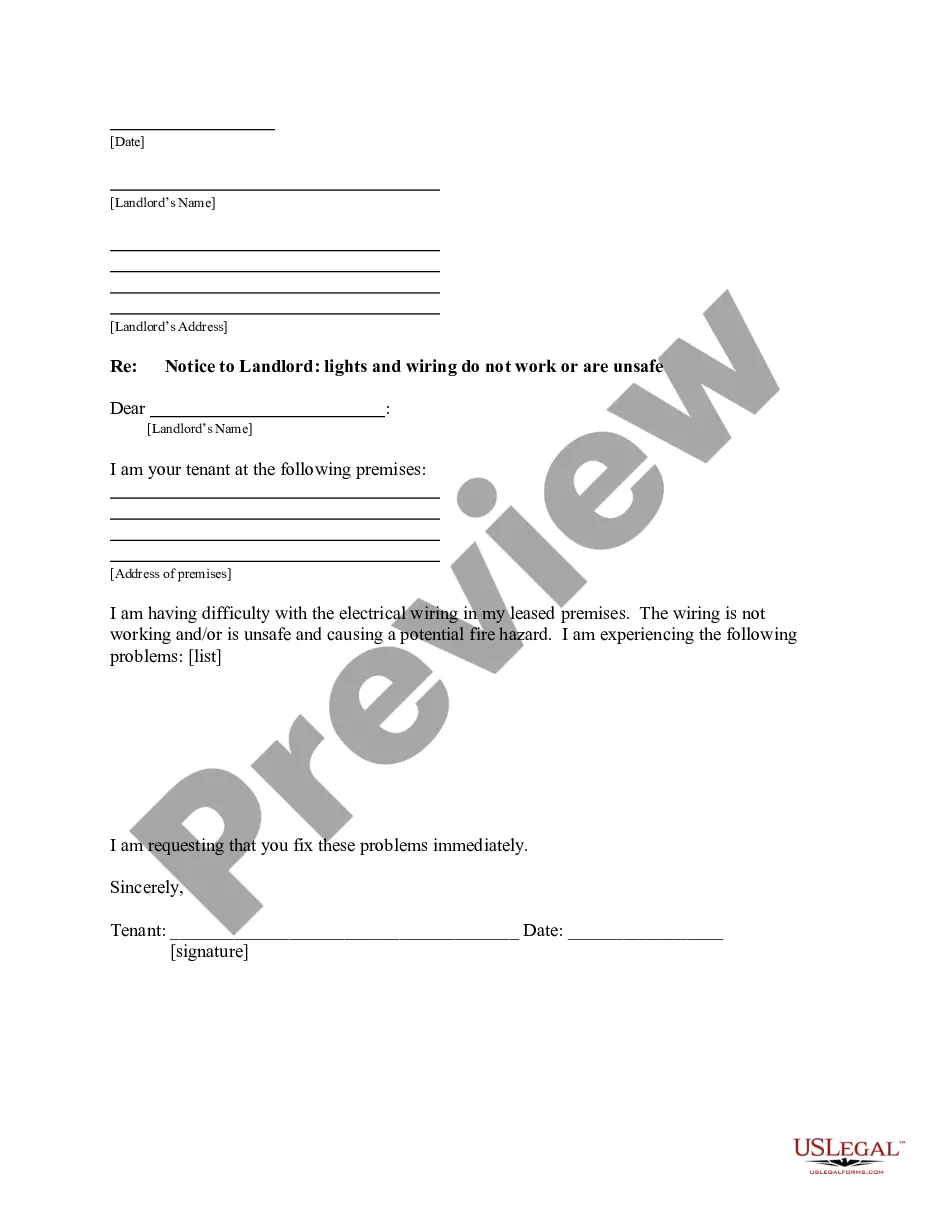

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Orange California Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage is a legal document designed to address situations where a mortgagee (lender) fails to execute and record the satisfaction and discharge of a mortgage in Orange, California. This complaint is filed by the mortgagor (borrower) to force the mortgagee to complete the necessary paperwork to clear the mortgage lien from the property title. In Orange, California, there may be various types of complaints to compel mortgagees to execute and record satisfaction and discharge of mortgages. Some possible variations include: 1. Residential Mortgage Complaint: This type of complaint is specific to residential properties, where a borrower seeks legal action against a mortgagee who has failed to execute and record satisfaction and discharge of the mortgage, resulting in a clouded title. 2. Commercial Mortgage Complaint: Similar to the residential mortgage complaint, this variation applies to commercial properties where a borrower is unable to clear the mortgage lien due to the mortgagee's non-compliance. 3. Defaulted Mortgage Complaint: When a borrower defaults on their mortgage payments and subsequently fulfills their obligations, they may file this complaint if the mortgagee fails to execute and record the satisfaction and discharge of the mortgage as agreed. 4. Fraudulent Mortgage Complaint: This type of complaint may occur if a borrower discovers that their mortgage was fraudulently obtained, and the mortgagee refuses to execute and record satisfaction and discharge of the mortgage. 5. Incomplete or Incorrect Mortgage Documentation Complaint: If the mortgagee has provided incomplete or incorrect mortgage documentation, resulting in difficulties while attempting to execute and record satisfaction and discharge of the mortgage, a borrower can file this complaint in Orange, California. In summary, an Orange California Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage is a legal avenue for borrowers to resolve issues arising from a mortgagee's failure to complete necessary paperwork to clear a mortgage lien from the property title. Different types of this complaint can be filed depending on the specifics of the situation, such as residential or commercial properties and various circumstances of the mortgage agreement.Orange California Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage is a legal document designed to address situations where a mortgagee (lender) fails to execute and record the satisfaction and discharge of a mortgage in Orange, California. This complaint is filed by the mortgagor (borrower) to force the mortgagee to complete the necessary paperwork to clear the mortgage lien from the property title. In Orange, California, there may be various types of complaints to compel mortgagees to execute and record satisfaction and discharge of mortgages. Some possible variations include: 1. Residential Mortgage Complaint: This type of complaint is specific to residential properties, where a borrower seeks legal action against a mortgagee who has failed to execute and record satisfaction and discharge of the mortgage, resulting in a clouded title. 2. Commercial Mortgage Complaint: Similar to the residential mortgage complaint, this variation applies to commercial properties where a borrower is unable to clear the mortgage lien due to the mortgagee's non-compliance. 3. Defaulted Mortgage Complaint: When a borrower defaults on their mortgage payments and subsequently fulfills their obligations, they may file this complaint if the mortgagee fails to execute and record the satisfaction and discharge of the mortgage as agreed. 4. Fraudulent Mortgage Complaint: This type of complaint may occur if a borrower discovers that their mortgage was fraudulently obtained, and the mortgagee refuses to execute and record satisfaction and discharge of the mortgage. 5. Incomplete or Incorrect Mortgage Documentation Complaint: If the mortgagee has provided incomplete or incorrect mortgage documentation, resulting in difficulties while attempting to execute and record satisfaction and discharge of the mortgage, a borrower can file this complaint in Orange, California. In summary, an Orange California Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage is a legal avenue for borrowers to resolve issues arising from a mortgagee's failure to complete necessary paperwork to clear a mortgage lien from the property title. Different types of this complaint can be filed depending on the specifics of the situation, such as residential or commercial properties and various circumstances of the mortgage agreement.