Riverside is a vibrant city located in Southern California, known for its diverse community, stunning landscapes, and thriving cultural scene. When establishing a Not for Profit Organization in the city, it becomes essential to understand the Riverside California Articles of Incorporation, which include important tax provisions. These legal documents outline the structure and purpose of the organization, as well as its tax obligations. The Articles of Incorporation for a Not for Profit Organization in Riverside, California, aim to detail the organization's fundamental information and need to adhere to specific regulations set forth by the state's laws. By including relevant keywords related to this topic, we can better explain the process and potential variations of the Riverside California Articles of Incorporation, Not for Profit Organization, with Tax Provisions. 1. "Riverside California Articles of Incorporation for Not for Profit Organizations": These articles serve as the founding document for a Not for Profit Organization in Riverside, establishing its legal existence and providing important information such as the organization's name, purpose, registered agent, and the names of the initial board members. 2. "Riverside California Articles of Incorporation with 501(c)(3) Tax Exempt Status": Certain Not for Profit Organizations in Riverside may seek 501(c)(3) tax-exempt status from the Internal Revenue Service (IRS). These articles would include specific provisions needed to comply with the IRS guidelines, ensuring the organization's eligibility to receive tax-deductible donations and other benefits associated with this status. 3. "Riverside California Articles of Incorporation with Dissolution Provisions": These articles include provisions outlining the process and requirements for dissolving a Not for Profit Organization in Riverside. It is crucial to specify how remaining assets should be distributed after the organization's termination, ensuring compliance with tax laws and preserving the organization's charitable intentions. 4. "Riverside California Articles of Incorporation for Charitable Trust Organizations": Charitable trust organizations, focused on philanthropic initiatives and social causes, may have specific articles designed to address the requirements set by the California Attorney General's Office. These articles often cover matters such as charitable purpose, assets, board responsibilities, and reporting obligations to the state. 5. "Riverside California Articles of Incorporation with Commercial Activities Provisions": In some cases, Not for Profit Organizations engage in limited commercial activities to support their charitable mission. Articles with commercial activities provisions highlight the organization's intention to conduct such operations, outlining guidelines to ensure compliance with tax laws and maintain their nonprofit status. These variations of Riverside California Articles of Incorporation for Not for Profit Organizations demonstrate the flexibility and options available depending on the organization's specific goals, activities, and eligibility for tax-exempt status. It is crucial to consult with legal professionals familiar with California nonprofit law to ensure compliance and a smooth incorporation process.

Riverside California Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

How to fill out Riverside California Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so valuable.

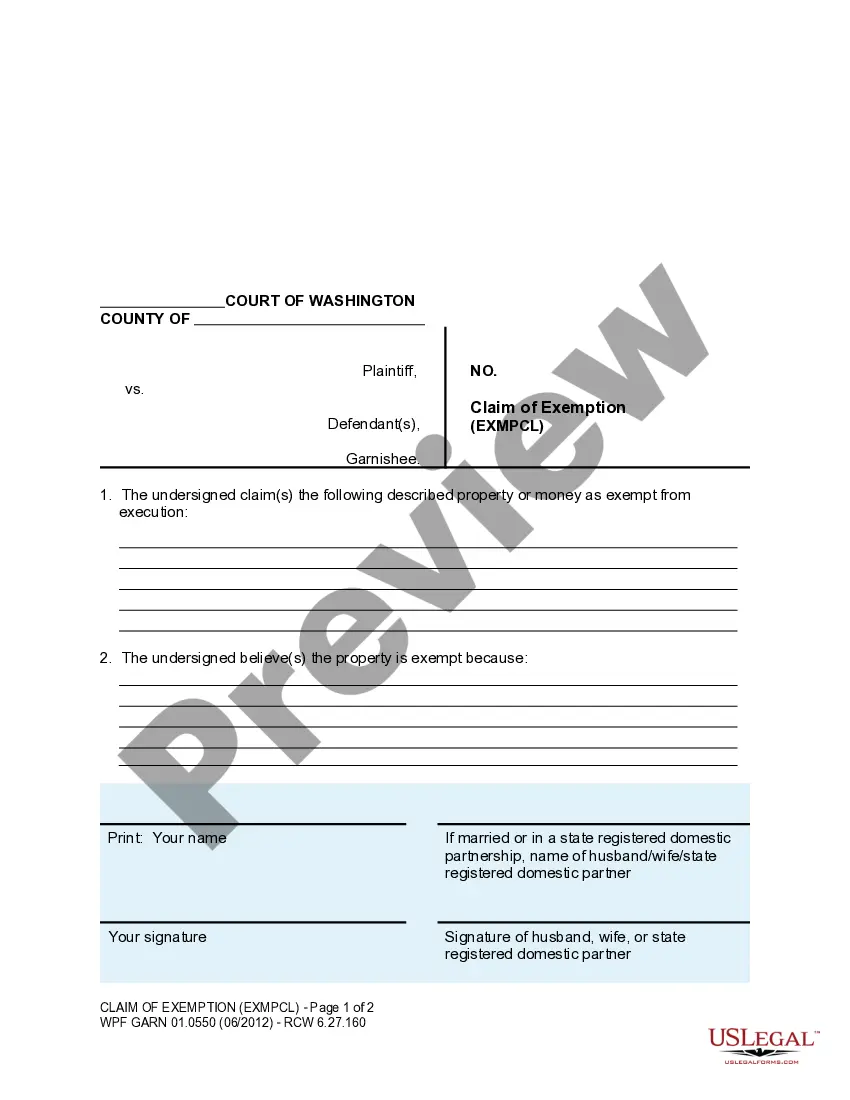

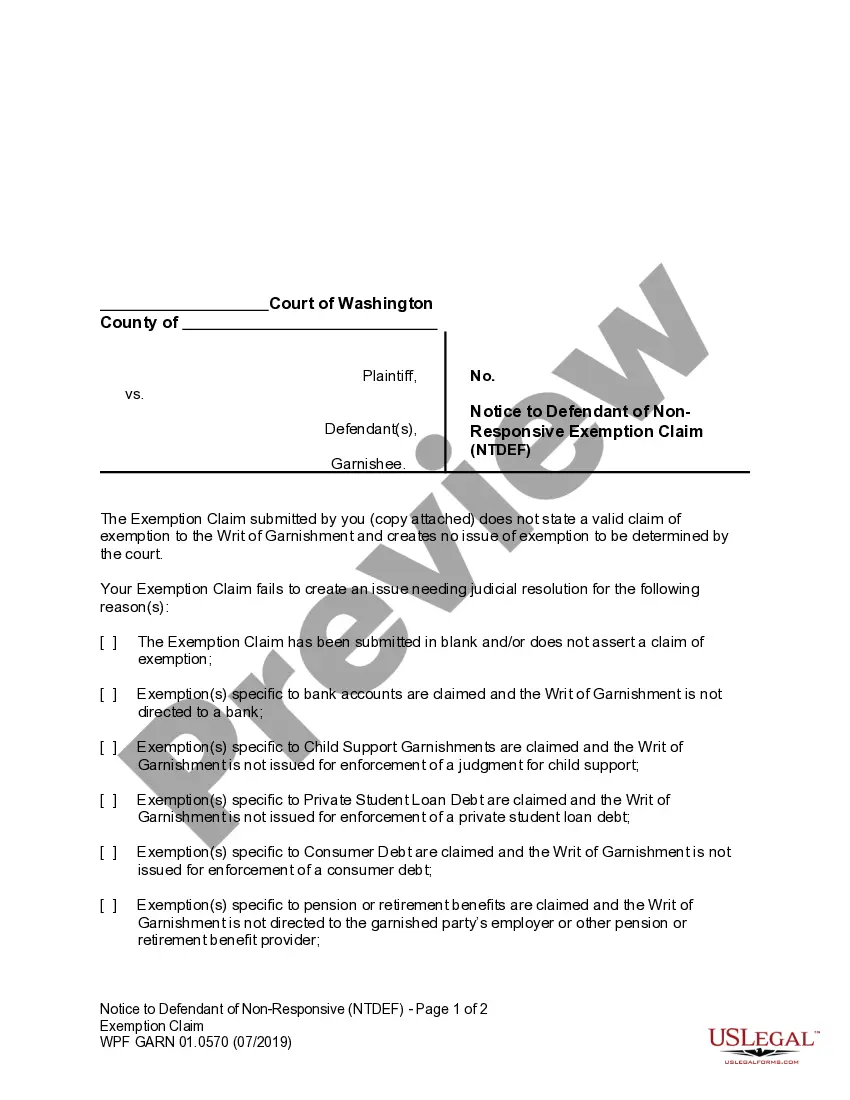

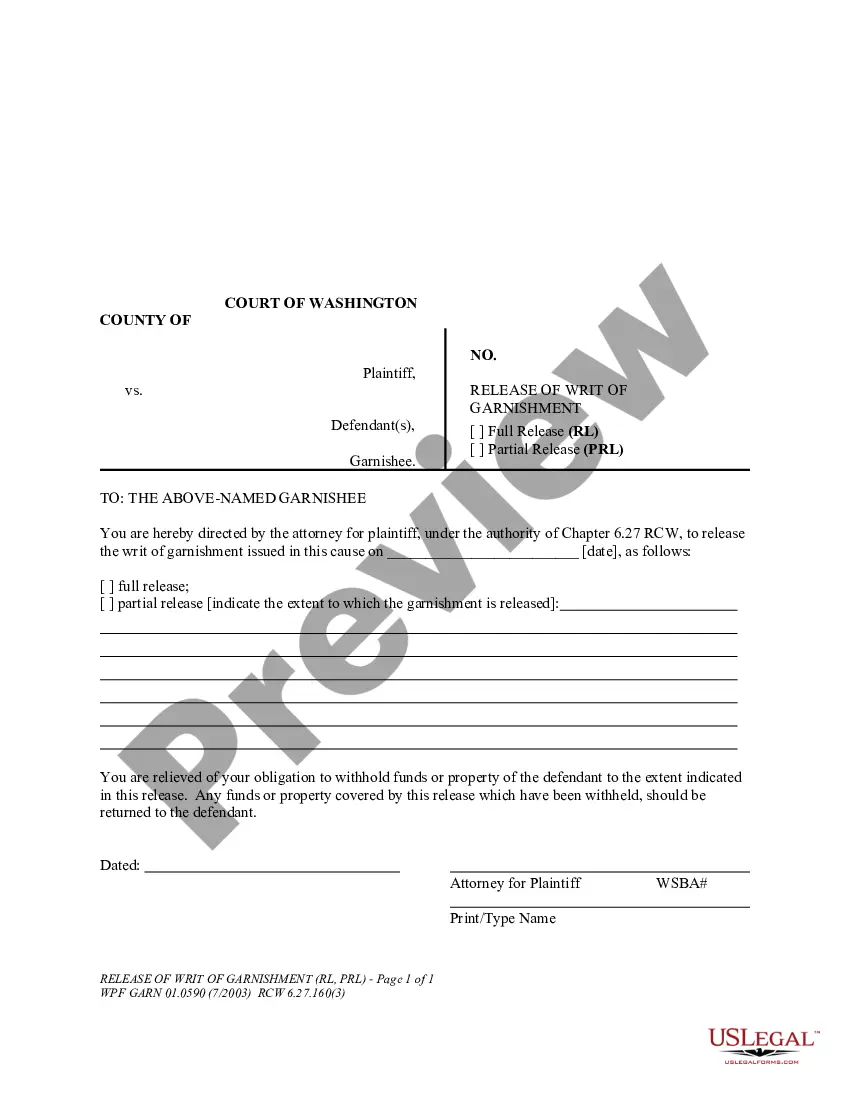

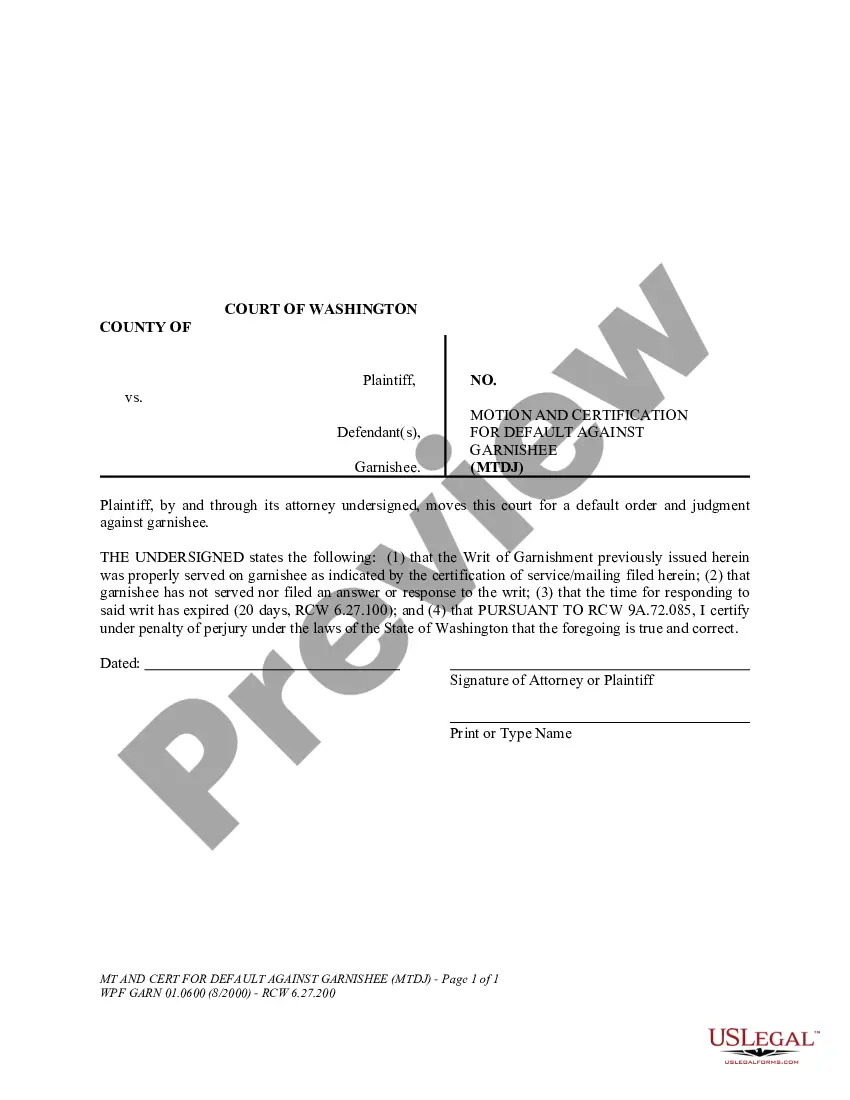

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business objective utilized in your region, including the Riverside Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Riverside Articles of Incorporation, Not for Profit Organization, with Tax Provisions will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Riverside Articles of Incorporation, Not for Profit Organization, with Tax Provisions:

- Make sure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Riverside Articles of Incorporation, Not for Profit Organization, with Tax Provisions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!