Contra Costa California Agreement to Compromise Debt is a legally binding arrangement that allows debtors and creditors to negotiate and agree upon a reduced settlement amount for outstanding debts. This agreement is predominantly used in the Contra Costa County area, located in the state of California. It provides a structured framework for debt resolution, facilitating a compromise that benefits both parties involved. Key terms associated with Contra Costa California Agreement to Compromise Debt include debt settlement, debt negotiation, debt reduction, debt compromise, and debt resolution. By employing these keywords, individuals seeking information about this agreement will find the most relevant content. There are several types of Contra Costa California Agreement to Compromise Debt which cater to different scenarios and debt types, including: 1. Personal Debt: This type of agreement allows individuals burdened with personal debts, such as credit card debt, medical bills, or personal loans, to negotiate with their creditors to reach a mutually agreeable reduction of the outstanding balance. 2. Business Debt: Entrepreneurs and business owners facing significant business-related debts, such as vendor invoices, business loans, or lease agreements, can utilize this agreement to formulate a sustainable repayment plan. 3. Tax Debt: The Contra Costa California Agreement to Compromise Debt also covers tax liabilities. Individuals and businesses struggling to pay their tax obligations to the Internal Revenue Service (IRS) or California Franchise Tax Board (FT) can negotiate a reduced settlement and establish a reasonable payment plan. 4. Mortgage Debt: Homeowners facing foreclosure or struggling with mortgage payments can negotiate an agreement with their mortgage lender utilizing this method. The agreement may involve a reduction in the principal balance or a modification of the loan terms to make it more affordable. 5. Student Loan Debt: Depending on the circumstances, individuals burdened with overwhelming student loan debt can negotiate a Contra Costa California Agreement to Compromise Debt to reduce their outstanding balances or modify repayment terms. It is important to note that each type of agreement has specific eligibility criteria, and individuals seeking debt relief should consult legal or financial professionals to assess their options and ensure compliance with relevant regulations. Overall, the Contra Costa California Agreement to Compromise Debt offers a structured and legally enforceable solution for individuals and businesses in Contra Costa County to tackle their financial burdens and work towards a more stable and debt-free future.

Contra Costa California Agreement to Compromise Debt

Description

How to fill out Contra Costa California Agreement To Compromise Debt?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Contra Costa Agreement to Compromise Debt, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Therefore, if you need the current version of the Contra Costa Agreement to Compromise Debt, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Contra Costa Agreement to Compromise Debt:

- Look through the page and verify there is a sample for your area.

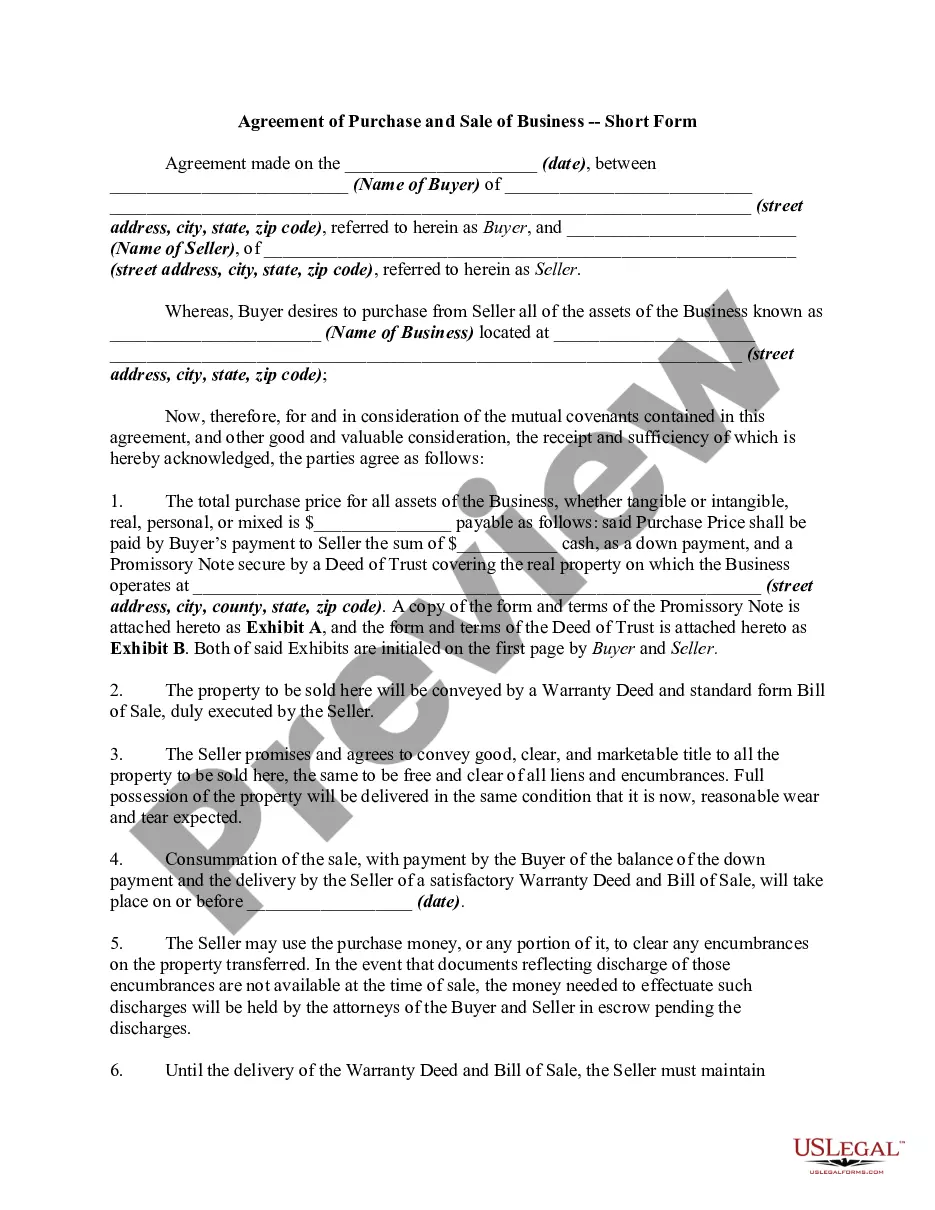

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Contra Costa Agreement to Compromise Debt and download it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!