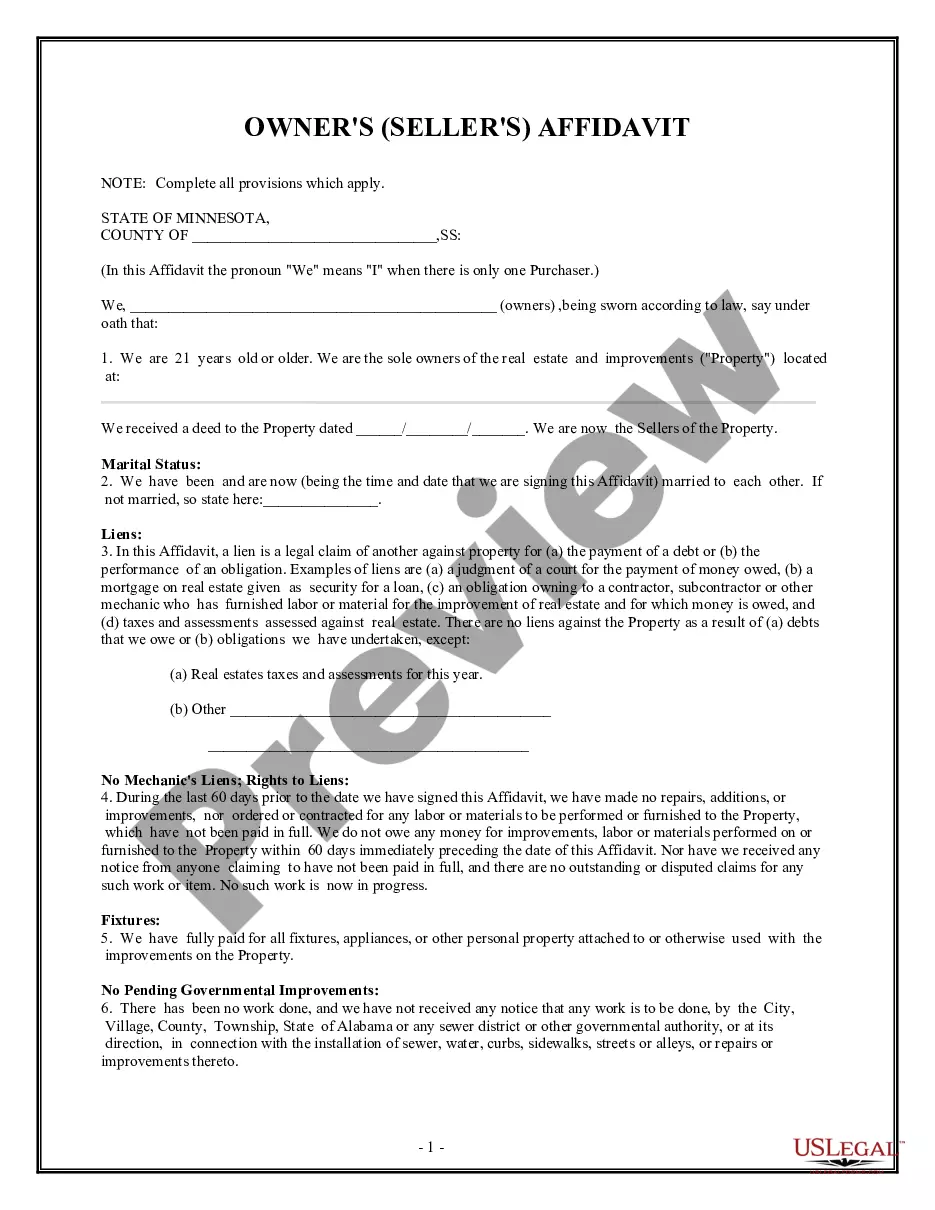

The Santa Clara California Short Sale Affidavit of Buyer is an official legal document that is used in real estate transactions within Santa Clara County, California. This affidavit is specifically designed for buyers who are involved in a short sale transaction, where the homeowner is selling the property for less than the amount owed on the mortgage. The purpose of the Santa Clara California Short Sale Affidavit of Buyer is to provide information and assurance to the mortgage lender regarding the buyer's eligibility and commitment to the purchase. This document contains important details about the buyer's finances, intentions, and understanding of the short sale process. Some relevant keywords related to the Santa Clara California Short Sale Affidavit of Buyer include: 1. Short sale: Refers to the sale of a property for an amount lower than the outstanding mortgage balance. 2. Affidavit: A written statement that is made under oath or affirmation, usually used as evidence in court proceedings. 3. Real estate transaction: The process of buying or selling a property. 4. Santa Clara County: The county located in the southern part of the San Francisco Bay Area in California. 5. Mortgage lender: The financial institution providing the loan to the homeowner, securing the property as collateral. 6. Eligibility: Refers to meeting specific criteria or requirements. 7. Commitment: The buyer's intention and dedication towards completing the purchase. 8. Finances: Pertains to monetary resources, income, assets, and liabilities. 9. Purchase: The act of acquiring a property by payment of a price. 10. Understanding: Refers to the buyer's comprehension of the short sale process and its implications. While there may not be different types of Santa Clara California Short Sale Affidavit of Buyer, there may be variations in terms of format or specific requirements from different lending institutions or real estate agents. It is crucial for buyers to consult with professionals experienced in short sales to obtain the correct documentation.

Santa Clara California Short Sale Affidavit of Buyer

Description

How to fill out Santa Clara California Short Sale Affidavit Of Buyer?

Preparing papers for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Santa Clara Short Sale Affidavit of Buyer without expert assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Santa Clara Short Sale Affidavit of Buyer on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Santa Clara Short Sale Affidavit of Buyer:

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!