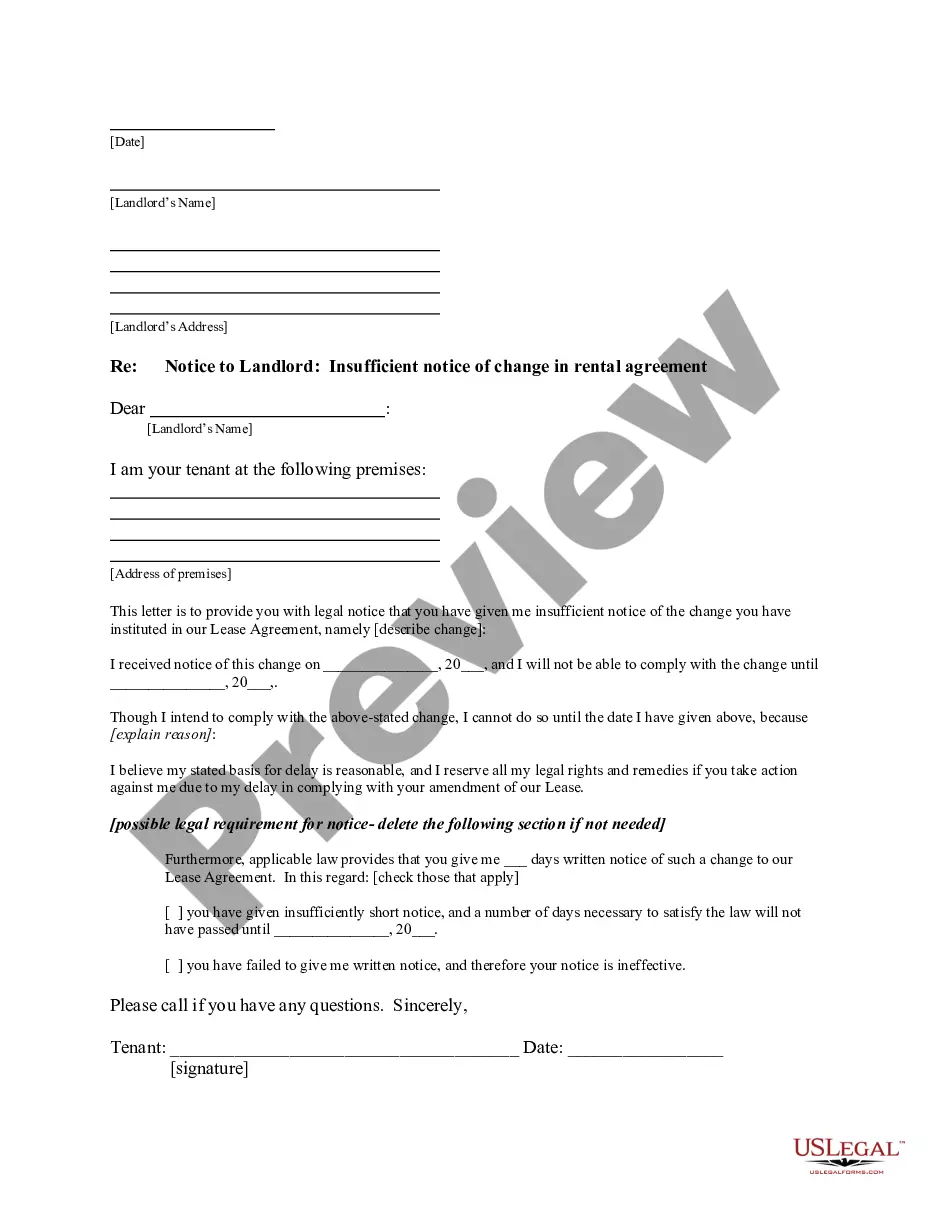

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Harris Texas Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage is a legal document filed in the Harris County, Texas, to ensure that a mortgagee fulfills their obligation to execute and record the satisfaction and discharge of a mortgage. This complaint is commonly used when a mortgagee fails to perform these essential tasks despite the borrower satisfying the loan. When a borrower fully repays a mortgage, the mortgagee is obligated to execute a satisfaction and discharge of the mortgage, signifying that the debt has been settled. Additionally, the mortgagee must also record this satisfaction with the county recorder's office to clear the property title from any encumbrances. In cases where the mortgagee neglects to complete these actions, the borrower can file a Harris Texas Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. By filing this complaint, the borrower seeks a court order compelling the mortgagee to fulfill their obligations and eliminate any remaining obligations on the property. This legal action protects the borrower's rights and interests, ensuring that the mortgage is no longer in effect and the property's title is clear. Different types of Harris Texas Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage may include various causes of action based on the specific circumstances of the case. These variations may include complaints related to: 1. Failure to execute satisfaction and discharge of mortgage: This complaint highlights the mortgagee's refusal or neglect to sign and execute the necessary documents releasing the property from the mortgage loan. 2. Failure to record satisfaction and discharge of mortgage: This complaint focuses on the mortgagee's failure to record the satisfaction and discharge of the mortgage with the county recorder's office, delaying the removal of the mortgage lien from the property's title. 3. Negligence causing harm: In certain cases, the mortgagee's negligence may have caused financial harm or affected the borrower's ability to conduct property-related transactions due to the delayed satisfaction and discharge. 4. Breach of contract: If the mortgagee's failure to execute and record the satisfaction and discharge of the mortgage violates any specific contractual agreements or industry standards, the borrower may file a complaint based on breach of contract. These variations illustrate the different aspects that can form the basis of a Harris Texas Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. By seeking legal recourse, borrowers aim to ensure a timely release of obligations and a clear property title, safeguarding their investment and property rights.Harris Texas Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage is a legal document filed in the Harris County, Texas, to ensure that a mortgagee fulfills their obligation to execute and record the satisfaction and discharge of a mortgage. This complaint is commonly used when a mortgagee fails to perform these essential tasks despite the borrower satisfying the loan. When a borrower fully repays a mortgage, the mortgagee is obligated to execute a satisfaction and discharge of the mortgage, signifying that the debt has been settled. Additionally, the mortgagee must also record this satisfaction with the county recorder's office to clear the property title from any encumbrances. In cases where the mortgagee neglects to complete these actions, the borrower can file a Harris Texas Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. By filing this complaint, the borrower seeks a court order compelling the mortgagee to fulfill their obligations and eliminate any remaining obligations on the property. This legal action protects the borrower's rights and interests, ensuring that the mortgage is no longer in effect and the property's title is clear. Different types of Harris Texas Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage may include various causes of action based on the specific circumstances of the case. These variations may include complaints related to: 1. Failure to execute satisfaction and discharge of mortgage: This complaint highlights the mortgagee's refusal or neglect to sign and execute the necessary documents releasing the property from the mortgage loan. 2. Failure to record satisfaction and discharge of mortgage: This complaint focuses on the mortgagee's failure to record the satisfaction and discharge of the mortgage with the county recorder's office, delaying the removal of the mortgage lien from the property's title. 3. Negligence causing harm: In certain cases, the mortgagee's negligence may have caused financial harm or affected the borrower's ability to conduct property-related transactions due to the delayed satisfaction and discharge. 4. Breach of contract: If the mortgagee's failure to execute and record the satisfaction and discharge of the mortgage violates any specific contractual agreements or industry standards, the borrower may file a complaint based on breach of contract. These variations illustrate the different aspects that can form the basis of a Harris Texas Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. By seeking legal recourse, borrowers aim to ensure a timely release of obligations and a clear property title, safeguarding their investment and property rights.