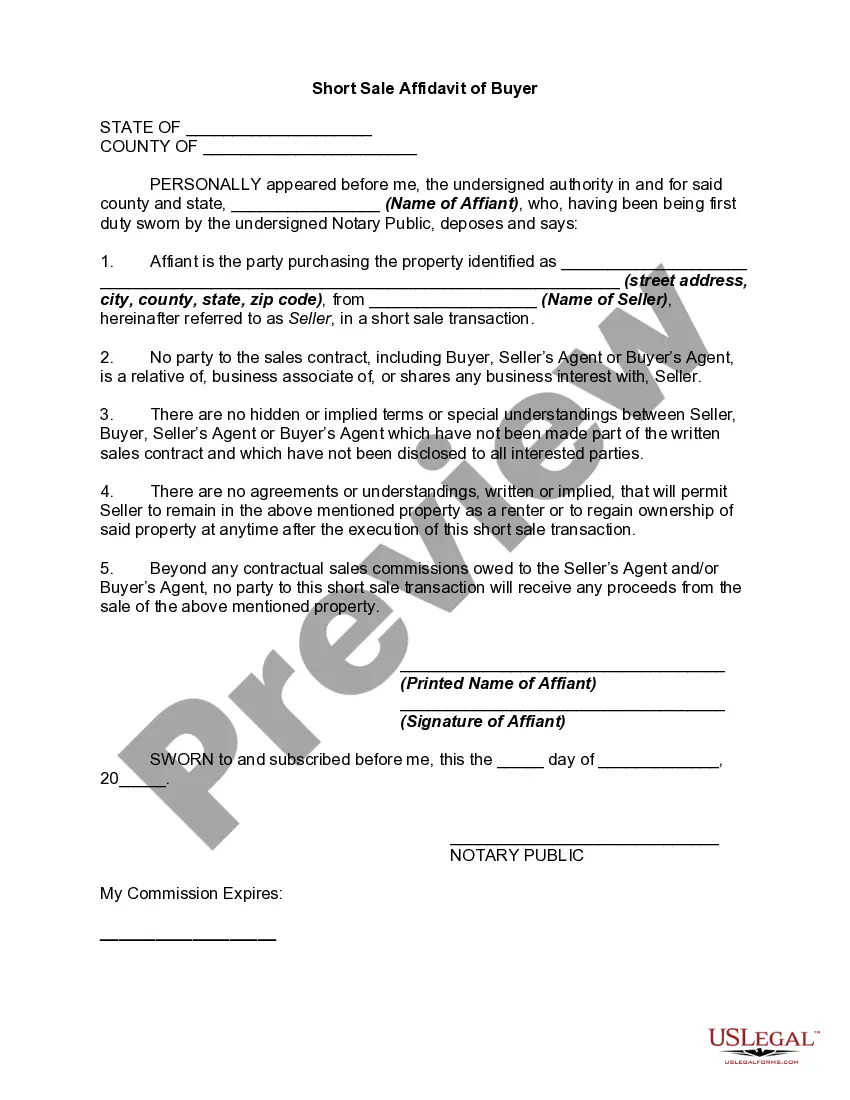

A Miami-Dade Florida Short Sale Affidavit of Buyer is a legal document that is required during the process of purchasing a short sale property in Miami-Dade County, Florida. This affidavit is an important part of the buyer's representation and disclosure during the transaction, ensuring the seller and the lender have accurate information about the buyer's qualifications and intentions. The purpose of the Miami-Dade Florida Short Sale Affidavit of Buyer is to provide a detailed description of the buyer's financial situation, including their income, assets, and liabilities. By completing this affidavit, the buyer confirms their eligibility for the short sale transaction, demonstrates their ability to afford the property, and acknowledges their understanding of the risks involved in purchasing a short sale property. Key elements included in the Miami-Dade Florida Short Sale Affidavit of Buyer are: 1. Buyer's Information: The affidavit begins by collecting the basic information of the buyer, such as their name, address, contact details, and social security number. 2. Property Information: The buyer specifies the address of the short sale property they are interested in purchasing, along with the legal description and property identification number. 3. Buyer's Financial Information: This section requires the buyer to disclose their current employment details, including employer name and contact information. The buyer must also provide details about all their sources of income, such as wages, bonuses, commission, rental income, or any other sources of revenue. Additionally, the buyer must disclose information regarding their assets, including bank accounts, investments, real estate properties owned, and any other valuable assets. Furthermore, the buyer must disclose their liabilities, such as mortgages, loans, credit card debts, or any other financial obligations. 4. Buyer's Representation: In this section, the buyer represents that all information provided in the affidavit is true and accurate to the best of their knowledge. They acknowledge that any false or misleading information may result in the cancellation of the purchase agreement. Different types of Miami-Dade Florida Short Sale Affidavit of Buyer may vary depending on the specific requirements of the lender or the listing agent involved in the transaction. However, the overall purpose and content of the affidavit generally remain consistent to ensure transparency and compliance during the short sale process. It is essential for buyers to provide complete and accurate information in the Miami-Dade Florida Short Sale Affidavit of Buyer, as any discrepancies or misrepresentations may lead to complications or even potential legal consequences. Seeking the guidance of a real estate professional or legal counsel experienced in short sales can help both buyers and sellers navigate this complex process smoothly and within legal boundaries.

Miami-Dade Florida Short Sale Affidavit of Buyer

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02761BG

Format:

Word;

Rich Text

Instant download

Description

In real estate, a short sale occurs when a bank or mortgage lender agrees to discount a loan balance due to an economic hardship on the part of the mortgagor (i.e., the seller). Circumstances determine whether or not banks will discount a loan balance. These circumstances are usually related to the current real estate market climate and the individual borrower's financial situation. A short sale typically is executed to prevent a home foreclosure. Often a bank will choose to allow a short sale if they believe that it will result in a smaller financial loss than foreclosing.

An arms-length or short sale affidavit is a document created by a bank in an attempt to prevent sellers from selling to relatives or friends to act as a straw buyer. Sometimes sellers make such side agreements. Then, after the transaction closes, the

pretend

buyers quickly transfer title back to the seller. This practice, in affect, means the sellers have repurchased their home at maybe half the cost, which greatly benefits those sellers.

A Miami-Dade Florida Short Sale Affidavit of Buyer is a legal document that is required during the process of purchasing a short sale property in Miami-Dade County, Florida. This affidavit is an important part of the buyer's representation and disclosure during the transaction, ensuring the seller and the lender have accurate information about the buyer's qualifications and intentions. The purpose of the Miami-Dade Florida Short Sale Affidavit of Buyer is to provide a detailed description of the buyer's financial situation, including their income, assets, and liabilities. By completing this affidavit, the buyer confirms their eligibility for the short sale transaction, demonstrates their ability to afford the property, and acknowledges their understanding of the risks involved in purchasing a short sale property. Key elements included in the Miami-Dade Florida Short Sale Affidavit of Buyer are: 1. Buyer's Information: The affidavit begins by collecting the basic information of the buyer, such as their name, address, contact details, and social security number. 2. Property Information: The buyer specifies the address of the short sale property they are interested in purchasing, along with the legal description and property identification number. 3. Buyer's Financial Information: This section requires the buyer to disclose their current employment details, including employer name and contact information. The buyer must also provide details about all their sources of income, such as wages, bonuses, commission, rental income, or any other sources of revenue. Additionally, the buyer must disclose information regarding their assets, including bank accounts, investments, real estate properties owned, and any other valuable assets. Furthermore, the buyer must disclose their liabilities, such as mortgages, loans, credit card debts, or any other financial obligations. 4. Buyer's Representation: In this section, the buyer represents that all information provided in the affidavit is true and accurate to the best of their knowledge. They acknowledge that any false or misleading information may result in the cancellation of the purchase agreement. Different types of Miami-Dade Florida Short Sale Affidavit of Buyer may vary depending on the specific requirements of the lender or the listing agent involved in the transaction. However, the overall purpose and content of the affidavit generally remain consistent to ensure transparency and compliance during the short sale process. It is essential for buyers to provide complete and accurate information in the Miami-Dade Florida Short Sale Affidavit of Buyer, as any discrepancies or misrepresentations may lead to complications or even potential legal consequences. Seeking the guidance of a real estate professional or legal counsel experienced in short sales can help both buyers and sellers navigate this complex process smoothly and within legal boundaries.