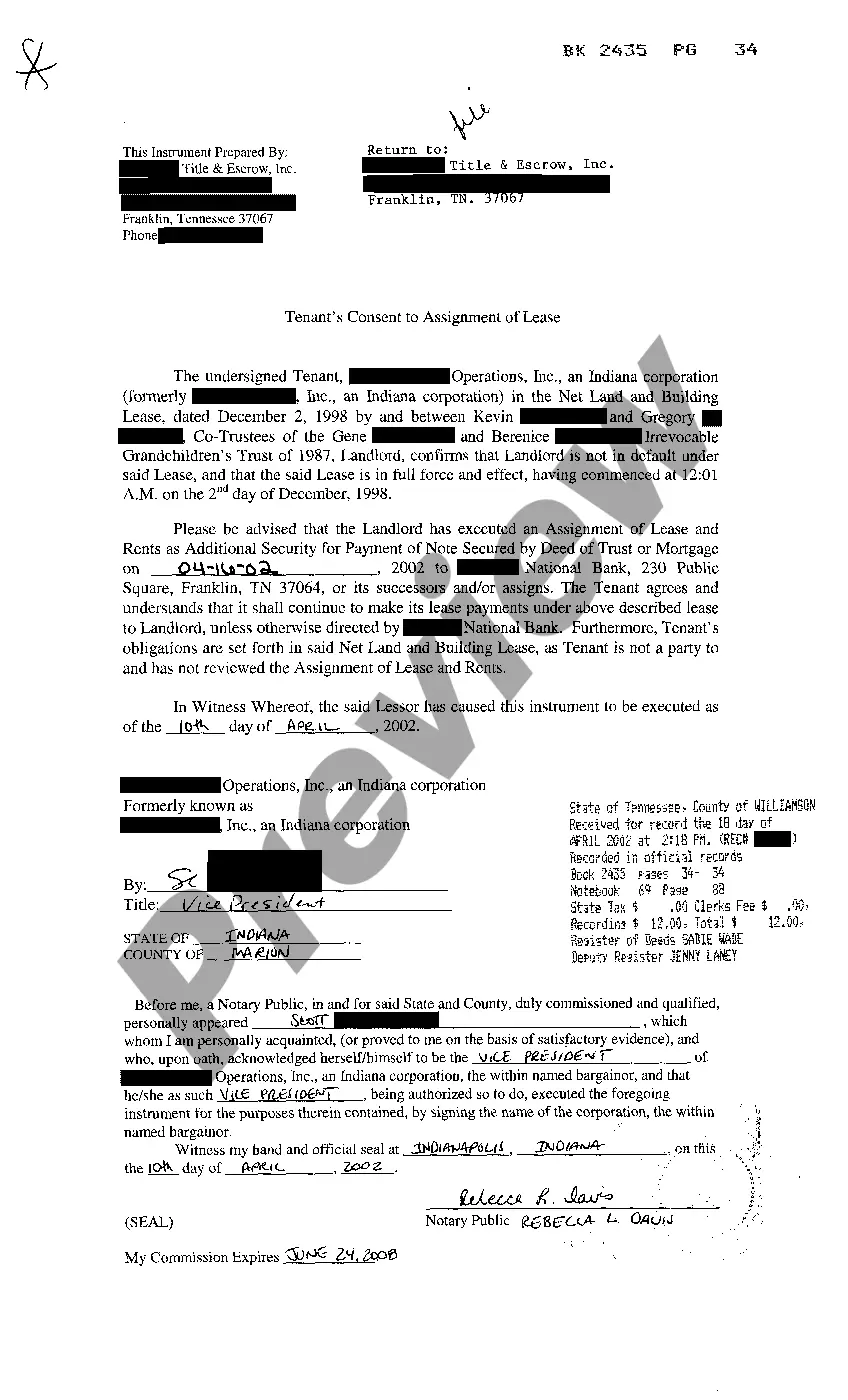

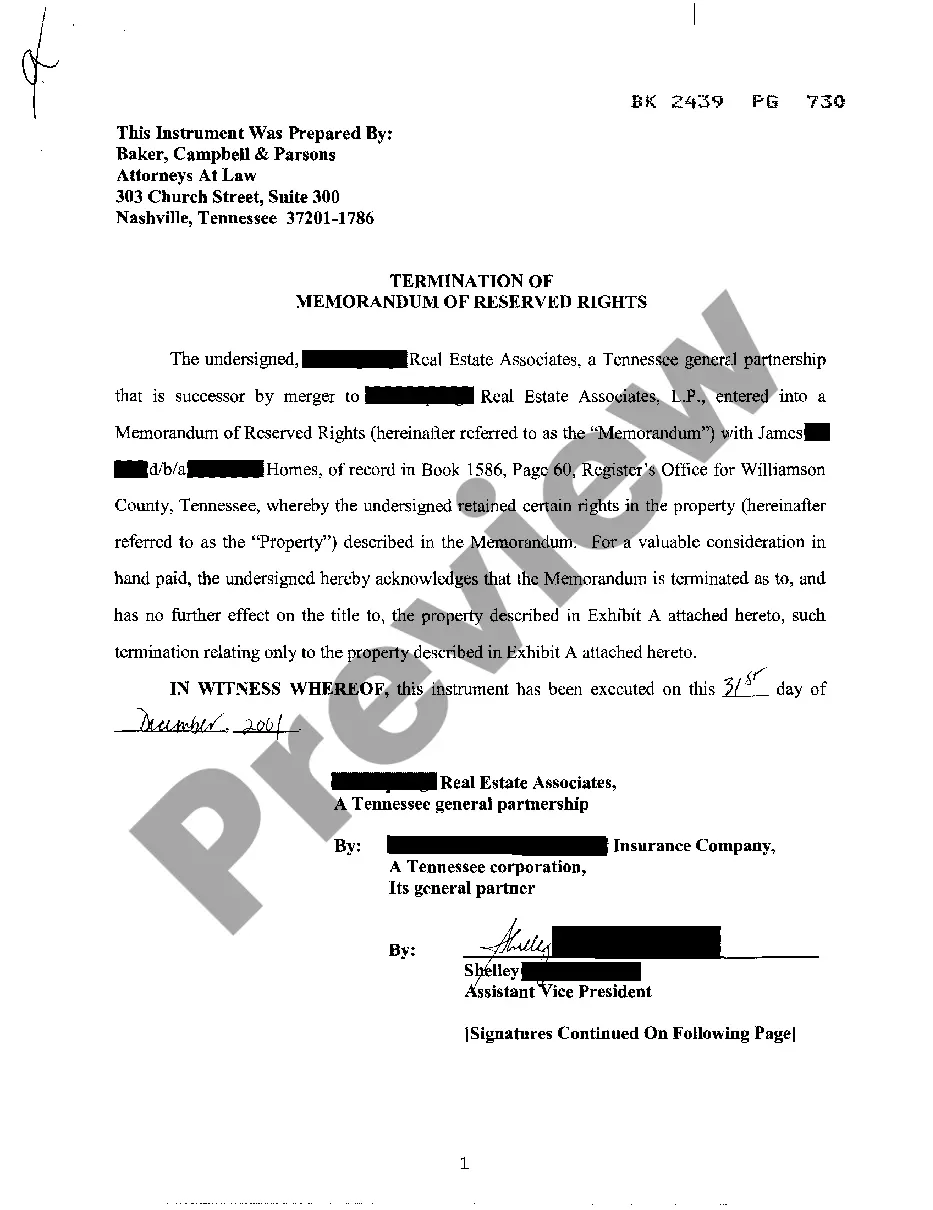

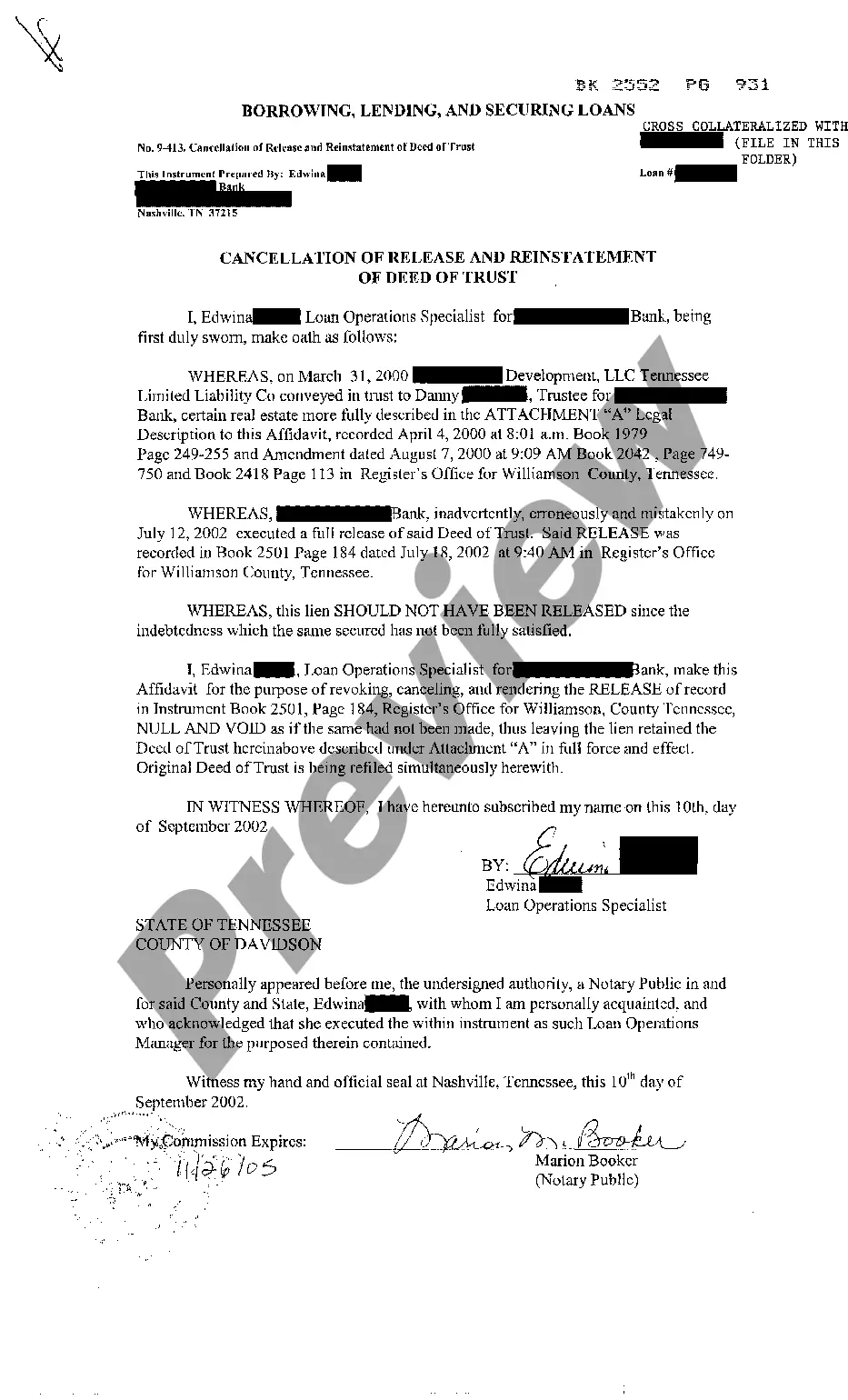

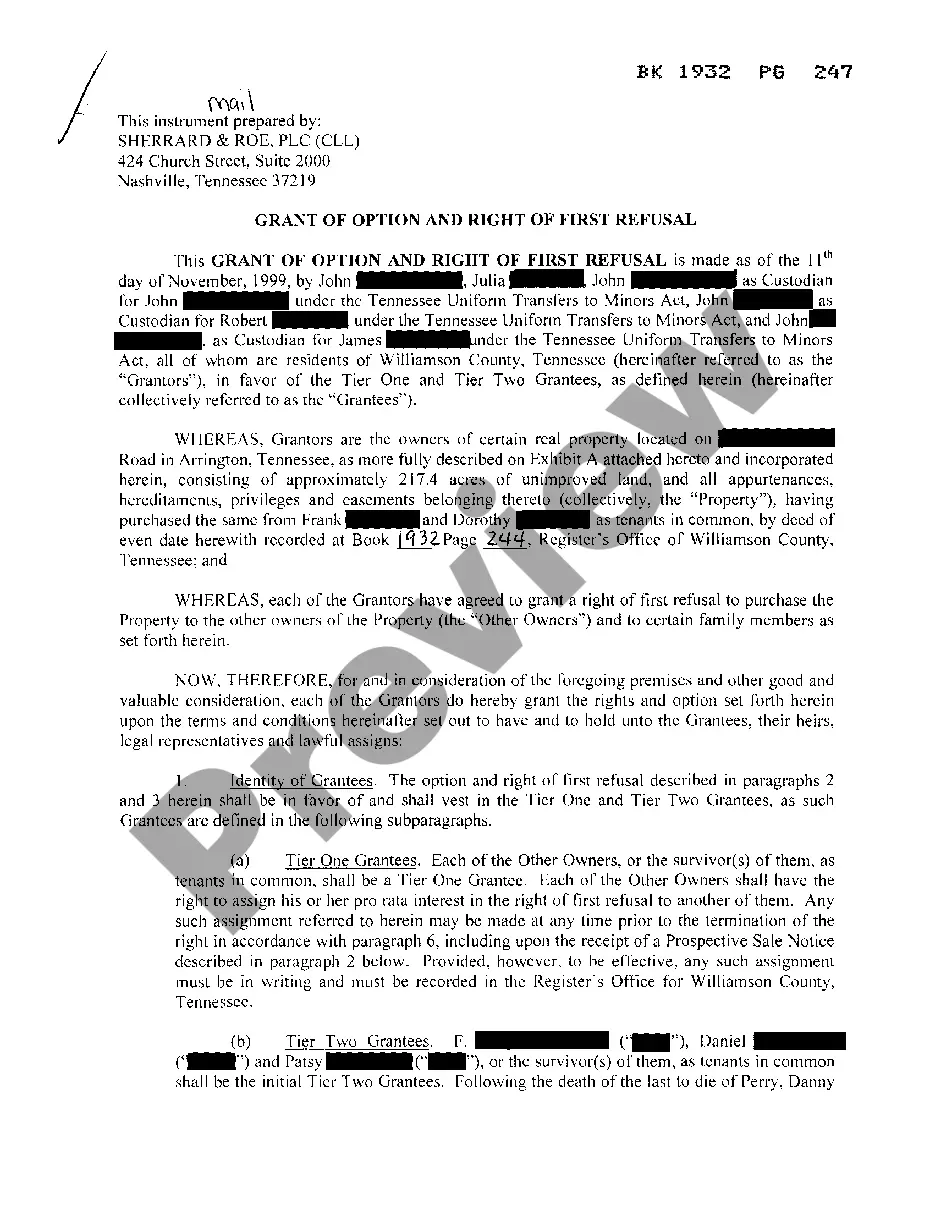

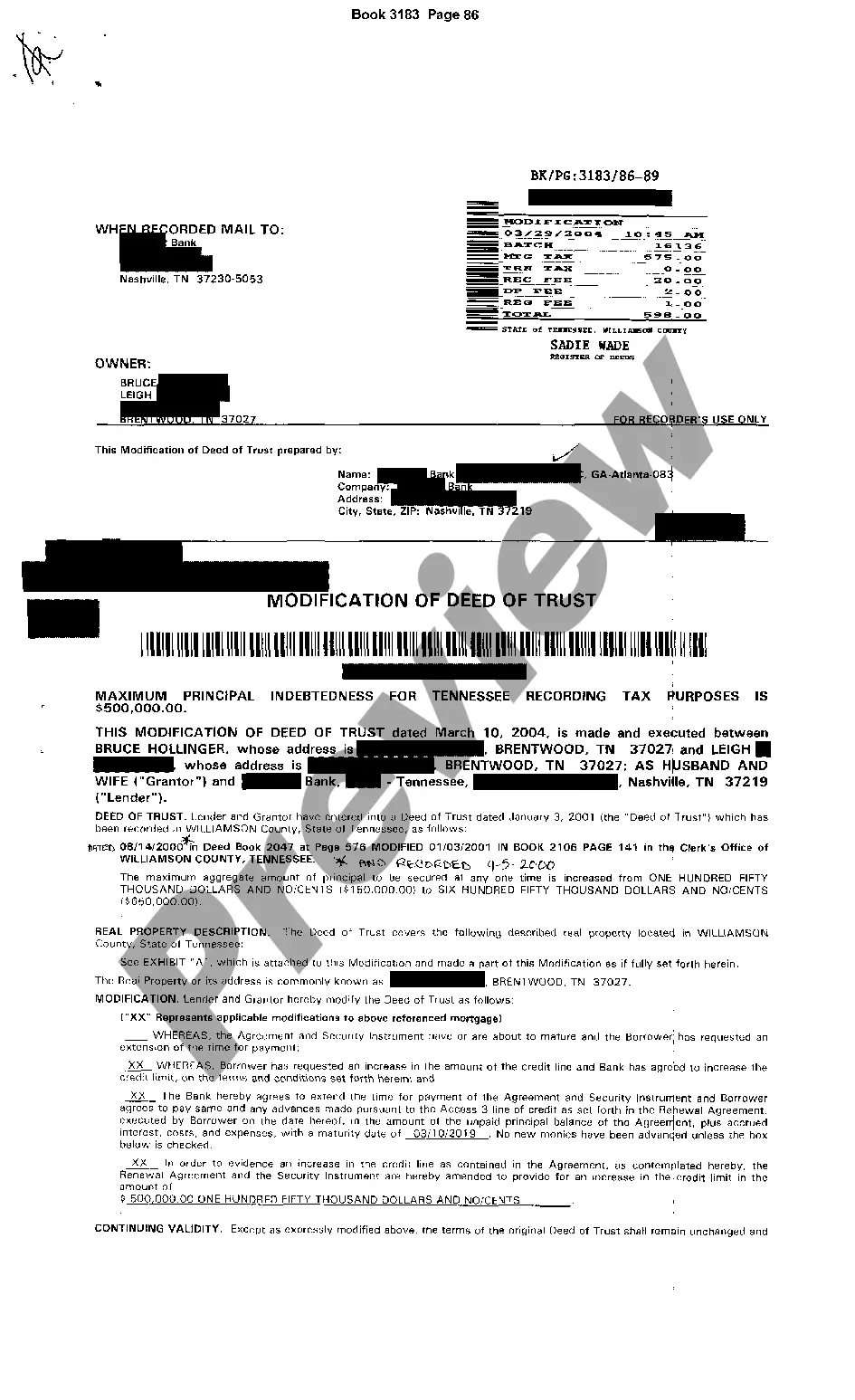

Maricopa Arizona Agreement to Compromise Debt is a legal agreement between debtors and creditors in Maricopa, Arizona, aimed at settling outstanding debts through a negotiated compromise. This agreement provides a structured framework for borrowers and lenders to reach a mutually agreeable resolution rather than pursuing lengthy legal proceedings. In Maricopa County, Arizona, two common types of Agreement to Compromise Debt include: 1. Maricopa Arizona Installment Agreement to Compromise Debt: This type of agreement typically involves debtors repaying their outstanding debt over a specified period in fixed installments. The debtor and creditor negotiate the terms of repayment, considering factors such as the debtor's financial situation, income, and ability to make regular payments. This agreement aims to resolve the debt through a structured payment plan while providing some relief to the debtor. 2. Maricopa Arizona Lump Sum Agreement to Compromise Debt: This type of agreement involves debtors settling their entire outstanding debt through a single lump-sum payment. Parties involved negotiate to determine an acceptable reduced amount, which the debtor pays in one payment to the creditor. This type of agreement is often preferred by debtors who have access to a significant sum of money or have obtained financial assistance from a third party. The Maricopa Arizona Agreement to Compromise Debt aims to help both debtors and creditors find a middle ground and avoid the time-consuming and expensive process of litigation. This agreement helps debtors who may be struggling with their financial obligations and creditors who may be open to receiving reduced payments instead of risking non-payment. During the negotiation process, both parties should consult legal professionals experienced in debt settlement and ensure that the agreement adheres to relevant laws and regulations in the Maricopa County area. Through the Maricopa Arizona Agreement to Compromise Debt, debtors can work towards managing their debt more effectively, while creditors can recover at least a portion of the outstanding amounts.

Maricopa Arizona Agreement to Compromise Debt

Description

How to fill out Maricopa Arizona Agreement To Compromise Debt?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Maricopa Agreement to Compromise Debt, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Agreement to Compromise Debt from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Maricopa Agreement to Compromise Debt:

- Take a look at the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!