Maricopa, Arizona Short Sale Affidavit of Buyer is a legal document that is essential in the process of a short sale transaction in Maricopa, Arizona. It outlines the buyer's acknowledgment, understanding, and agreement with the terms and conditions associated with purchasing a property through a short sale. This affidavit serves as a binding agreement between the buyer and the seller, as well as any other parties involved in the short sale process, such as the lender or mortgage service. It ensures that the buyer is fully aware of the potential risks and challenges associated with buying a distressed property and agrees to proceed with the purchase under these circumstances. The Maricopa, Arizona Short Sale Affidavit of Buyer typically includes the following information: 1. Buyer's Information: The affidavit begins by capturing the buyer's personal details, such as their full name, address, contact information, and any other relevant identification information. 2. Property Details: This section involves providing comprehensive information about the property in question, including its address, legal description, and any other specific identifiers. 3. Short Sale Acknowledgment: The buyer acknowledges that they are participating in a short sale and understands that the seller's lender or mortgage service must approve the sale. They acknowledge the possibility of delays and the potential for the lender to reject the short sale. 4. Property Condition: The buyer confirms that they have inspected the property and are aware of its condition, including any known defects or issues. They acknowledge that the property is sold "as-is" and accept it in its current state. 5. Financial Obligations: The buyer agrees to meet all financial obligations associated with the transaction, including providing earnest money deposits and ensuring availability of funds for the purchase. They also acknowledge their responsibility for any additional fees or costs related to the short sale. 6. Title Issues: The buyer acknowledges that the property may have existing liens, judgments, or other encumbrances that might affect the sale. They understand the importance of obtaining a clear title and may be responsible for resolving some of these issues. Different types of Maricopa, Arizona Short Sale Affidavit of Buyer may include variations based on specific circumstances or requirements set by the seller's lender or mortgage service. These types could include variations for different lenders, government-backed loan programs, or specific conditions within the short sale agreement. It is crucial for buyers to carefully review and understand the particular affidavit they are signing to ensure compliance with all relevant terms.

Maricopa Arizona Short Sale Affidavit of Buyer

Description

How to fill out Maricopa Arizona Short Sale Affidavit Of Buyer?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Maricopa Short Sale Affidavit of Buyer, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Maricopa Short Sale Affidavit of Buyer from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Maricopa Short Sale Affidavit of Buyer:

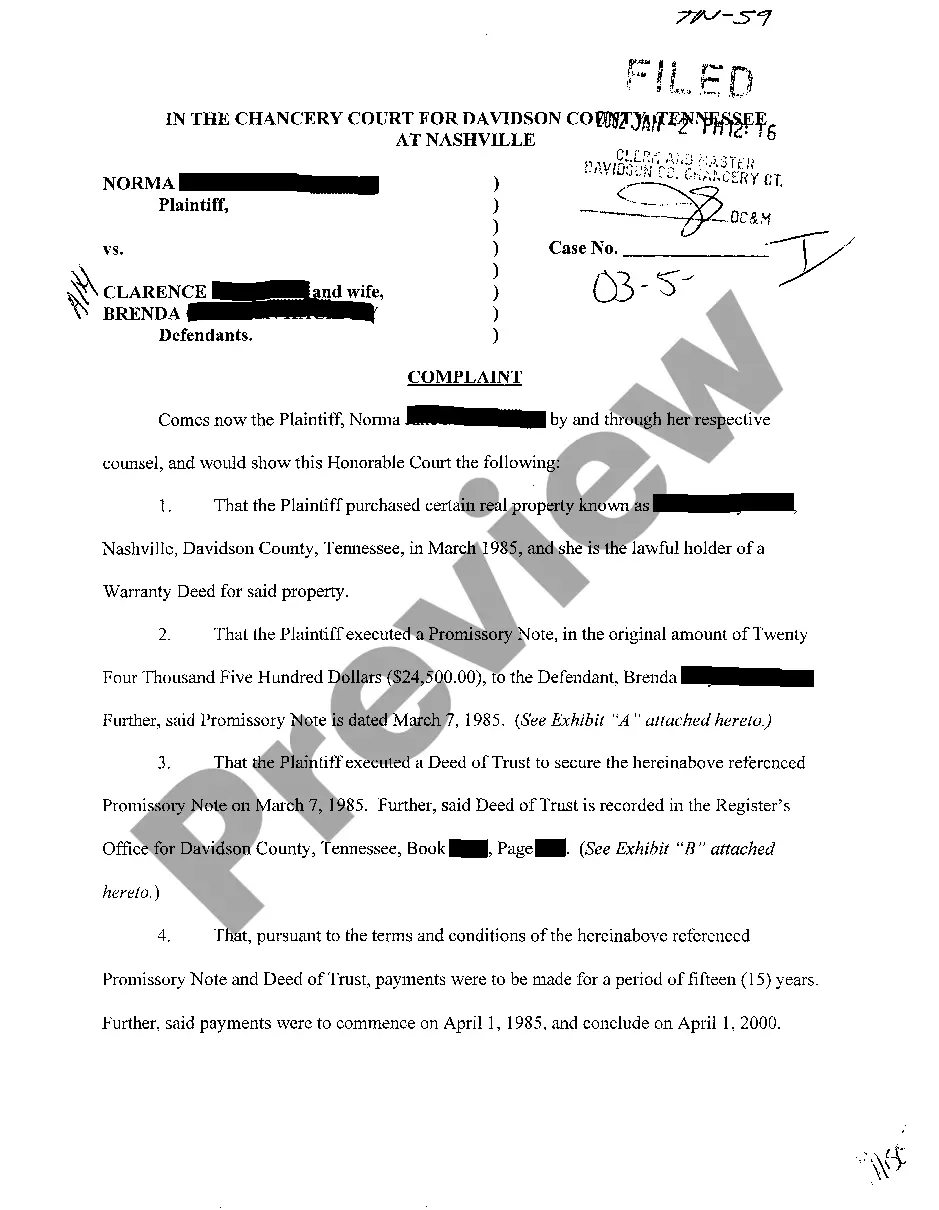

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!