This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

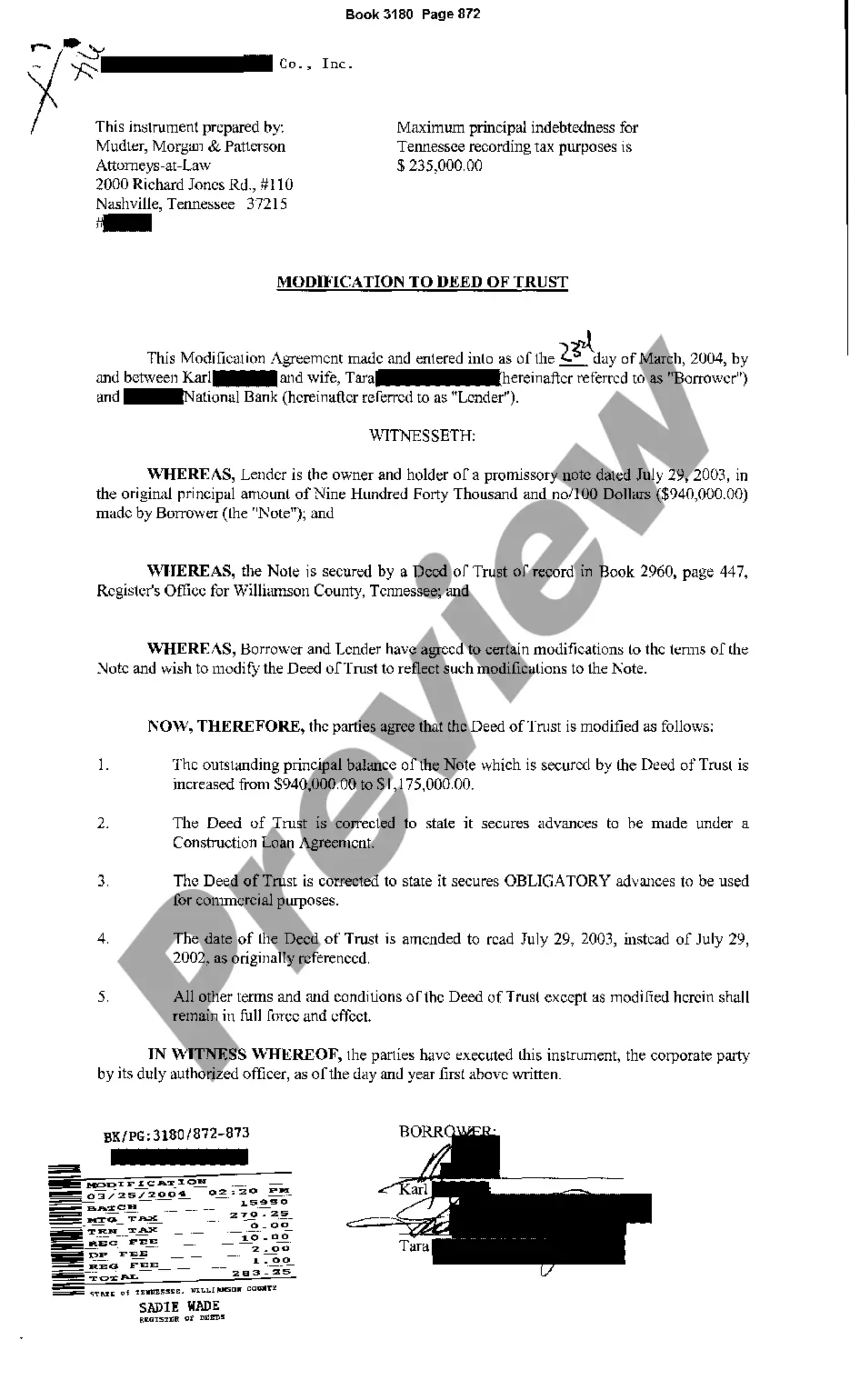

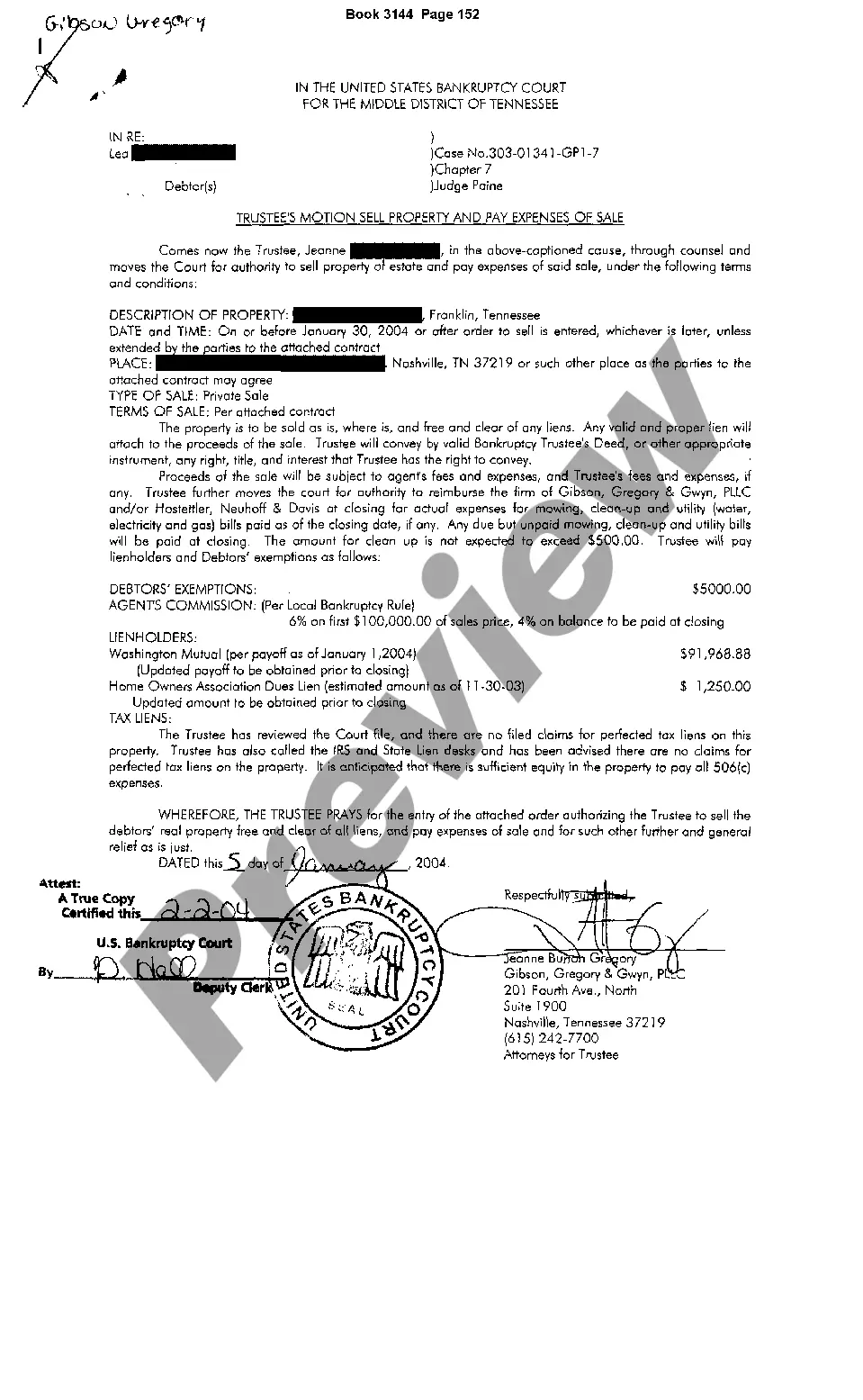

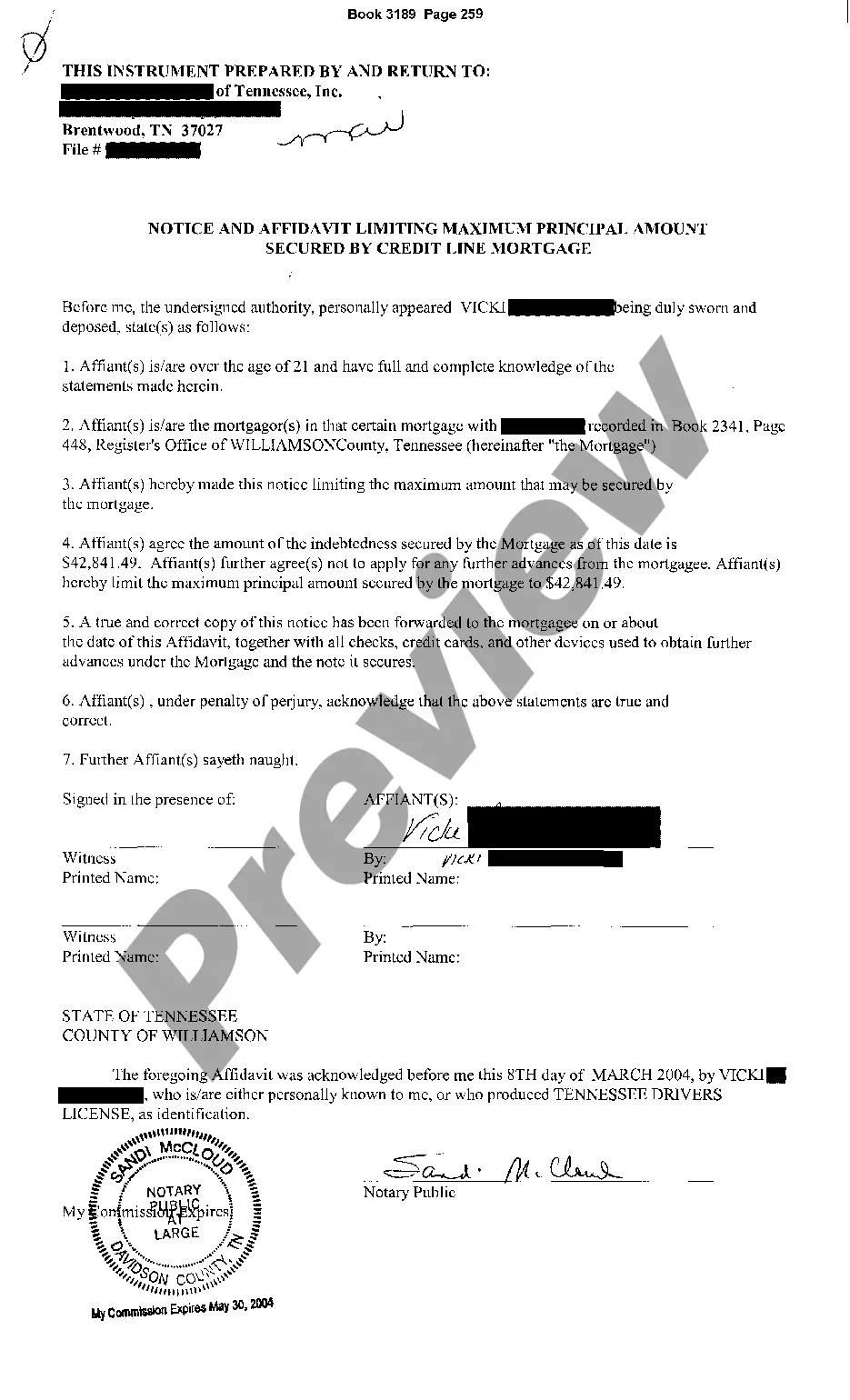

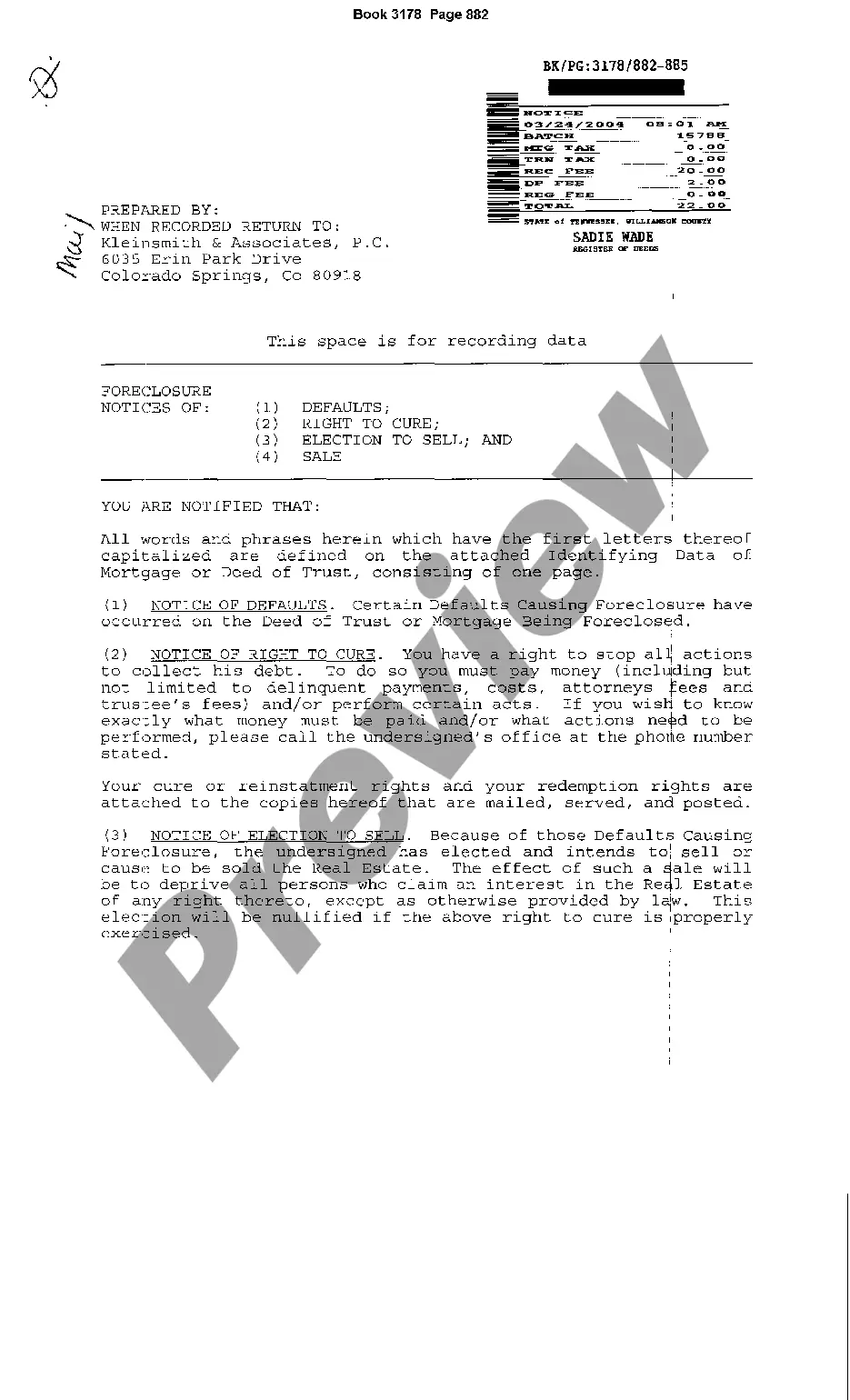

Maricopa Arizona Agreement to Extend Debt Payment Terms is a legal contract that allows parties involved to modify the terms of an existing debt payment plan, usually in order to extend the repayment period. This agreement is a crucial tool for debtors who are encountering financial difficulties and need more time to fulfill their obligations. The Maricopa Arizona Agreement to Extend Debt Payment Terms typically includes details such as the names of the involved parties, the original debt agreement reference, and the specific terms that are being modified. The agreement outlines the newly proposed repayment schedule, specifying the new deadlines, and installment amounts. There may be different types of Maricopa Arizona Agreement to Extend Debt Payment Terms depending on the nature of the debt and the creditor's willingness to negotiate. Some common variations include: 1. Personal Loan Agreement Extension: This type of agreement is used when individuals borrow money from friends, family, or acquaintances and need to extend the repayment period due to unforeseen circumstances. It allows both parties to renegotiate the terms and avoid any potential disputes. 2. Business Debt Extension Agreement: When businesses face financial hardships, they may opt for this agreement to extend their debt payment terms with creditors or financial institutions. This can provide the necessary breathing room to reorganize finances, improve cash flow, and ultimately avoid bankruptcy. 3. Mortgage Loan Modification Agreement: Homeowners who are struggling to meet their mortgage payments may find relief through this type of agreement. By extending the loan repayment period, reducing interest rates, or even adjusting the principal amount, borrowers can make their mortgage payments more manageable and avoid foreclosure. 4. Student Loan Agreement Extension: In some cases, individuals may face difficulty repaying their student loans due to job losses or other financial setbacks. The Maricopa Arizona Agreement to Extend Debt Payment Terms can be utilized to modify the repayment schedule, allowing students more time to pay back their loans. It's important to note that each agreement will have specific terms and conditions tailored to the unique circumstances of the debtor and lender. Seeking legal advice or consulting with a financial professional is advisable to ensure compliance with relevant laws and regulations when pursuing a Maricopa Arizona Agreement to Extend Debt Payment Terms.Maricopa Arizona Agreement to Extend Debt Payment Terms is a legal contract that allows parties involved to modify the terms of an existing debt payment plan, usually in order to extend the repayment period. This agreement is a crucial tool for debtors who are encountering financial difficulties and need more time to fulfill their obligations. The Maricopa Arizona Agreement to Extend Debt Payment Terms typically includes details such as the names of the involved parties, the original debt agreement reference, and the specific terms that are being modified. The agreement outlines the newly proposed repayment schedule, specifying the new deadlines, and installment amounts. There may be different types of Maricopa Arizona Agreement to Extend Debt Payment Terms depending on the nature of the debt and the creditor's willingness to negotiate. Some common variations include: 1. Personal Loan Agreement Extension: This type of agreement is used when individuals borrow money from friends, family, or acquaintances and need to extend the repayment period due to unforeseen circumstances. It allows both parties to renegotiate the terms and avoid any potential disputes. 2. Business Debt Extension Agreement: When businesses face financial hardships, they may opt for this agreement to extend their debt payment terms with creditors or financial institutions. This can provide the necessary breathing room to reorganize finances, improve cash flow, and ultimately avoid bankruptcy. 3. Mortgage Loan Modification Agreement: Homeowners who are struggling to meet their mortgage payments may find relief through this type of agreement. By extending the loan repayment period, reducing interest rates, or even adjusting the principal amount, borrowers can make their mortgage payments more manageable and avoid foreclosure. 4. Student Loan Agreement Extension: In some cases, individuals may face difficulty repaying their student loans due to job losses or other financial setbacks. The Maricopa Arizona Agreement to Extend Debt Payment Terms can be utilized to modify the repayment schedule, allowing students more time to pay back their loans. It's important to note that each agreement will have specific terms and conditions tailored to the unique circumstances of the debtor and lender. Seeking legal advice or consulting with a financial professional is advisable to ensure compliance with relevant laws and regulations when pursuing a Maricopa Arizona Agreement to Extend Debt Payment Terms.