General Form of Factoring Agreement — Assignment of Accounts Receivable may include specialized provisions tailored to specific industries or situations. For example: 1. Recourse Factoring: In this type of agreement, the Assignor bears the risk of non-payment. If a customer fails to pay within a specified period, the Assignee has the right to reclaim the unpaid invoice amount from the Assignor. 2. Non-Recourse Factoring: Unlike recourse factoring, the Assignor is protected from the risk of non-payment. The Assignee assumes full responsibility for the collection of the assigned accounts, even in the case of invoice defaults or insolvencies. 3. Construction Factoring: This variant caters specifically to the construction industry, where progress payments and retention amounts may complicate the factoring process. The agreement may include provisions to address such complexities, ensuring a smooth flow of funds for construction projects. In summary, the Cook Illinois General Form of Factoring Agreement — Assignment of Accounts Receivable is a crucial financial instrument that allows businesses to convert their accounts receivable into immediate cash. It provides a structured framework to transfer ownership rights, establish responsibilities, and maintain confidentiality between the Assignor and the Assignee.

Cook Illinois General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out Cook Illinois General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Cook General Form of Factoring Agreement - Assignment of Accounts Receivable, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Cook General Form of Factoring Agreement - Assignment of Accounts Receivable from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Cook General Form of Factoring Agreement - Assignment of Accounts Receivable:

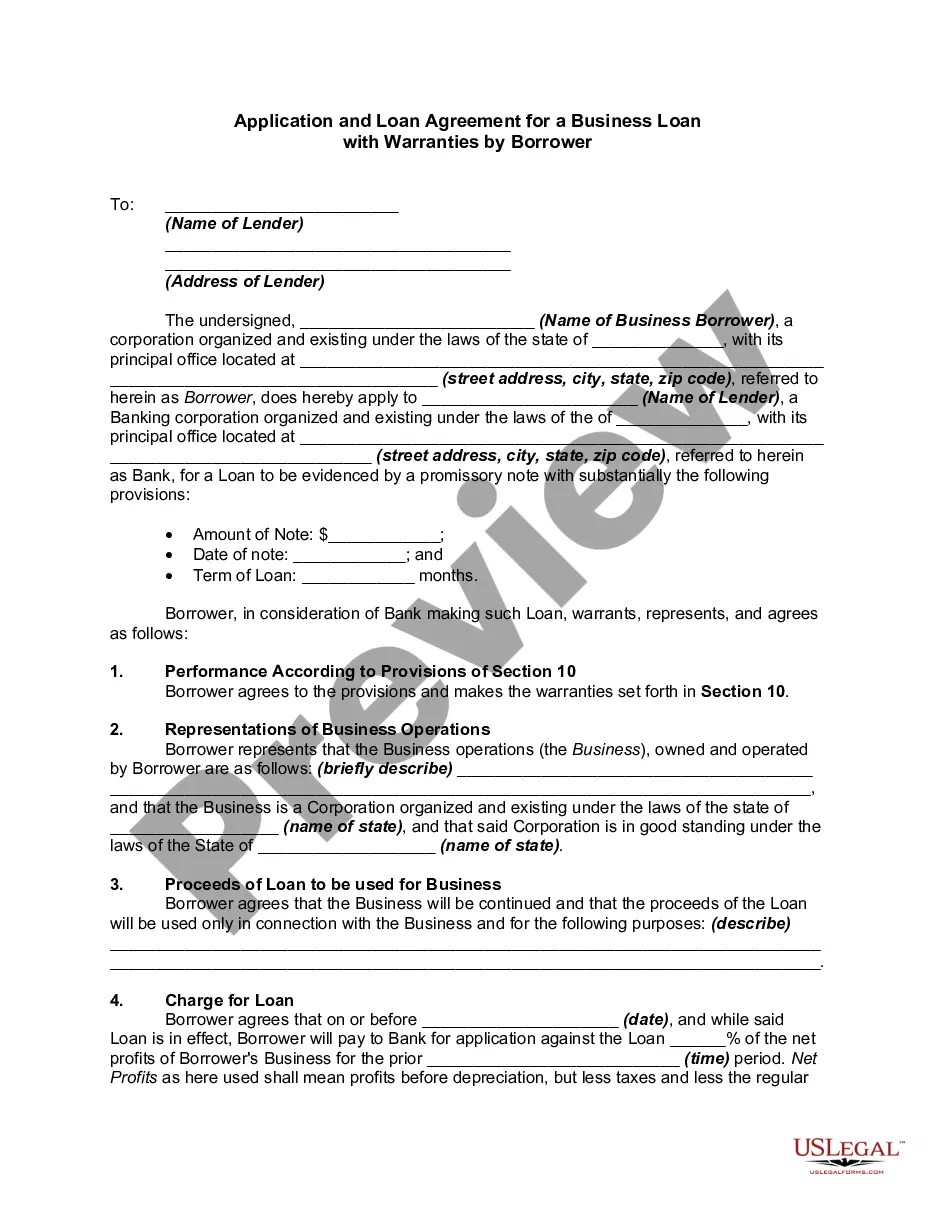

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!