Title: An In-depth Look at the Palm Beach Florida Agreement to Compromise Debt Introduction: The Palm Beach Florida Agreement to Compromise Debt is a legally binding document that allows debtors and creditors to reach a settlement in order to resolve outstanding debts. This agreement offers a mutually beneficial solution, helping both parties avoid prolonged legal battles and potential financial damages. In this article, we will explore the various aspects of the Palm Beach Florida Agreement to Compromise Debt, including its purpose, benefits, and different types available. 1. Understanding the Purpose and Function of the Palm Beach Florida Agreement to Compromise Debt: The Palm Beach Florida Agreement to Compromise Debt enables debtors and creditors to come to a reasonable settlement, easing financial burdens and preventing further complications. It outlines the terms, conditions, and compromises agreed upon by both parties involved in the debt dispute. 2. Benefits of the Palm Beach Florida Agreement to Compromise Debt: i) Avoidance of Legal Proceedings: This agreement provides an alternative to lengthy court processes, minimizing the expenses and time associated with litigation for both parties. ii) Debt Reduction: Debtors facing financial hardship can negotiate a reduced payment amount, relieving their financial strain and allowing them to meet their obligations more feasibly. iii) Guaranteed Repayment: Creditors can ensure they receive a partial payment rather than risking the debtor declaring bankruptcy, which may result in no repayment at all. 3. Different Types of Palm Beach Florida Agreement to Compromise Debt: Although the core objective remains the same, there are various types of Palm Beach Florida Agreement to Compromise Debt, each catering to specific circumstances: i) Credit Card Debt Agreement: Tailored for resolving outstanding balances on credit cards, this type of agreement offers debtors the opportunity to negotiate reduced interest rates or waivers on certain fees. ii) Medical Debt Agreement: Designed to address medical debts, this agreement may enable debtors to establish manageable repayment plans or request debt forgiveness for certain medical expenses. iii) Personal Loan Debt Agreement: This type of agreement is applicable to personal loans and allows individuals to negotiate reduced interest rates, extended payment terms, or an overall reduced balance. iv) Business Debt Agreement: Aimed specifically at resolving debts incurred by businesses, this agreement may involve negotiations regarding repayment terms, forgiveness of certain liabilities, or restructuring of the debt. Conclusion: The Palm Beach Florida Agreement to Compromise Debt offers a viable solution for individuals or businesses struggling with debt-related issues. By facilitating negotiations and ensuring mutually beneficial compromises, this agreement enables debtors to regain financial stability while providing creditors with the assurance of partial repayment. Whether it is credit card, medical, personal loan, or business debt, the Palm Beach Florida Agreement to Compromise Debt serves as a helpful tool to resolve outstanding financial obligations efficiently and effectively.

Palm Beach Florida Agreement to Compromise Debt

Description

How to fill out Palm Beach Florida Agreement To Compromise Debt?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Palm Beach Agreement to Compromise Debt is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to get the Palm Beach Agreement to Compromise Debt. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

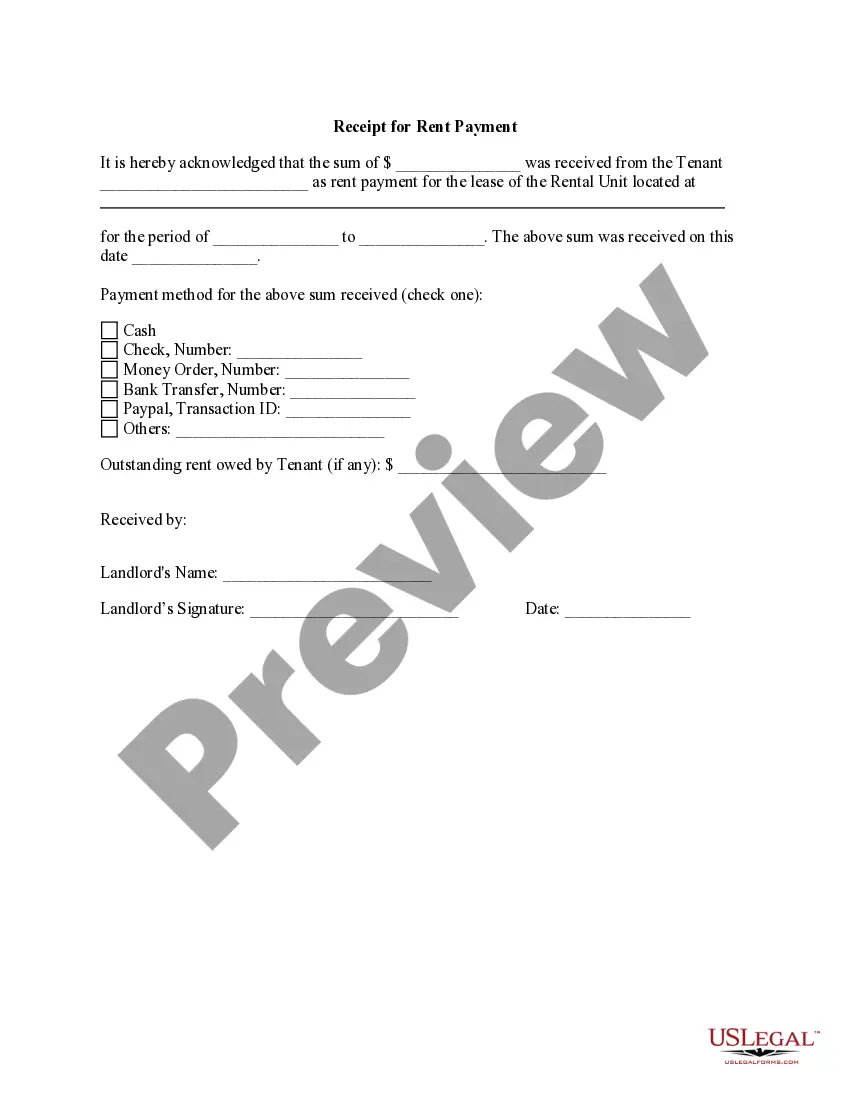

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Palm Beach Agreement to Compromise Debt in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!