San Diego, California, is a city located on the coast of Southern California. It is widely known for its beautiful beaches, favorable climate, and vibrant neighborhoods. As a famous tourist destination and a hub of economic activity, San Diego attracts a diverse and dynamic population. The "San Diego California Agreement to Compromise Debt" is a legal arrangement designed to assist individuals and businesses in resolving their financial obligations. This agreement provides a mechanism for debtors to negotiate with their creditors to reach a mutually agreeable settlement, often resulting in the reduction or cancellation of a portion of their outstanding debts. Keywords: San Diego, California, Agreement to Compromise Debt, legal arrangement, financial obligations, debtors, creditors, settlement, reduction, cancellation, outstanding debts. Different types of San Diego California Agreement to Compromise Debt may include: 1. Personal Debt Compromise Agreement: This type of agreement is entered into by individuals struggling with personal debt, such as credit card debts, medical bills, or personal loans. It aims to help individuals manage their financial difficulties by negotiating a reduced payment plan or a lump-sum settlement with their creditors. 2. Business Debt Compromise Agreement: This agreement is specific to businesses in San Diego, California, seeking relief from substantial debts. It allows businesses to work with their creditors to restructure or reduce their debts, enabling them to continue operations and avoid bankruptcy. 3. Mortgage Debt Compromise Agreement: Homeowners facing difficulties in meeting their mortgage obligations may enter into this type of agreement to find resolutions with their lenders. It provides an opportunity to negotiate lowered interest rates, extend payment terms, or even reduce the principal amount owed. 4. Tax Debt Compromise Agreement: This agreement is designed for individuals or businesses struggling with tax-related debts. It allows taxpayers to negotiate with the tax authorities, such as the Internal Revenue Service (IRS) or the California Franchise Tax Board, to settle their tax liabilities through a compromised amount or payment plan. 5. Student Loan Debt Compromise Agreement: Many students and graduates in San Diego carry significant student loan debt. This type of agreement enables borrowers to explore options for reducing or restructuring their student loan obligations, including negotiating lower interest rates, extending repayment periods, or reaching a lump-sum settlement. Keywords: Personal Debt Compromise Agreement, Business Debt Compromise Agreement, Mortgage Debt Compromise Agreement, Tax Debt Compromise Agreement, Student Loan Debt Compromise Agreement, debt restructuring, settlement negotiations, payment plan, financial relief, bankruptcy avoidance.

San Diego California Agreement to Compromise Debt

Description

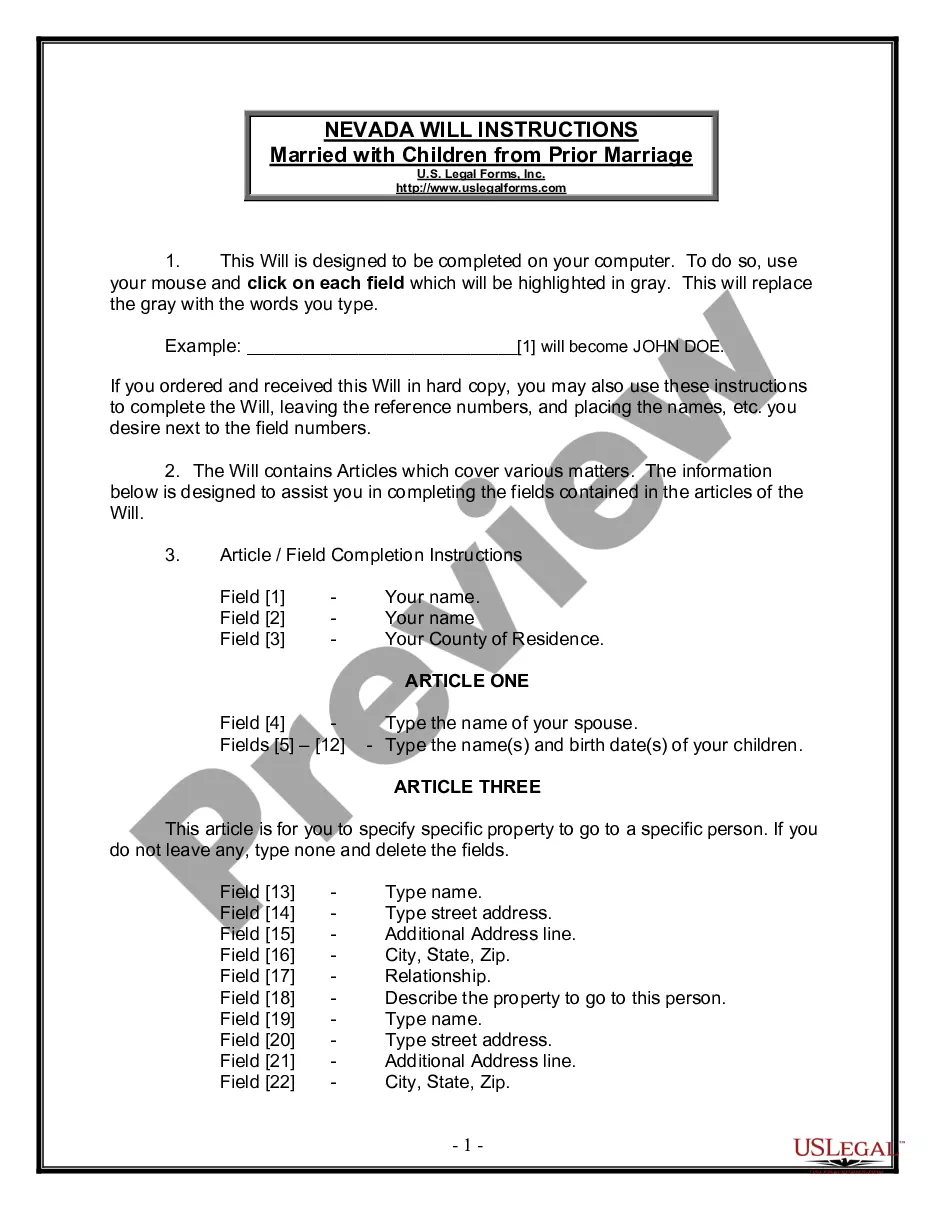

How to fill out San Diego California Agreement To Compromise Debt?

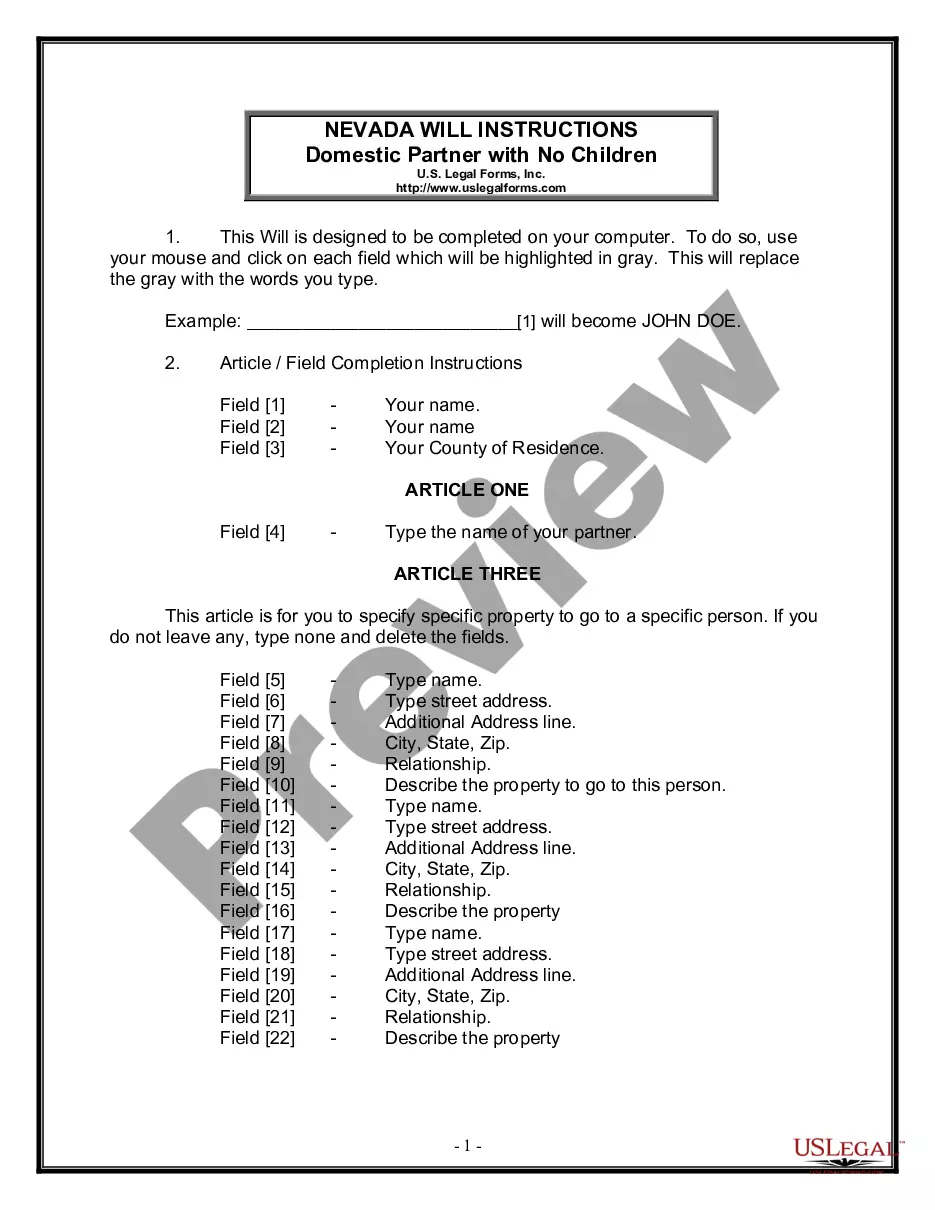

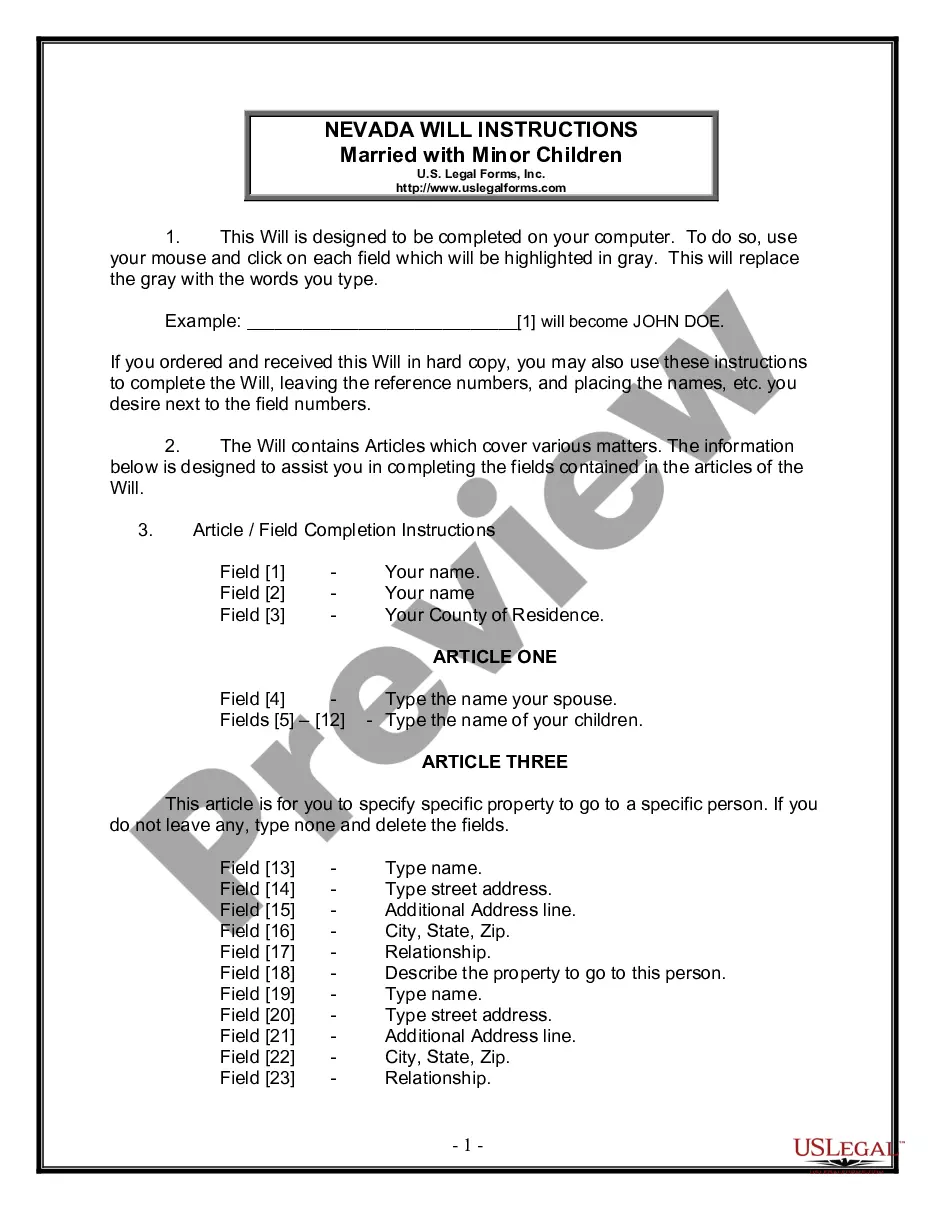

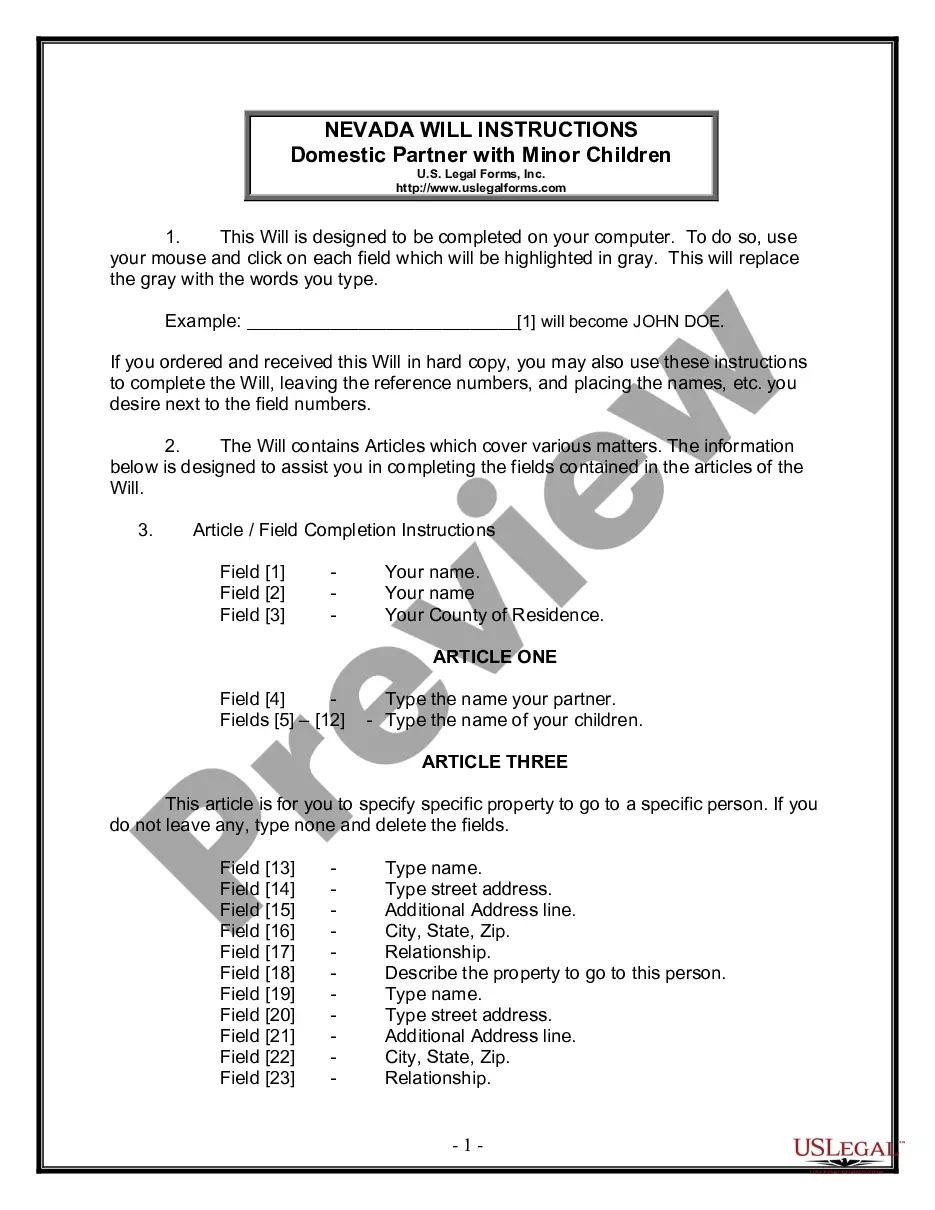

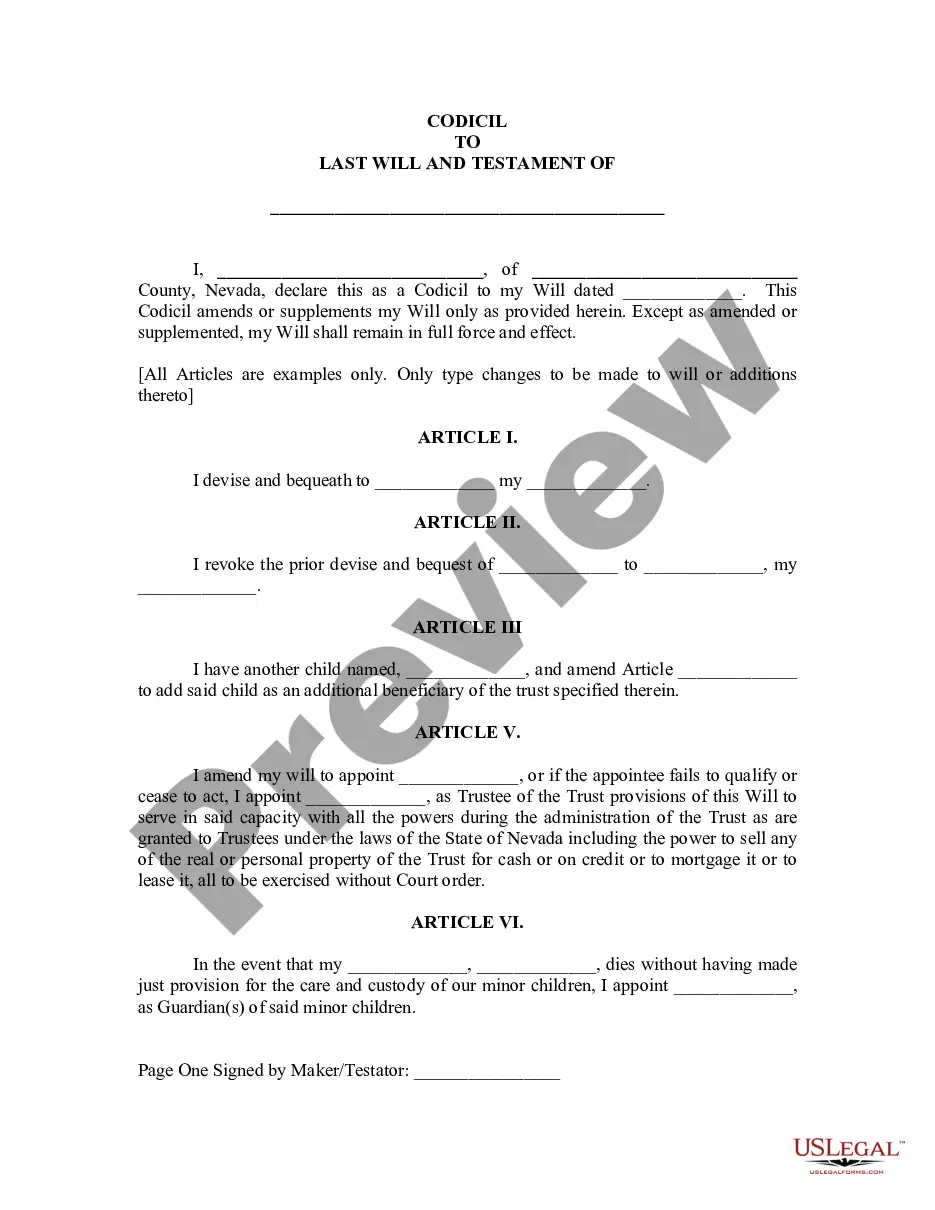

Are you looking to quickly draft a legally-binding San Diego Agreement to Compromise Debt or probably any other document to take control of your personal or business matters? You can select one of the two options: contact a professional to write a legal document for you or create it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get professionally written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific document templates, including San Diego Agreement to Compromise Debt and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, carefully verify if the San Diego Agreement to Compromise Debt is tailored to your state's or county's laws.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were looking for by using the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the San Diego Agreement to Compromise Debt template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. In addition, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!