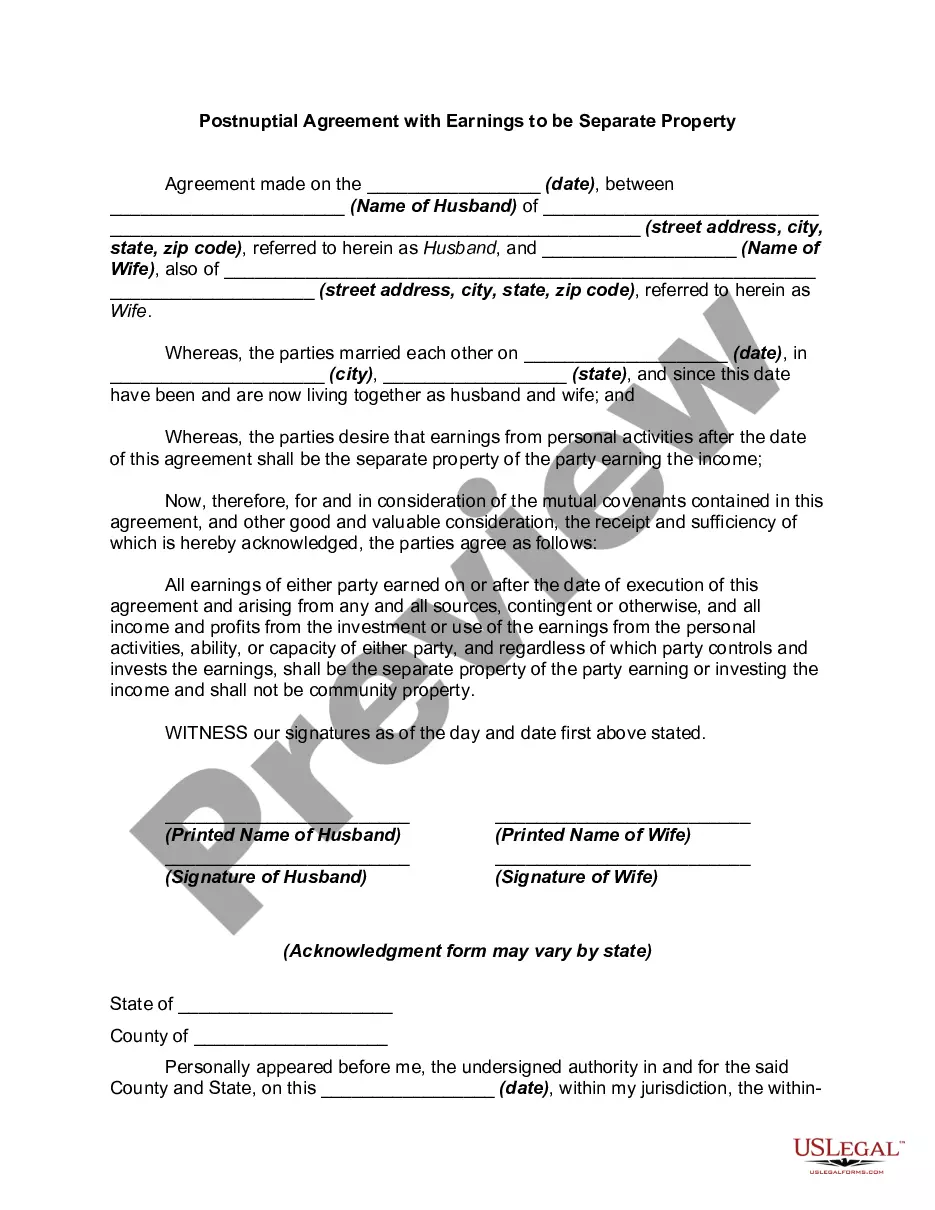

A postnuptial agreement is a written contract executed after a couple gets married to settle the couple's affairs and assets in the event of a separation or divorce.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Collin Texas Postnuptial Agreement with Earnings to be Separate Property is a legal document that outlines the division and ownership of assets acquired during a marriage. This agreement is relevant for couples residing in Collin County, Texas, who wish to protect their individual earnings and assets in the event of a divorce or separation. When drafting a Collin Texas Postnuptial Agreement with Earnings to be Separate Property, it is crucial to include specific keywords to ensure clarity and legal validity. Here are some keywords that should be mentioned in the agreement: 1. Earnings: The agreement should clearly define what is considered "earnings" or income that would be classified as separate property. Typically, this includes income from employment, investments, businesses, and any other monetary gains acquired individually during the marriage. 2. Separate Property: The agreement must establish what constitutes separate property, i.e., assets or debts that belong solely to one spouse and are not subject to division upon divorce. This may include properties owned before marriage, inheritance, gifts, or personal assets acquired during the marriage but kept separate. There can be variants of Collin Texas Postnuptial Agreement with Earnings to be Separate Property based on specific circumstances or provisions desired by the couple. Here are some potential types: 1. Limited Postnuptial Agreement: This type of agreement focuses solely on determining the ownership and division of earnings made during the marriage. It may not cover other aspects, such as property division or spousal support. 2. Comprehensive Postnuptial Agreement: In contrast to a limited agreement, this type encompasses a broader range of provisions, including separate property, assets, debts, child custody, and spousal support. 3. Conditional Postnuptial Agreement: This agreement may specify certain conditions or circumstances under which the agreement's provisions would be invalidated or amended. For example, it could outline that certain earnings would become shared marital property after a set number of years or upon achieving a particular financial milestone. 4. Customizable Postnuptial Agreement: This type allows the couple to tailor the agreement to their unique needs and preferences. It may have specific clauses related to business ownership, intellectual property rights, or other assets of particular significance. Remember, it is vital to consult with an experienced family law attorney who can guide you through the process of creating a Collin Texas Postnuptial Agreement with Earnings to be Separate Property. Each couple's situation is unique, and professional advice can ensure that the agreement reflects their intentions accurately and complies with relevant laws.Collin Texas Postnuptial Agreement with Earnings to be Separate Property is a legal document that outlines the division and ownership of assets acquired during a marriage. This agreement is relevant for couples residing in Collin County, Texas, who wish to protect their individual earnings and assets in the event of a divorce or separation. When drafting a Collin Texas Postnuptial Agreement with Earnings to be Separate Property, it is crucial to include specific keywords to ensure clarity and legal validity. Here are some keywords that should be mentioned in the agreement: 1. Earnings: The agreement should clearly define what is considered "earnings" or income that would be classified as separate property. Typically, this includes income from employment, investments, businesses, and any other monetary gains acquired individually during the marriage. 2. Separate Property: The agreement must establish what constitutes separate property, i.e., assets or debts that belong solely to one spouse and are not subject to division upon divorce. This may include properties owned before marriage, inheritance, gifts, or personal assets acquired during the marriage but kept separate. There can be variants of Collin Texas Postnuptial Agreement with Earnings to be Separate Property based on specific circumstances or provisions desired by the couple. Here are some potential types: 1. Limited Postnuptial Agreement: This type of agreement focuses solely on determining the ownership and division of earnings made during the marriage. It may not cover other aspects, such as property division or spousal support. 2. Comprehensive Postnuptial Agreement: In contrast to a limited agreement, this type encompasses a broader range of provisions, including separate property, assets, debts, child custody, and spousal support. 3. Conditional Postnuptial Agreement: This agreement may specify certain conditions or circumstances under which the agreement's provisions would be invalidated or amended. For example, it could outline that certain earnings would become shared marital property after a set number of years or upon achieving a particular financial milestone. 4. Customizable Postnuptial Agreement: This type allows the couple to tailor the agreement to their unique needs and preferences. It may have specific clauses related to business ownership, intellectual property rights, or other assets of particular significance. Remember, it is vital to consult with an experienced family law attorney who can guide you through the process of creating a Collin Texas Postnuptial Agreement with Earnings to be Separate Property. Each couple's situation is unique, and professional advice can ensure that the agreement reflects their intentions accurately and complies with relevant laws.