The San Diego California Assignment and Transfer of Stock is a legal process that involves the transfer of ownership or assignment of stocks from one party to another. This assignment and transfer can occur in various settings, including corporations, limited liability companies (LCS), partnerships, or other entities that issue stocks. This process is crucial for companies looking to change ownership, restructure their shares, or facilitate investments. It involves the assignment of shares by the current shareholder (assignor) to another individual or entity (assignee), thereby transferring the ownership rights associated with those shares. There are different types of San Diego California Assignment and Transfer of Stock, each catering to specific situations and requirements: 1. Stock Assignment and Transfer Agreement: This is the most common type of stock transfer document used in San Diego. It outlines the terms and conditions of the transfer, including the number of shares, purchase price, and any restrictions or conditions associated with the stock transfer. 2. Restricted Stock Assignment: In some cases, stocks may have restrictions imposed on them, limiting their transferability. These restrictions can include lock-up periods, vesting schedules, or requirements for shareholder approval. The Restricted Stock Assignment outlines these restrictions and facilitates the transfer within the specified parameters. 3. Stock Power Form: This form is used when a shareholder wants to authorize the transfer of their stocks to another party. It acts as a legal document, evidencing the transfer and providing the necessary instructions to update the company's records. 4. Stock Purchase Agreement: This agreement is used when the transfer of stocks involves a purchase transaction between the assignor and assignee. It specifies the purchase price, terms of payment, representations, and warranties of both parties, and any additional terms related to the transfer. 5. Stock Transfer Ledger: This is an essential record-keeping document that tracks all stock transfers, assignments, and changes in ownership within a company. It includes information such as the names of the parties involved, the number of shares transferred, dates, and any relevant stock certificate numbers. Overall, the San Diego California Assignment and Transfer of Stock process plays a key role in facilitating the transfer of ownership and ensuring compliance with legal requirements. It is vital for both individuals and companies to fully understand the type of stock transfer involved and the applicable legal documents to protect their interests in these transactions.

San Diego California Assignment and Transfer of Stock

Description

How to fill out San Diego California Assignment And Transfer Of Stock?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the San Diego Assignment and Transfer of Stock, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the San Diego Assignment and Transfer of Stock, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Diego Assignment and Transfer of Stock:

- Look through the page and verify there is a sample for your region.

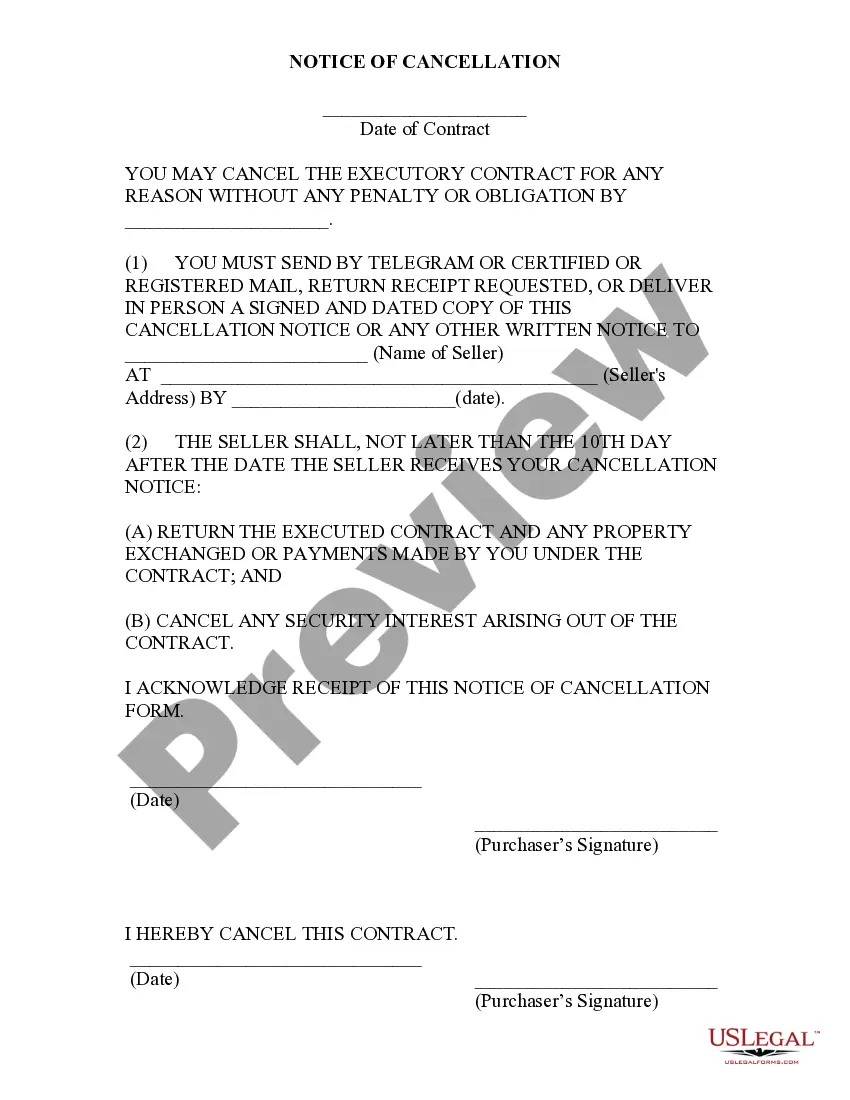

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your San Diego Assignment and Transfer of Stock and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!