The Oakland Michigan Sworn Statement regarding Proof of Loss for Automobile Claim is a legal document that serves as evidence of a claim made by an individual regarding a loss or damage to their vehicle. This statement is crucial in the insurance claims process and is designed to provide a comprehensive and detailed account of the incident. The Oakland Michigan Sworn Statement is used in various scenarios, including accidents, thefts, vandalism, or any other event resulting in damage to a vehicle. It ensures that the claimant provides all necessary information to the insurance company, helping to expedite the claims process and determine the appropriate compensation. When filling out the Oakland Michigan Sworn Statement, claimants must provide essential details such as their personal information, policy number, date, time, and location of the incident. They should describe the circumstances of the loss, including any witnesses present, if applicable. Additionally, a comprehensive description of the damages sustained by the vehicle, including photographs and repair estimates, should be attached to support the claim. Claimants must sign the Sworn Statement under oath, affirming the accuracy and truthfulness of the information provided. Any false statements or misleading information can result in the denial of the claim or potential legal consequences. It is important to note that the Oakland Michigan Sworn Statement regarding Proof of Loss for an Automobile Claim may have variations or additional requirements depending on the insurance company or specific policy. Claimants should carefully review their insurance policy guidelines and consult with their insurance agent or legal counsel to ensure compliance with the relevant regulations and requirements. In conclusion, the Oakland Michigan Sworn Statement regarding Proof of Loss for Automobile Claim is a crucial document used to detail and support a claim made due to loss or damage to a vehicle. Providing accurate, complete, and truthful information is essential to ensure a smooth claims process and obtain fair compensation.

Oakland Michigan Sworn Statement regarding Proof of Loss for Automobile Claim

Description

How to fill out Oakland Michigan Sworn Statement Regarding Proof Of Loss For Automobile Claim?

Preparing papers for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Oakland Sworn Statement regarding Proof of Loss for Automobile Claim without expert help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Oakland Sworn Statement regarding Proof of Loss for Automobile Claim on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Oakland Sworn Statement regarding Proof of Loss for Automobile Claim:

- Look through the page you've opened and check if it has the sample you need.

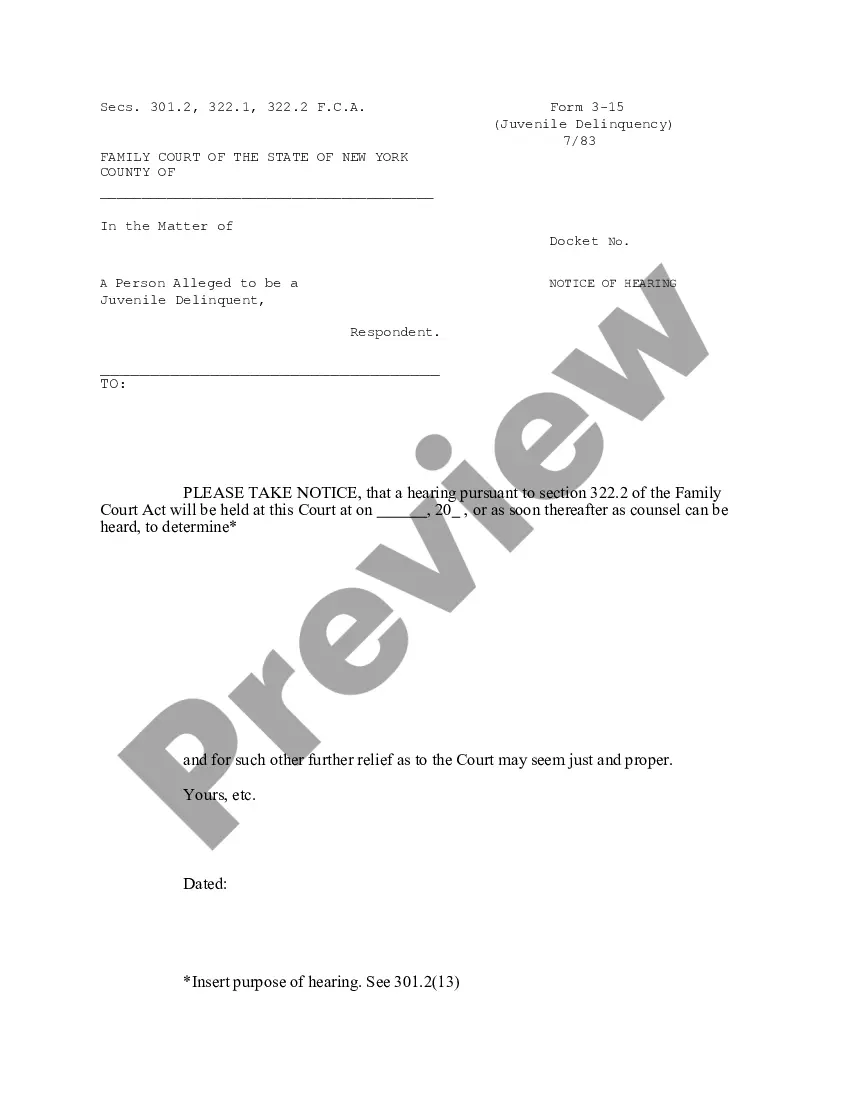

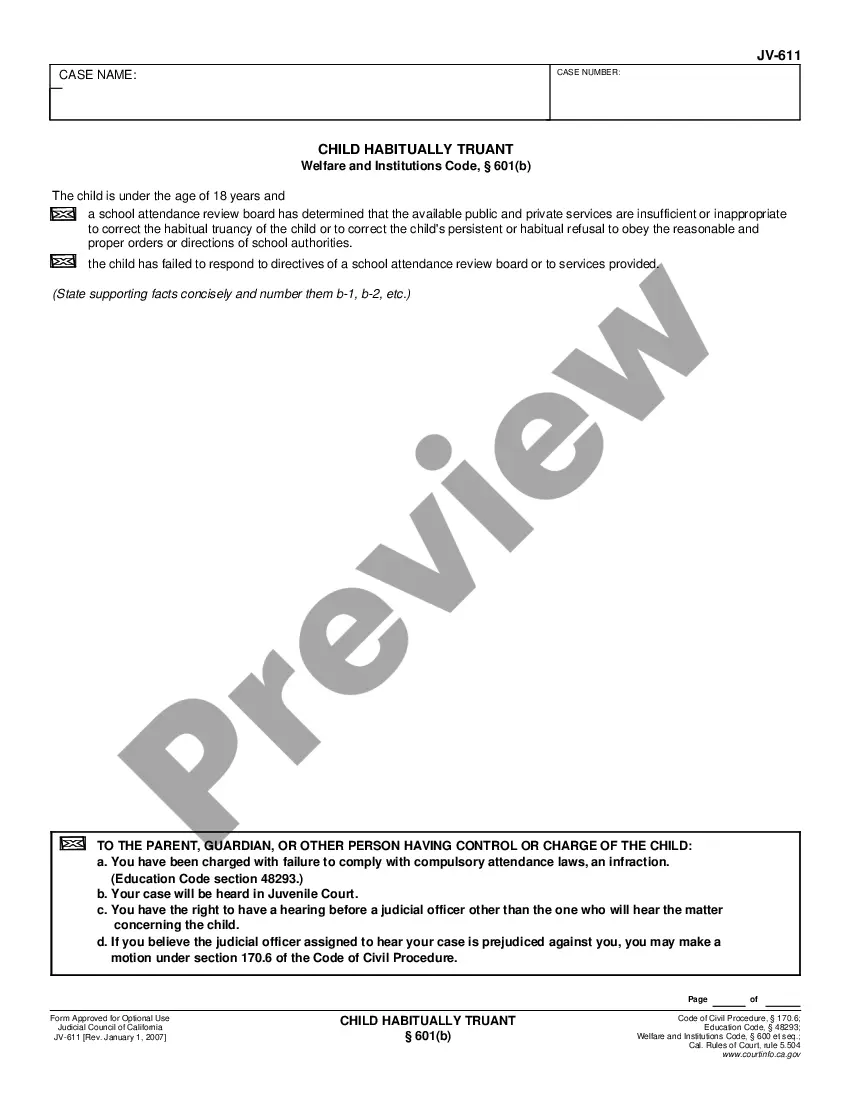

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any scenario with just a couple of clicks!

Form popularity

FAQ

A sworn proof of loss (SPOL) is a really very simple. It is a one-page document that you fill out stating your amount of damages, that is, the amount you believe it will cost to fully repair and restore your property to the condition it was in before the storm, fire, or other peril, and you sign it under oath.

Proof of loss is a legal document that explains what's been damaged or stolen and how much money you're claiming. Your insurer may have you fill one out, depending on the loss. Homeowners, condo and renters insurance can typically help cover personal property.

In the property insurance industry, a statement of loss is synonymous with a proof of loss. Whether your insurer calls it by one name or the other, the document is prepared by your insurer's claim adjuster to itemize your damaged goods that need replacement or repair after a disaster involving your business or home.

A sworn statement in proof of loss is a formal statement most insurance companies required you file a compensation claim. The document prevents insurance fraud by substantiating the value of the insured's costs through official documentation and a notarized signature.

6 Steps to Fill Out a Proof of Loss Document The date and cause of the loss. Coverage amounts at the time the loss occurred. Documents that support the value of your property and the amount of loss you claim such as estimates, inventories, receipts, etc. Policy number. Parties that have an interest in the property.

6 Steps to Fill Out a Proof of Loss Document The date and cause of the loss. Coverage amounts at the time the loss occurred. Documents that support the value of your property and the amount of loss you claim such as estimates, inventories, receipts, etc. Policy number. Parties that have an interest in the property.

When required, you should file your Proof of Loss form as soon as possible but no later than the date specified in your insurance policy. It's typically required within 60 days after the incident that led to your insurance claim.

A proof of loss requires a formal statement of the claim, usually sworn with the notarized signature of the insured, and is designed to facilitate the investigation of the claim and enable the insurer to protect its interests.