Philadelphia Pennsylvania Articles of Incorporation for Not-for-Profit Organizations with Tax Provisions are legal documents that establish the formation of a non-profit organization in the city of Philadelphia, Pennsylvania. These documents play a crucial role in outlining the organization's purpose, structure, and intentions while ensuring compliance with state and federal tax laws. Here, we will provide a detailed description of these articles, emphasizing relevant keywords. 1. Key Elements: The Articles of Incorporation for a not-for-profit organization in Philadelphia, Pennsylvania, contain several essential sections, including: a. Name: The legal name of the organization should be distinct and must comply with the state's naming requirements. b. Purpose: This section outlines the organization's mission or purpose, specifying the intended activities and services it aims to offer. c. Members and Directors: The articles detail the qualifications and responsibilities of members and board directors governing the organization. d. Registered Office and Agent: A physical address and a registered agent in Philadelphia, responsible for receiving legal notices and official correspondences, must be provided. e. Governance and Bylaws: The governance structure, decision-making processes, and bylaws regulations within the organization are described. f. Dissolution: The conditions and procedures for dissolving the organization are stated, ensuring proper handling of assets upon termination. g. Tax Provisions: This section affirms compliance with federal and Pennsylvania tax laws and requirements for tax-exempt status, such as the provision of necessary documentation to maintain tax-exempt status. 2. Limitations and Designations: a. Standard Articles of Incorporation: These are the generic articles used by most not-for-profit organizations in Philadelphia, complying with legal requirements and providing tax provisions necessary for tax-exempt status. b. Specialized Articles for Religious Organizations: Religious organizations may opt for specialized articles that reflect their unique requirements and purposes while adhering to relevant tax provisions and exemptions. c. Educational or Charitable Articles: Organizations dedicated to education, charitable purposes, or community development may have specific articles tailored to their activities, highlighting tax provisions relevant to their sector. 3. Tax Provisions: a. 501(c)(3) Status: The Articles of Incorporation will incorporate provisions necessary to obtain and maintain a tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This enables donors to make tax-deductible contributions and ensures compliance with federal tax regulations. b. Charitable Solicitation Registration: Depending on the organization's intention to solicit funds or donations, the articles may outline requirements for registering with appropriate state authorities or filing annual charitable solicitation reports. c. Reporting and Accountability: The articles may specify guidelines for financial reporting and the establishment of an independent audit committee, ensuring transparency and accountability. In conclusion, Philadelphia Pennsylvania's Articles of Incorporation for Not-for-Profit Organizations with Tax Provisions are fundamental legal documents that establish and define the purpose, structure, and tax compliance obligations of non-profit entities in the region. These articles may vary based on the specific nature of the organization, such as religious or educational purposes, while always incorporating the necessary tax provisions to maintain tax-exempt status.

Philadelphia Pennsylvania Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

How to fill out Philadelphia Pennsylvania Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Philadelphia Articles of Incorporation, Not for Profit Organization, with Tax Provisions is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Philadelphia Articles of Incorporation, Not for Profit Organization, with Tax Provisions. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

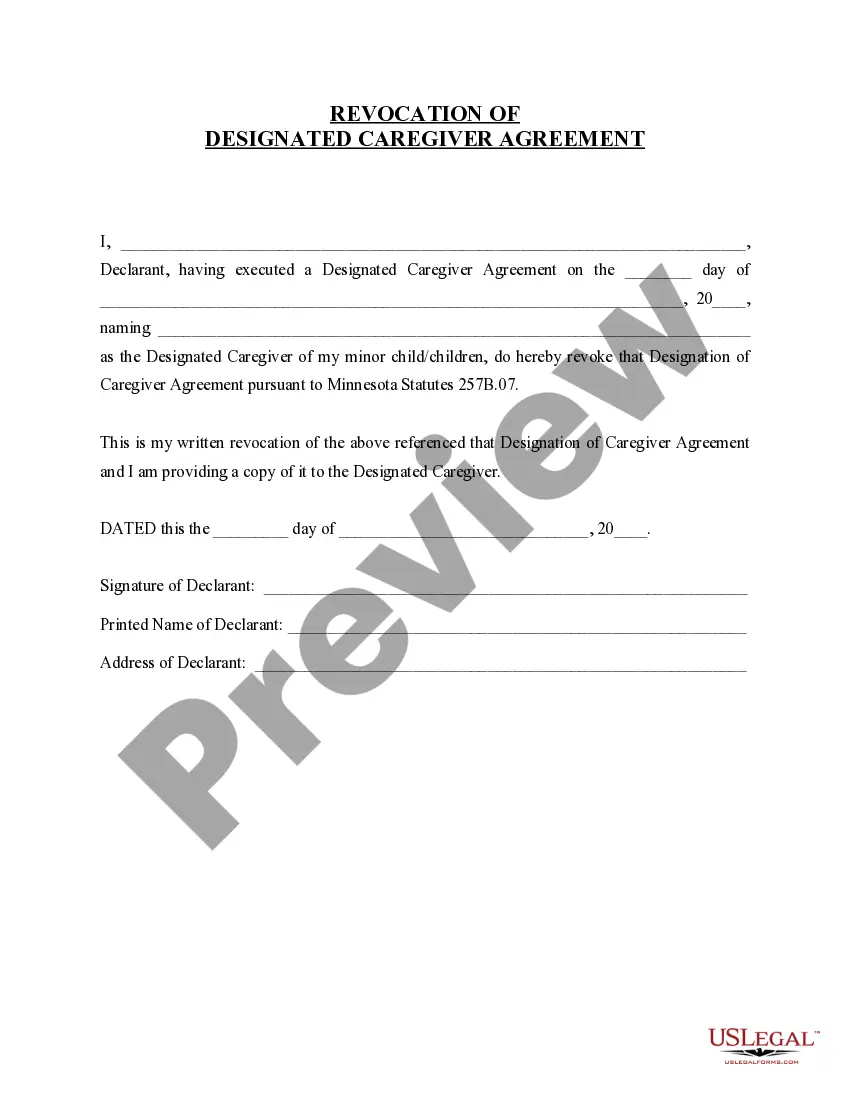

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Philadelphia Articles of Incorporation, Not for Profit Organization, with Tax Provisions in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!