The Harris Texas Articles of Incorporation, Not for Profit Organization, with Tax Provisions is a legal document that outlines the formation and operation of a nonprofit organization in Harris County, Texas. It includes specific clauses related to tax-exempt status and compliance with IRS regulations. This article will provide a detailed description of the key components of these Articles of Incorporation, as well as the different types available. 1. Purpose: The Articles of Incorporation begin with a statement defining the purpose and activities of the nonprofit organization. It should clearly state the organization's charitable, educational, religious, scientific, or other tax-exempt purpose. 2. Name and Address: The document must include the official name of the nonprofit organization along with its principal office address. The name should not conflict with any existing entity or violate any trademark laws. 3. Registered Agent: The nonprofit organization is required to designate a registered agent who will act as a point of contact for any legal notices or communications on behalf of the organization. The registered agent must have a physical address in Harris County. 4. Duration: This section specifies the duration of the organization, which is often perpetual unless otherwise indicated. 5. Membership: The Articles may include provisions related to the membership structure of the organization, including the qualifications, rights, and obligations of members. 6. Board of Directors: This section outlines the composition, powers, and responsibilities of the organization's board of directors. It may specify the number of directors, their term limits, and the process for electing or removing them. 7. Dissolution Clause: The Articles of Incorporation must contain a dissolution clause, which explains the procedures to be followed in the event of the organization's dissolution and the distribution of its assets to other tax-exempt entities. 8. Tax Exemption Provisions: Harris Texas Articles of Incorporation for a Not for Profit Organization with Tax Provisions will contain specific language required by the IRS to establish the organization's tax-exempt status. These provisions ensure compliance with federal and state tax laws and regulations. 9. Amendments: The process and requirements for amending the Articles of Incorporation should be included, detailing how changes may be made to the document in the future. There may be variations of the Harris Texas Articles of Incorporation for a Not for Profit Organization with Tax Provisions based on the specific needs and preferences of the nonprofit. For example: — Articles for Religious Organizations: These might include additional provisions related to religious doctrine, rituals, or practices, depending on the nature of the organization. — Articles for Educational Organizations: Nonprofits focused on education might have specific clauses outlining the programs, courses, or research activities they will undertake. — Articles for Social Service Organizations: Nonprofits providing social services might emphasize the types of community support, outreach, or aid programs they plan to offer. In conclusion, the Harris Texas Articles of Incorporation, Not for Profit Organization, with Tax Provisions lay the foundation for a tax-exempt nonprofit organization in Harris County. These legal documents establish the organization's purpose, structure, and compliance with tax regulations. Different variations may exist based on the specific focus or goals of the nonprofit entity.

Harris Texas Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

How to fill out Harris Texas Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life sphere, finding a Harris Articles of Incorporation, Not for Profit Organization, with Tax Provisions suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Harris Articles of Incorporation, Not for Profit Organization, with Tax Provisions, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Harris Articles of Incorporation, Not for Profit Organization, with Tax Provisions:

- Examine the content of the page you’re on.

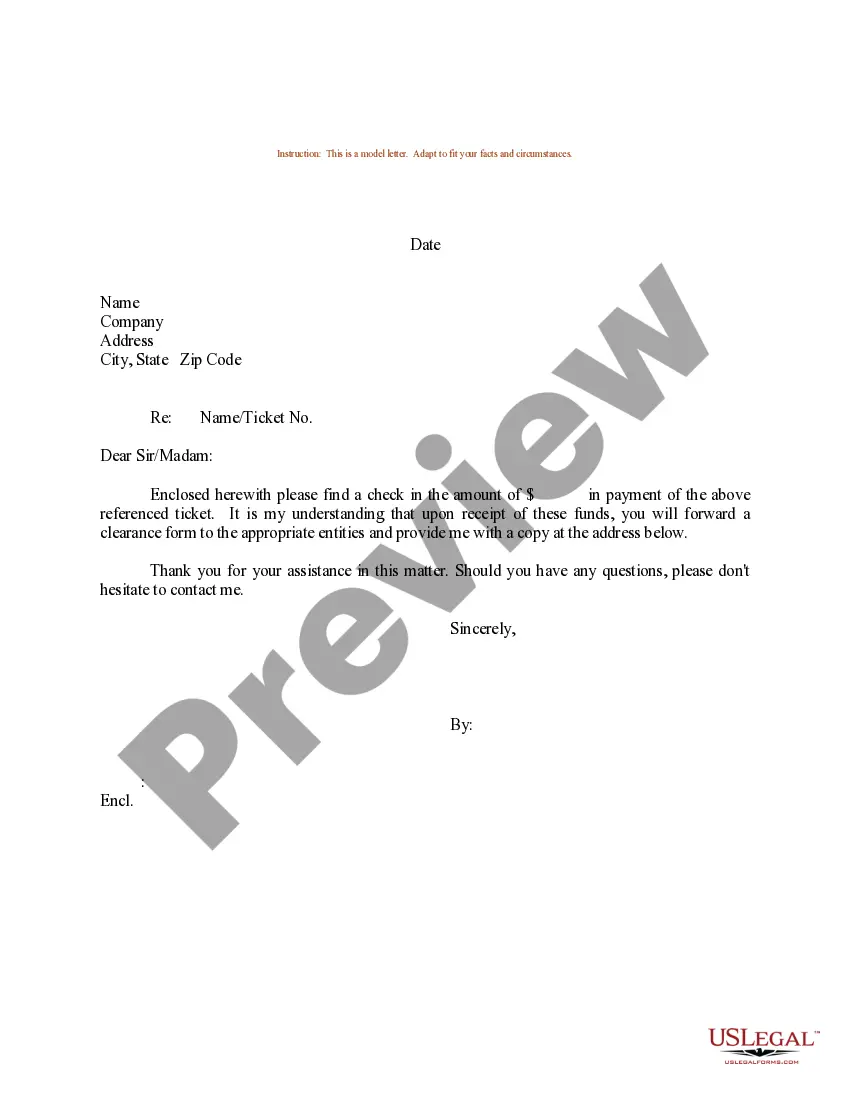

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Harris Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!