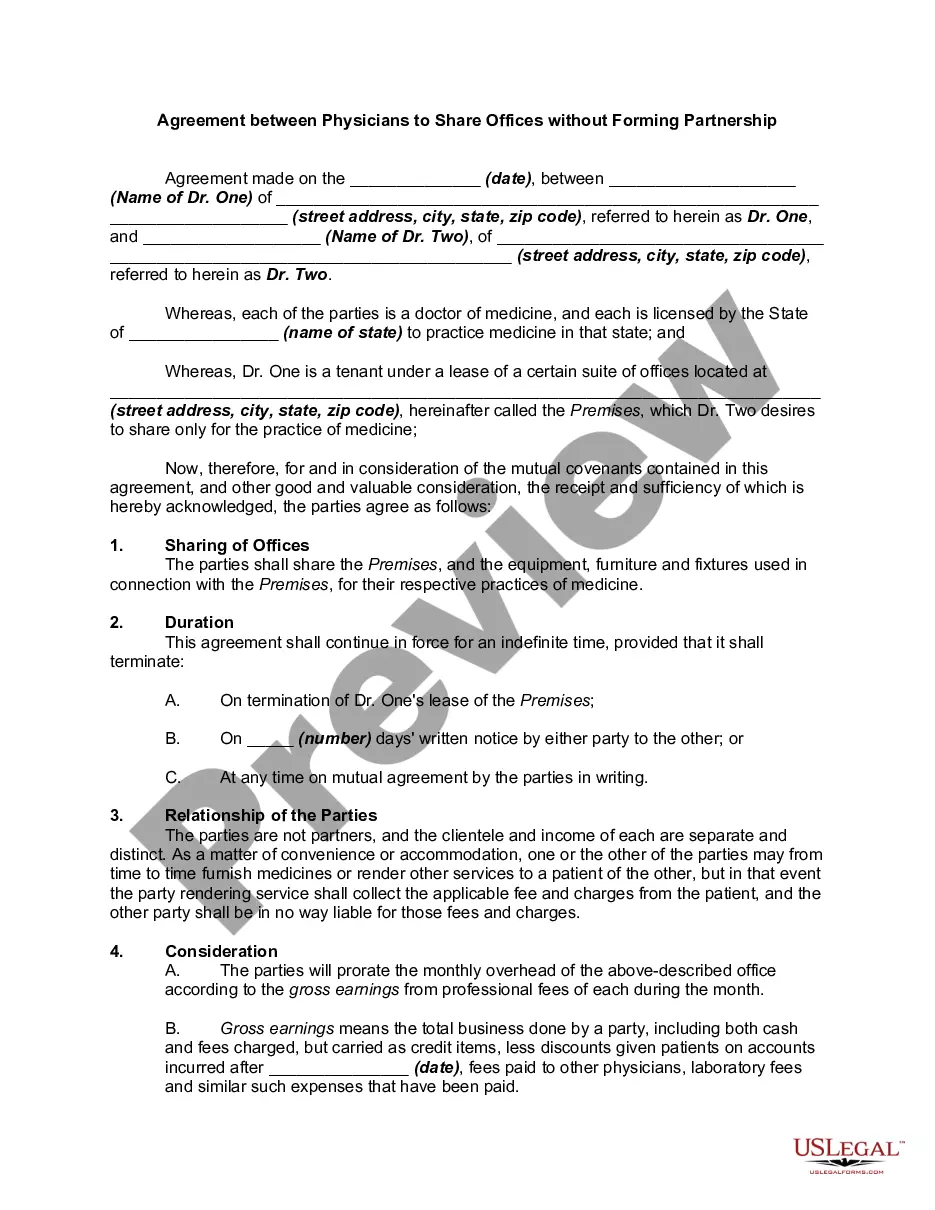

Oakland Michigan Agreement to Compromise Debt is a legally binding agreement between a debtor and a creditor to settle an outstanding debt for an amount less than the full balance owed. This agreement is specific to the Oakland County in Michigan and is designed to help individuals or businesses struggling with debt to find a reasonable resolution. The primary purpose of the Oakland Michigan Agreement to Compromise Debt is to avoid litigation and reach a mutually beneficial compromise. It provides a framework for negotiation between the debtor and creditor to establish new terms for repaying the debt, taking into consideration the debtor's financial situation and the creditor's willingness to recoup a portion of the outstanding balance. The specific terms and conditions of an Oakland Michigan Agreement to Compromise Debt may vary depending on factors such as the nature of the debt, the amount owed, and the parties involved. However, some key elements typically included in such agreements are: 1. Debt Information: This section provides a detailed description of the debt, including the original amount owed, the creditor's name, account number, and the date the debt was incurred. 2. Debtor's Financial Statement: The debtor is required to disclose their current financial status, including income, assets, liabilities, and monthly expenses. This information helps the creditor assess the debtor's ability to repay the debt and negotiate a fair compromise. 3. Proposed Settlement Amount: The debtor proposes a specific reduced amount that they are willing and able to pay to settle the debt. This amount is often negotiated through discussions between the debtor and creditor. 4. Repayment Terms: This section outlines the agreed-upon terms for repaying the compromised debt. It may include information about the payment schedule, interest rates (if applicable), and any additional fees or penalties. 5. Release of Liability: Once the agreed-upon settlement amount is paid in full, the creditor agrees to release the debtor from any further liability related to the debt. This ensures that the debtor is no longer legally obligated to pay the remaining balance. It is important to note that Oakland Michigan Agreement to Compromise Debt may differ based on the type of debt involved. Common types of debts that can be resolved through such agreements include credit card debt, medical bills, personal loans, and small business debts. In summary, an Oakland Michigan Agreement to Compromise Debt is a valuable tool for individuals or businesses struggling with their financial obligations. It provides a structured approach to debt resolution, allowing debtors and creditors to work towards a fair compromise that benefits both parties while avoiding the need for costly litigation.

Oakland Michigan Agreement to Compromise Debt

Description

How to fill out Oakland Michigan Agreement To Compromise Debt?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Oakland Agreement to Compromise Debt is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Oakland Agreement to Compromise Debt. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Oakland Agreement to Compromise Debt in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!