Dallas Texas Short Sale Affidavit of Buyer is a legal document that plays a crucial role in the process of purchasing a property under short sale conditions in the city of Dallas, Texas. This affidavit is often required by lenders or sellers to ensure transparency and compliance throughout the transaction. The Dallas Texas Short Sale Affidavit of Buyer usually includes the following key details: 1. Buyer Information: The document begins with the buyer's name, address, contact information, and any additional relevant identification details. 2. Property Information: The affidavit contains the property address, legal description, and relevant details about the property being purchased. 3. Statement of Understanding: The buyer acknowledges and confirms their understanding of the short sale process, including the potential risks and responsibilities involved in such transactions. 4. Financial Information: The affidavit may require the buyer to disclose their financial status, including their ability to finance the purchase and meet their obligations as specified in the sale agreement. 5. Statement of Arm's Length Transaction: This part of the affidavit ensures that the buyer and seller are not affiliated in any way that would compromise the integrity of the short sale transaction. This declaration confirms that the buyer is not related to, or in business with, the seller or any parties involved. 6. Non-Refundable Deposit: In some cases, the affidavit may include an acknowledgment that the buyer has provided a non-refundable deposit or earnest money, typically required in short sale transactions. 7. Compliance with Guidelines: The buyer affirms their compliance with all applicable laws, regulations, and guidelines related to short sale transactions in Dallas, Texas. Types of Dallas Texas Short Sale Affidavit of Buyer: 1. Standard Dallas Texas Short Sale Affidavit of Buyer: This is the most common type, used for typical short sale transactions in Dallas, Texas. 2. Affidavit for Multiple Buyers: When multiple individuals are involved in purchasing a short sale property, an affidavit outlining the details of each buyer may be required. 3. Investor Affidavit: If the buyer is an investor or purchasing the property as an investment, a specialized affidavit catering to investor-specific requirements may be necessary. 4. FHA/VA Affidavit: If the short sale involves financing through the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), a separate affidavit may be required to ensure compliance with their respective guidelines. It's important to note that the specific requirements and types of Dallas Texas Short Sale Affidavit of Buyer may vary depending on the lender, the nature of the transaction, and any additional local or state regulations. Therefore, it is crucial for buyers to consult with a real estate attorney or a qualified professional to ensure accurate completion of the affidavit as per the specific circumstances of the transaction.

Dallas Texas Short Sale Affidavit of Buyer

Description

How to fill out Dallas Texas Short Sale Affidavit Of Buyer?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Dallas Short Sale Affidavit of Buyer.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Dallas Short Sale Affidavit of Buyer will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Dallas Short Sale Affidavit of Buyer:

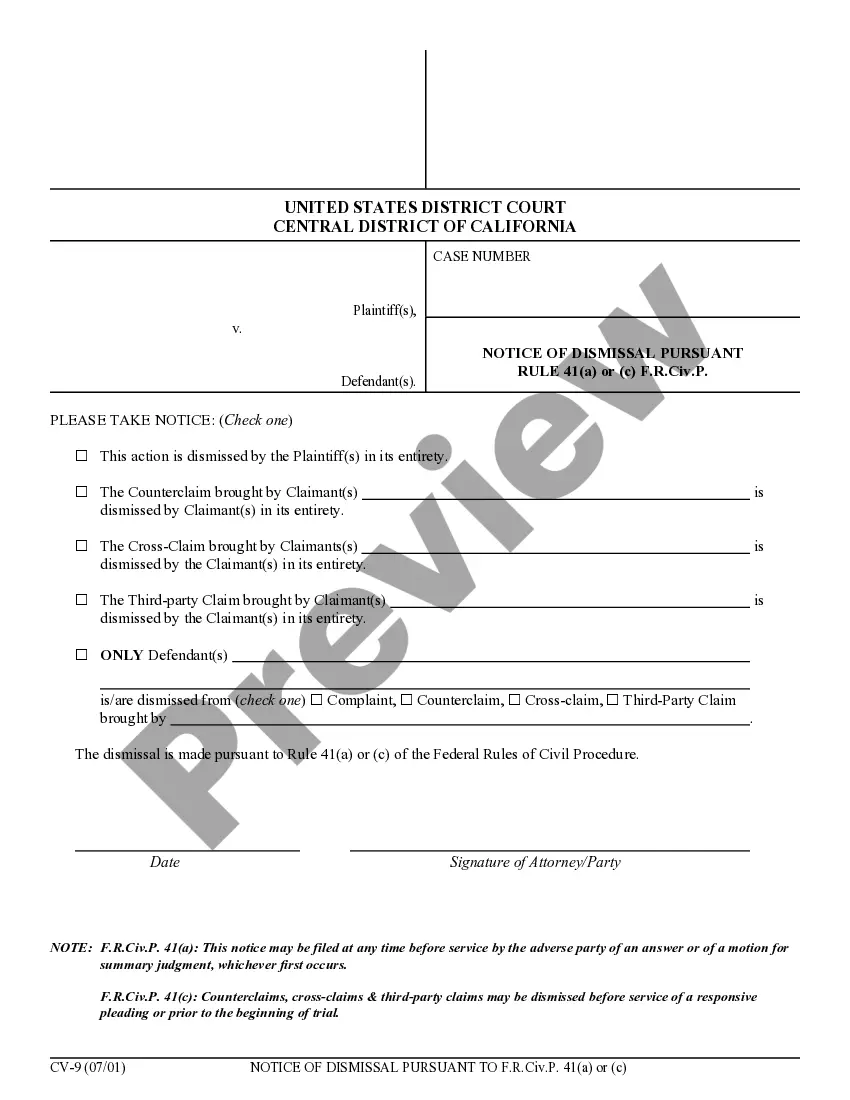

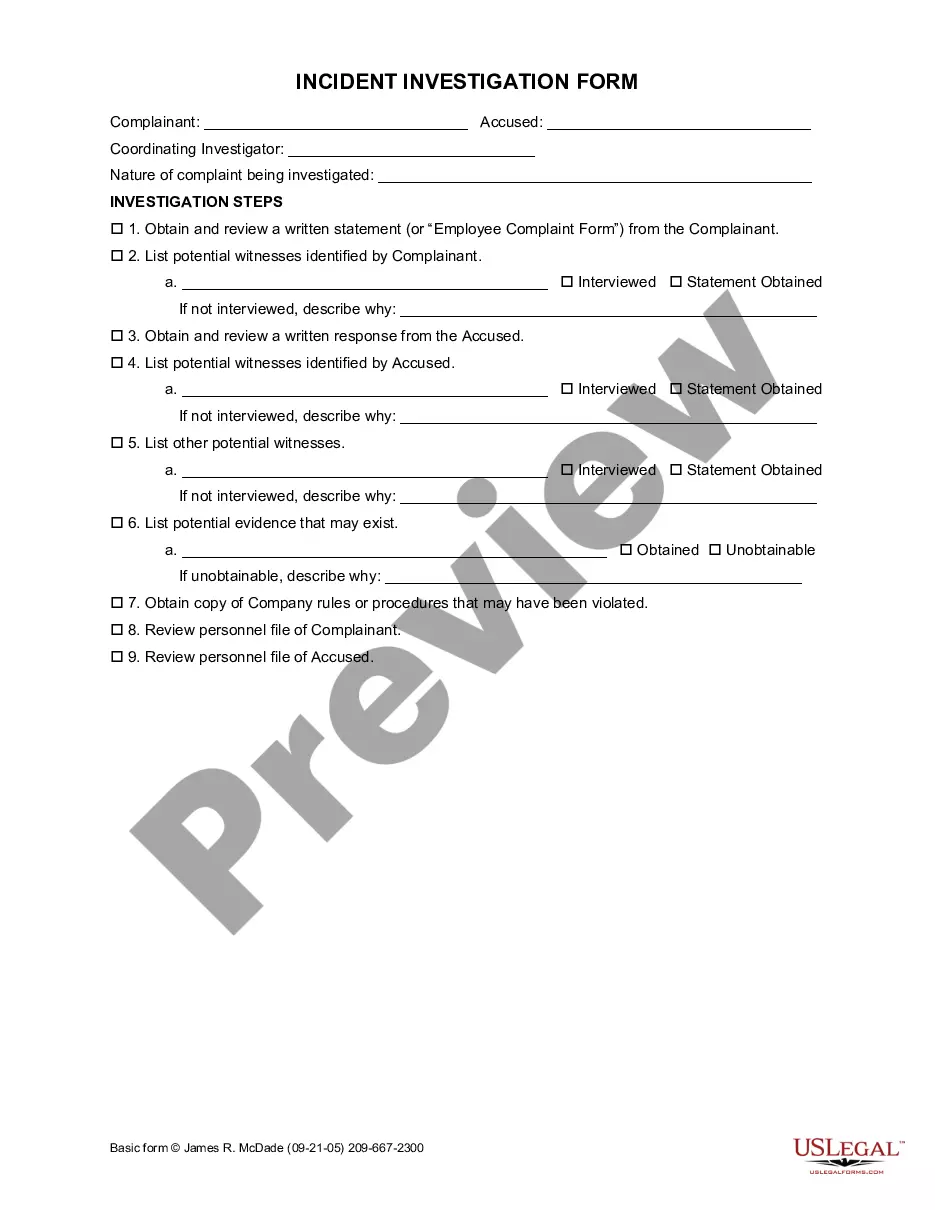

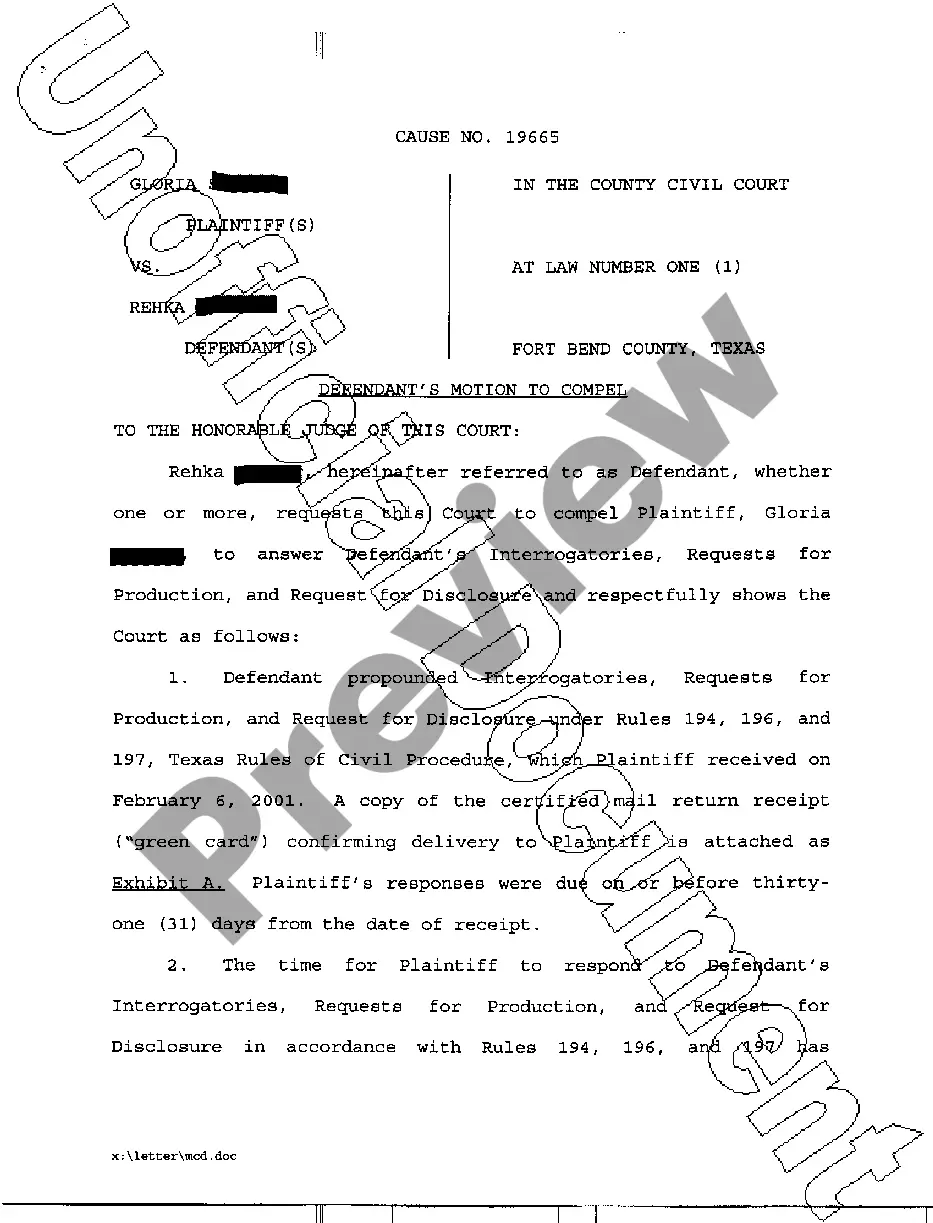

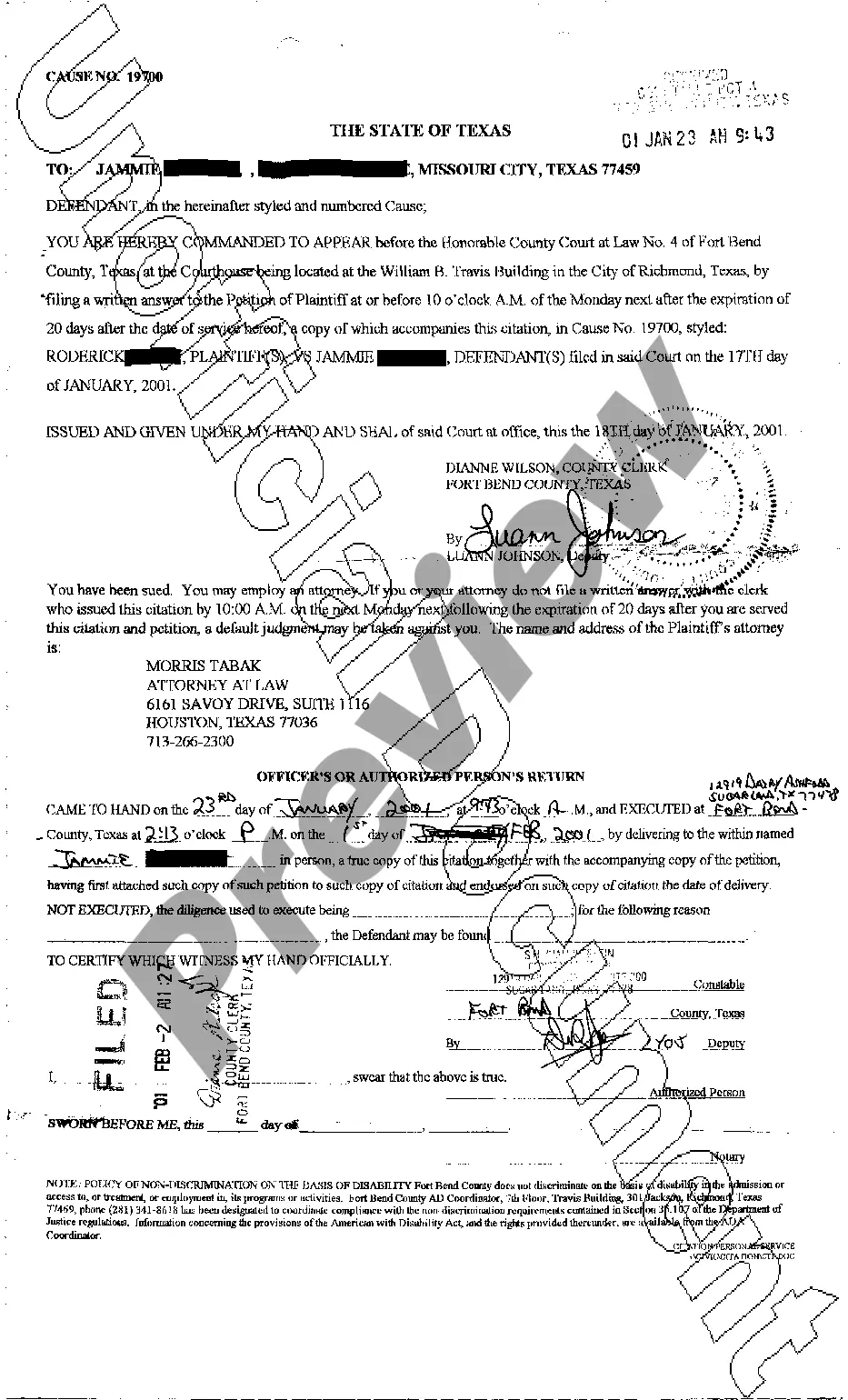

- Make sure you have opened the right page with your localised form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Dallas Short Sale Affidavit of Buyer on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!