Dallas Texas Assignment and Transfer of Stock is a legal process that involves the transfer of ownership of shares or stocks from one party to another in the Dallas, Texas area. This type of transaction usually occurs when a company or individual wants to transfer their ownership rights, benefits, and responsibilities of a particular stock or share in a corporation to another party. Keywords: Dallas Texas, Assignment and Transfer of Stock, ownership, shares, stocks, transfer, legal process, benefits, responsibilities, corporation. There are different types of Dallas Texas Assignment and Transfer of Stock, including: 1. Direct Transfer: This type of transfer involves the direct transfer of ownership from one party to another. The parties involved in the transaction can use either physical stock certificates or electronic book-entry systems to facilitate the transfer. 2. Gift Transfer: In certain cases, an individual may decide to gift their ownership rights in a stock or share to another party. This type of transfer may involve certain tax implications and gift restrictions, which need to be considered and complied with during the transfer process. 3. Inheritance Transfer: When the owner of a stock or share passes away, their ownership rights may be transferred to their heirs or beneficiaries through the process of inheritance transfer. This type of transfer often involves legal procedures such as probate and estate administration. 4. Assignment of Stock: In some cases, an individual or entity may assign their ownership rights to another party through a legally binding agreement. This type of transfer typically requires the drafting and execution of a stock assignment agreement, which outlines the rights and obligations of the parties involved. 5. Corporate Mergers and Acquisitions: Stock transfers can also occur during corporate mergers and acquisitions in Dallas, Texas. When one company acquires another, the ownership rights in the target company's stocks or shares may be transferred to the acquiring company's shareholders as part of the deal. It is important to consult with a qualified attorney or financial advisor when undertaking any Dallas Texas Assignment and Transfer of Stock to ensure compliance with relevant regulations and to protect the interests of all parties involved in the transaction.

Dallas Texas Assignment and Transfer of Stock

Description

How to fill out Dallas Texas Assignment And Transfer Of Stock?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Dallas Assignment and Transfer of Stock is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Dallas Assignment and Transfer of Stock. Follow the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

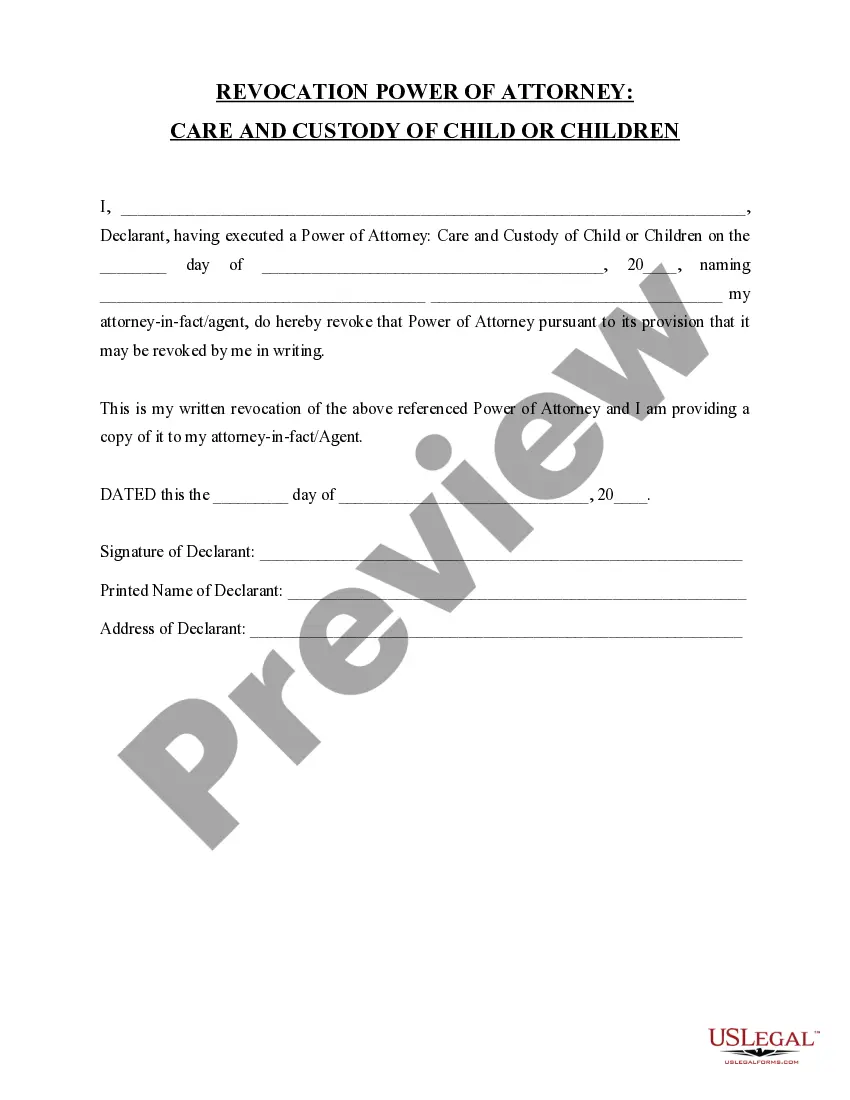

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Assignment and Transfer of Stock in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!