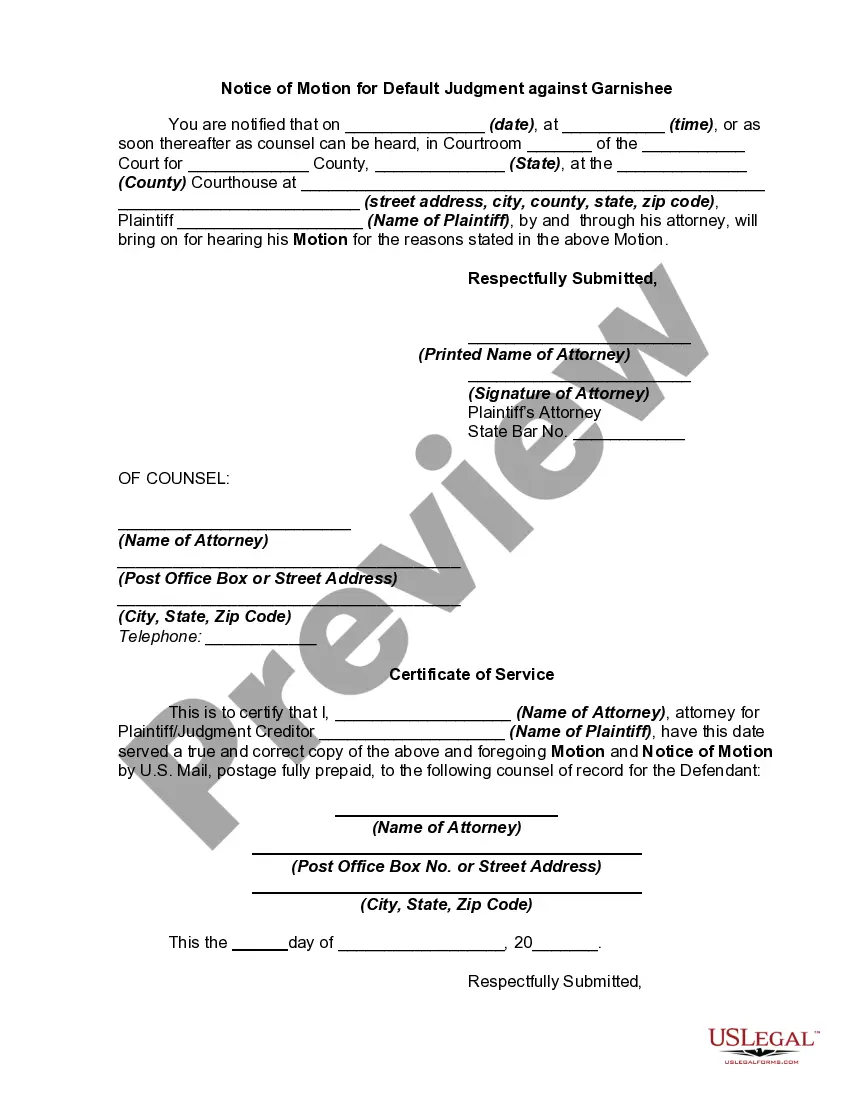

Most states have laws that provided that if a garnishee, personally summoned, shall fail to answer as required by law, the court shall enter a judgment against him for the amount of plaintiff's demand.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cook Illinois is a notable transportation company that operates in the state of Illinois. In legal proceedings, such as debt collections, a garnishee is an individual or entity that holds the debtor's assets, such as wages or bank accounts, which can be used to satisfy the debt owed to the creditor. A Motion for Default Judgment against Garnishee refers to an application filed by the creditor in a legal dispute, requesting the court to issue a default judgment against the garnishee. Keywords: Cook Illinois, Motion for Default Judgment against Garnishee, transportation company, Illinois, legal proceedings, debt collections, garnishee, assets, wages, bank accounts, creditor, default judgment. Different types of Cook Illinois Motion for Default Judgment against Garnishee: 1. Wage Garnishment: This type of motion is filed when the creditor seeks to collect the debt by garnishing the debtor's wages. The garnishee, usually the debtor's employer, is ordered by the court to deduct a portion of the debtor's wages and remit them directly to the creditor until the debt is satisfied. 2. Bank Account Garnishment: In cases where the debtor has funds in a bank account, the creditor may file a motion for default judgment against the garnishee, which is the bank in this instance. The court can order the bank to freeze the debtor's account and transfer the funds to the creditor to settle the outstanding debt. 3. Property Garnishment: If the debtor owns or possesses valuable assets, such as real estate, vehicles, or valuable objects, a motion for default judgment against the garnishee can be filed to seize and auction off these assets. The proceeds from the sale are then used to pay off the debt owed to the creditor. 4. Non-Wage Garnishment: This type of motion encompasses any garnishment that does not involve the debtor's wages. It can be applied to garnish various assets, including bank accounts, real estate, vehicles, or other personal property of value. 5. Subsequent Garnishment: In certain cases, the creditor may need to file multiple motions for default judgment against different garnishees to collect the complete debt owed. This may occur if the debtor has multiple sources of income or holds assets at various institutions. These different types of Cook Illinois motions for default judgment against garnishee provide creditors with legal recourse to recover debts owed to them by utilizing the garnishee's assets to satisfy the outstanding obligations.