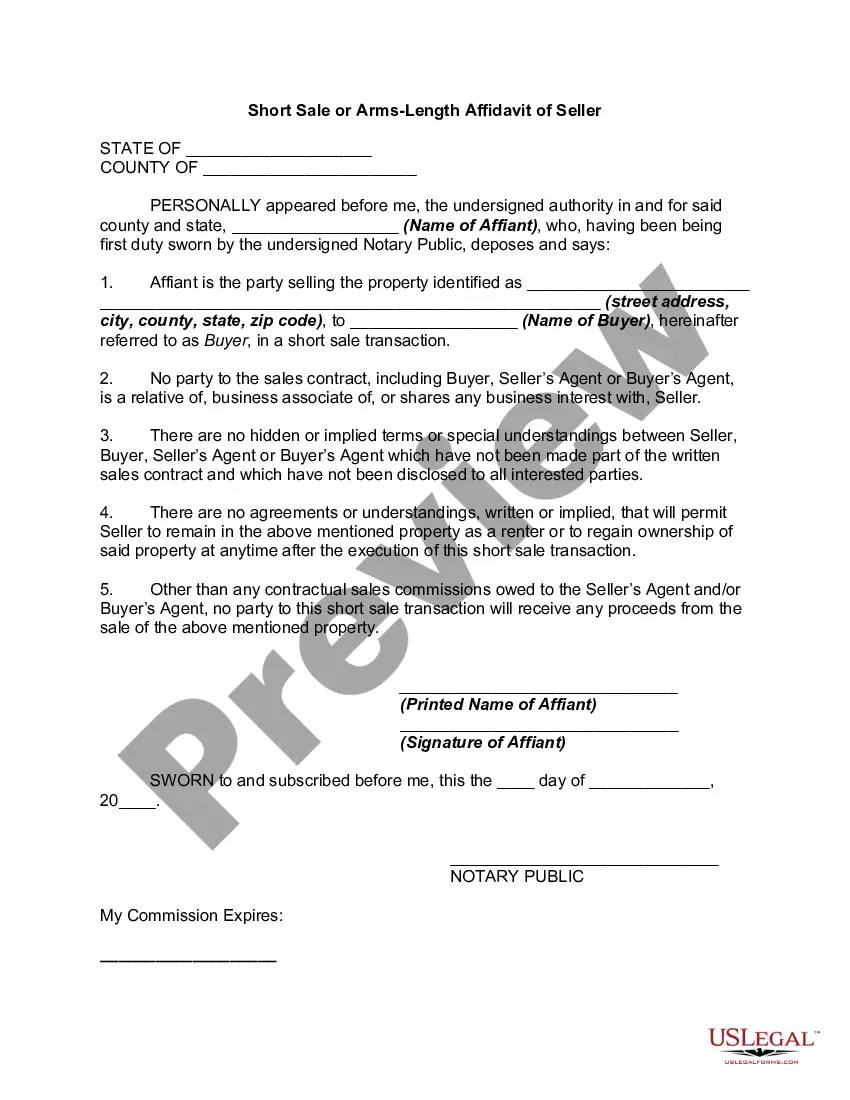

In real estate, a short sale occurs when a bank or mortgage lender agrees to discount a loan balance due to an economic hardship on the part of the mortgagor (i.e., the seller). Circumstances determine whether or not banks will discount a loan balance. These circumstances are usually related to the current real estate market climate and the individual borrower's financial situation. A short sale typically is executed to prevent a home foreclosure. Often a bank will choose to allow a short sale if they believe that it will result in a smaller financial loss than foreclosing.

An arms-length or short sale affidavit is a document created by a bank in an attempt to prevent sellers from selling to relatives or friends to act as a straw buyer. Sometimes sellers make such side agreements. Then, after the transaction closes, the pretend buyers quickly transfer title back to the seller. This practice, in affect, means the sellers have repurchased their home at maybe half the cost, which greatly benefits those sellers.

Hennepin County, Minnesota Short Sale or Arms Length Affidavit: A Comprehensive Guide In Hennepin County, Minnesota, homeowners undertaking a short sale or engaging in a real estate transaction involving an arms' length affidavit may encounter specific requirements and guidelines. Understanding the intricacies of these processes is crucial to prevent any legal complications and ensure a smooth transaction. This detailed description provides relevant information about the Hennepin County Short Sale or Arms Length Affidavit, highlighting its purpose and different types if applicable. 1. Hennepin County Short Sale: A short sale occurs when a homeowner selling their property owes more on the mortgage than the estimated market value of the home. To authorize a short sale in Hennepin County, sellers may be required to submit a Short Sale Affidavit, also known as a Financial Information Worksheet, to their lender or mortgage service. This document often includes comprehensive financial details, demonstrating the homeowner's inability to repay the full mortgage amount. The Short Sale Affidavit aims to prove that selling the property at a lesser amount is the most viable solution for all parties involved. 2. Hennepin County Arms Length Affidavit: The Arms Length Affidavit is a crucial component in real estate transactions to ensure that all involved parties are unrelated and operating independently of one another. It aims to prevent fraudulent activities or conflicts of interest that could potentially influence the sale price of a property. This affidavit guarantees that the transaction is conducted fairly, without any hidden arrangements or compromises between the buyer and seller. It is typically used when the buyer has a personal relationship or connection with the seller, such as being a family member, business partner, or close friend. Different Types of Hennepin County Short Sale or Arms Length Affidavits: While not specific to Hennepin County, certain variations of Short Sale or Arms Length Affidavits may exist based on lender requirements or specific circumstances. Some possible variations include: 1. Financial Hardship Affidavit: This affidavit elaborates on the financial difficulties experienced by the homeowner requesting a short sale. It incorporates detailed information concerning income, expenses, assets, and debts, aiming to demonstrate the homeowner's inability to meet their mortgage obligation. 2. Property Valuation Affidavit: In cases where there is a dispute over the market value of the property, a Property Valuation Affidavit may be required. This affidavit allows a professional appraiser to provide an independent evaluation of the property, ensuring a fair market price. Conclusion: When approaching a short sale or a real estate transaction that requires an Arms Length Affidavit in Hennepin County, Minnesota, it is important to understand the specific requirements and guidelines to ensure a successful process. By submitting the appropriate affidavits and complying with all necessary procedures, homeowners can navigate the complexities of these transactions while maintaining transparency and fairness. Remember, consulting with a qualified real estate professional or attorney is always recommended navigating these processes effectively.Hennepin County, Minnesota Short Sale or Arms Length Affidavit: A Comprehensive Guide In Hennepin County, Minnesota, homeowners undertaking a short sale or engaging in a real estate transaction involving an arms' length affidavit may encounter specific requirements and guidelines. Understanding the intricacies of these processes is crucial to prevent any legal complications and ensure a smooth transaction. This detailed description provides relevant information about the Hennepin County Short Sale or Arms Length Affidavit, highlighting its purpose and different types if applicable. 1. Hennepin County Short Sale: A short sale occurs when a homeowner selling their property owes more on the mortgage than the estimated market value of the home. To authorize a short sale in Hennepin County, sellers may be required to submit a Short Sale Affidavit, also known as a Financial Information Worksheet, to their lender or mortgage service. This document often includes comprehensive financial details, demonstrating the homeowner's inability to repay the full mortgage amount. The Short Sale Affidavit aims to prove that selling the property at a lesser amount is the most viable solution for all parties involved. 2. Hennepin County Arms Length Affidavit: The Arms Length Affidavit is a crucial component in real estate transactions to ensure that all involved parties are unrelated and operating independently of one another. It aims to prevent fraudulent activities or conflicts of interest that could potentially influence the sale price of a property. This affidavit guarantees that the transaction is conducted fairly, without any hidden arrangements or compromises between the buyer and seller. It is typically used when the buyer has a personal relationship or connection with the seller, such as being a family member, business partner, or close friend. Different Types of Hennepin County Short Sale or Arms Length Affidavits: While not specific to Hennepin County, certain variations of Short Sale or Arms Length Affidavits may exist based on lender requirements or specific circumstances. Some possible variations include: 1. Financial Hardship Affidavit: This affidavit elaborates on the financial difficulties experienced by the homeowner requesting a short sale. It incorporates detailed information concerning income, expenses, assets, and debts, aiming to demonstrate the homeowner's inability to meet their mortgage obligation. 2. Property Valuation Affidavit: In cases where there is a dispute over the market value of the property, a Property Valuation Affidavit may be required. This affidavit allows a professional appraiser to provide an independent evaluation of the property, ensuring a fair market price. Conclusion: When approaching a short sale or a real estate transaction that requires an Arms Length Affidavit in Hennepin County, Minnesota, it is important to understand the specific requirements and guidelines to ensure a successful process. By submitting the appropriate affidavits and complying with all necessary procedures, homeowners can navigate the complexities of these transactions while maintaining transparency and fairness. Remember, consulting with a qualified real estate professional or attorney is always recommended navigating these processes effectively.