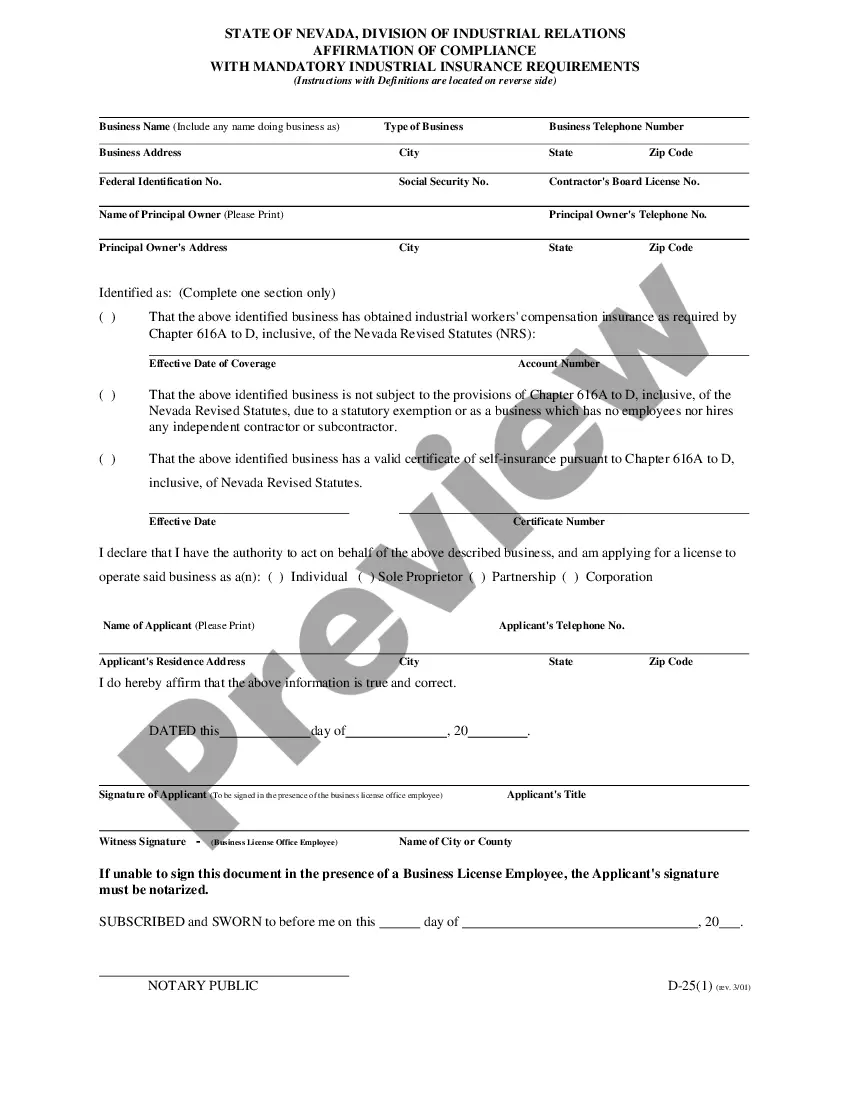

A San Diego California Short Sale Affidavit of Buyer is a legal document that is typically used during the process of purchasing a property through a short sale in San Diego, California. This affidavit serves as a declaration by the buyer, confirming various details concerning their intentions, financial situation, and the understanding of their responsibilities in the short sale transaction. The purpose of the San Diego California Short Sale Affidavit of Buyer is to provide the lender and other parties involved in the short sale process with necessary information and assurance that the buyer is acting in good faith and is capable of fulfilling their responsibilities as outlined in the purchase agreement. Some of the essential details that may be included in a San Diego California Short Sale Affidavit of Buyer are: 1. Identification and Contact Information: The affidavit will require the buyer's name, address, phone number, and email address. 2. Statement of Intent: The buyer will affirm their intention to purchase the property being sold through a short sale and their understanding that the purchase is subject to the approval of the lender. 3. Financial Information: The buyer will disclose their financial situation, including details about their income, assets, liabilities, outstanding debts, and credit history. This information helps assess the buyer's ability to proceed with the purchase and negotiate with the lender. 4. Buyer's Representation: The affidavit may include a section where the buyer confirms that they have engaged a licensed real estate agent or attorney to represent them throughout the short sale process. 5. Offer and Purchase Details: The buyer will outline the terms of their offer, including the purchase price, any contingencies, and the desired timeline for closing the transaction. 6. Acknowledgment of Risks: The affidavit will typically contain a section where the buyer acknowledges the risks associated with a short sale, such as potential delays, the property being sold "as-is," and the possibility of the lender rejecting the offer. It's important to note that specific variations of the San Diego California Short Sale Affidavit of Buyer may exist, depending on the lender or real estate professionals involved. These variations may focus on additional details or require specific disclosures unique to the San Diego real estate market.

San Diego California Short Sale Affidavit of Buyer

Description

How to fill out San Diego California Short Sale Affidavit Of Buyer?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the San Diego Short Sale Affidavit of Buyer, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Consequently, if you need the recent version of the San Diego Short Sale Affidavit of Buyer, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Short Sale Affidavit of Buyer:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your San Diego Short Sale Affidavit of Buyer and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!