This form involves the sale of a small business. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

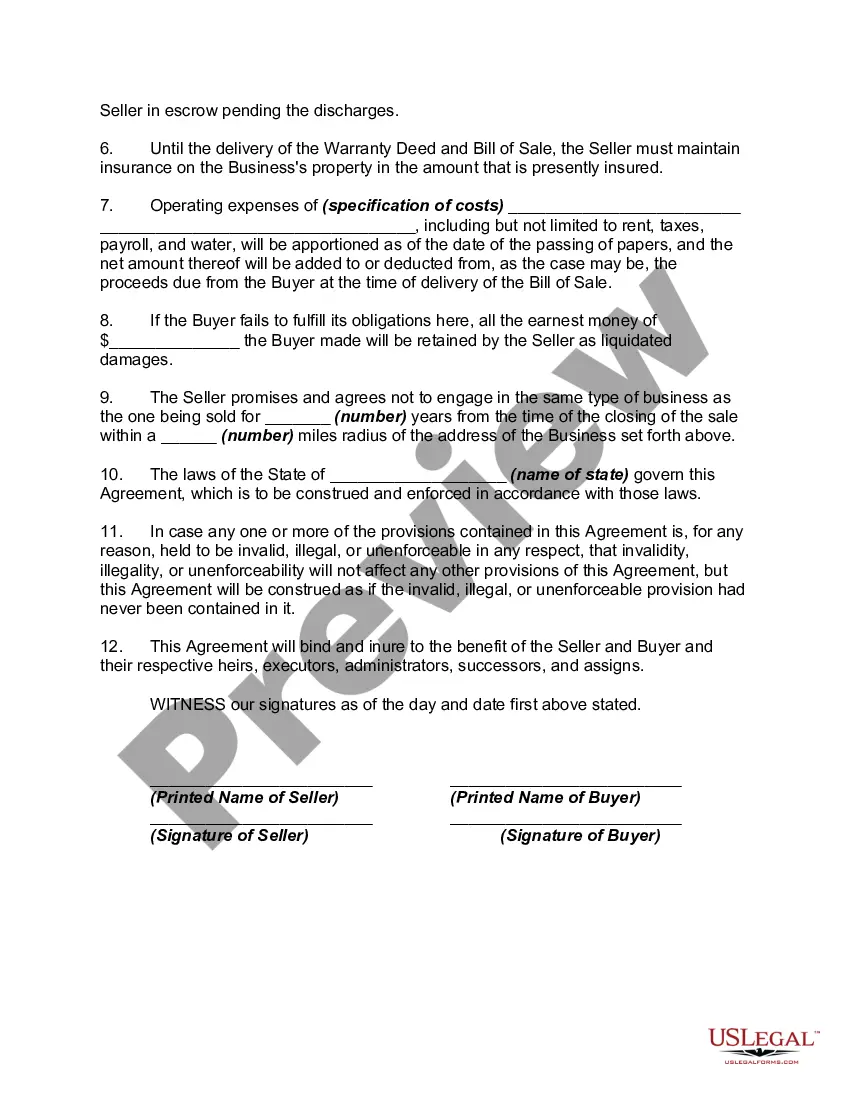

The Harris Texas Agreement of Purchase and Sale of Business — Short Form is a legally binding document used in the state of Texas that outlines the terms and conditions for the purchase and sale of a business. This agreement is designed to provide a concise and simplified version of the full purchase agreement, making it easier for both parties involved to understand and execute the transaction. The Harris Texas Agreement of Purchase and Sale of Business — Short Form covers essential aspects of the transaction, including the purchase price, payment terms, assets being transferred, liabilities, representations and warranties, and dispute resolution procedures. It helps protect the rights and interests of both the buyer and the seller. There are different types of Harris Texas Agreement of Purchase and Sale of Business — Short Form, which may vary based on the specific nature of the business being sold. Some common variations may include agreements for the sale of a retail business, professional practice, manufacturing company, or service-based business. The agreement typically starts with identifying information about the buyer and the seller, followed by a detailed description of the business being sold. The purchase price and payment terms are then clearly outlined, including any potential adjustments or contingencies. The agreement also addresses the assets being transferred, which may include tangible assets like inventory, equipment, and real estate, as well as intangible assets such as trademarks, customer lists, and goodwill. It is important that both parties thoroughly review and verify the accuracy of the listed assets. The inclusion of representations and warranties in the agreement ensures that both parties disclose accurate and complete information about the business, such as its financial condition, legal compliance, and any ongoing contracts or agreements. These representations and warranties serve to protect the buyer from hidden liabilities or misrepresentation by the seller. In the event of a dispute arising from the agreement, the Harris Texas Agreement of Purchase and Sale of Business — Short Form provides a section outlining the preferred method of dispute resolution, such as mediation, arbitration, or litigation. It is crucial for both parties to consult with legal professionals experienced in business transactions to ensure the agreement adequately covers their needs and protects their interests. The Harris Texas Agreement of Purchase and Sale of Business — Short Form is a valuable tool to facilitate a smooth and efficient business transaction, providing a clear framework and understanding for both buyers and sellers in the state of Texas.The Harris Texas Agreement of Purchase and Sale of Business — Short Form is a legally binding document used in the state of Texas that outlines the terms and conditions for the purchase and sale of a business. This agreement is designed to provide a concise and simplified version of the full purchase agreement, making it easier for both parties involved to understand and execute the transaction. The Harris Texas Agreement of Purchase and Sale of Business — Short Form covers essential aspects of the transaction, including the purchase price, payment terms, assets being transferred, liabilities, representations and warranties, and dispute resolution procedures. It helps protect the rights and interests of both the buyer and the seller. There are different types of Harris Texas Agreement of Purchase and Sale of Business — Short Form, which may vary based on the specific nature of the business being sold. Some common variations may include agreements for the sale of a retail business, professional practice, manufacturing company, or service-based business. The agreement typically starts with identifying information about the buyer and the seller, followed by a detailed description of the business being sold. The purchase price and payment terms are then clearly outlined, including any potential adjustments or contingencies. The agreement also addresses the assets being transferred, which may include tangible assets like inventory, equipment, and real estate, as well as intangible assets such as trademarks, customer lists, and goodwill. It is important that both parties thoroughly review and verify the accuracy of the listed assets. The inclusion of representations and warranties in the agreement ensures that both parties disclose accurate and complete information about the business, such as its financial condition, legal compliance, and any ongoing contracts or agreements. These representations and warranties serve to protect the buyer from hidden liabilities or misrepresentation by the seller. In the event of a dispute arising from the agreement, the Harris Texas Agreement of Purchase and Sale of Business — Short Form provides a section outlining the preferred method of dispute resolution, such as mediation, arbitration, or litigation. It is crucial for both parties to consult with legal professionals experienced in business transactions to ensure the agreement adequately covers their needs and protects their interests. The Harris Texas Agreement of Purchase and Sale of Business — Short Form is a valuable tool to facilitate a smooth and efficient business transaction, providing a clear framework and understanding for both buyers and sellers in the state of Texas.